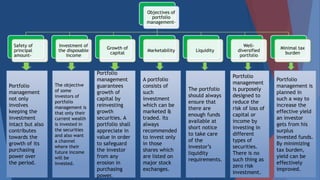

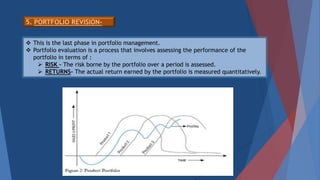

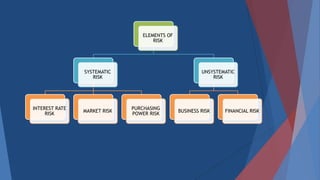

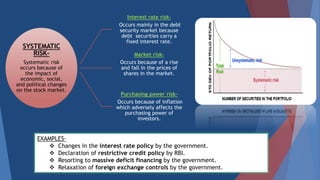

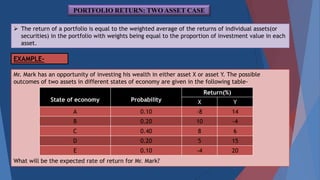

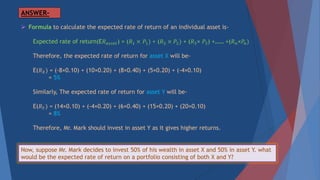

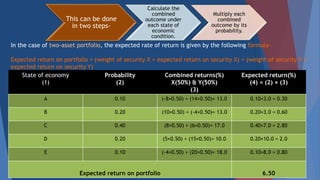

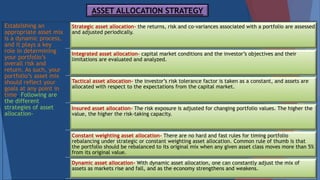

The document discusses portfolio management and asset allocation strategies. It defines a portfolio as a collection of investments that can include stocks, mutual funds, bonds, and cash. It then describes different types of portfolios including a market portfolio and a zero investment portfolio. The main phases of portfolio management are outlined as security analysis, portfolio analysis, portfolio selection, portfolio revision, and portfolio evaluation. Asset allocation strategies focus on establishing an appropriate mix of asset classes in a portfolio to optimize risk and return based on an investor's goals.