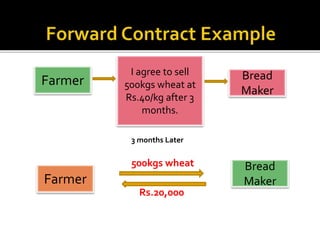

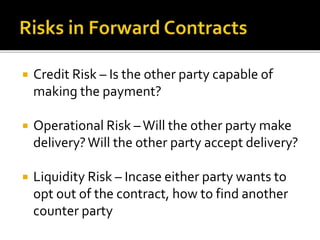

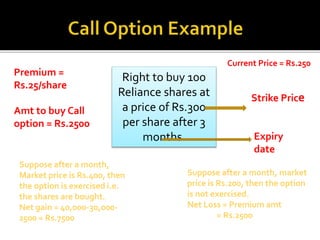

This document provides an overview of derivatives and the capital markets in India. It defines key terms like the primary and secondary markets, stock exchanges, indices, and types of derivatives like forwards, futures, options, and swaps. It describes the functions and objectives of derivatives for hedging risk and speculation. The history of derivatives trading in India is summarized, along with the major participants like hedgers, speculators, and arbitrageurs.