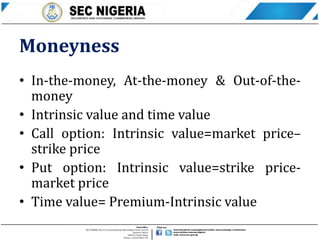

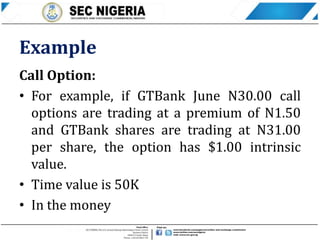

This document defines and explains options contracts. It discusses that an options contract is an agreement that gives the buyer the right, but not the obligation, to buy or sell an asset at a future date at an agreed upon price. It outlines key features of options contracts including the underlying instrument, contract size, premium, strike price, and expiration date. It also defines put and call options and discusses concepts like moneyness, intrinsic and time value, and examples of calculating these values. Finally, it covers advantages like making money and hedging risk, and disadvantages like options being a wasting asset and complexity.