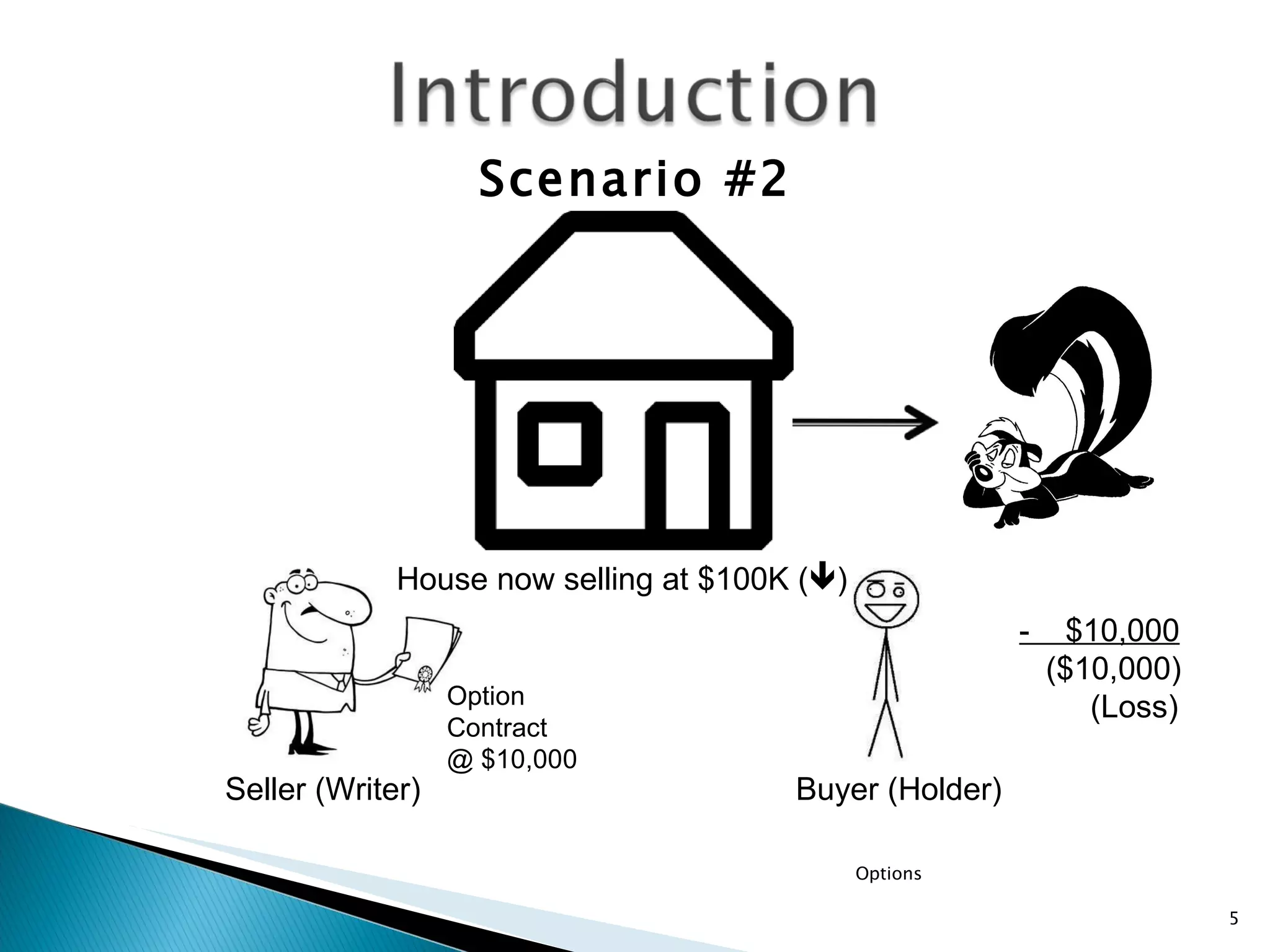

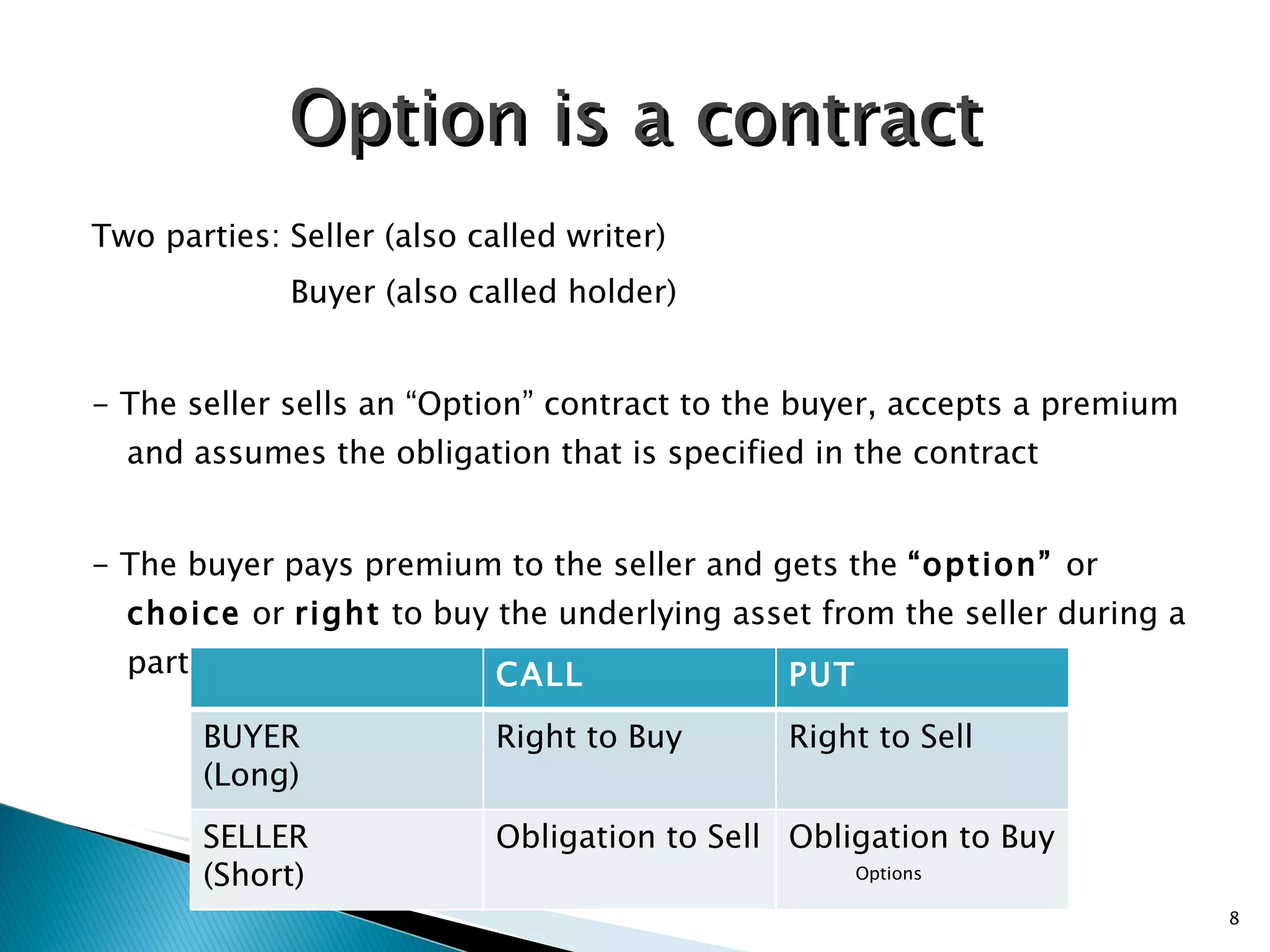

The document provides an introduction to corporate finance options, including:

- A brief history of options and their use in ancient Greece.

- Current options markets and regulators.

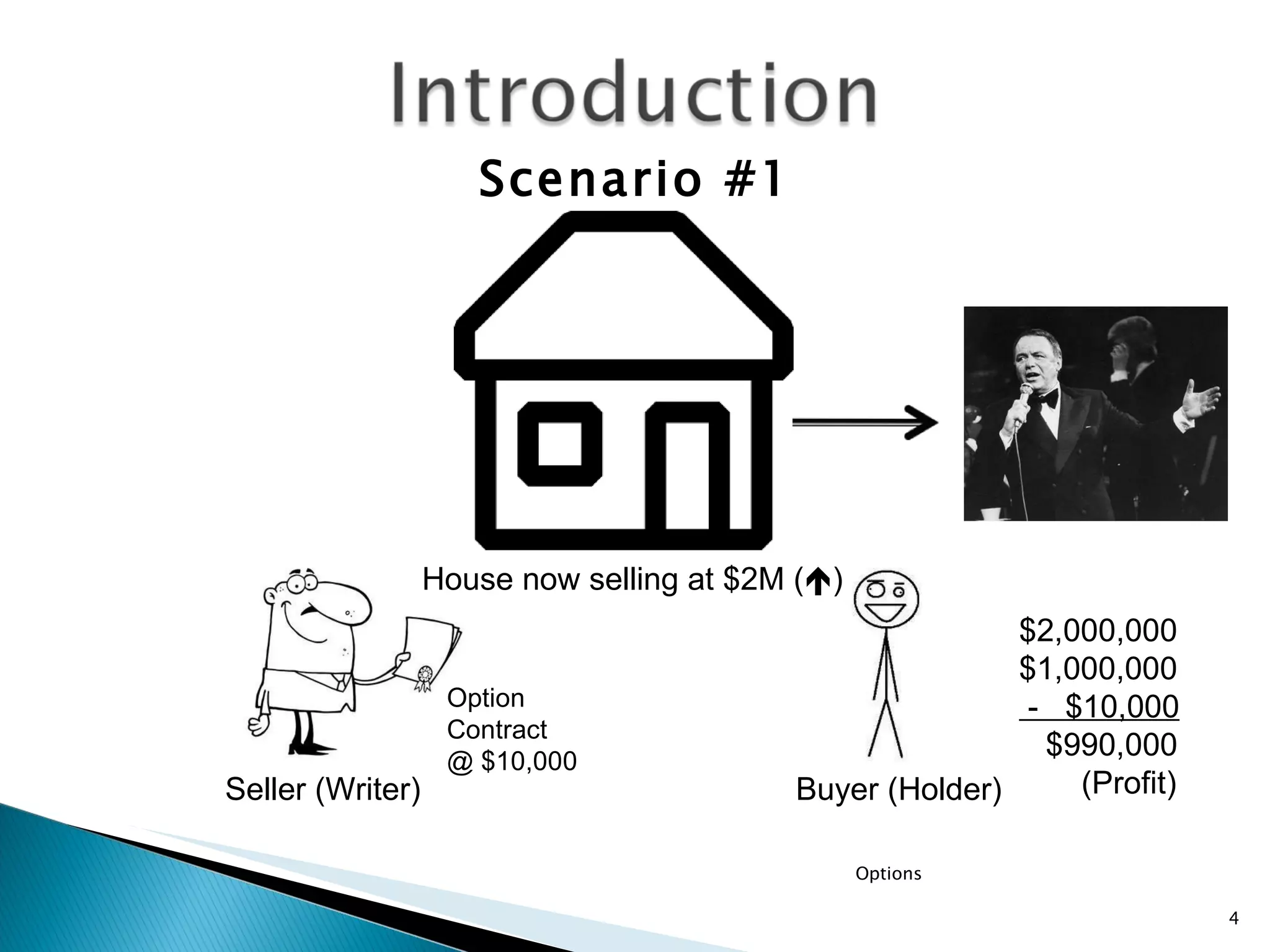

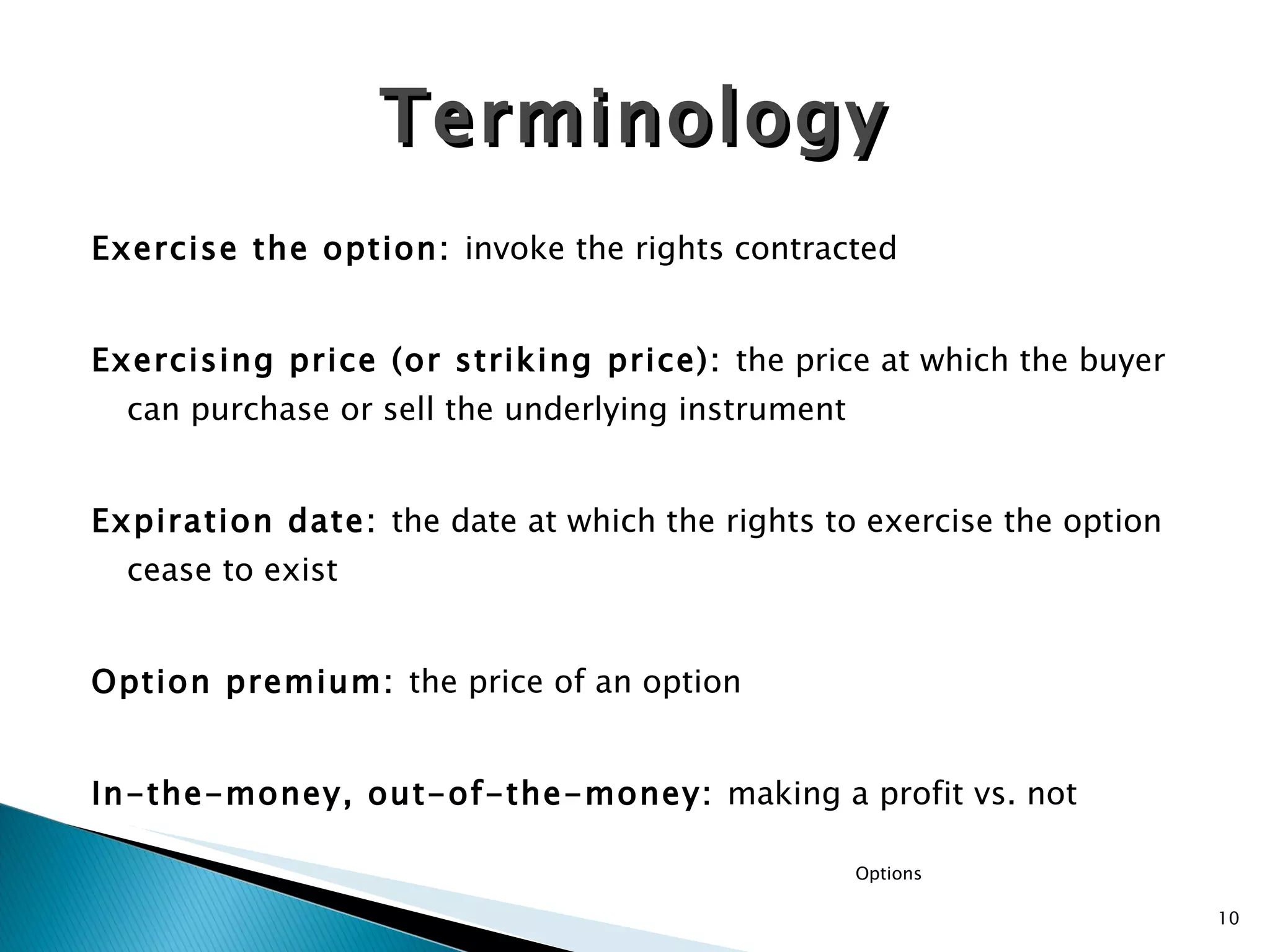

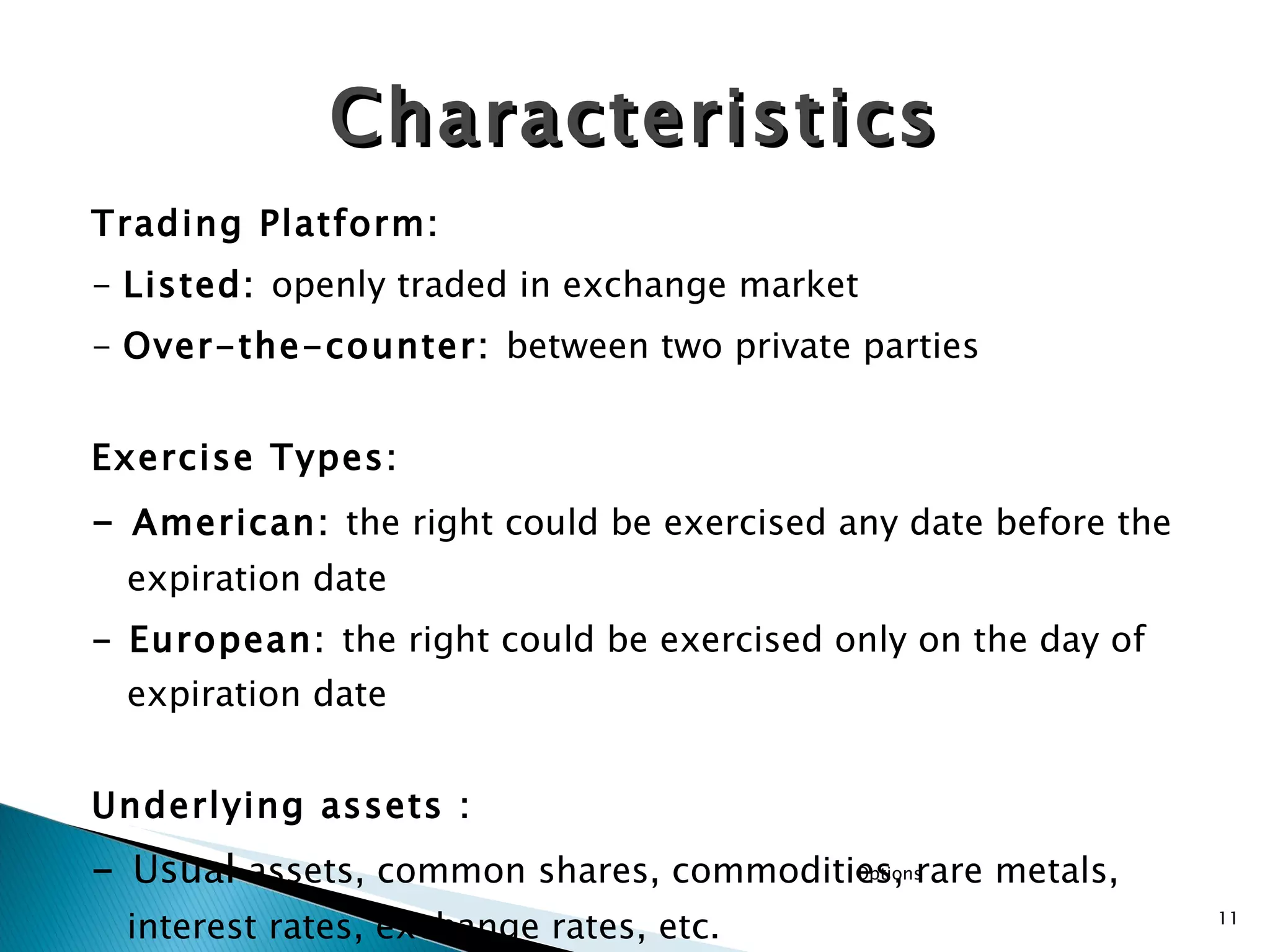

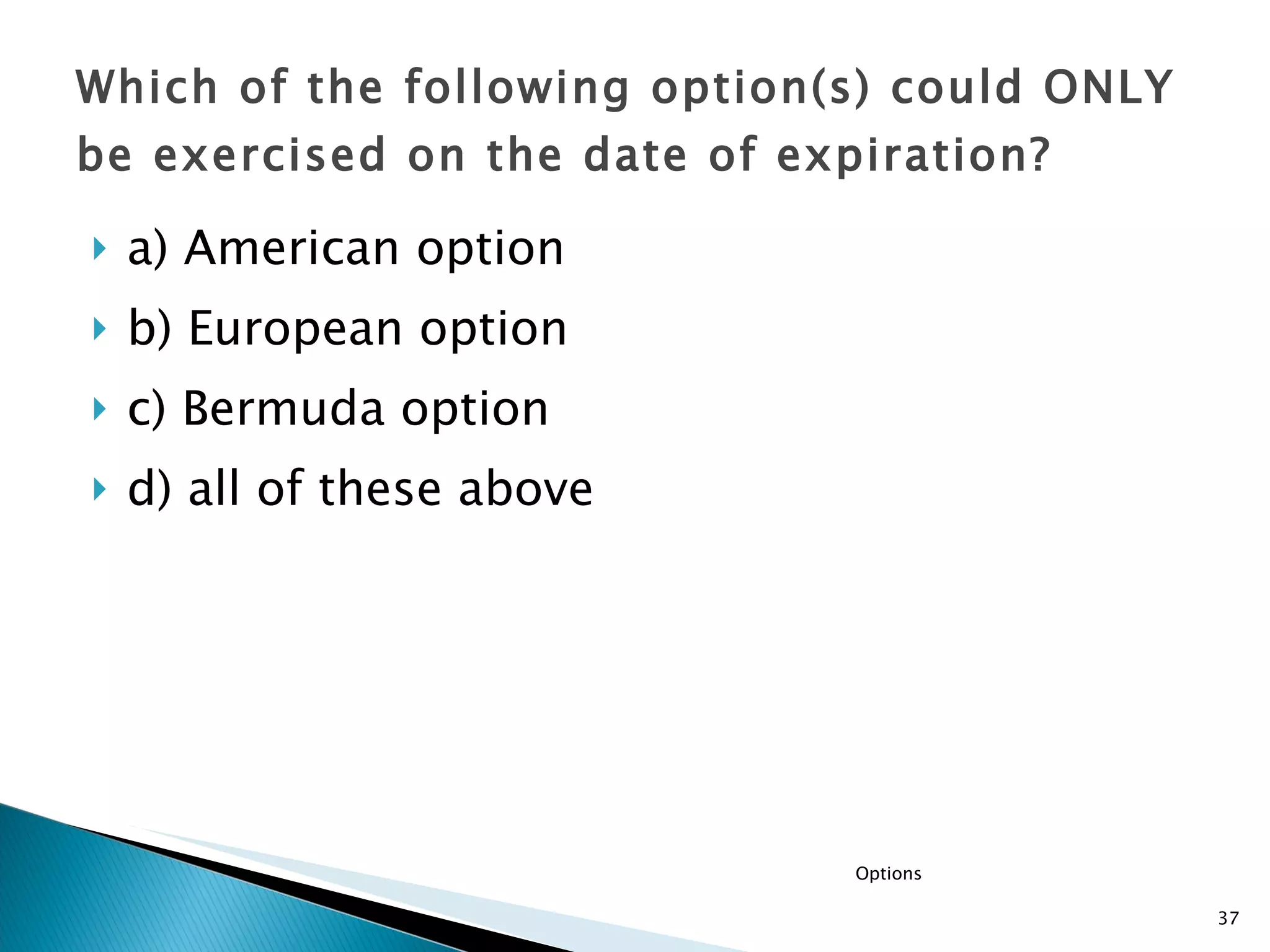

- Key terminology related to options contracts.

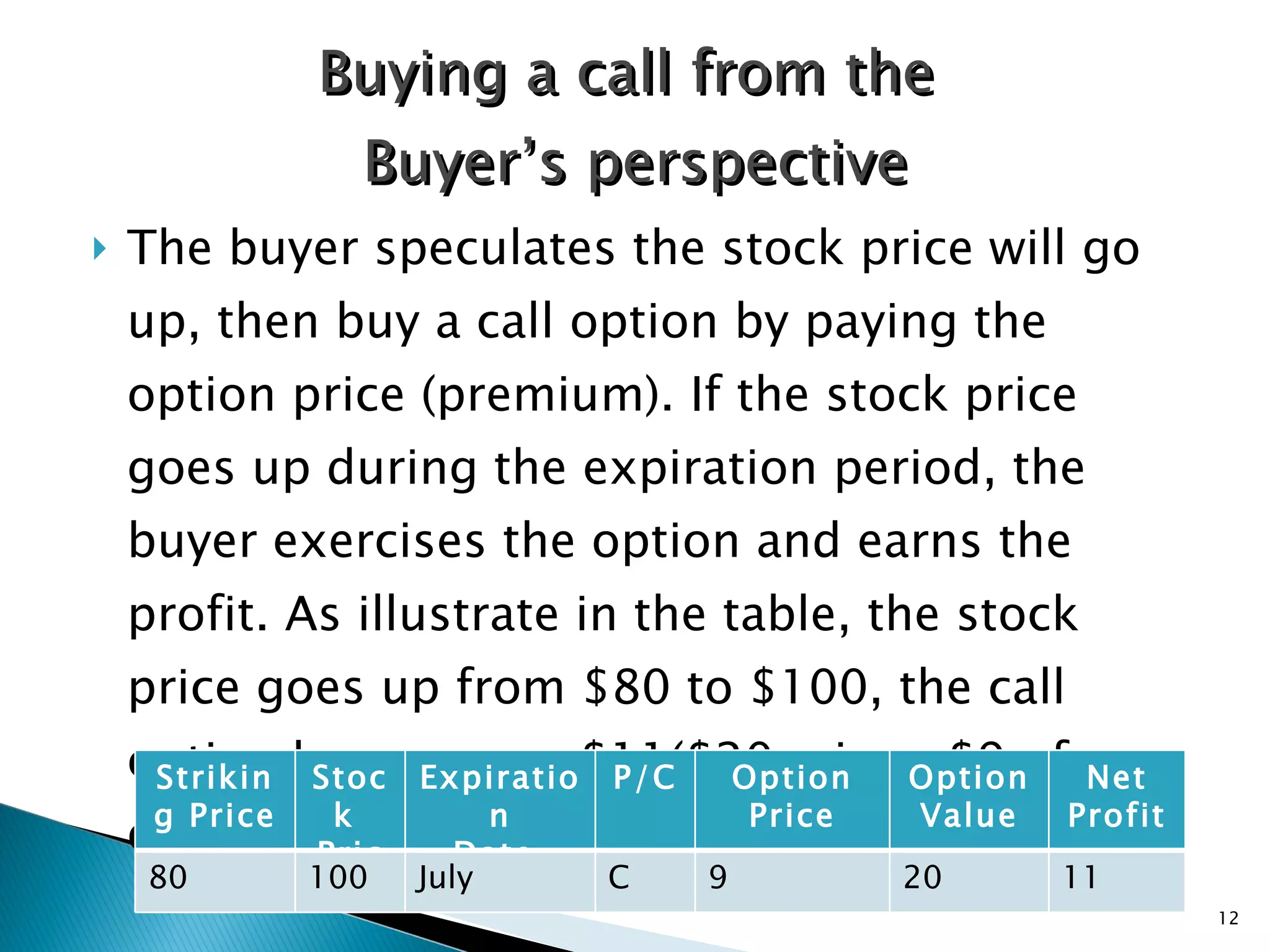

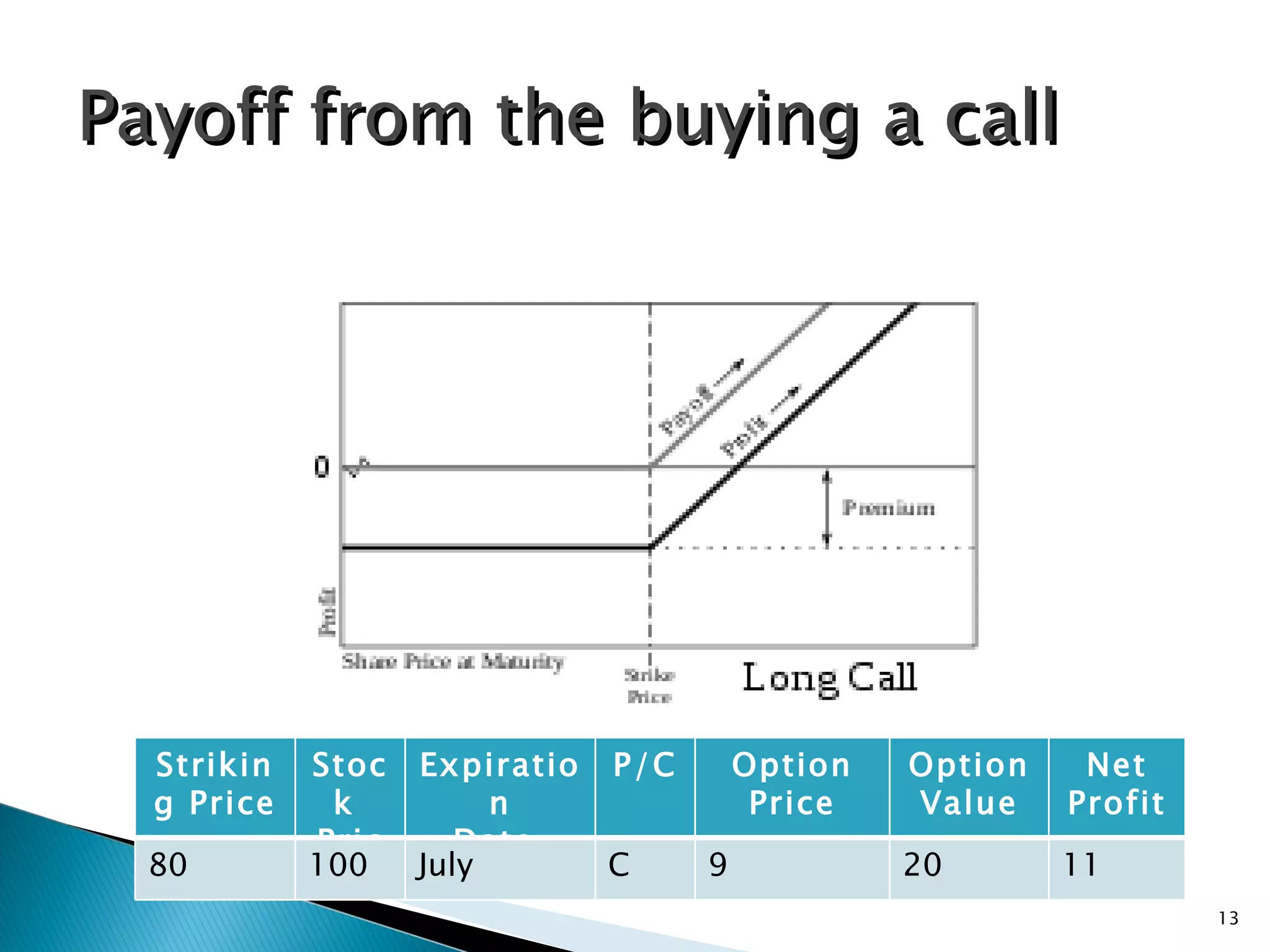

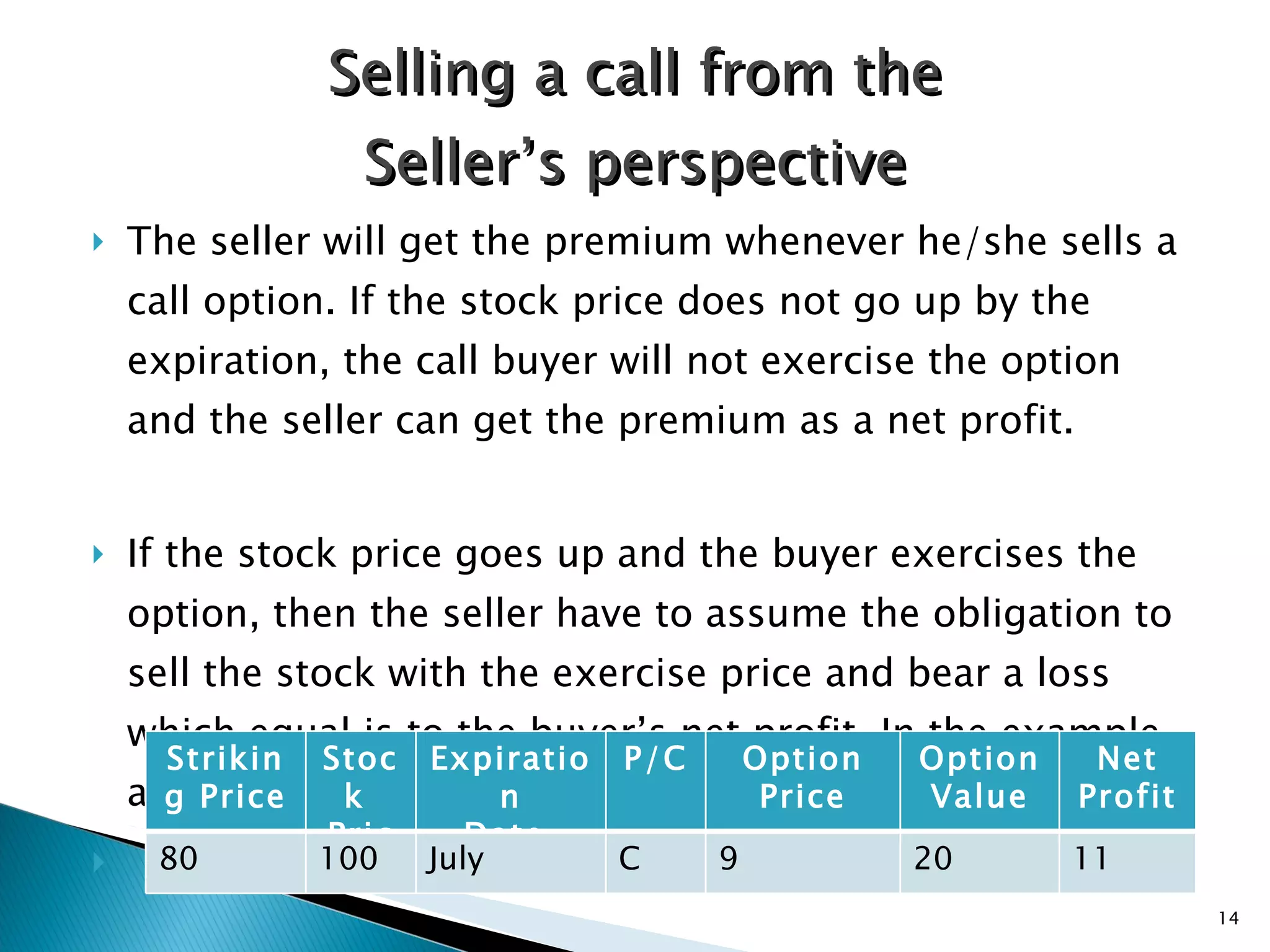

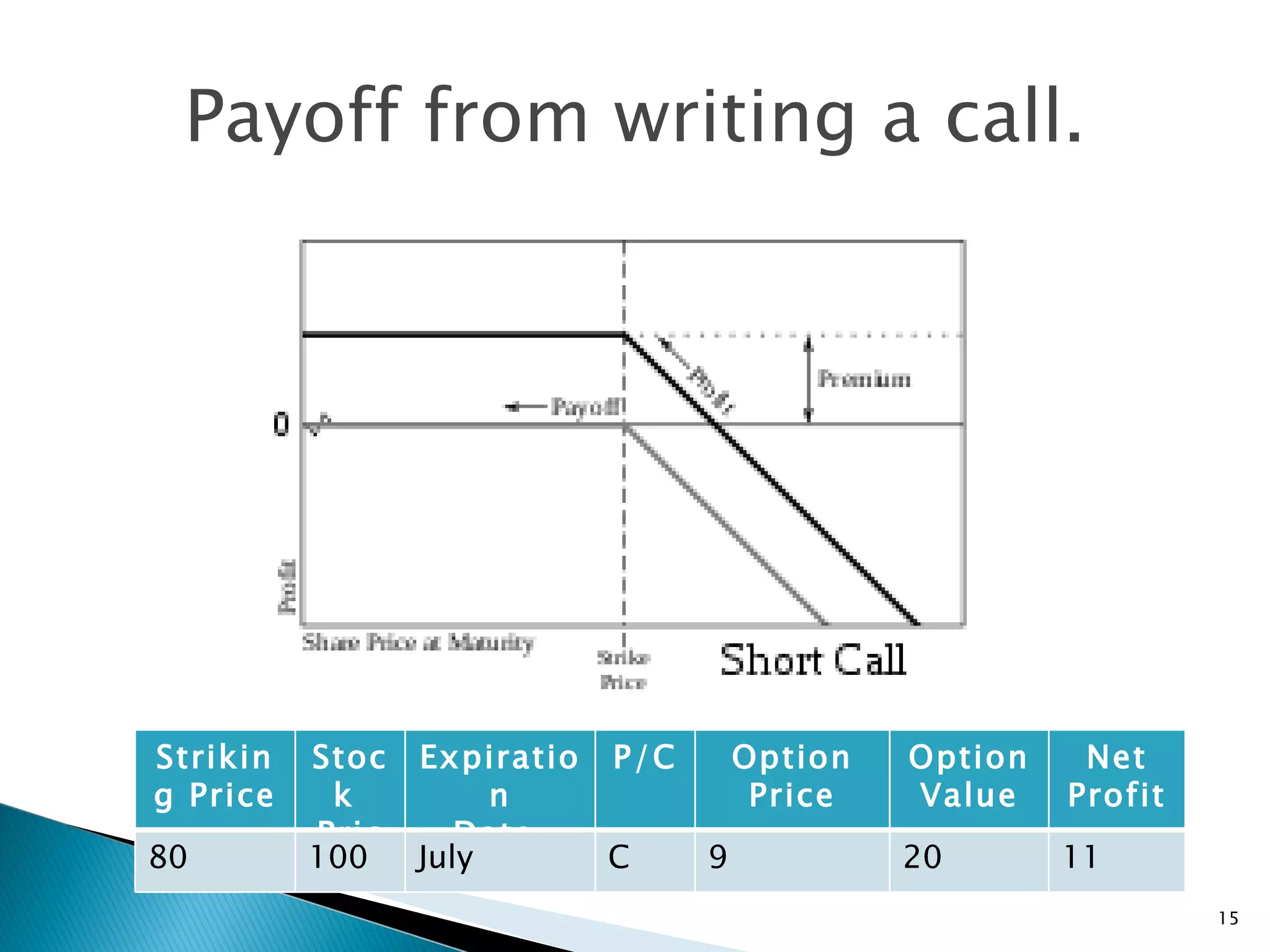

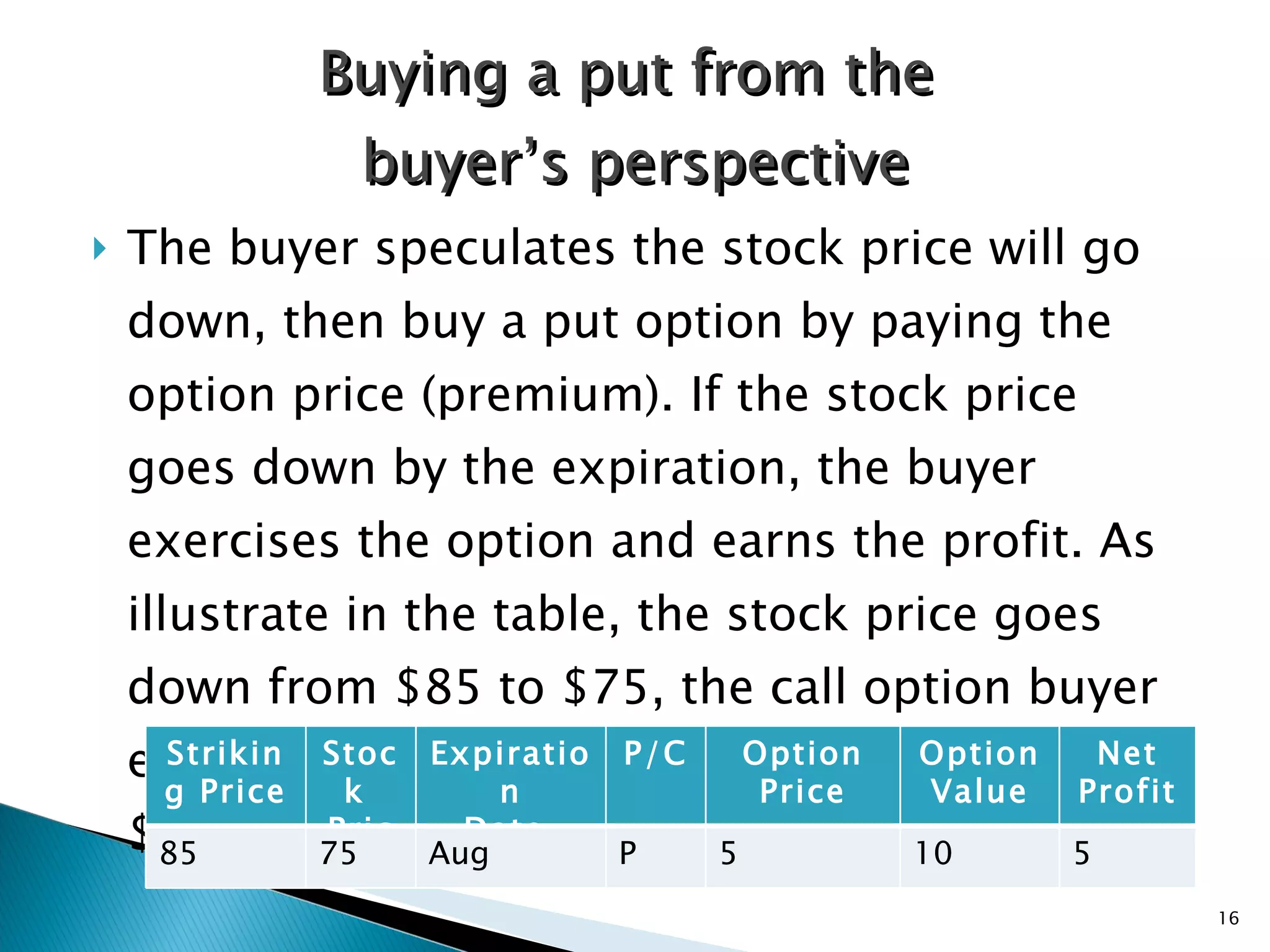

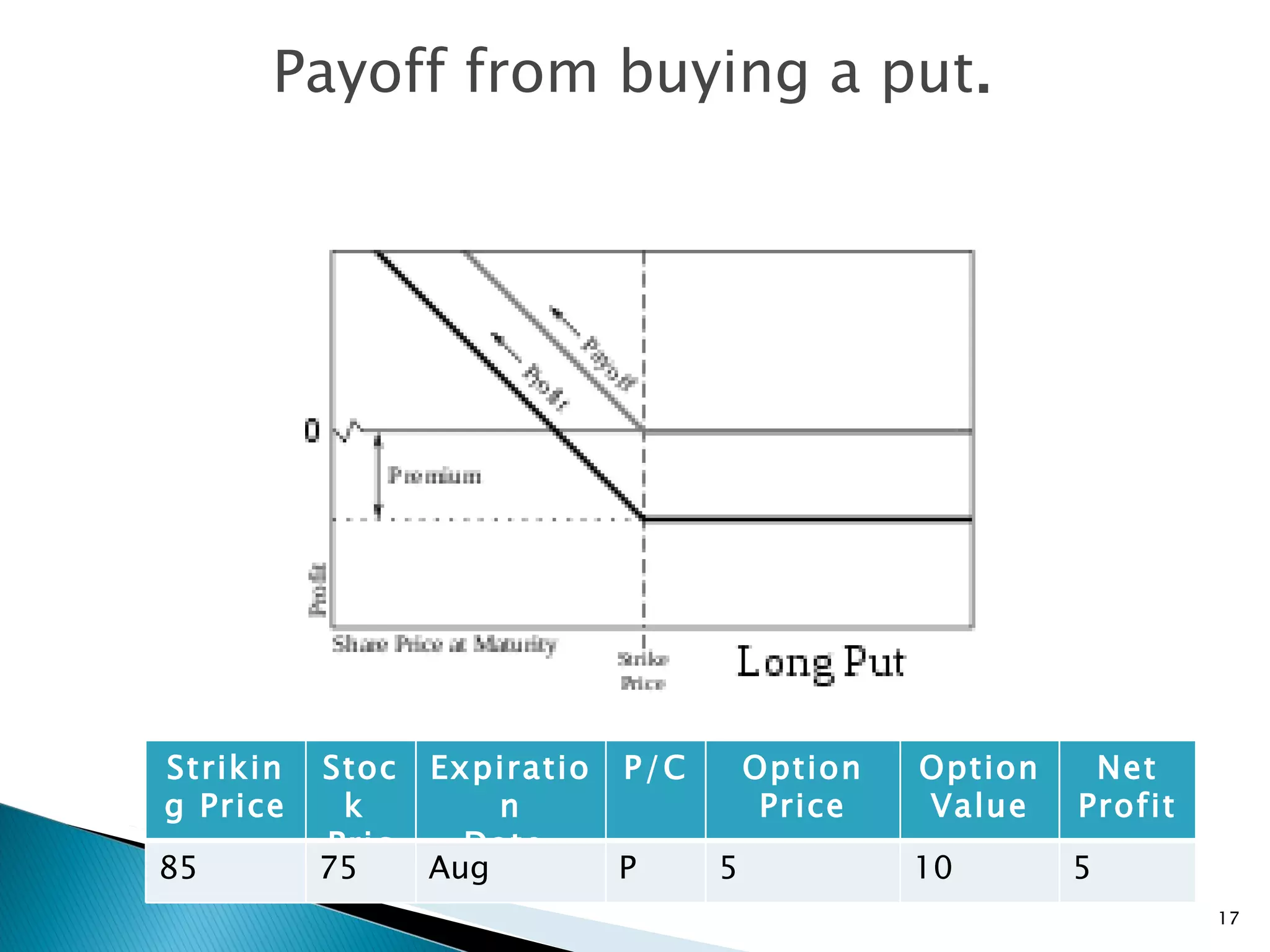

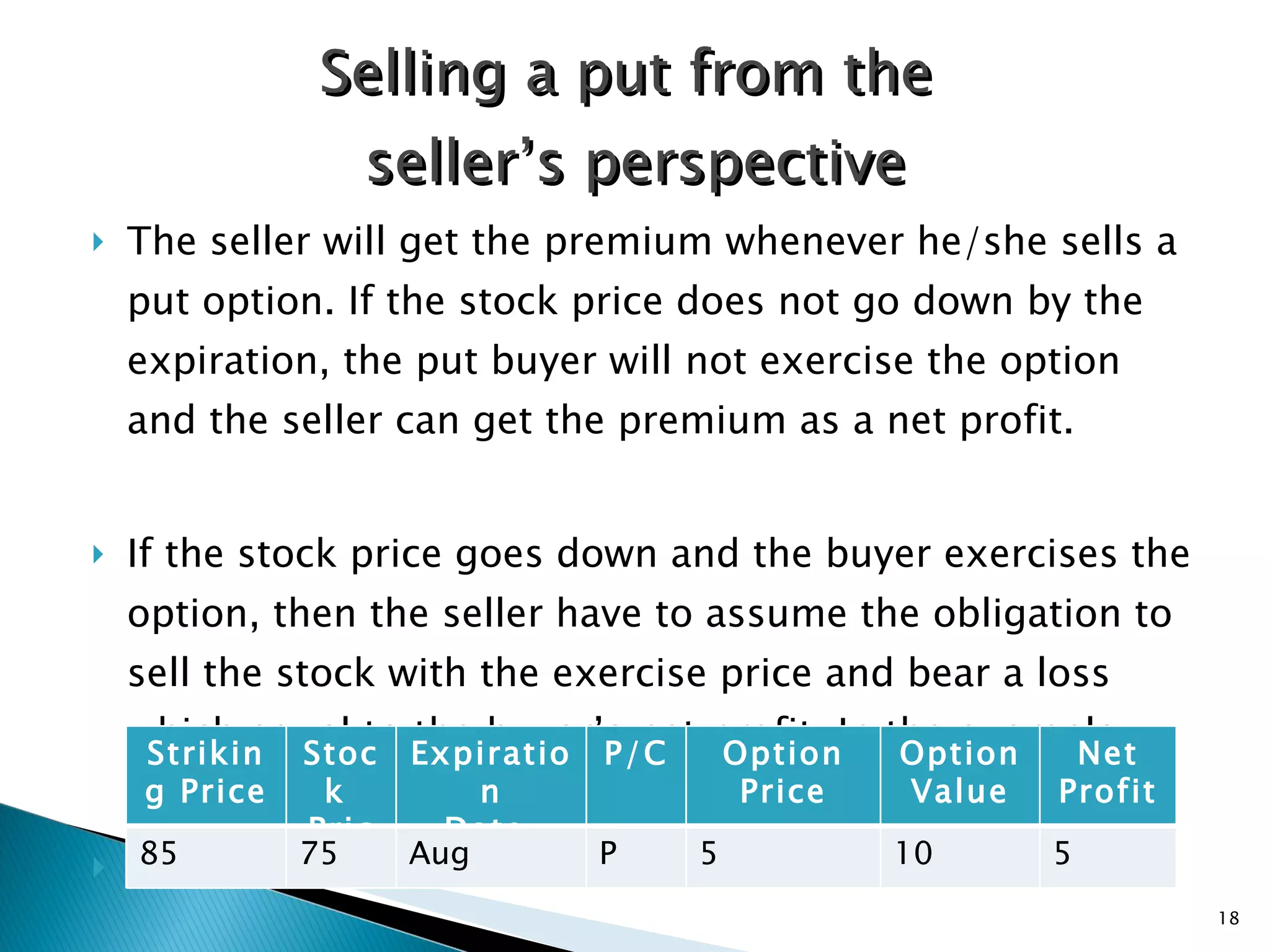

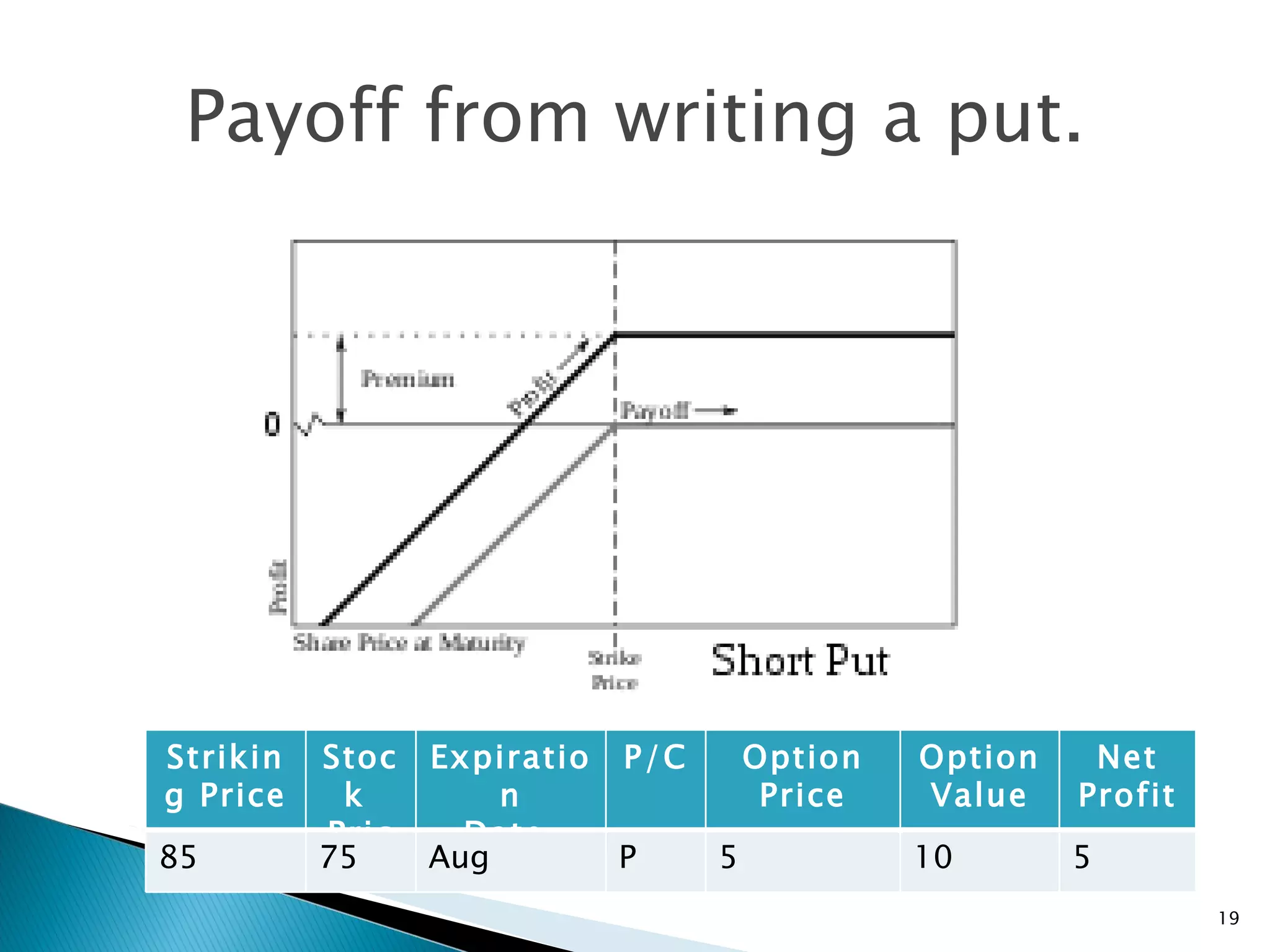

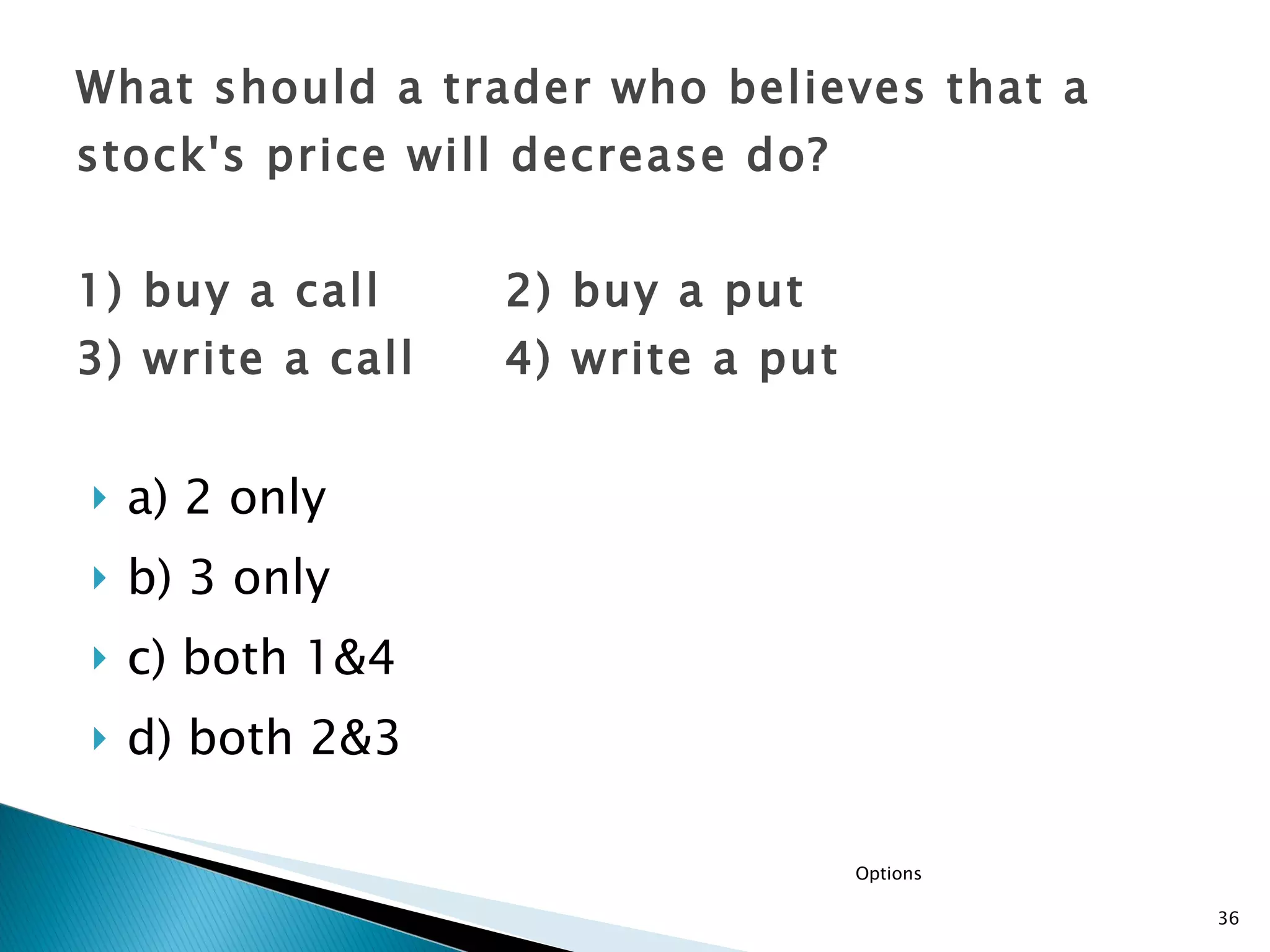

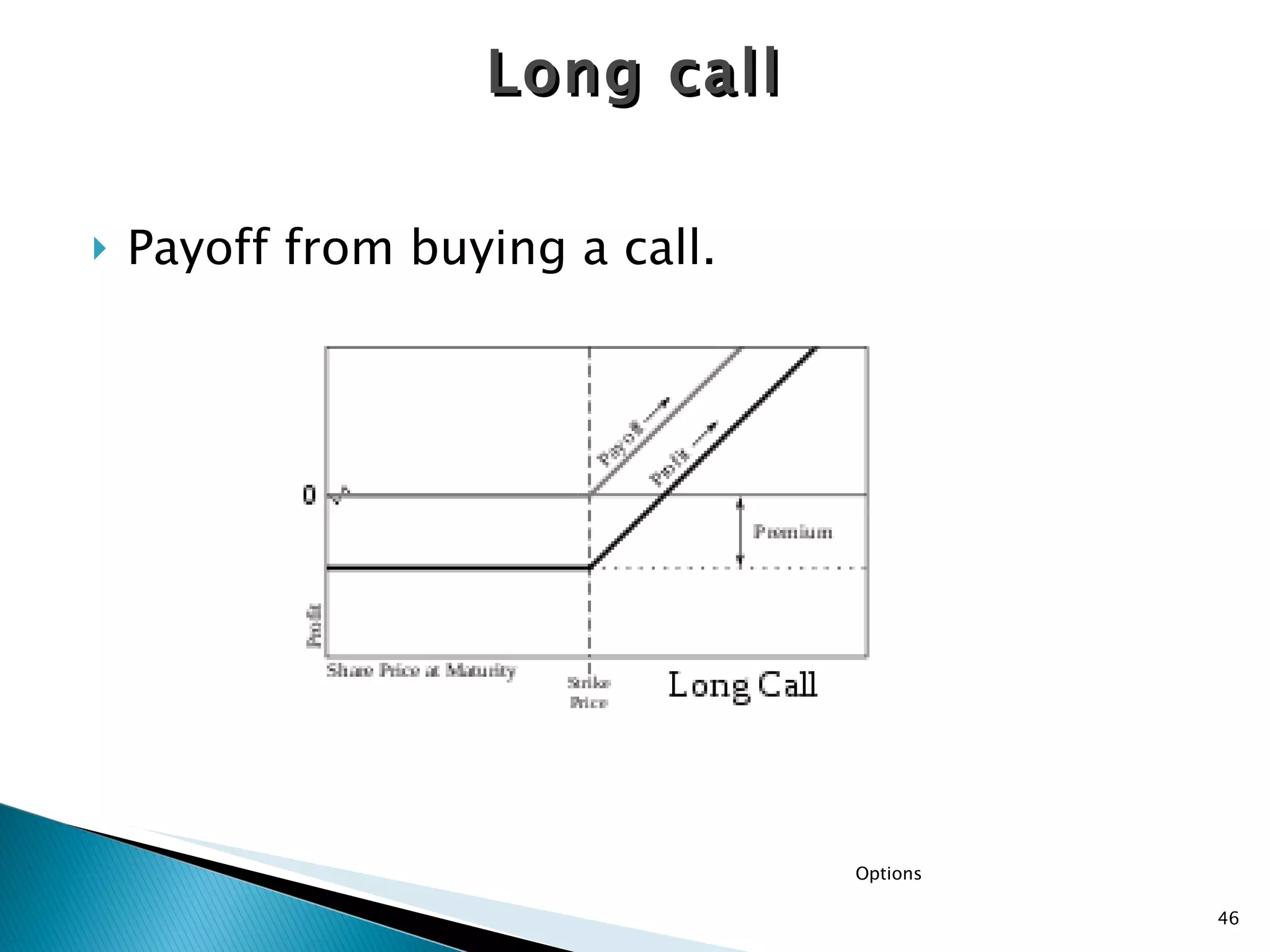

- The main types of options - calls and puts.

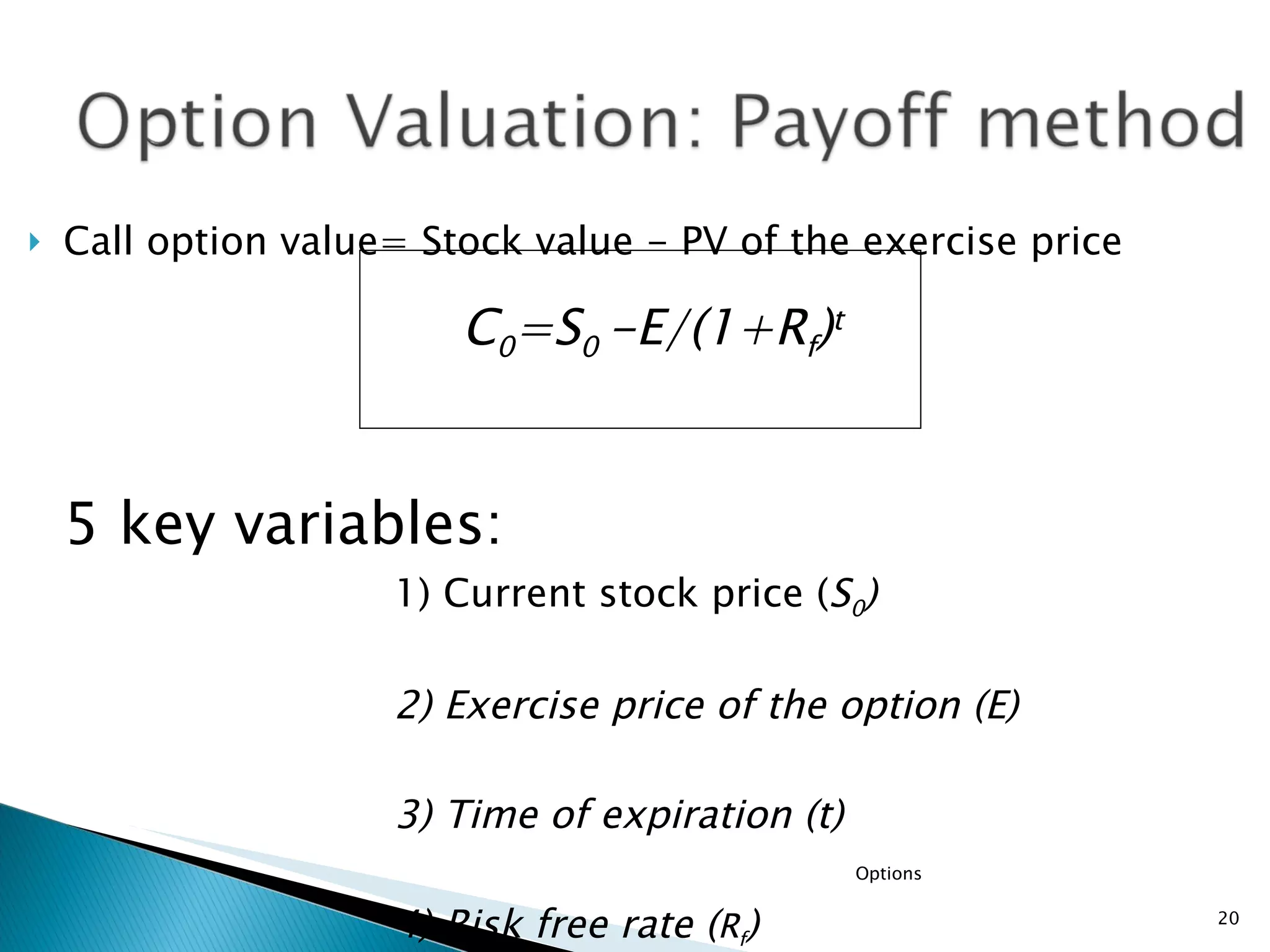

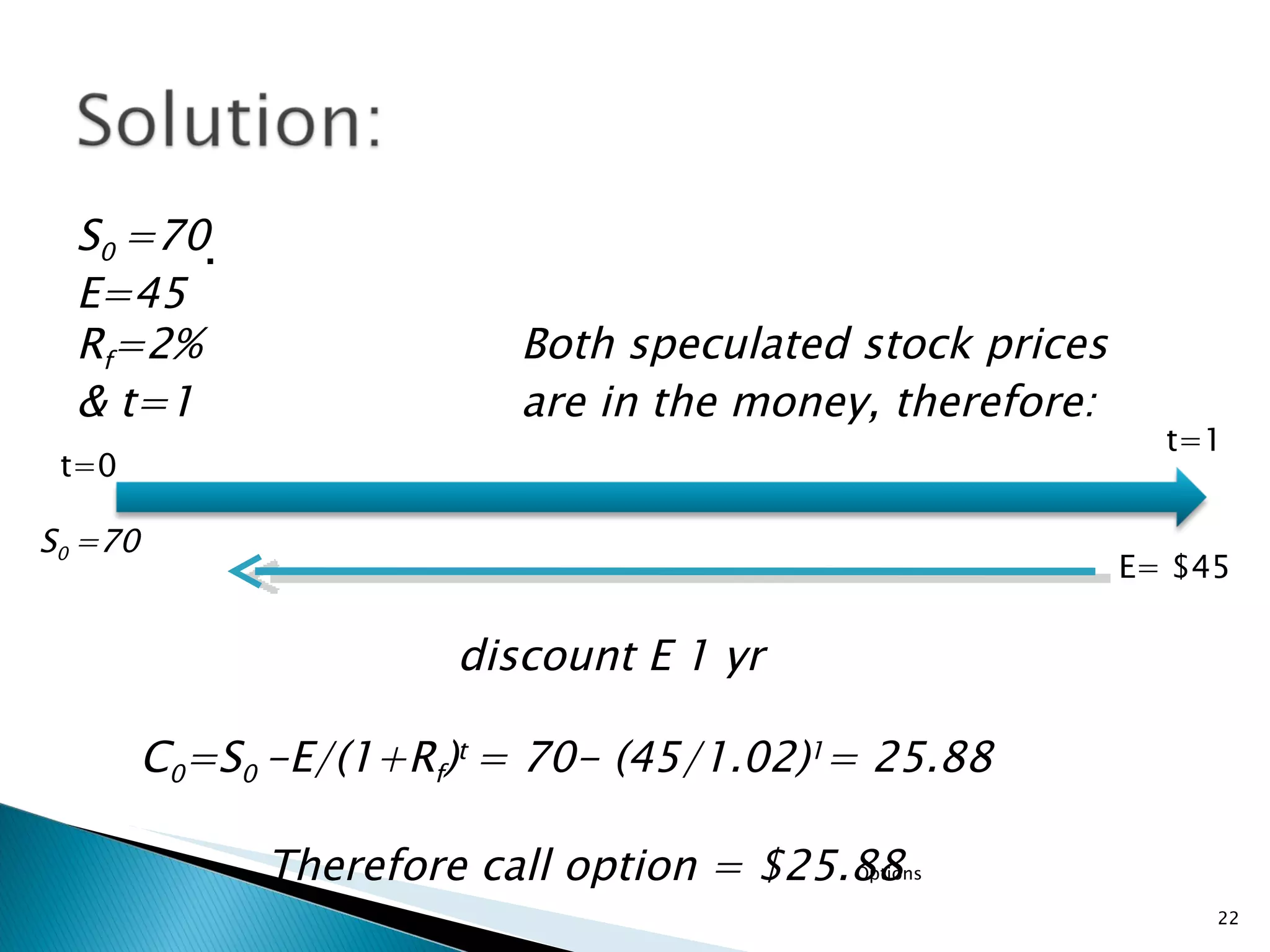

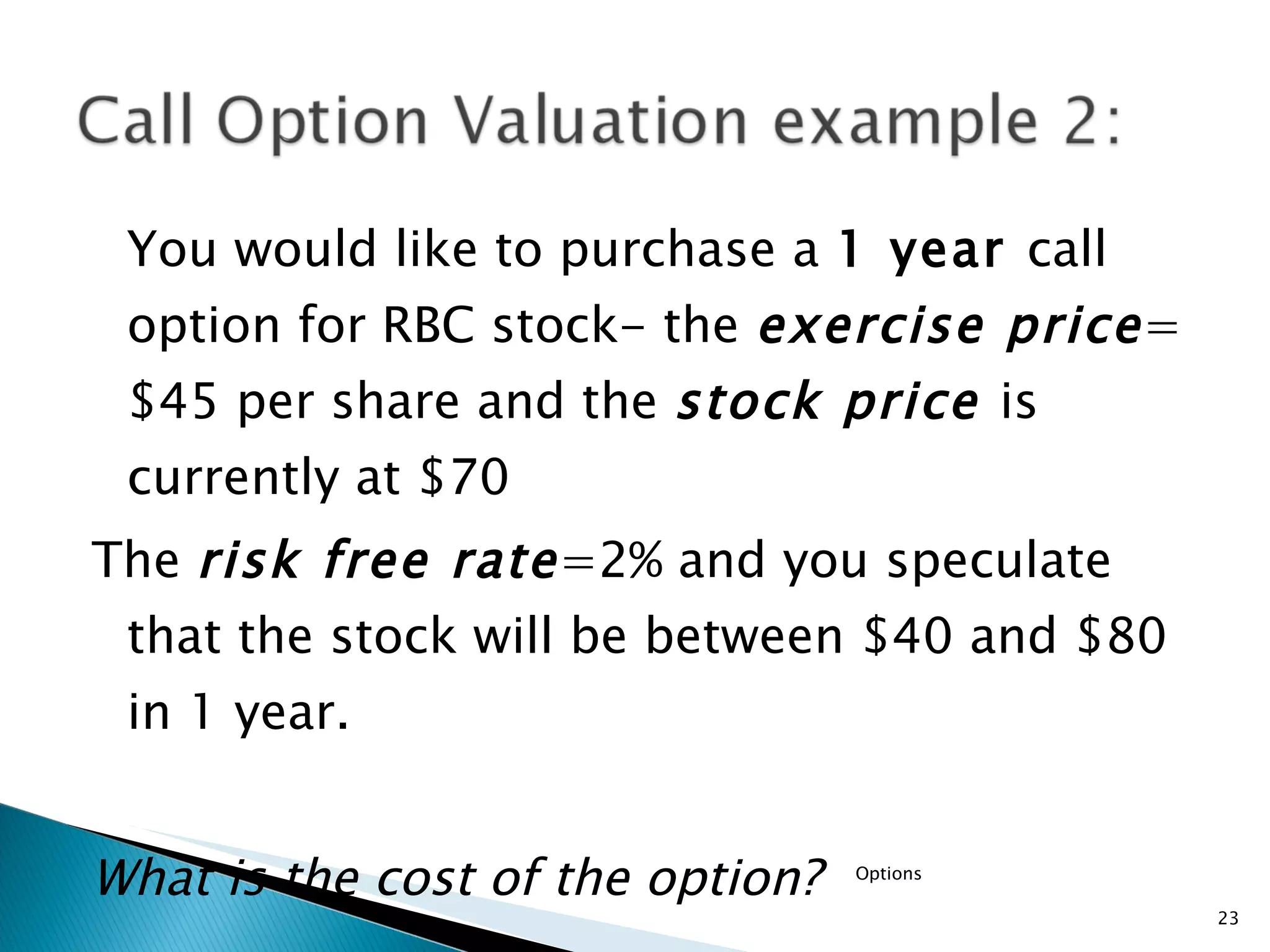

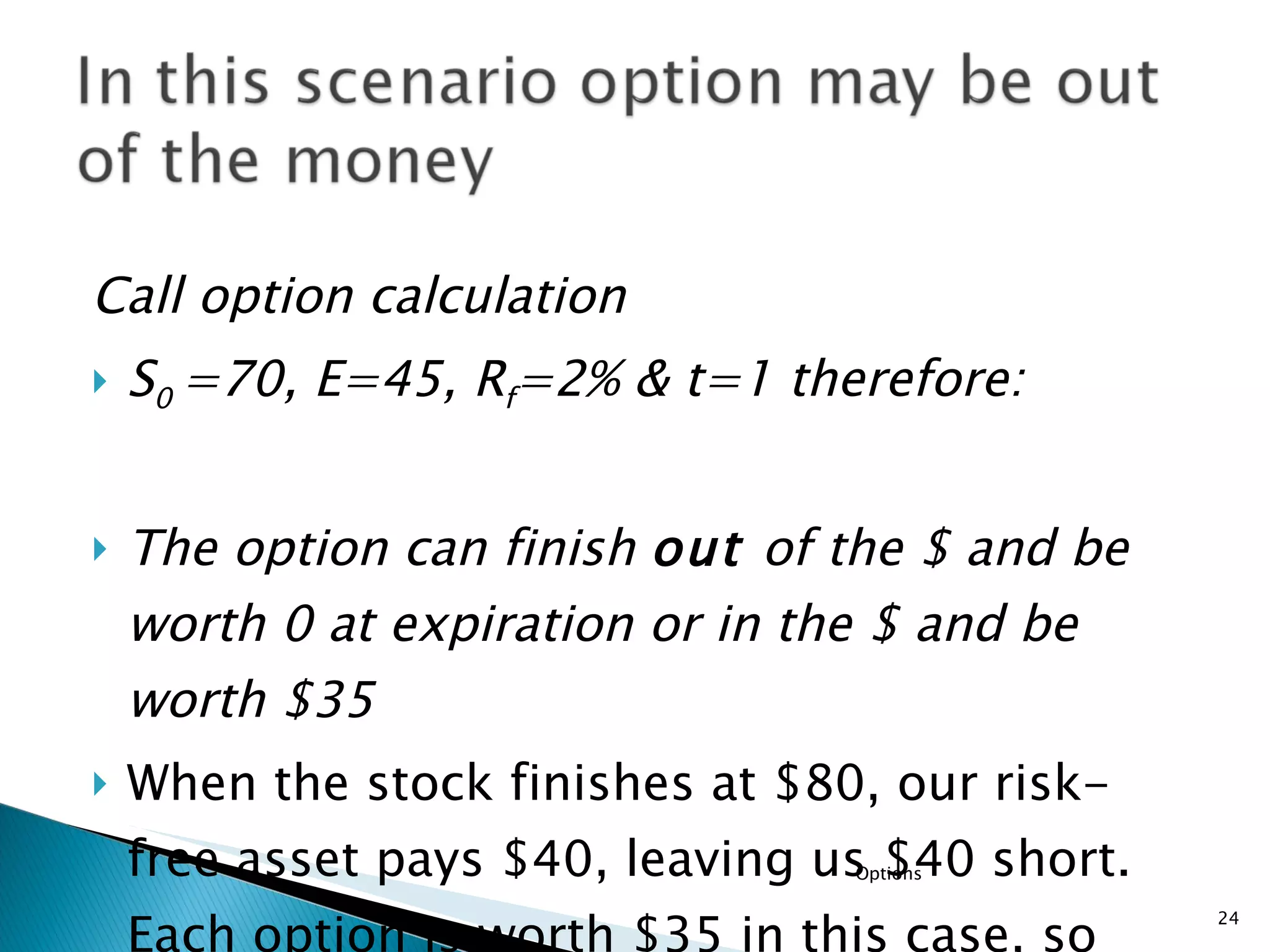

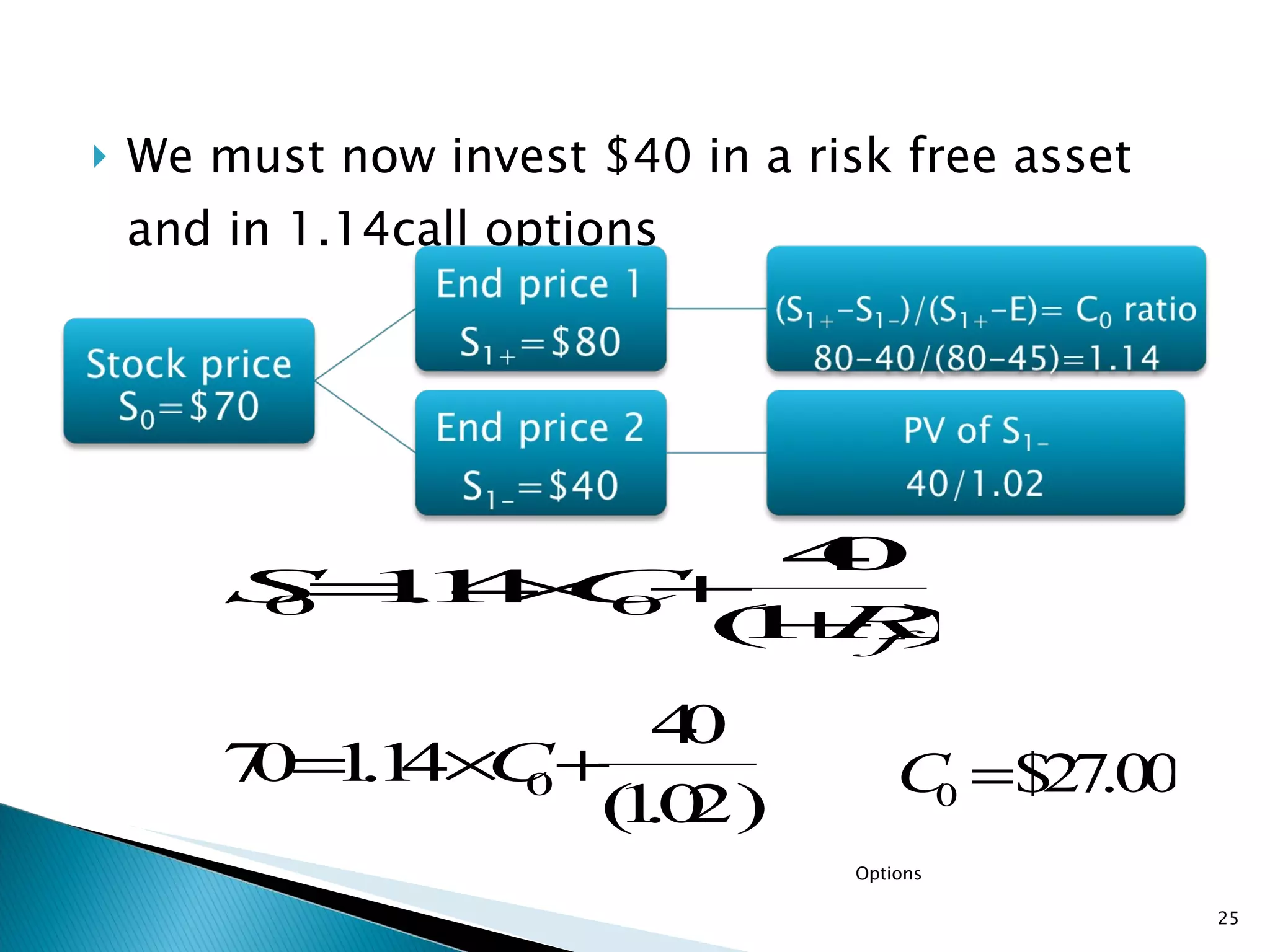

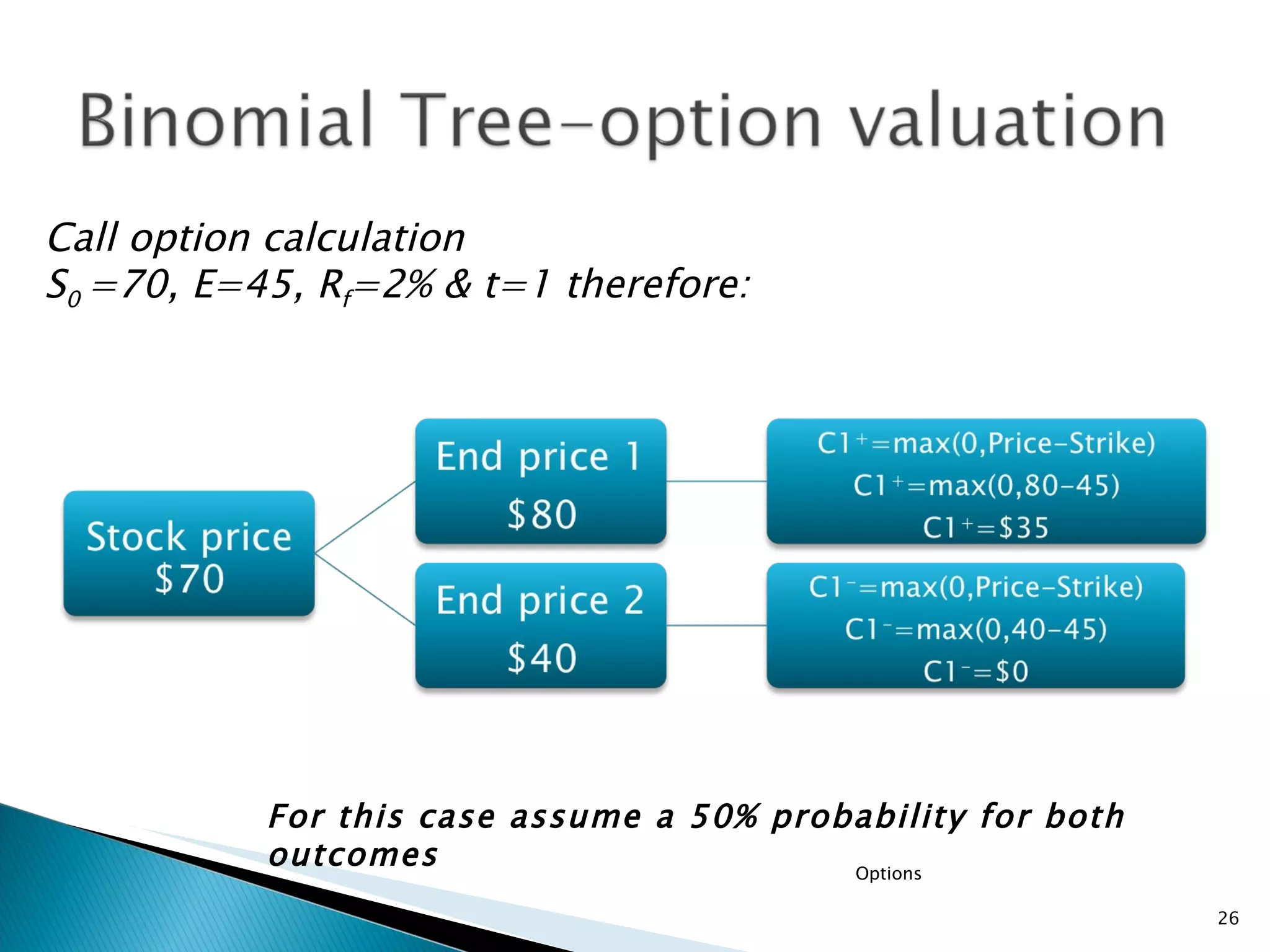

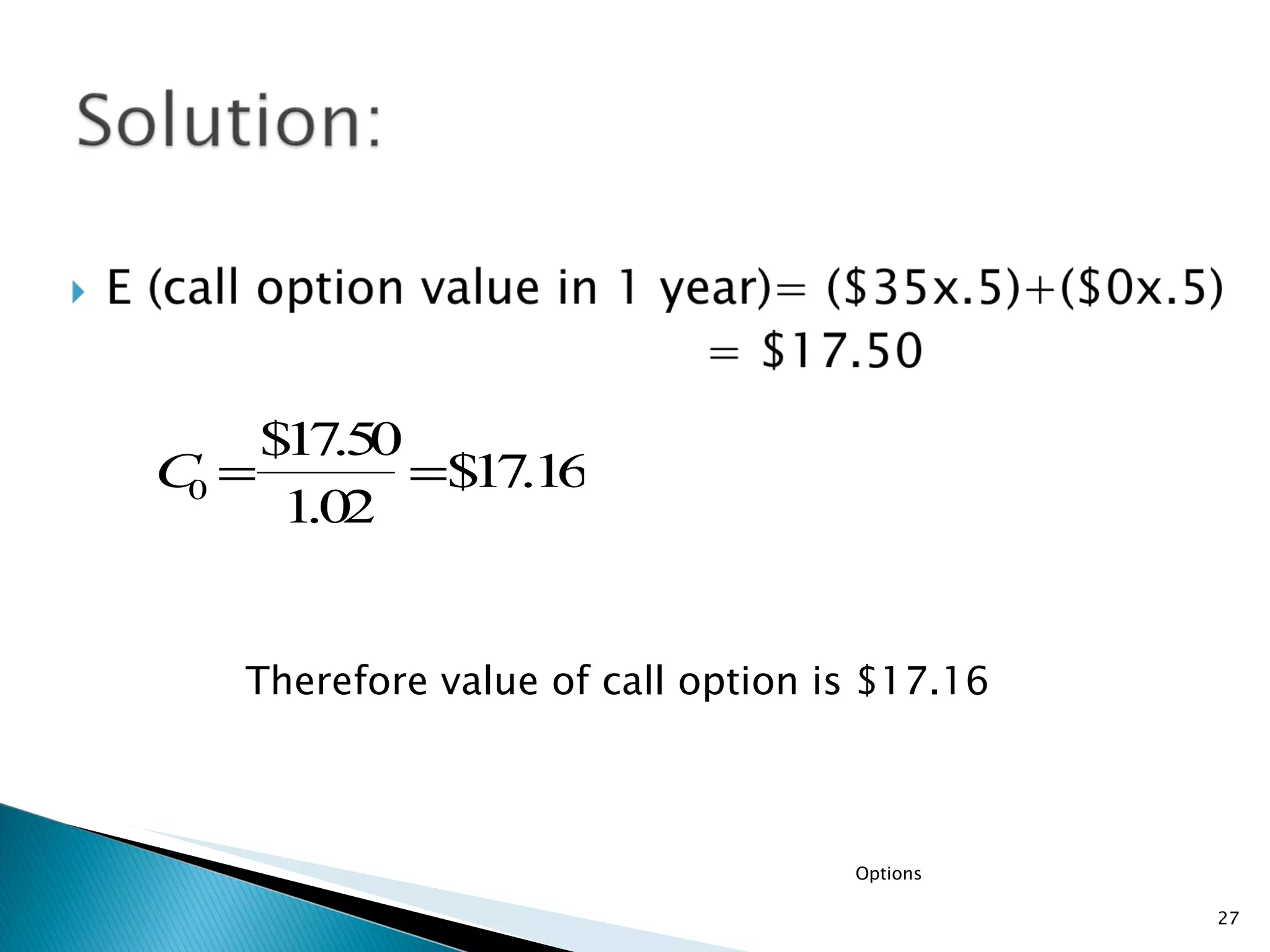

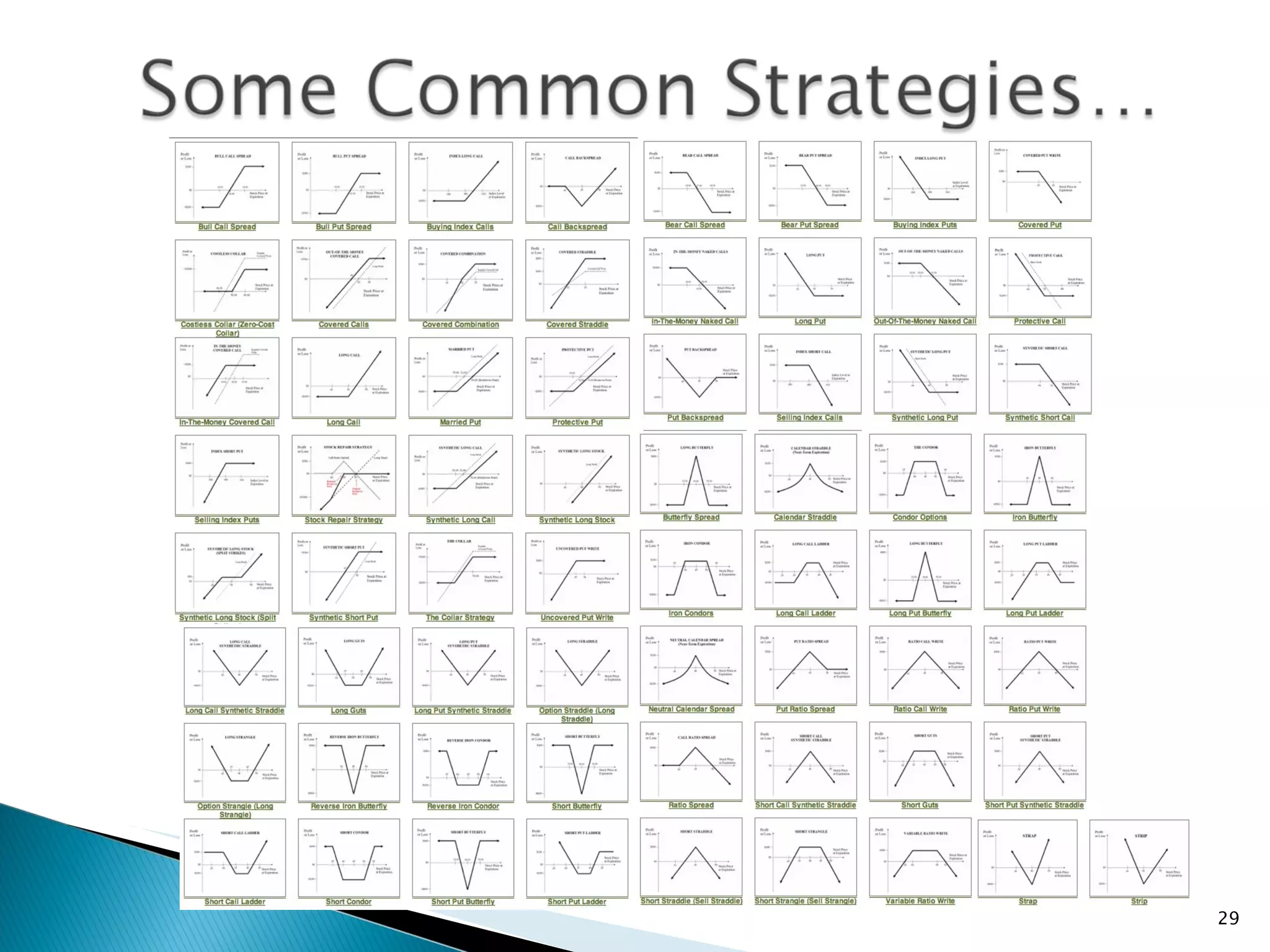

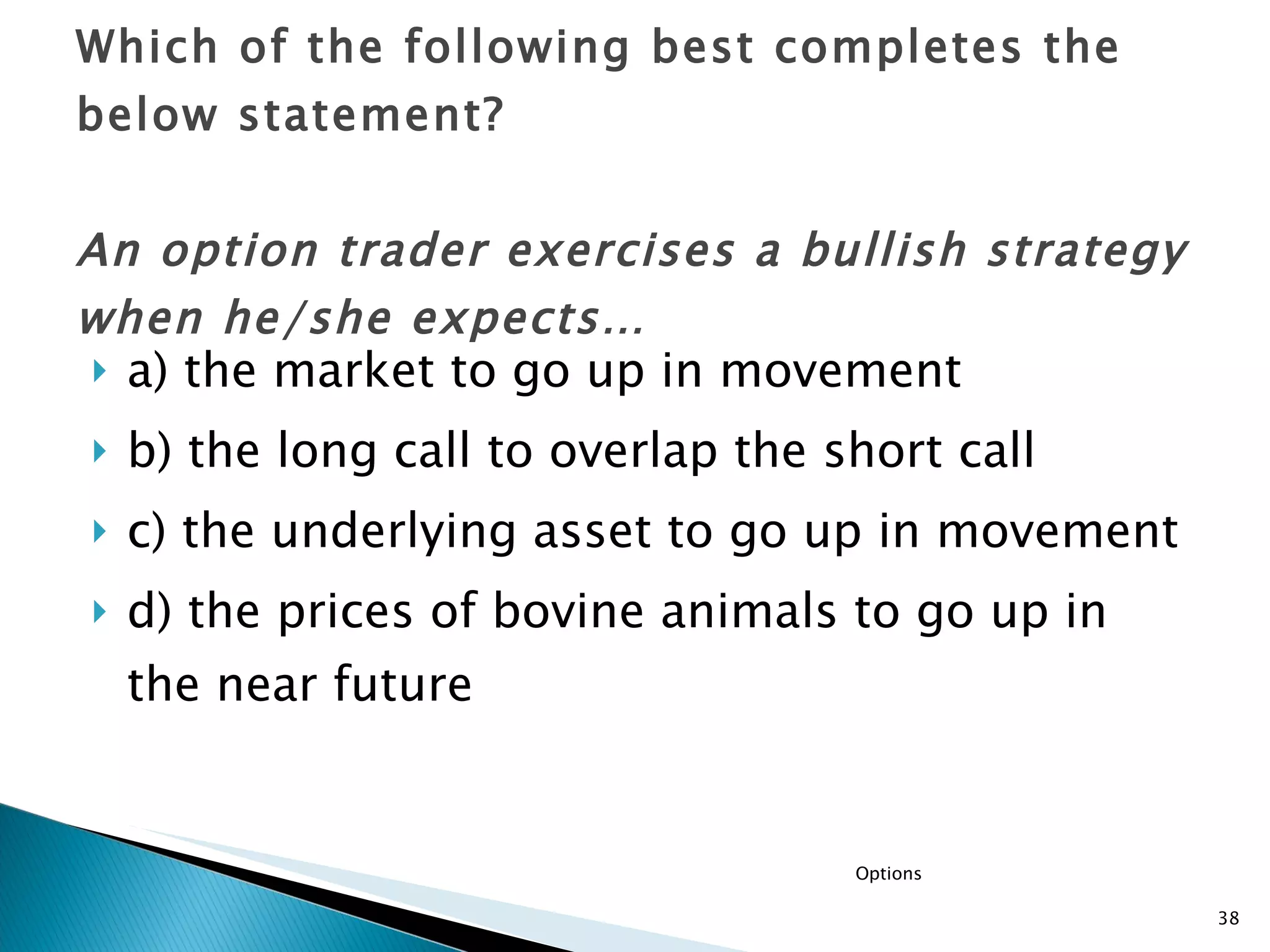

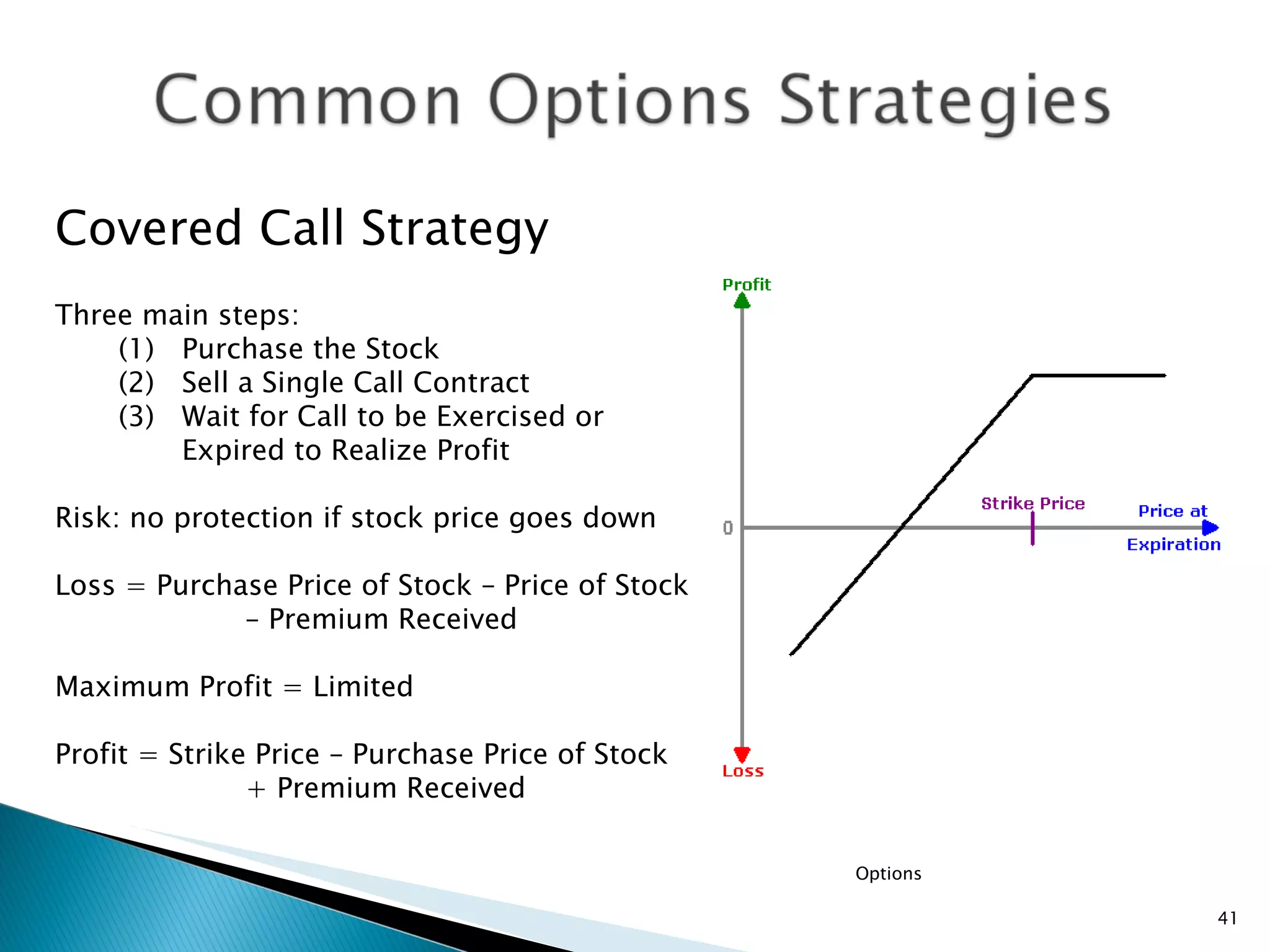

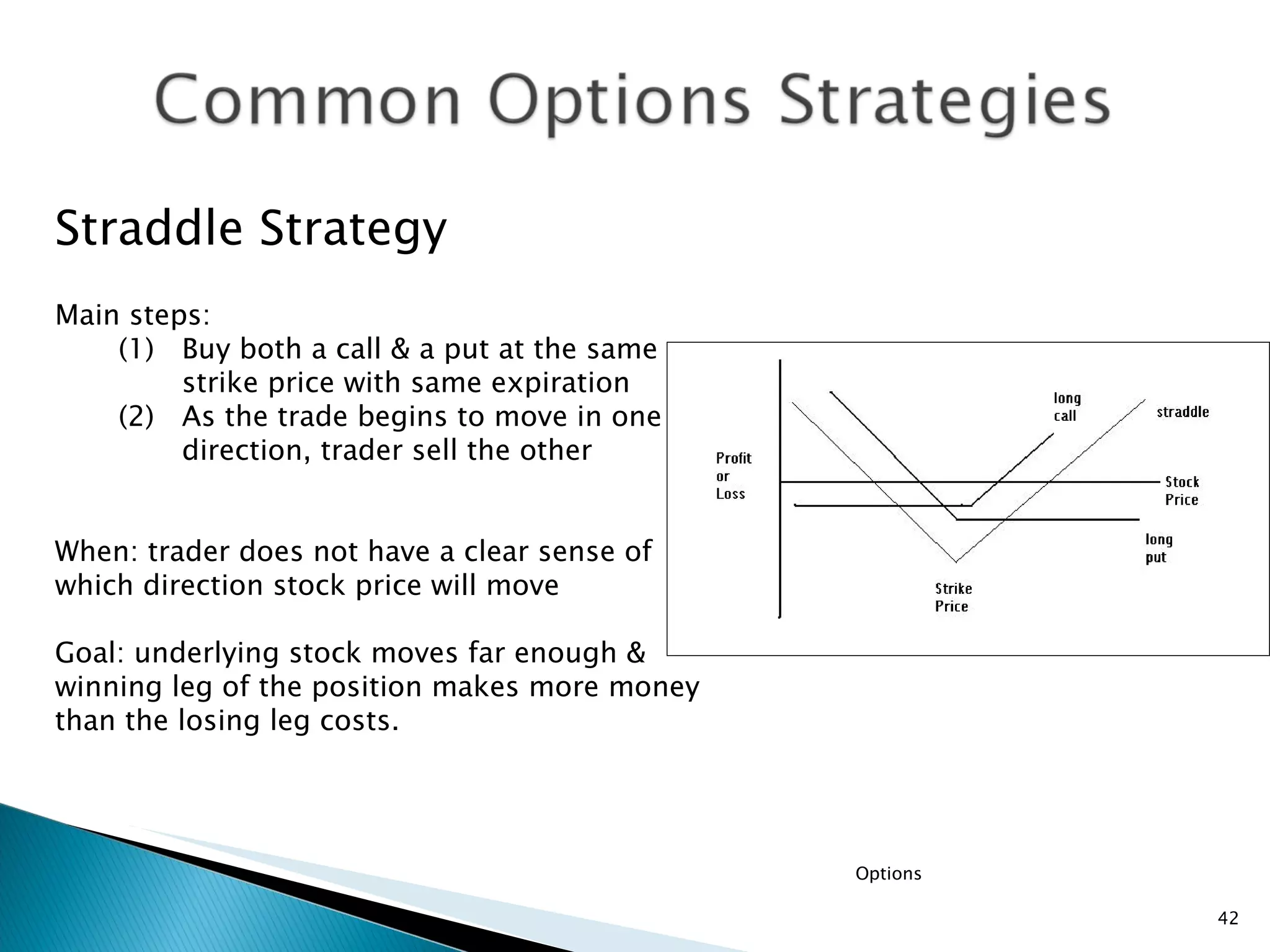

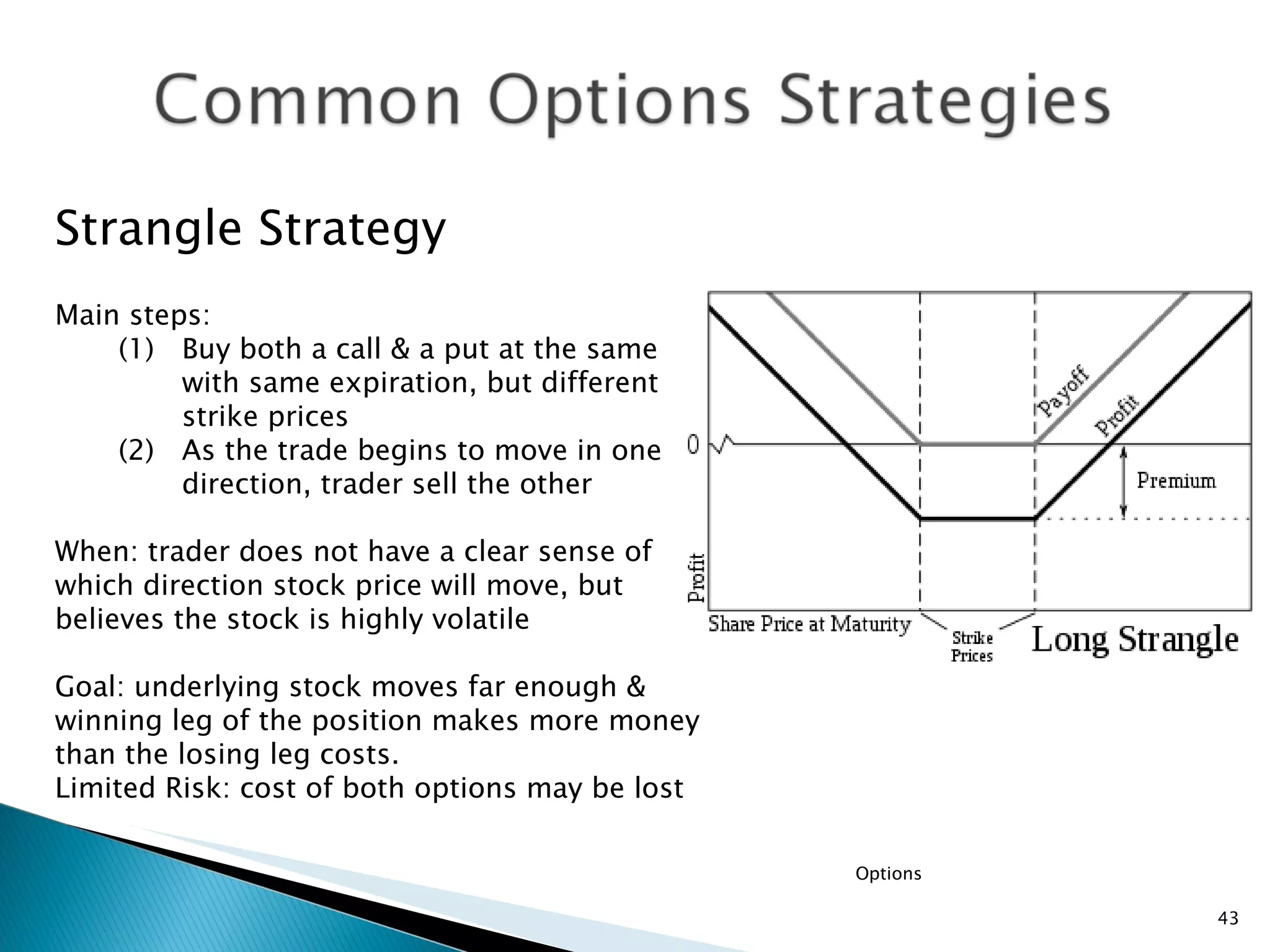

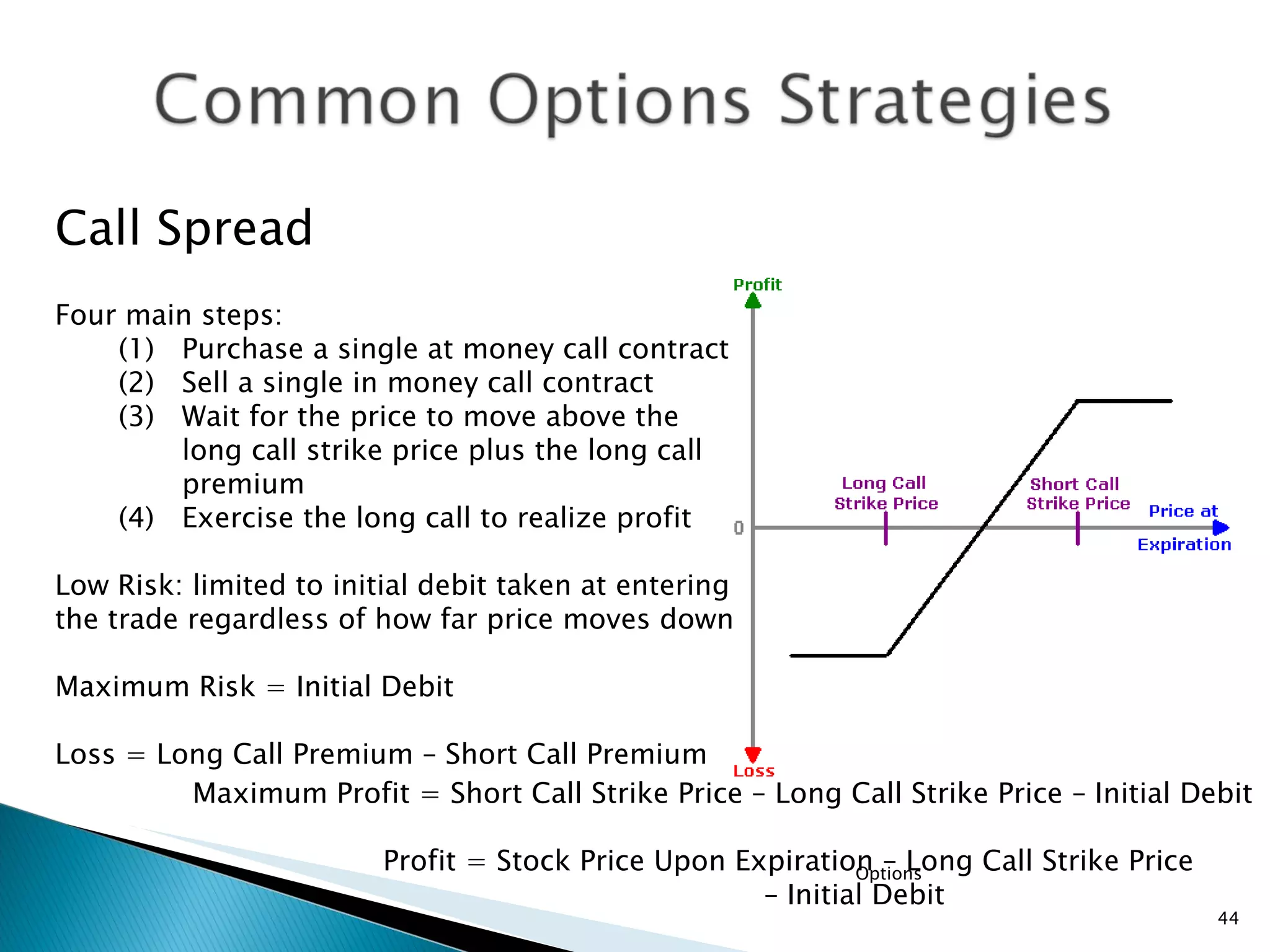

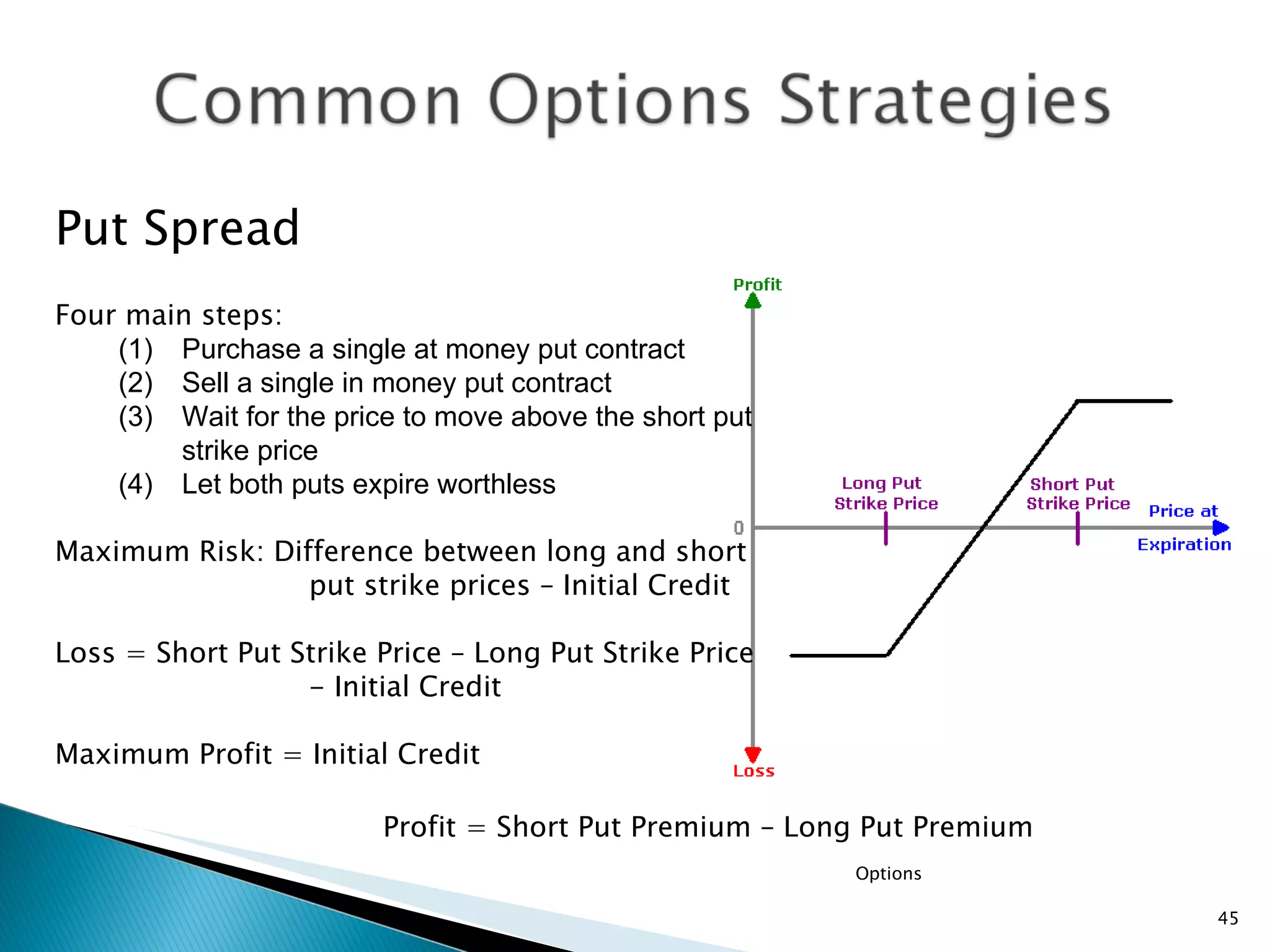

- Common valuation methods and strategies for options positions, including bullish, bearish, and neutral strategies.