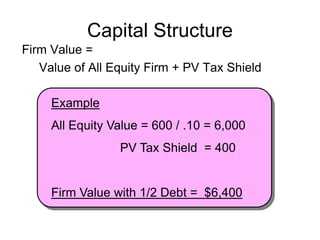

The document discusses the advantages and disadvantages of debt versus equity in capital structure, highlighting that debt can be beneficial due to tax deductibility but increases risk for shareholders. It also outlines Modigliani and Miller's propositions regarding the irrelevance of capital structure in perfect markets while presenting the trade-off between financial leverage and associated risks. Furthermore, it addresses the implications of corporate taxes and financial distress, leading to theories like the trade-off theory and pecking order theory related to capital structure decisions.