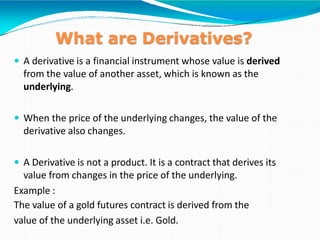

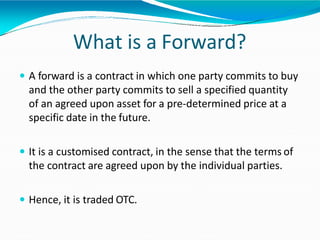

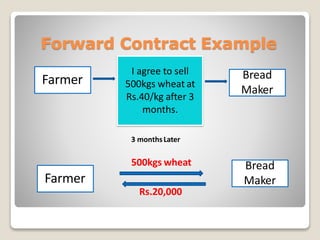

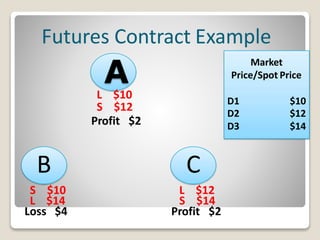

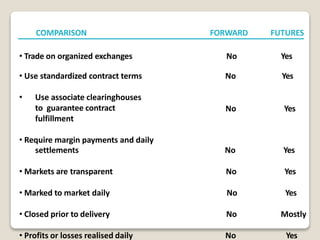

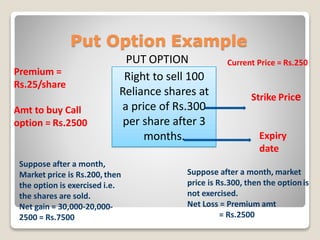

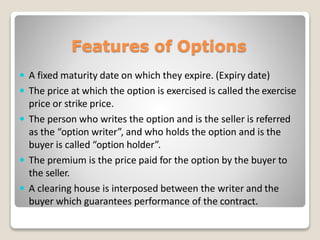

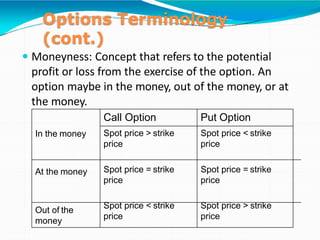

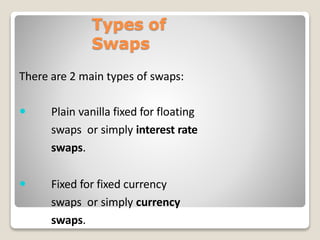

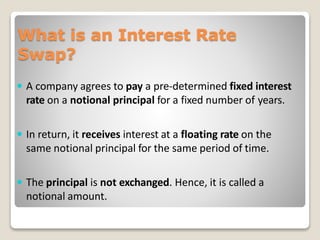

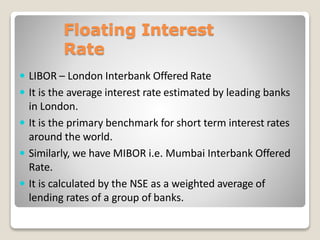

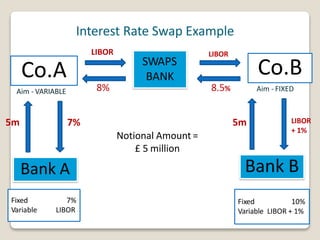

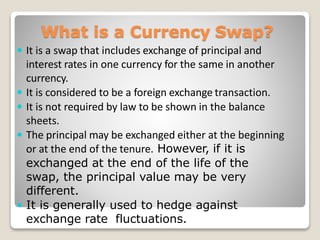

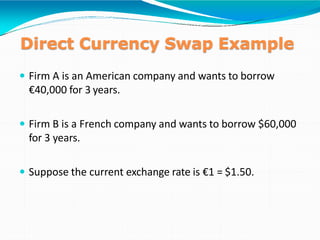

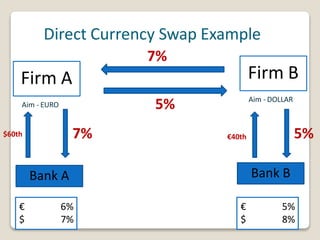

The document discusses various derivatives contracts including forwards, futures, options, swaps, and their key characteristics. A forward contract involves a customized, over-the-counter agreement to buy or sell an asset at a future date for a predetermined price. A future is a standardized forward contract traded on an exchange. Options provide the right but not obligation to buy or sell an asset. Swaps involve exchanging cash flows of different assets or currencies to hedge risks.