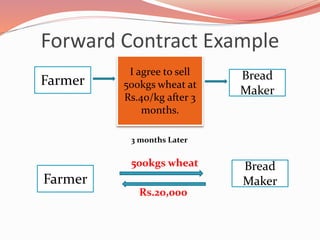

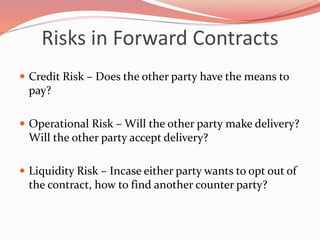

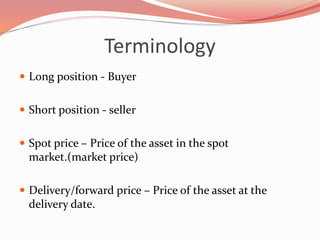

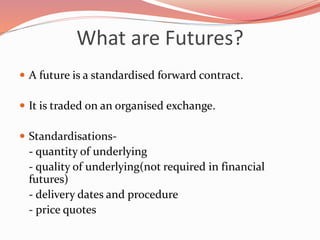

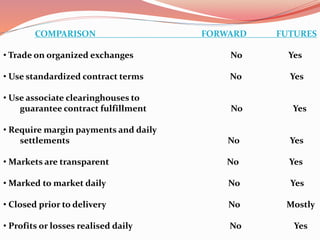

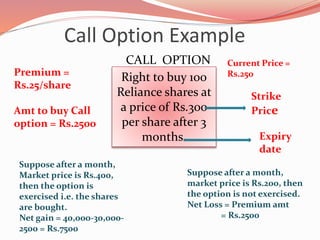

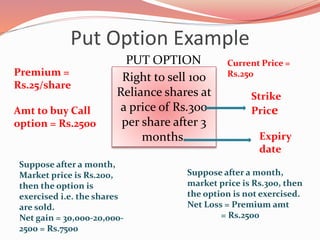

This document defines various derivatives instruments and concepts. It begins by explaining that derivatives derive their value from an underlying asset and include futures, forwards, and options. It then discusses the different types of traders in derivatives markets including hedgers, speculators, and arbitrageurs. The document also compares over-the-counter (OTC) derivatives to exchange-traded derivatives and outlines some of the economic benefits of using derivatives. It provides examples and definitions for specific derivative types like forwards, futures, and options.