This document discusses various methods for valuing common stock, including:

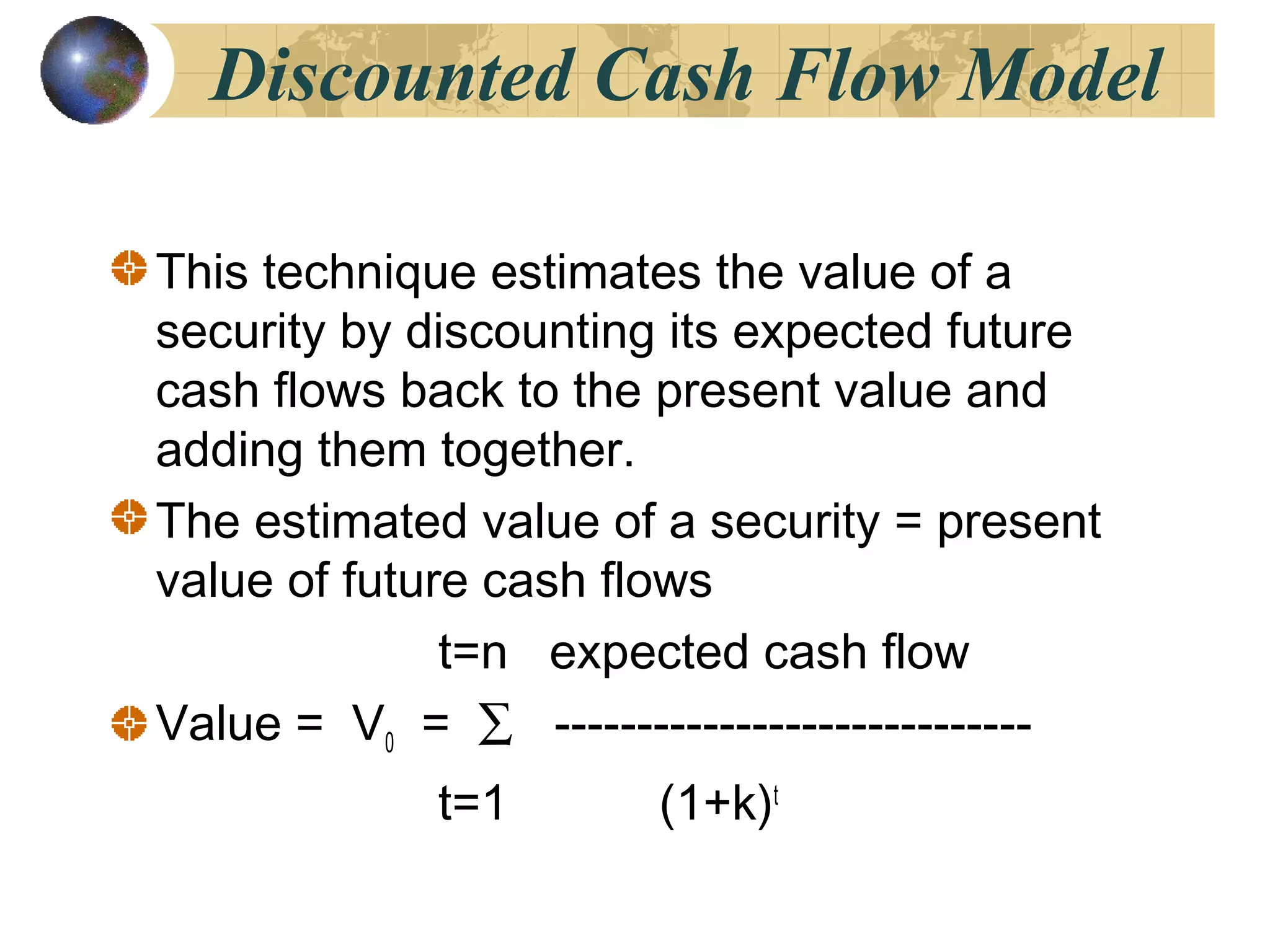

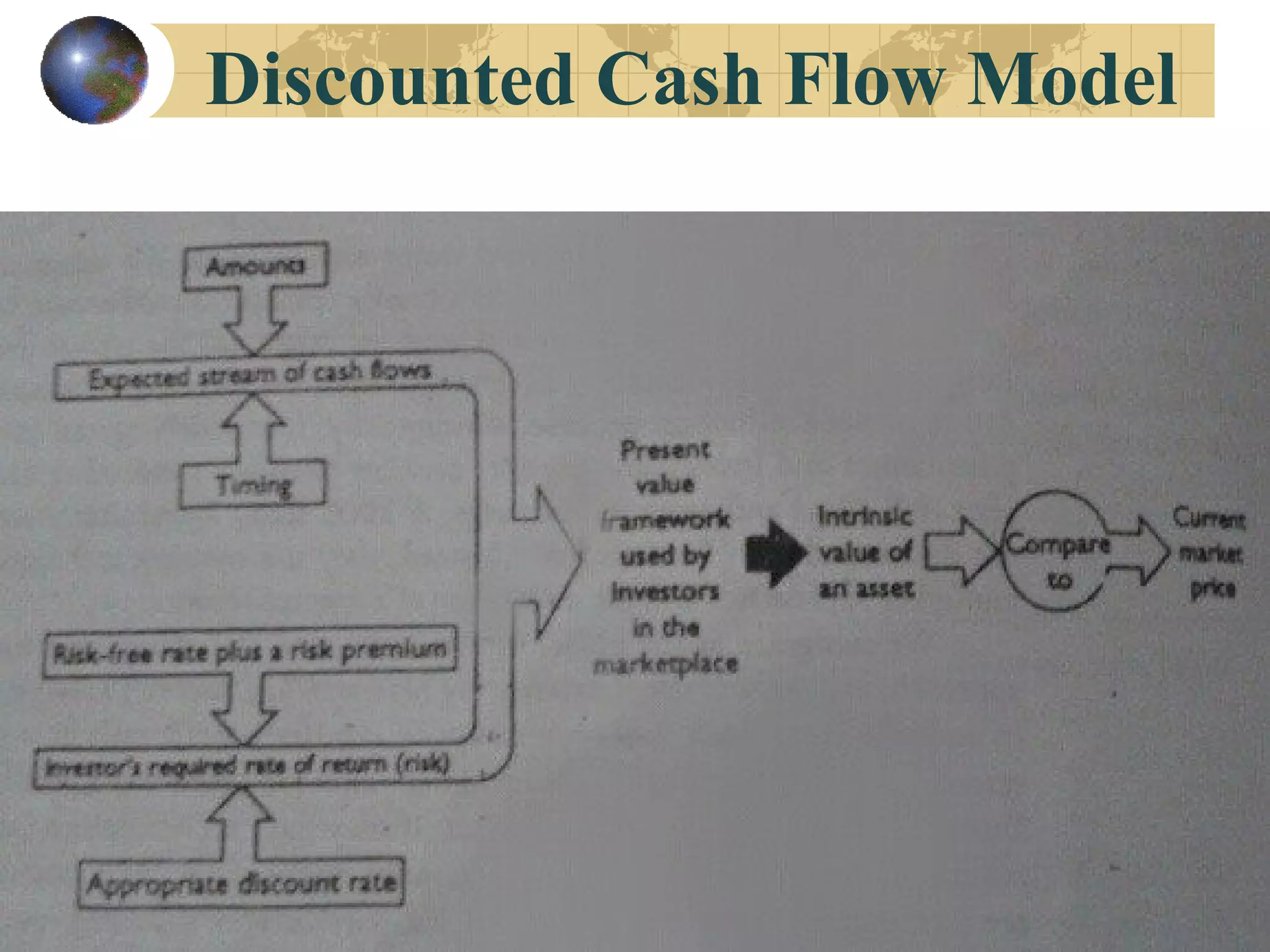

1. The discounted cash flow model, which values a stock based on the present value of its expected future cash flows.

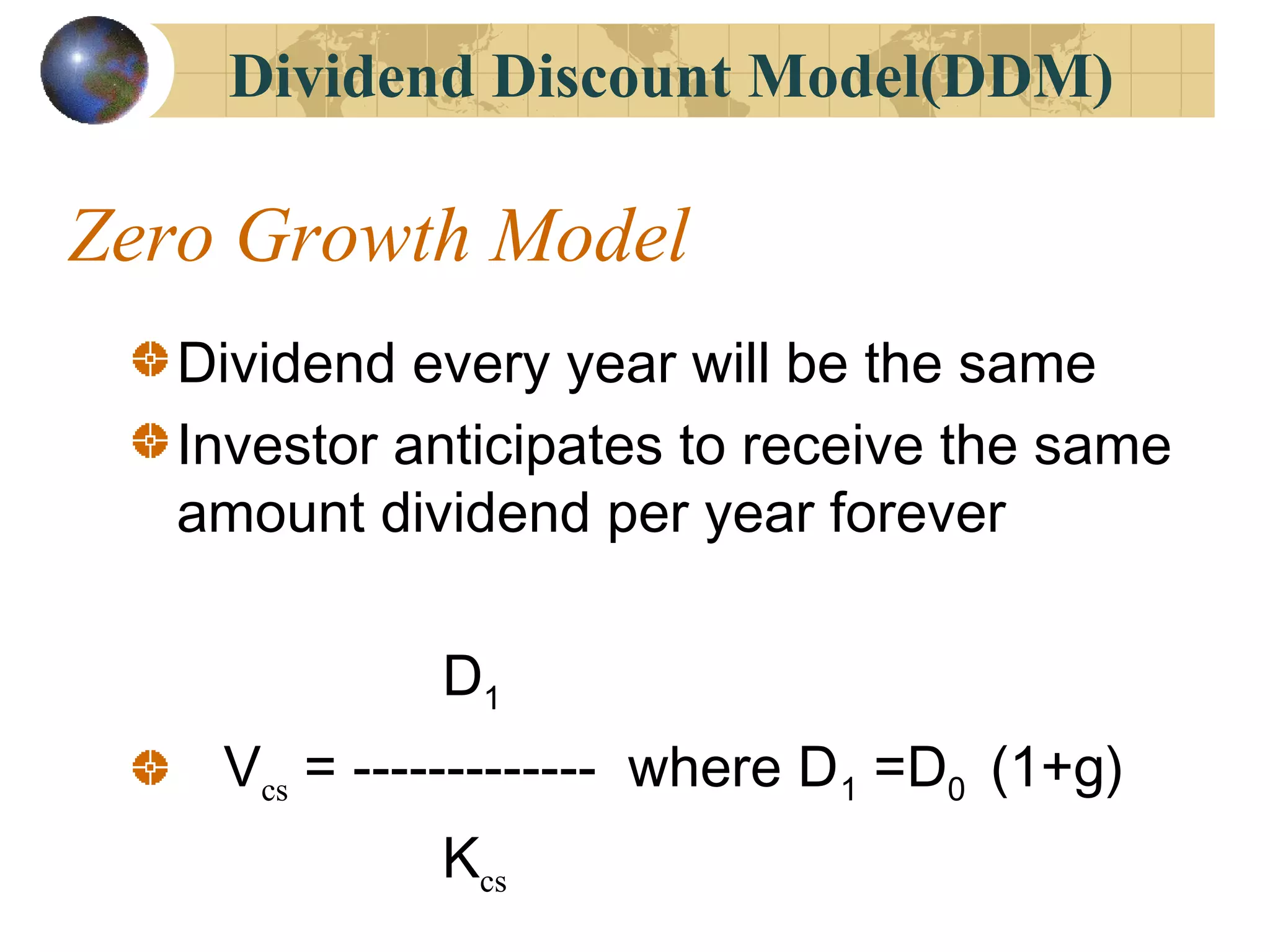

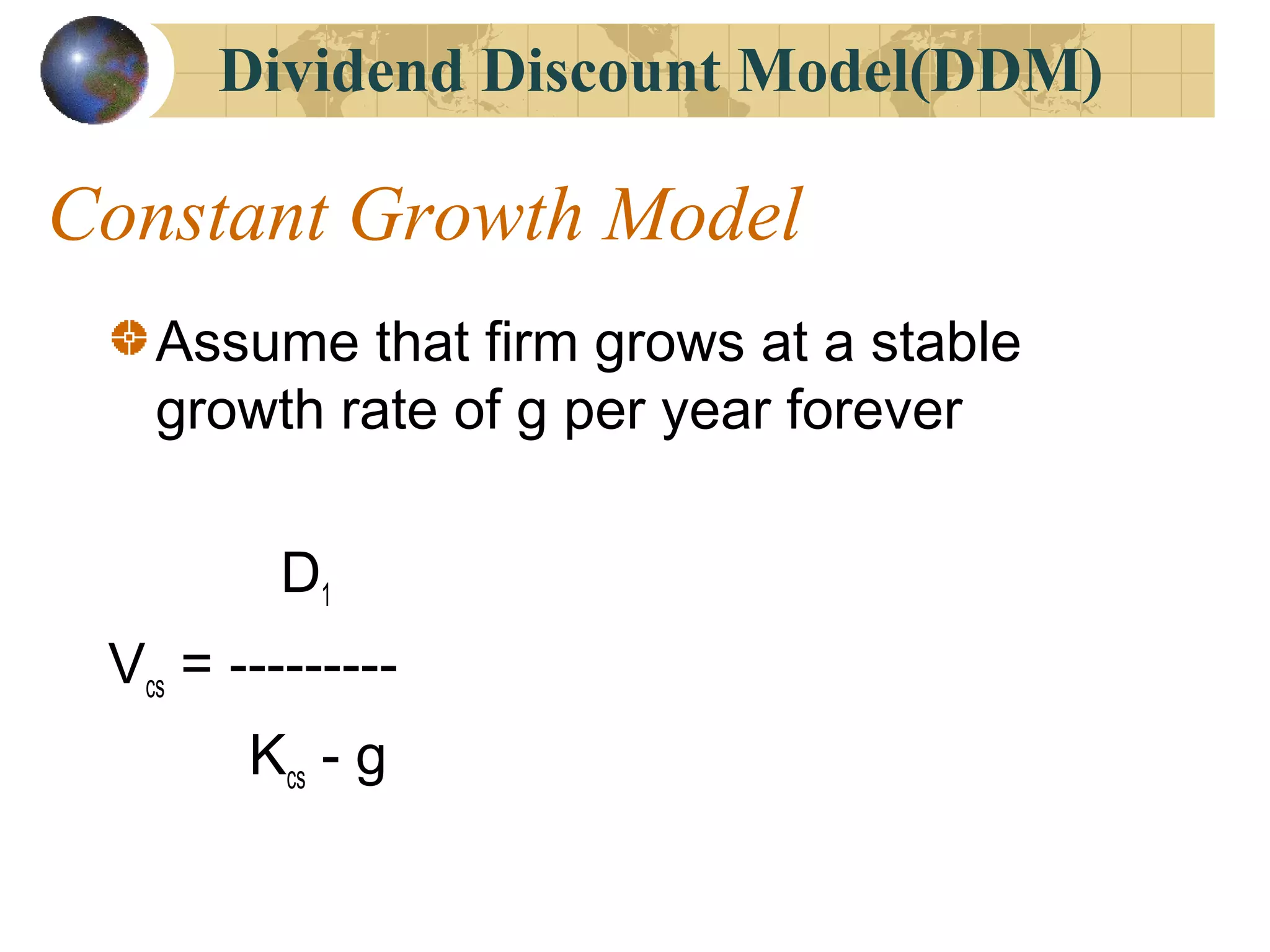

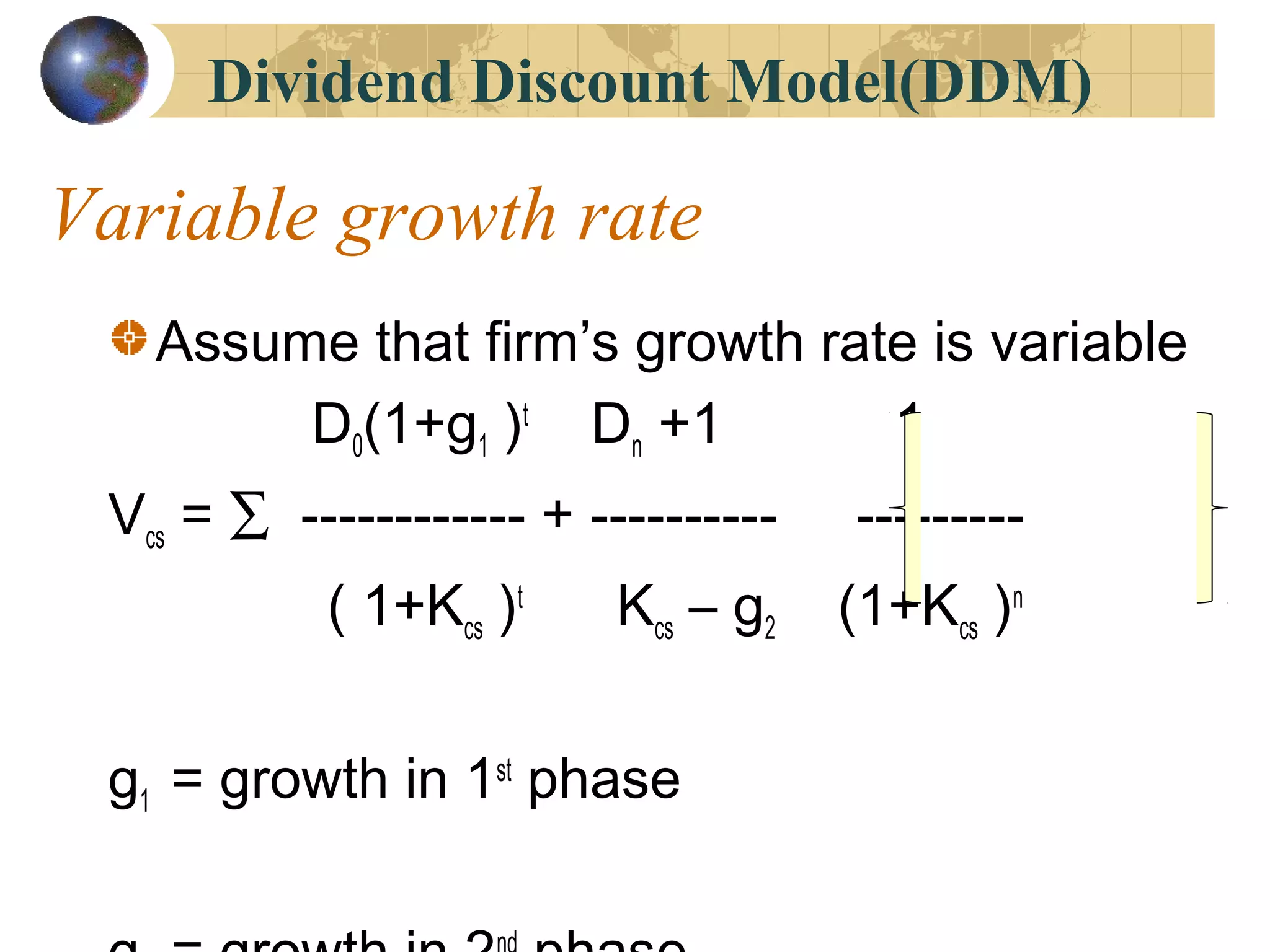

2. The dividend discount model (DDM), which values a stock based on the present value of its expected future dividends. Constant and variable growth DDM are discussed.

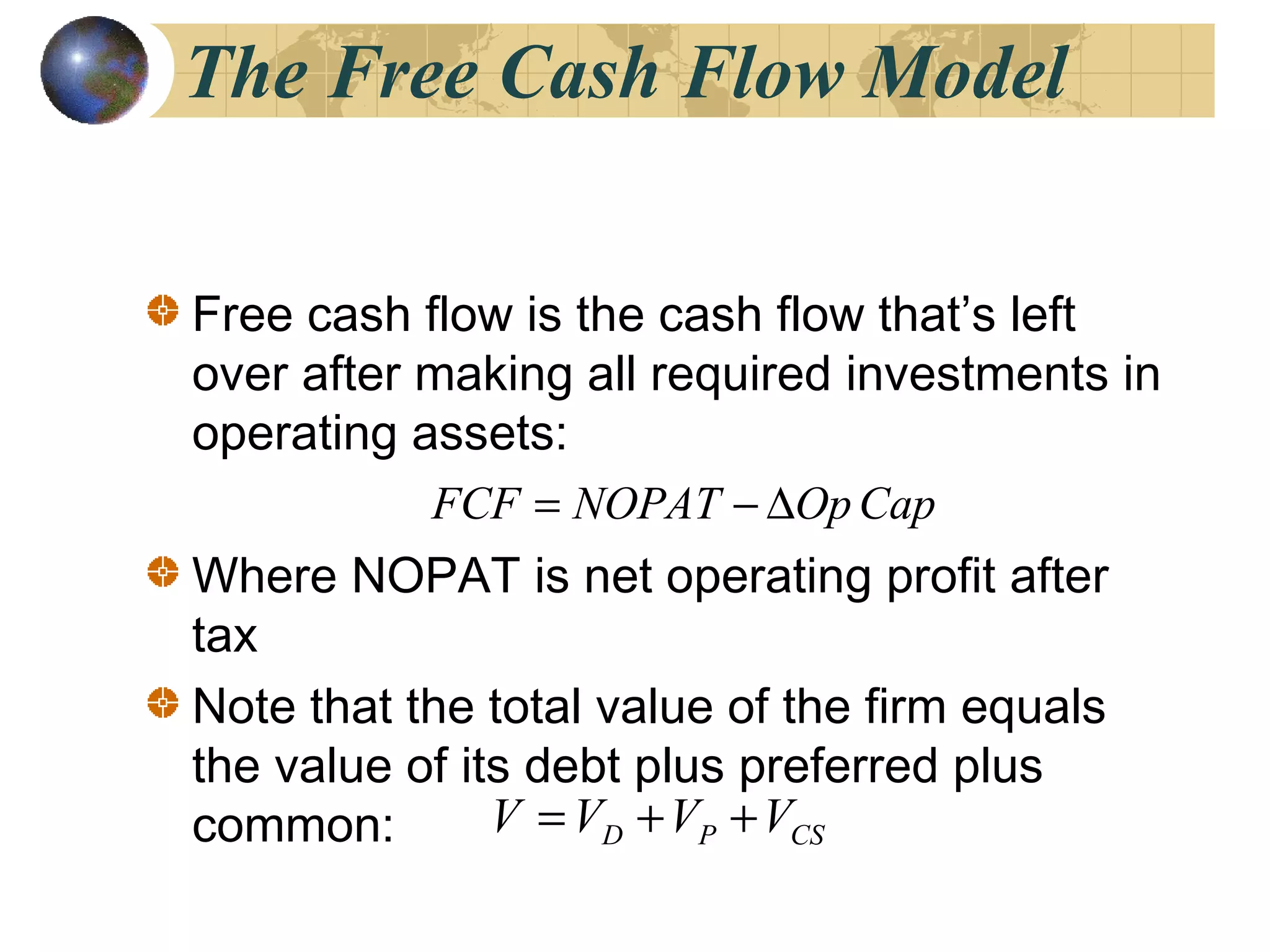

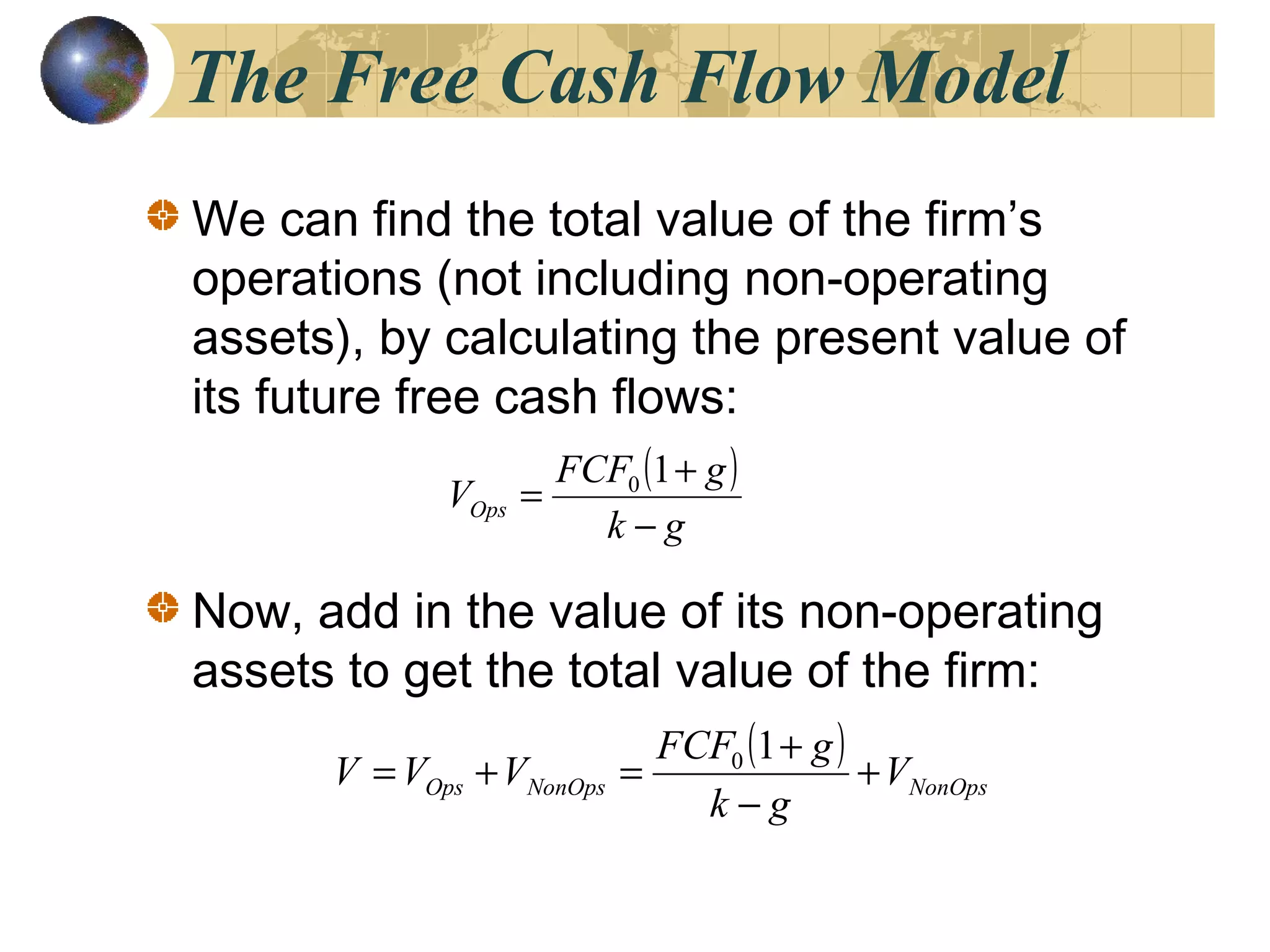

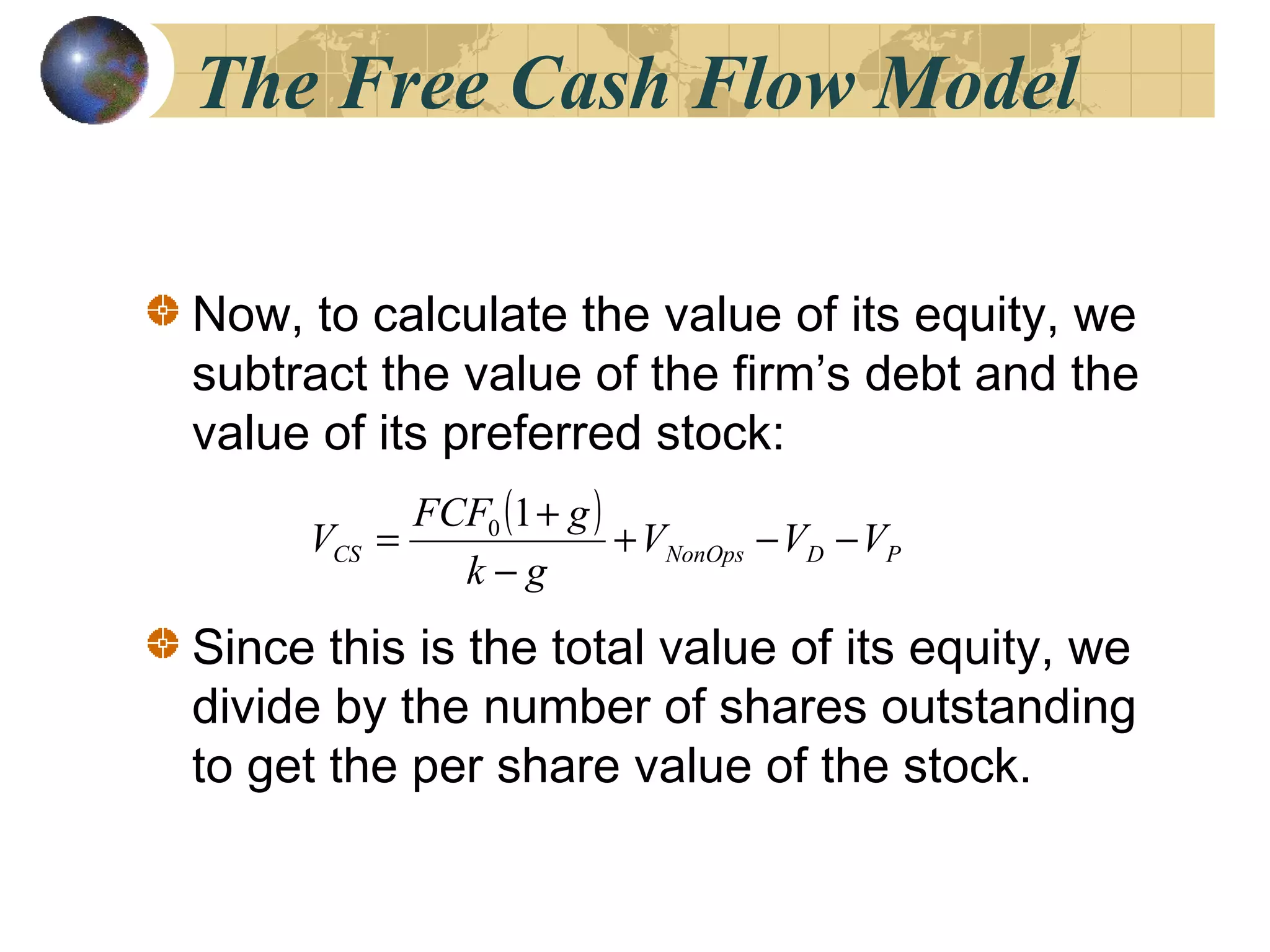

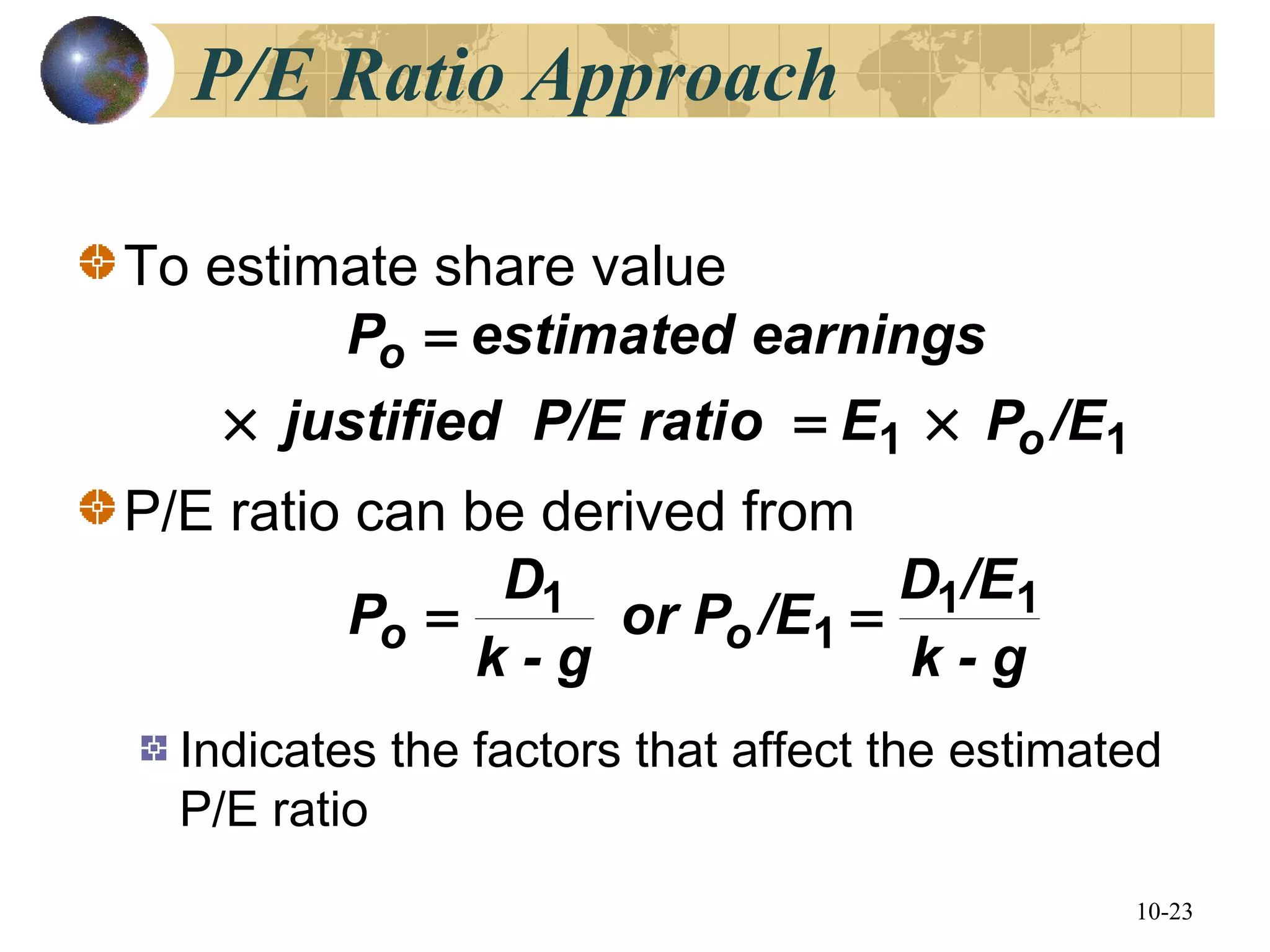

3. Other valuation methods like the free cash flow model, P/E ratio approach, and price-to-sales ratio are also presented. The document concludes that the best estimate of a stock's value is usually the present value of its estimated future dividends.