1) Portfolio construction involves blending different asset classes like stocks, bonds, and cash to obtain returns while minimizing risk through diversification.

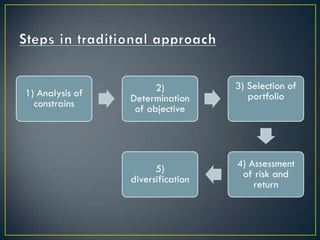

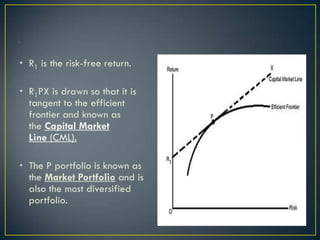

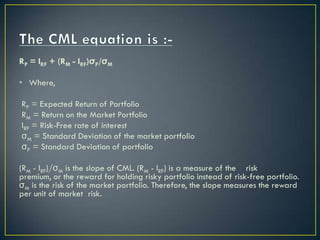

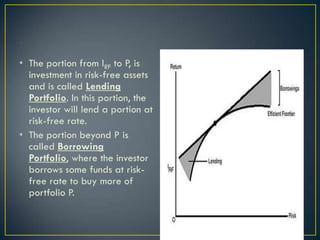

2) There are two main approaches - the traditional approach selects securities to meet an investor's needs, while the Markowitz efficient frontier approach constructs portfolios that maximize expected return for a given level of risk.

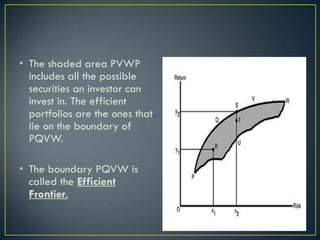

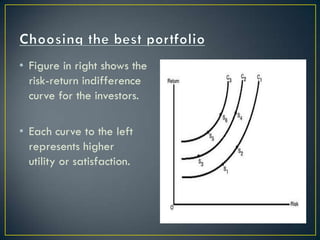

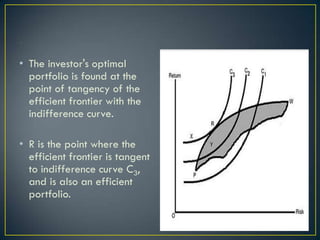

3) The Markowitz model helps investors reduce risk by choosing securities whose returns do not move together, identifying the efficient frontier of portfolio options, and allowing investors to select the portfolio with the highest return for a given risk level.