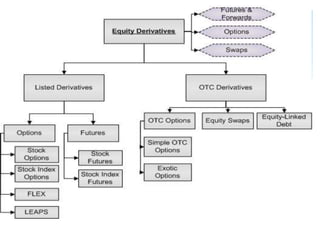

1. The document discusses various types of derivatives including equity derivatives, forwards, futures, options, swaps, and warrants.

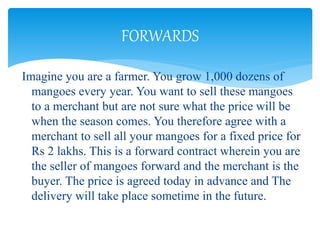

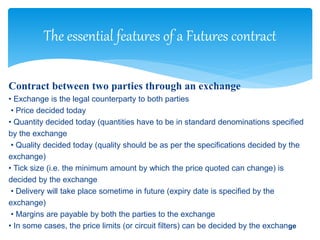

2. It explains the key features and differences between these derivatives, such as how forwards are customized contracts while futures are exchange-traded standardized contracts.

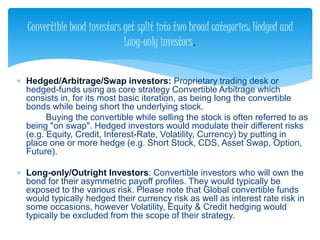

3. The roles of various participants in the derivatives markets are discussed, including hedgers who use derivatives to mitigate risk, speculators who take on risk to profit from price movements, and arbitrageurs who seek to profit from temporary price discrepancies.