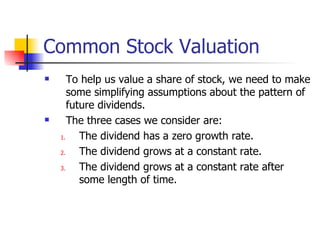

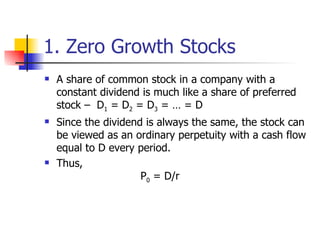

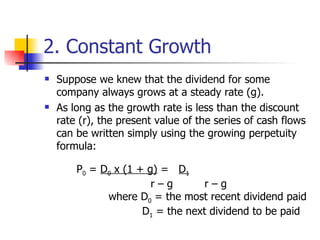

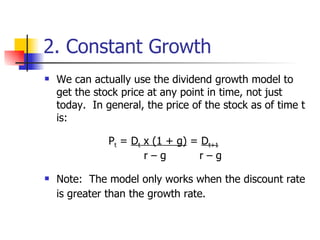

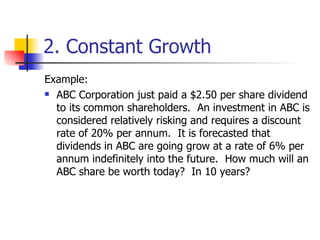

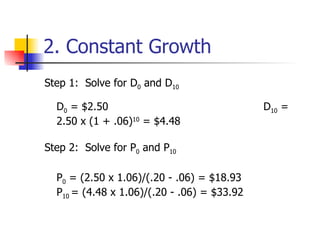

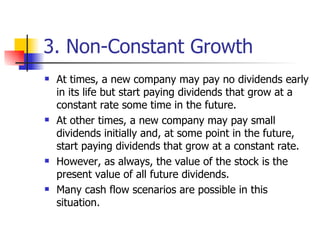

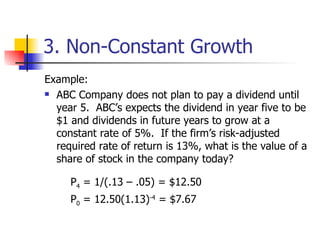

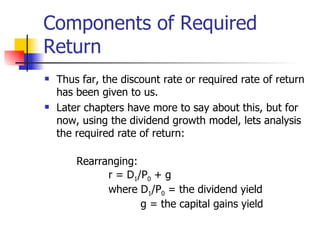

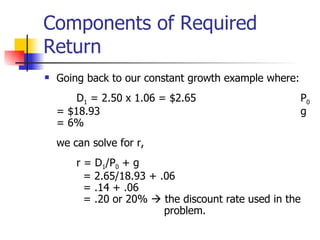

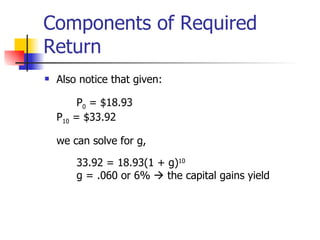

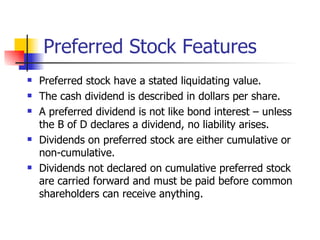

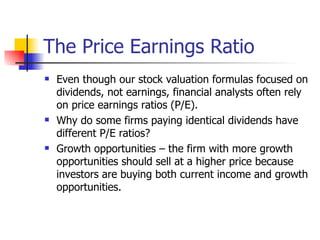

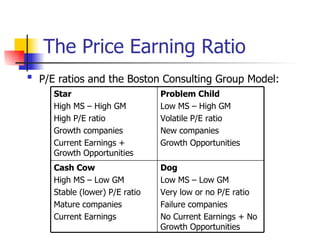

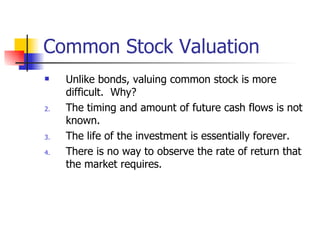

The document discusses various methods for valuing common stock, including calculating the present value of future dividends using the dividend discount model. It outlines three cases for the pattern of future dividends: zero growth, constant growth, and non-constant growth. Key valuation formulas and an example are provided. Additional stock features and components of the required return such as the dividend yield and capital gains yield are also examined.

![Common Stock Valuation One method to determine the price of a share of stock is to calculate present value of all future dividends. P 0 = Σ [D t /(1 + r) t ] where t = 1 to ∞ How many future dividends are there? In principle, there can be an infinite number.](https://image.slidesharecdn.com/stockvaluation-100903093157-phpapp01/85/Stock-Valuation-3-320.jpg)