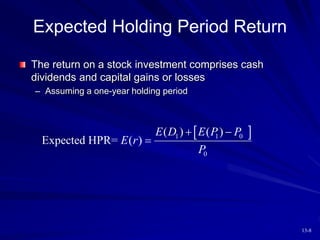

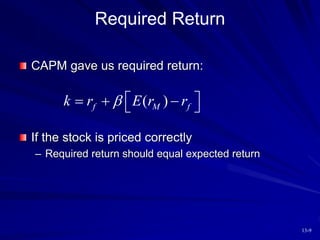

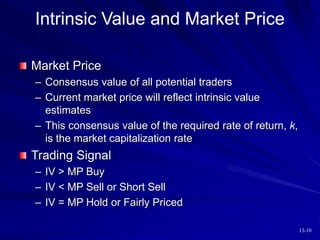

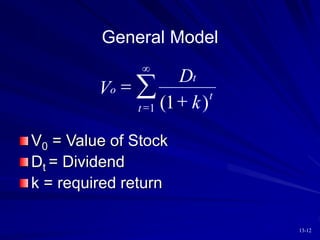

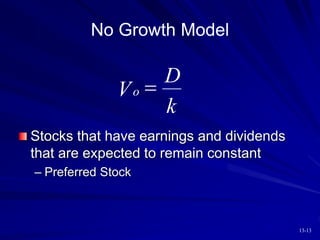

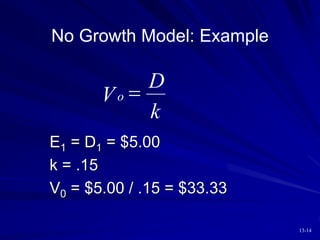

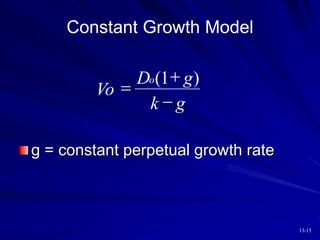

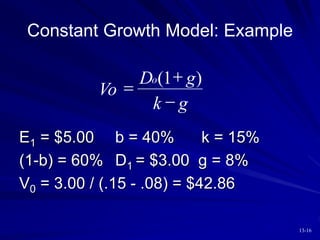

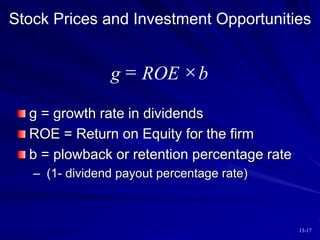

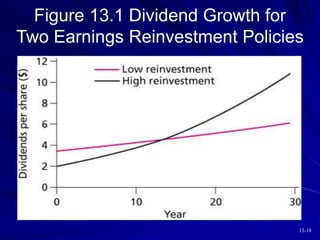

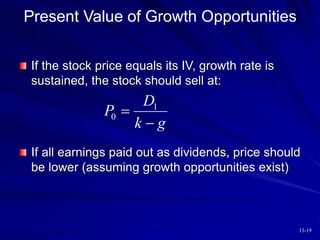

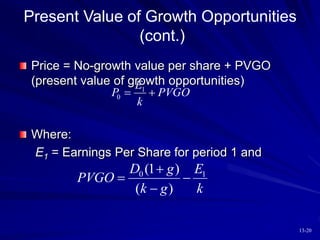

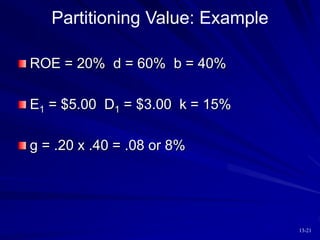

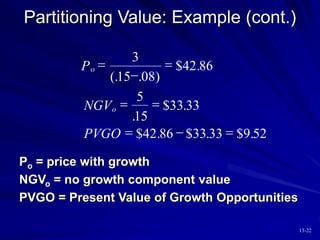

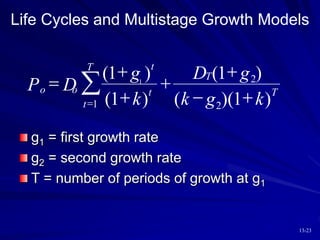

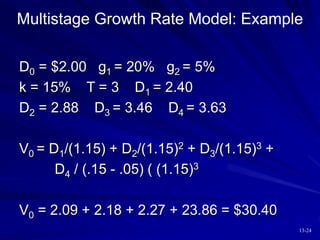

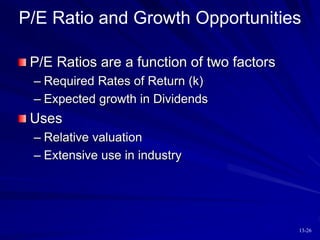

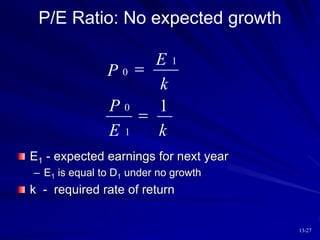

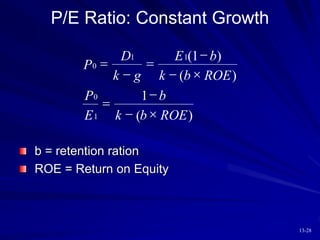

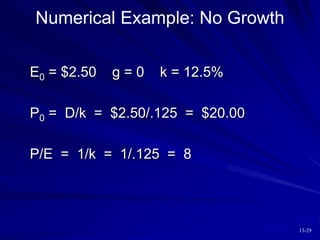

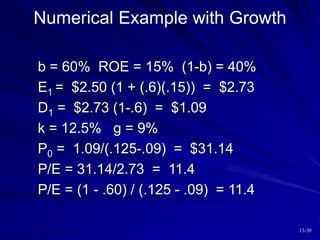

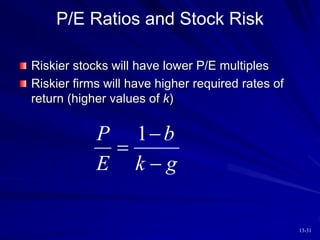

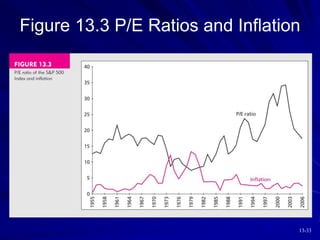

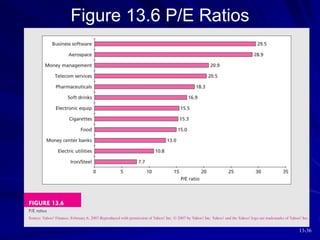

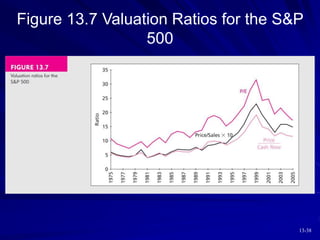

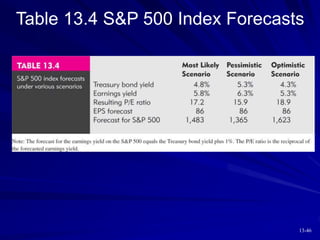

This document discusses various models for valuing equity, including balance sheet models, dividend discount models, and price/earnings ratios. It describes the constant growth model and multi-stage growth models in detail. It also discusses using free cash flow approaches and comparing intrinsic value to market price. Overall, the document provides an overview of fundamental approaches to valuing stocks.