The document discusses the Capital Asset Pricing Model (CAPM) and its application in calculating the cost of capital for risky projects, emphasizing the significance of beta as a measure of systematic risk. It details the process of estimating costs of equity and weighted average cost of capital (WACC) while highlighting the challenges in accurately gauging a firm's overall cost of capital. Furthermore, it explores the importance of efficient markets and the impact of various factors, such as insider trading and market predictions, on investment decisions.

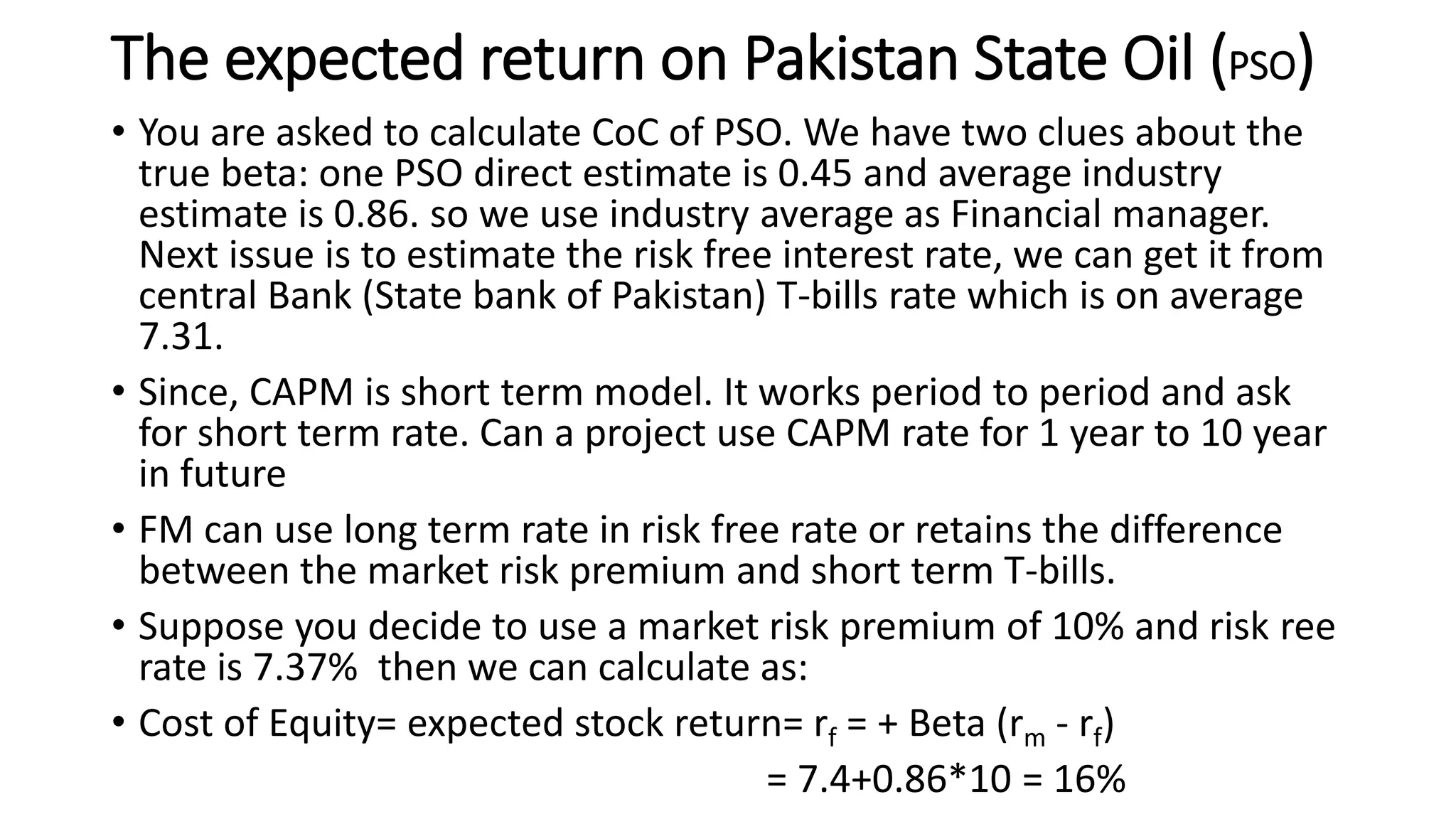

![Introduction: Cost of Capital

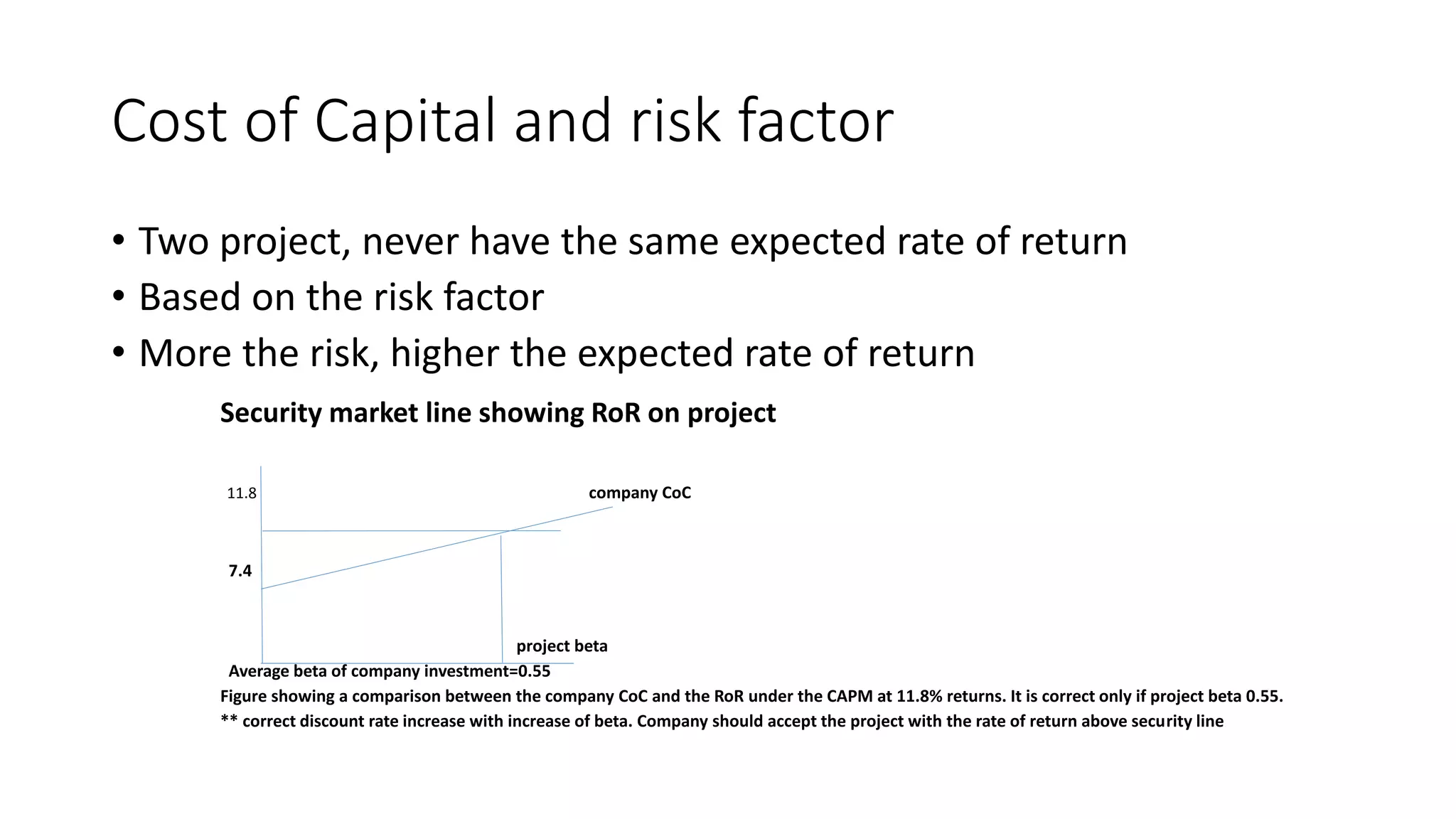

Expected return on a portfolio of all the company’s existing securities.

It is the opportunity for investment in the firm’s assets

Hence, the appropriate discount for the firm’s risk projects

If company has no debt outstanding then the cost of capital is just the

expected rate of return on firm’s stock

Eg

a company has beta of about 0.55, risk free rate is 7.4 and

market risk premium is 8% then CAPM would imply rate of return:

r= rf +[(Beta (rm)] =.074+ .55*.08](https://image.slidesharecdn.com/capmforriskyprojectlec7-160516194449/75/capital-asset-pricing-model-for-calculating-cost-of-capital-for-risk-for-risky-project-and-efficient-market-lec-7-3-2048.jpg)