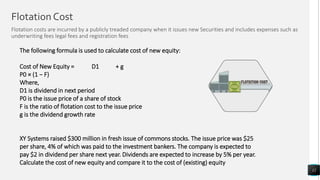

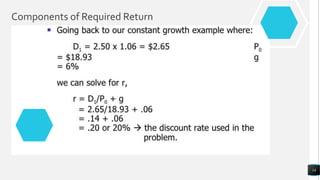

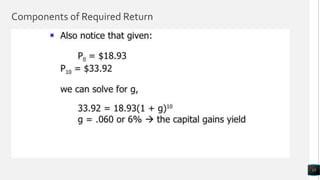

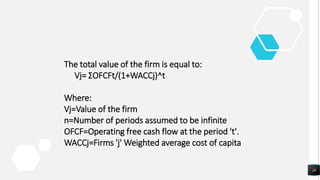

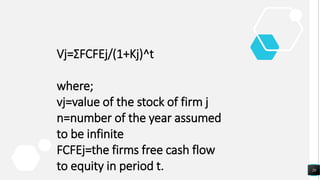

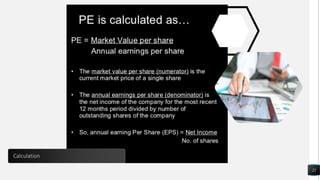

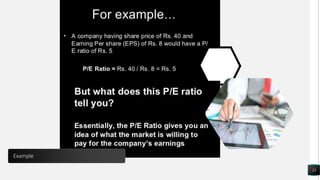

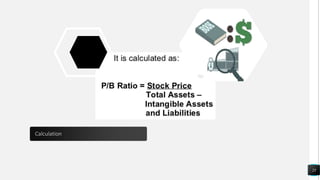

The document discusses stock valuation methods, emphasizing the complexities of evaluating common stocks compared to bonds due to uncertain future cash flows and perpetual investment life. It outlines key concepts such as the zero growth model, constant growth model, and the impact of retained earnings, flotation costs, and various financial ratios on stock valuation. Additionally, it explains the importance of understanding shareholder rights and the implications of different classes of common stock on corporate control.