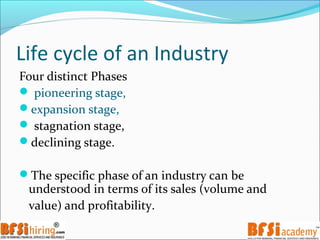

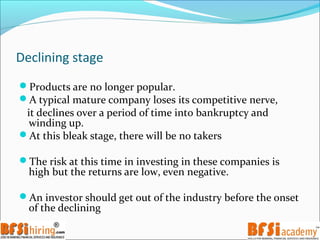

The document outlines the four stages of an industry's life cycle: pioneering, expansion, stagnation, and declining. It then provides details about each stage. The pioneering stage involves a new industry becoming established with few competitors. The expansion stage sees increased competition and innovation. The stagnation stage involves slower sales growth and emphasis on profits. Finally, the declining stage is when products are no longer popular and risks are high for investors. The document also discusses Porter's five forces model and how to analyze competitive conditions, characteristics, and market structure of an industry.