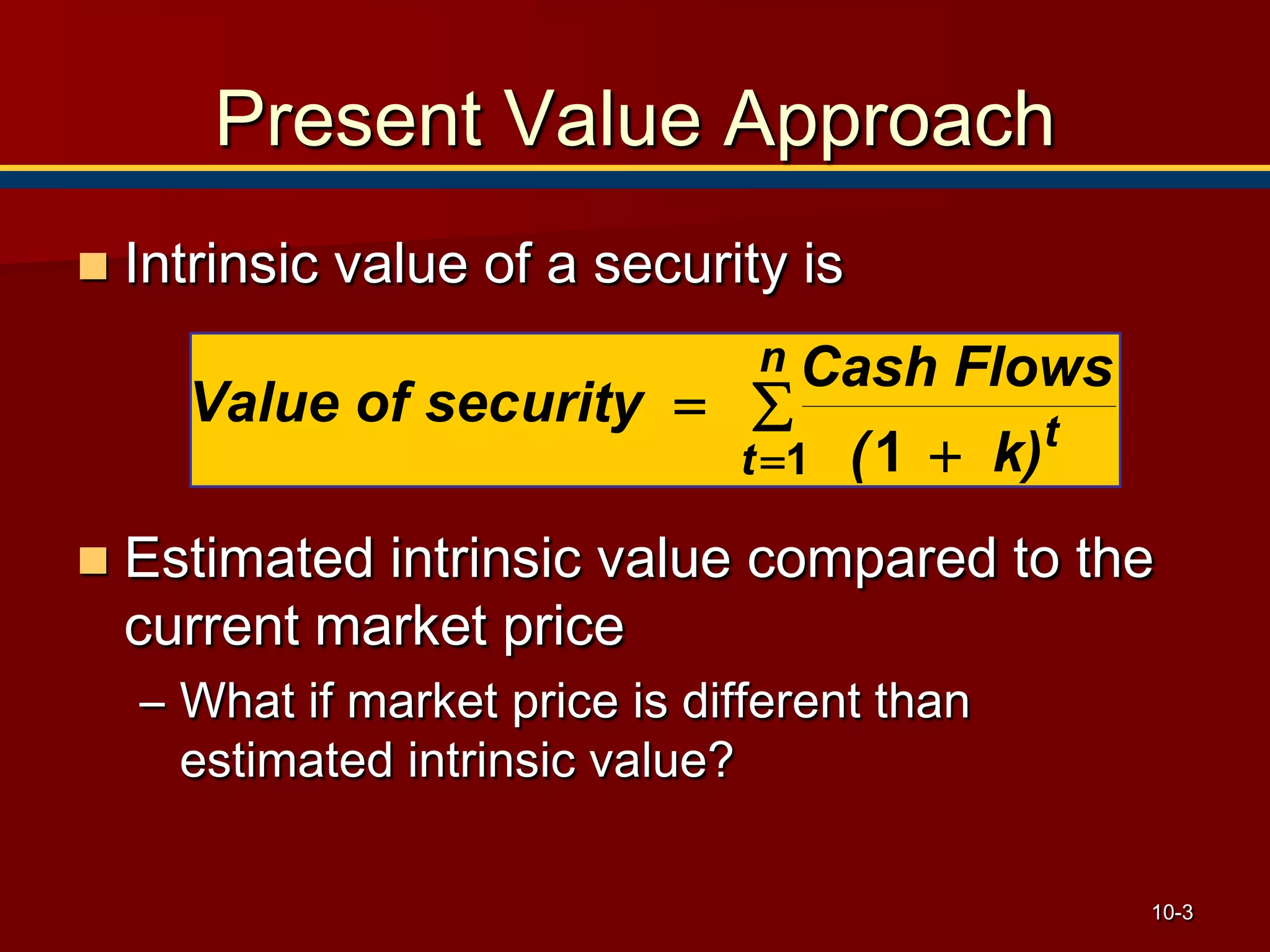

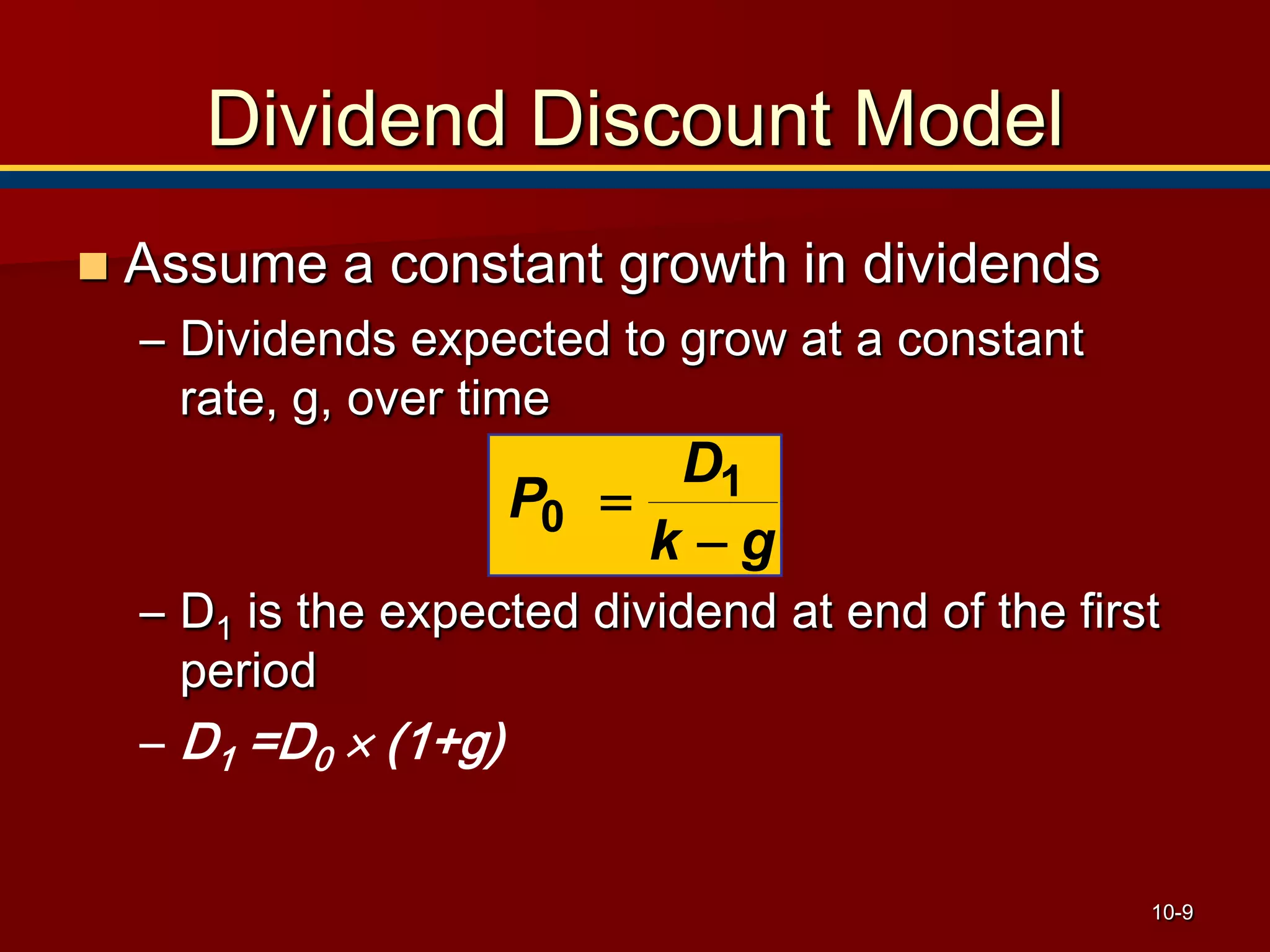

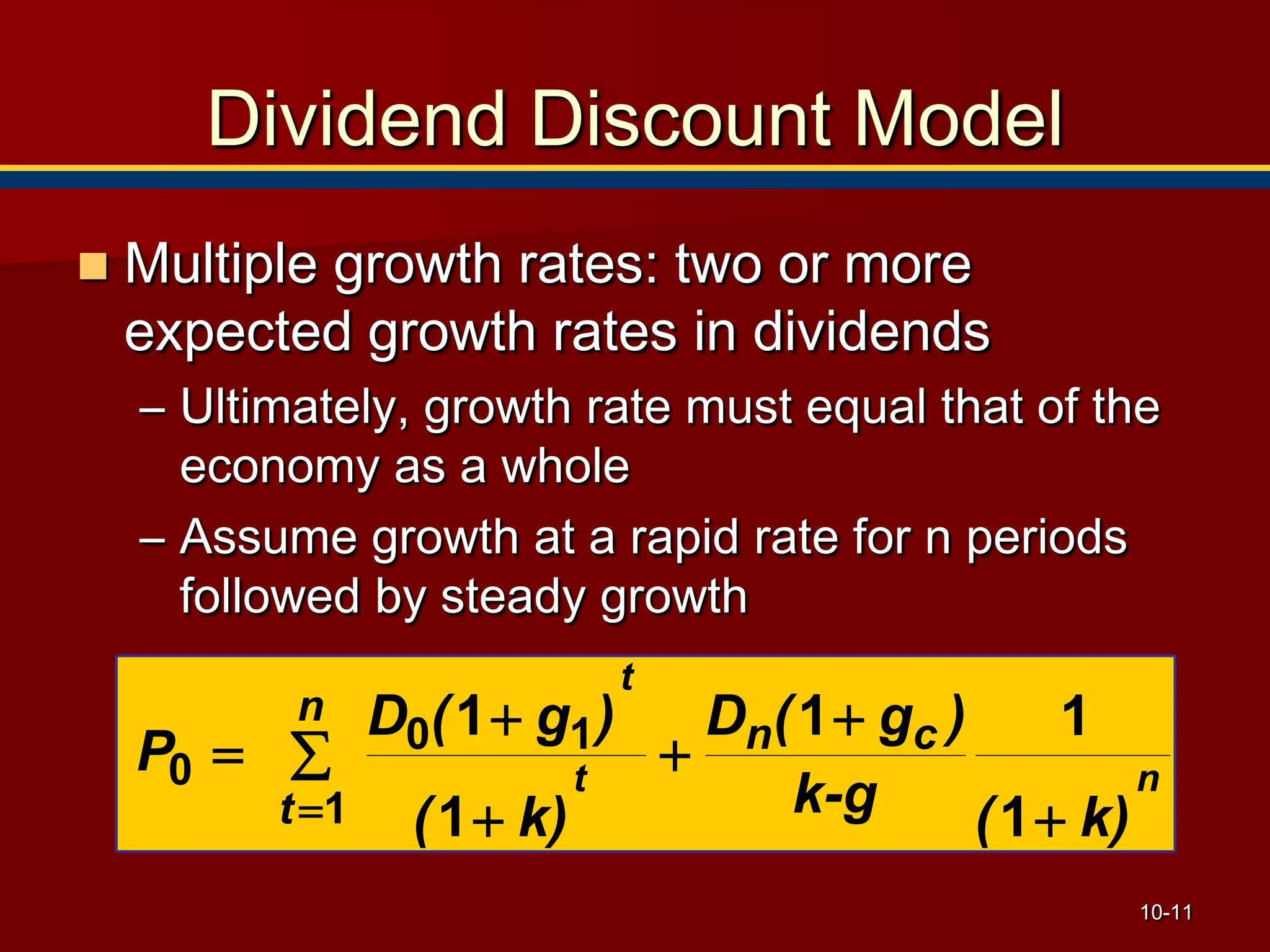

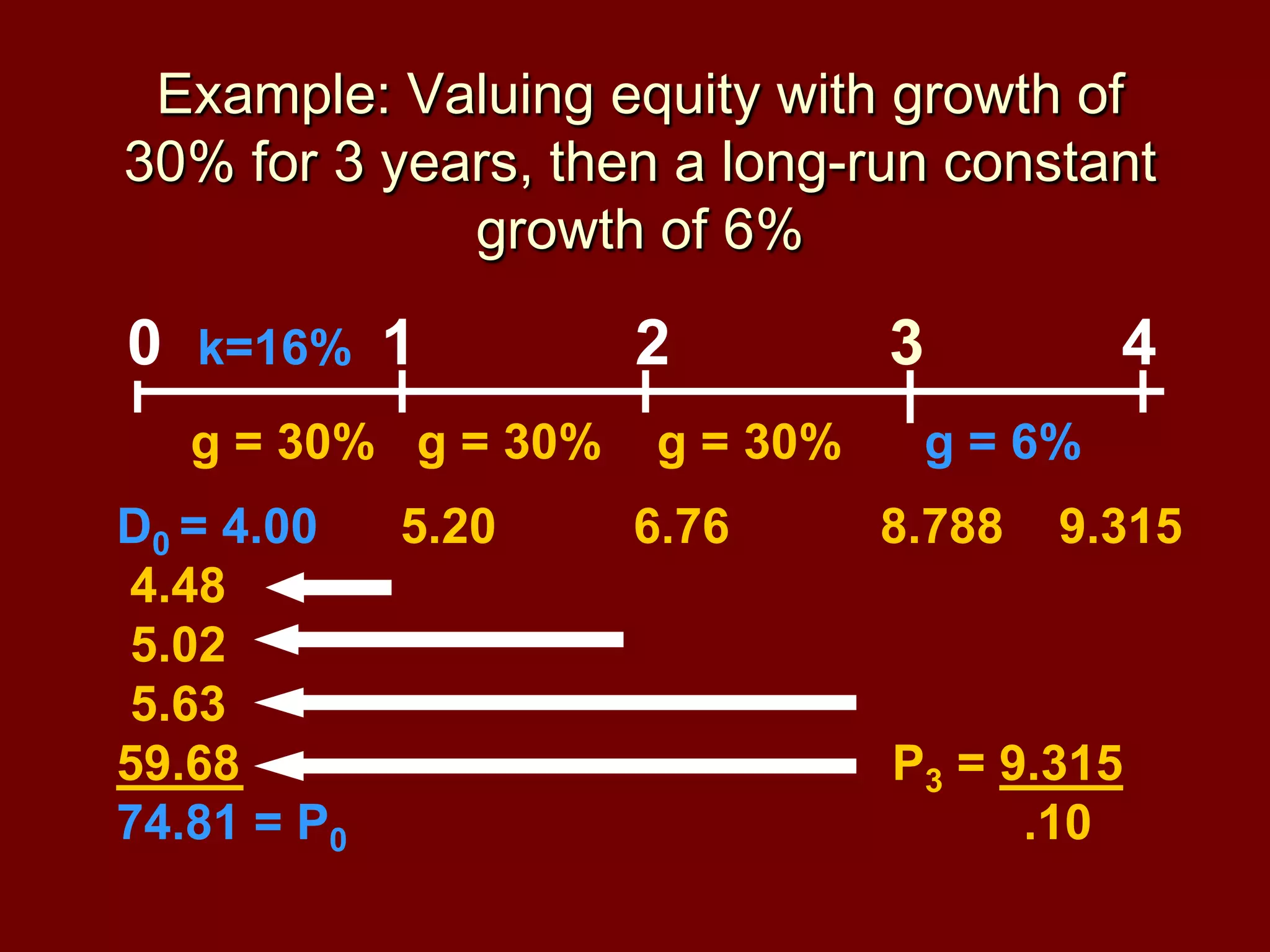

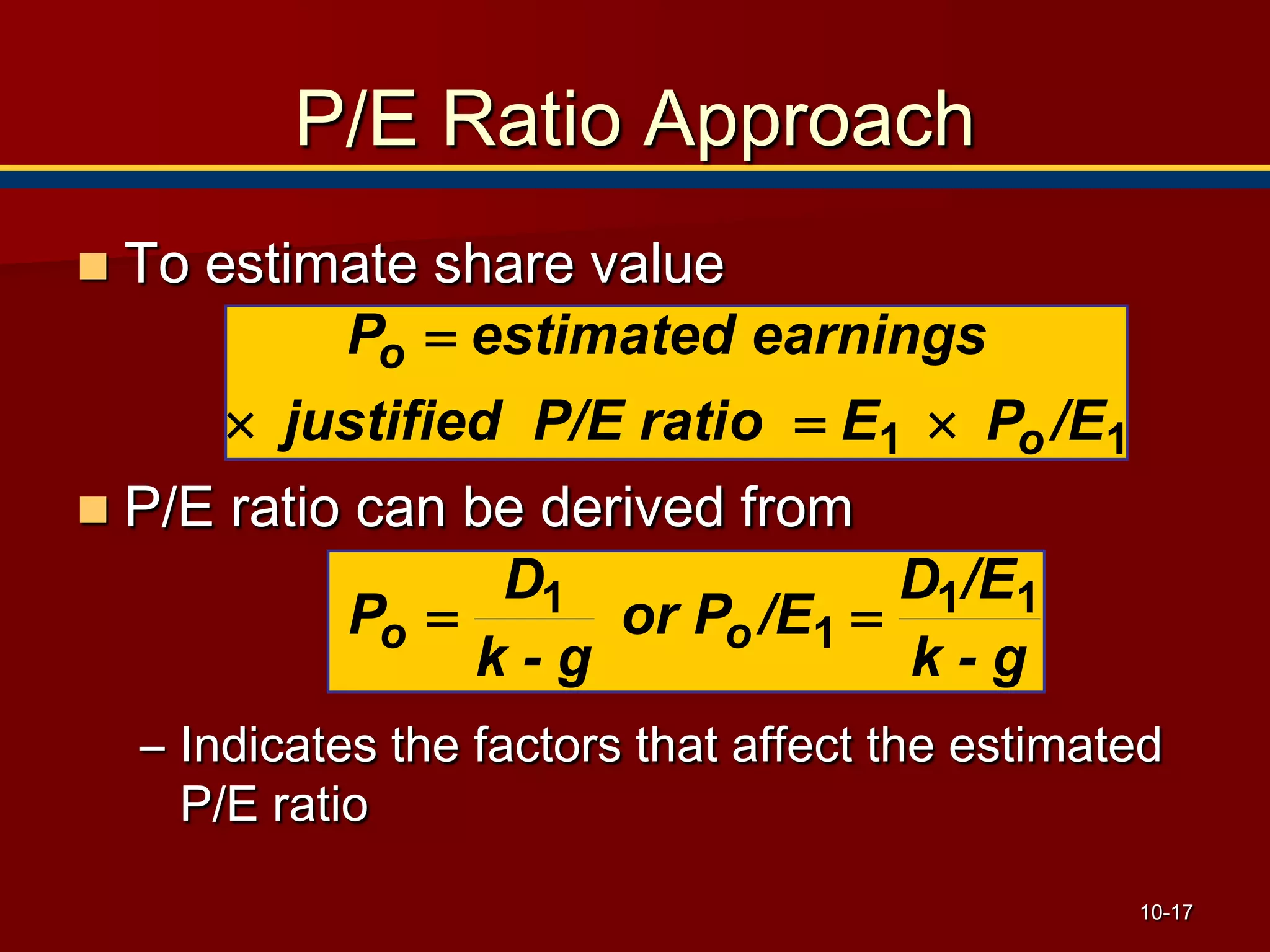

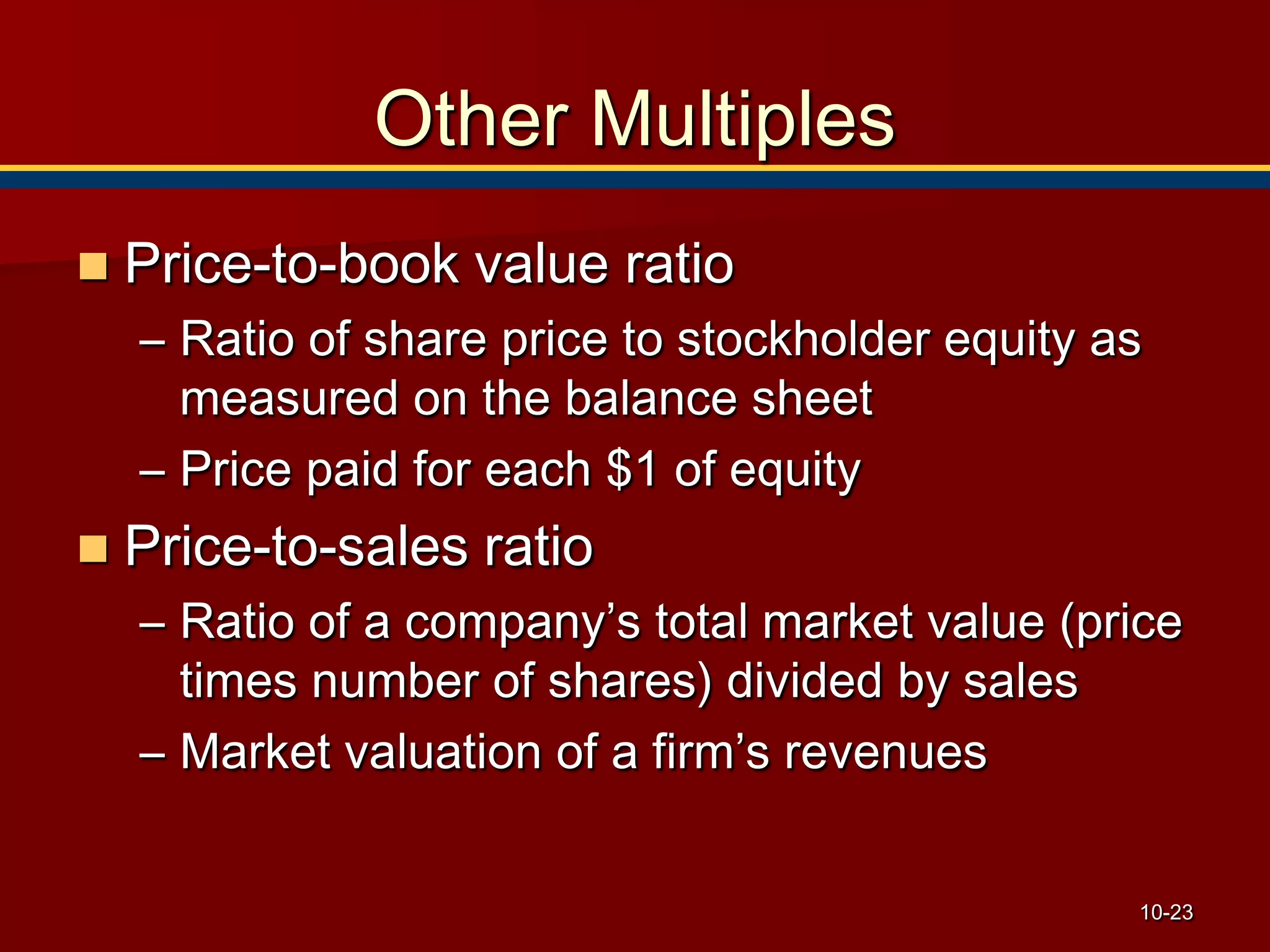

The document discusses common stock valuation methods, focusing on the present value approach and the price-to-earnings (P/E) ratio. It explains how to estimate the intrinsic value of a security based on expected cash flows and dividend discount models, considering growth rates and their implications for stock prices. Additionally, it highlights the relationship between P/E ratios, payout ratios, and required rates of return, emphasizing the importance of estimating future dividends and their impact on valuation.