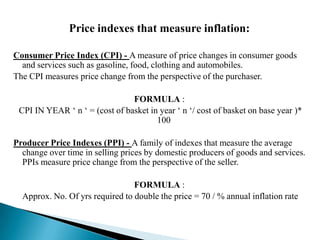

Inflation is defined as a sustained increase in prices for goods and services, measured as an annual percentage. It reduces purchasing power over time. Deflation is falling prices, while hyperinflation is very rapid inflation that can damage an economy. Stagflation combines inflation with high unemployment and stagnation. Demand-pull and cost-push inflation occur when demand outpaces supply or costs increase, respectively. Governments use fiscal and monetary policies like interest rates, budgets and currency supply to reduce aggregate demand and control inflation.