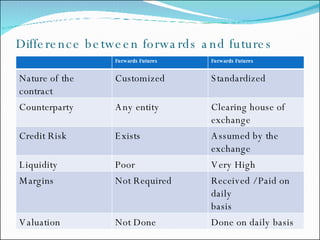

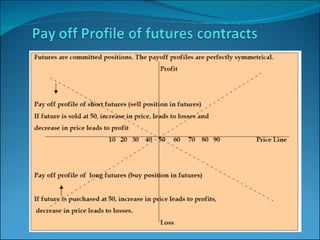

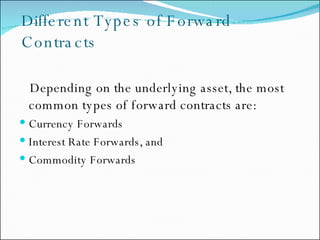

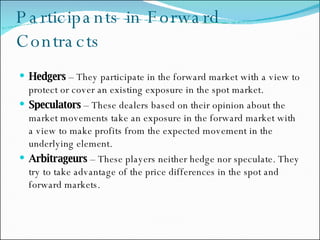

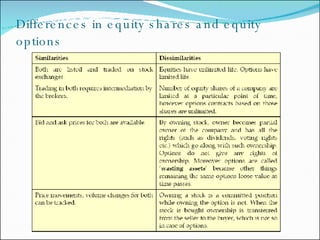

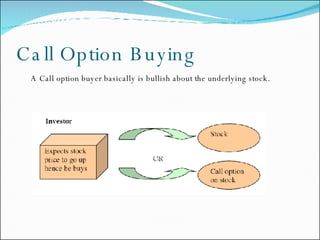

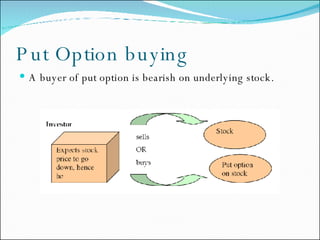

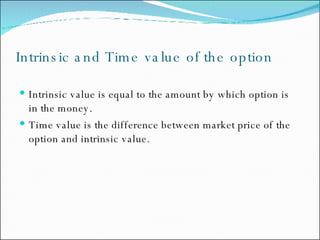

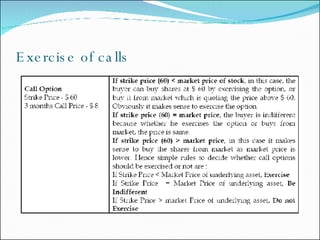

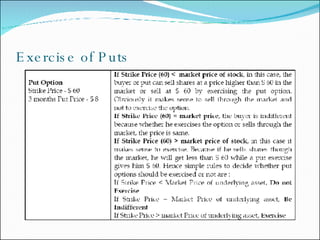

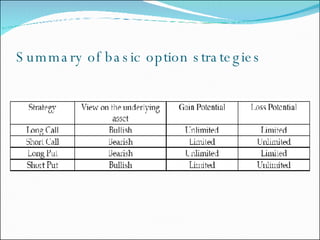

This document provides an introduction and overview of derivatives, including their history, types, and uses. It discusses futures, forwards, and options contracts. Futures are exchange-traded standardized contracts that require daily margin payments and settlement. Forwards are over-the-counter customized contracts that involve credit risk. Options provide the right but not obligation to buy or sell an underlying asset at a specified price on or before expiration. The document defines call and put options and explores factors that influence option pricing.