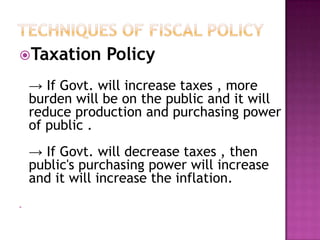

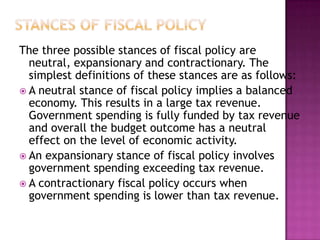

Fiscal policy involves a government's revenue collection and spending behaviors and techniques to influence economic growth and development. Key techniques of fiscal policy include taxation, government expenditure, deficit financing, and public debt. Fiscal policy stances can be neutral, expansionary, or contractionary depending on whether government spending exceeds, equals, or is less than tax revenue. While expansionary fiscal policy can fight economic recession by increasing aggregate demand, contractionary policy can curb inflation. However, the effectiveness of fiscal policy in reality faces limitations such as rising inflation, failure to reduce black money, and increasing unemployment despite government spending.