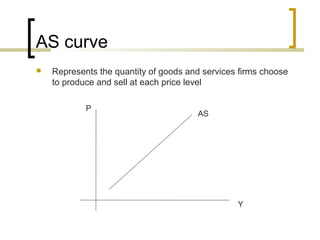

This document discusses key concepts in Keynesian economics including aggregate demand, aggregate supply, and their relationship. It explains that according to Keynesian theory, output and employment are determined by aggregate demand. The aggregate demand curve slopes positively, showing the total quantity demanded at each price level in the economy. The aggregate supply curve can be upward-sloping in the short-run due to sticky wages and prices. The intersection of the aggregate demand and supply curves indicates the general equilibrium in the economy.

![Contd….

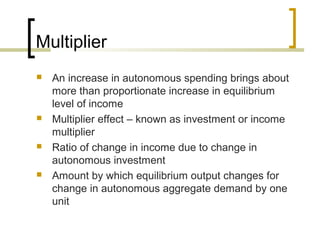

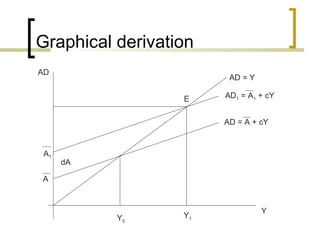

In equilibrium, Y = AD

Y = A + c(1-t) Y

Y [1-c(1-t)] = A where A = a+ cTR+ I+ G

Y = A / 1-c(1-t)

Multiplier in presence of taxes = α = 1 / 1–c(1-t)

Government spending can increase A by the

amount of purchases G and by the amount of

induced spending out of transfers bTR

Increased A will increase Y depending on the value

of MPC and tax rate

When tax rates (t) are higher, value of multiplier is

lower](https://image.slidesharecdn.com/aggregatedemandandsupply-130323071201-phpapp01/85/Aggregate-demand-and-supply-15-320.jpg)