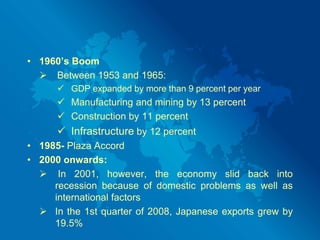

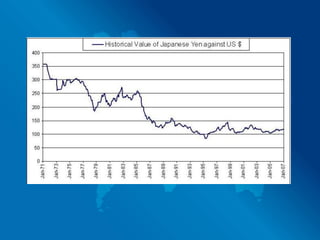

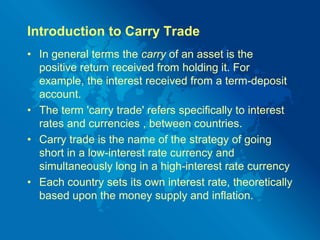

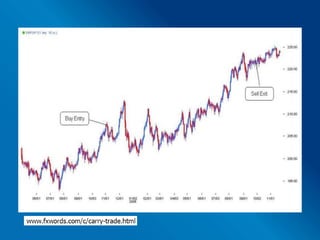

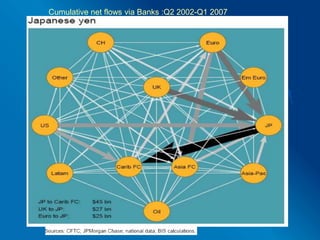

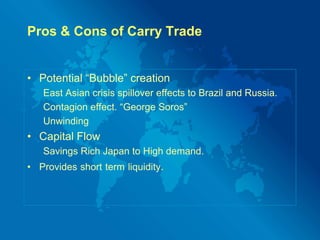

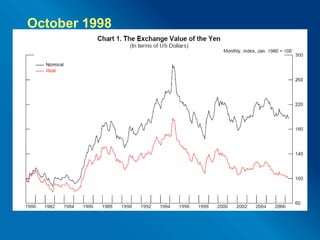

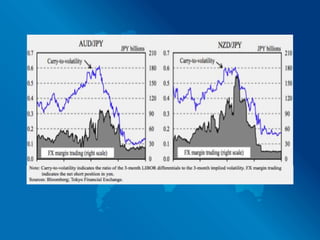

This document discusses the yen carry trade, which involves borrowing low-interest Japanese yen to invest in higher yielding currencies. It provides background on Japan's post-war economic growth and details how structural weaknesses in Japanese banks and its central bank's easy monetary policy contributed to the yen carry trade. The document outlines the mechanics of carry trades and analyzes periods of unwinding in 1998, 2006, and 2007 that were sparked by events like the LTCM crisis and subprime mortgage fears, causing sharp yen appreciation and global market volatility.