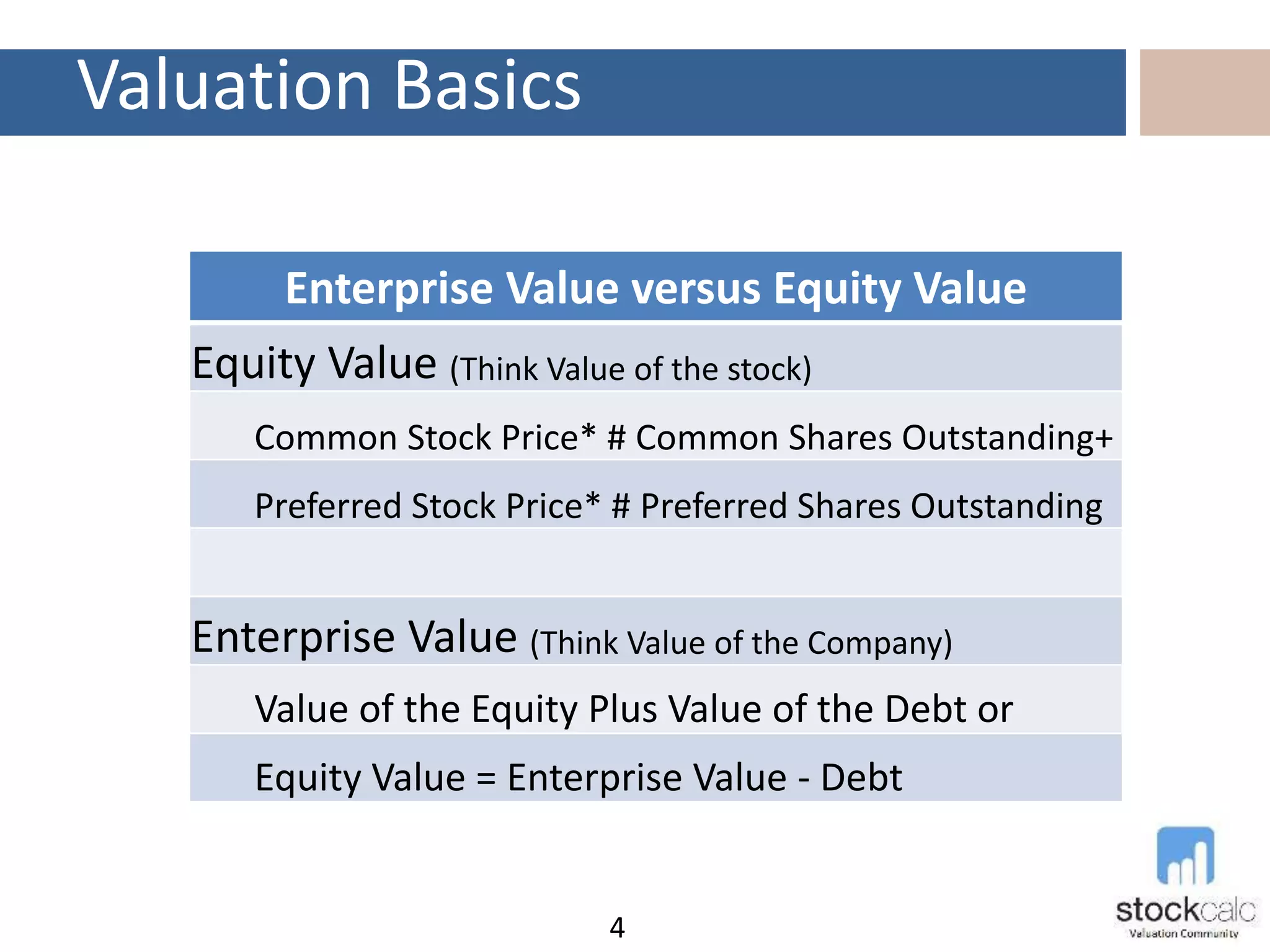

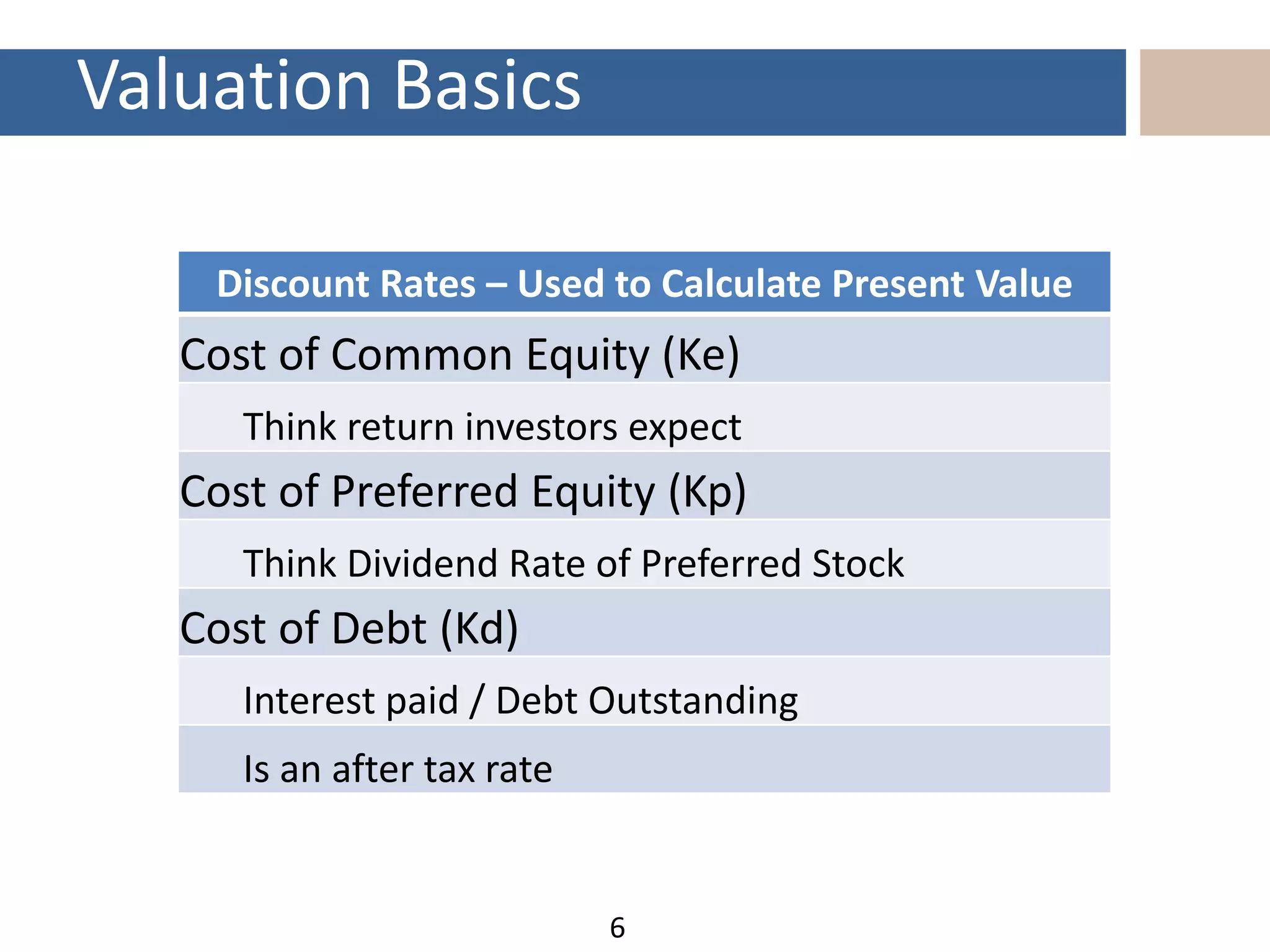

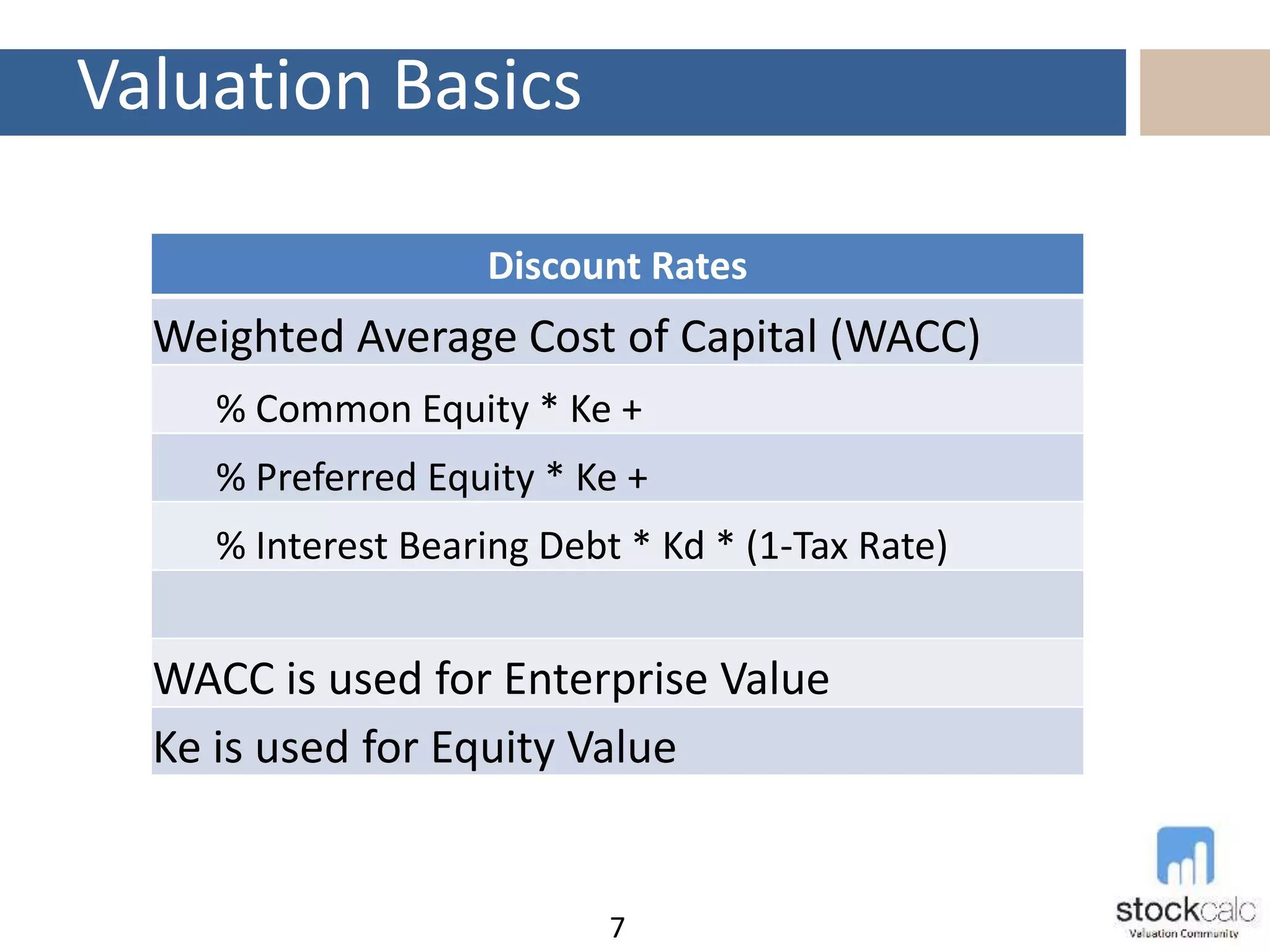

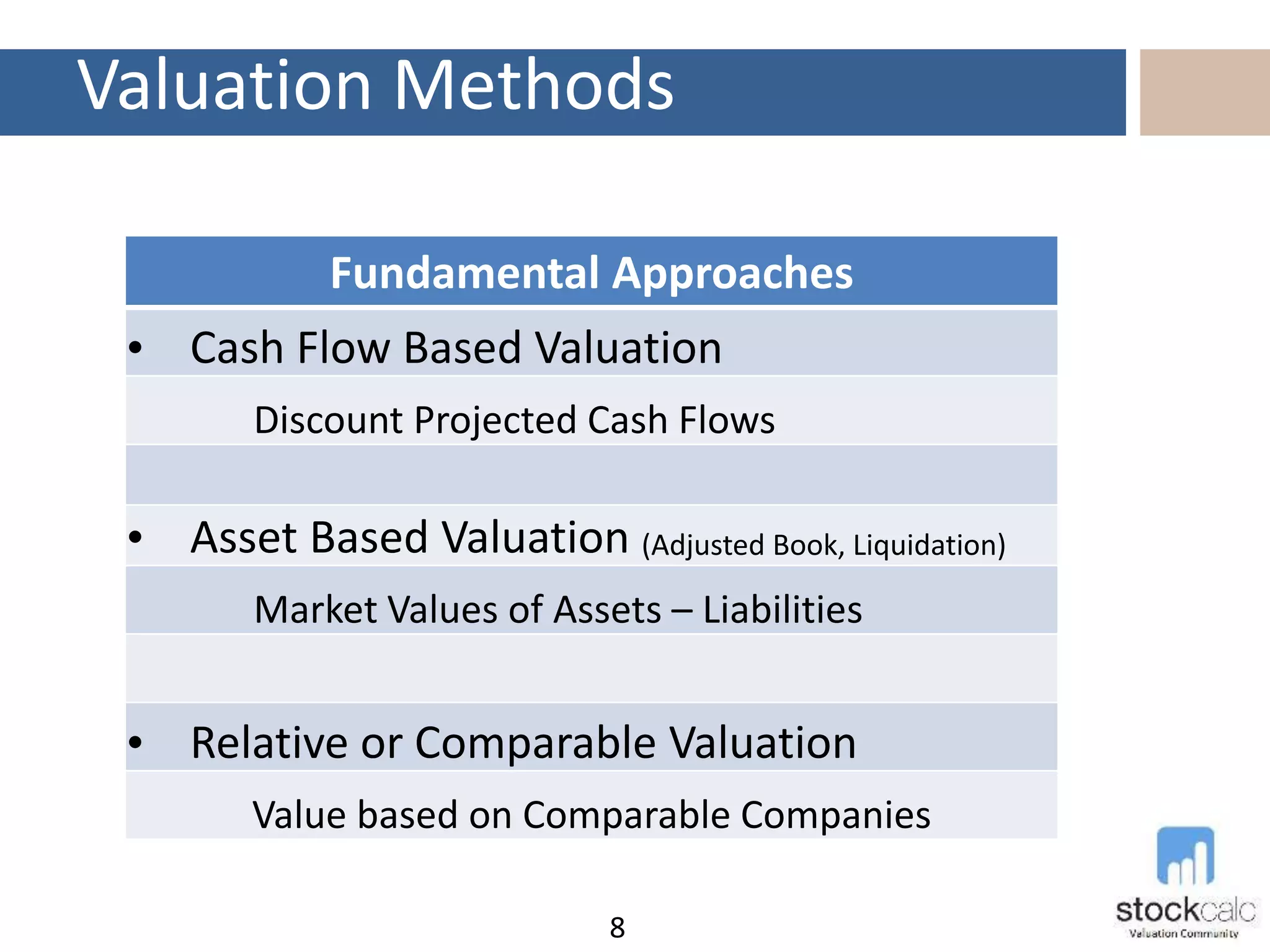

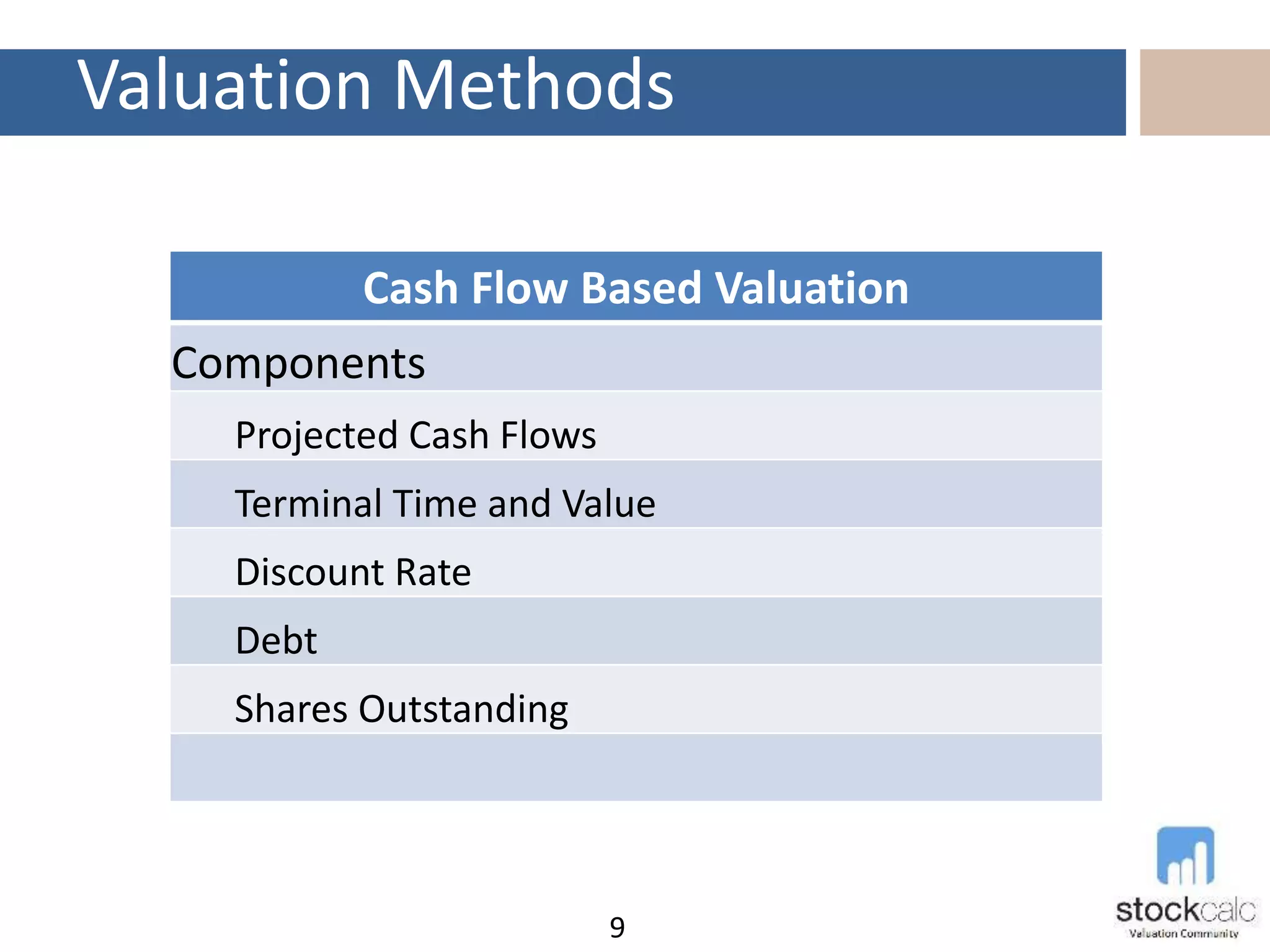

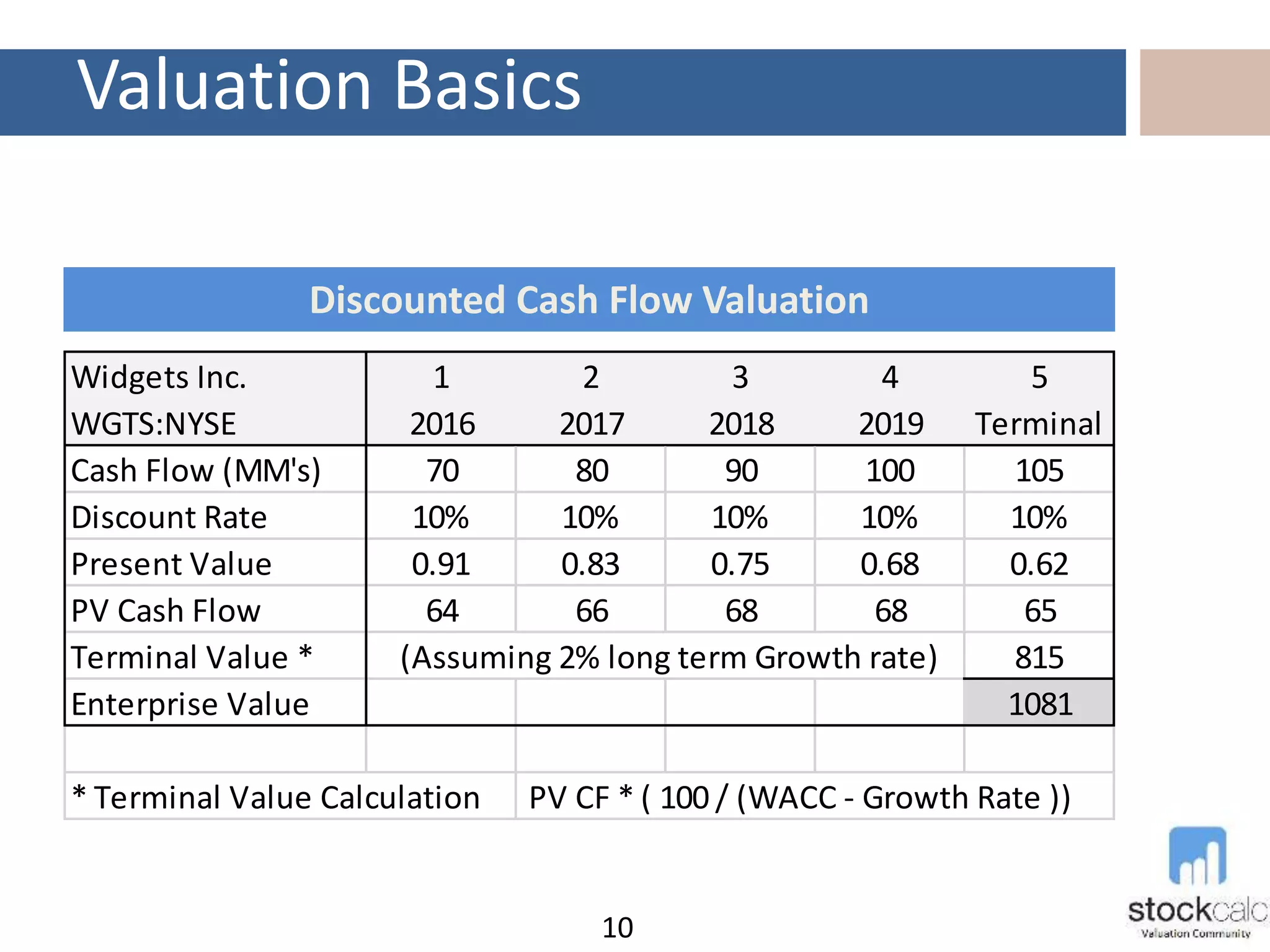

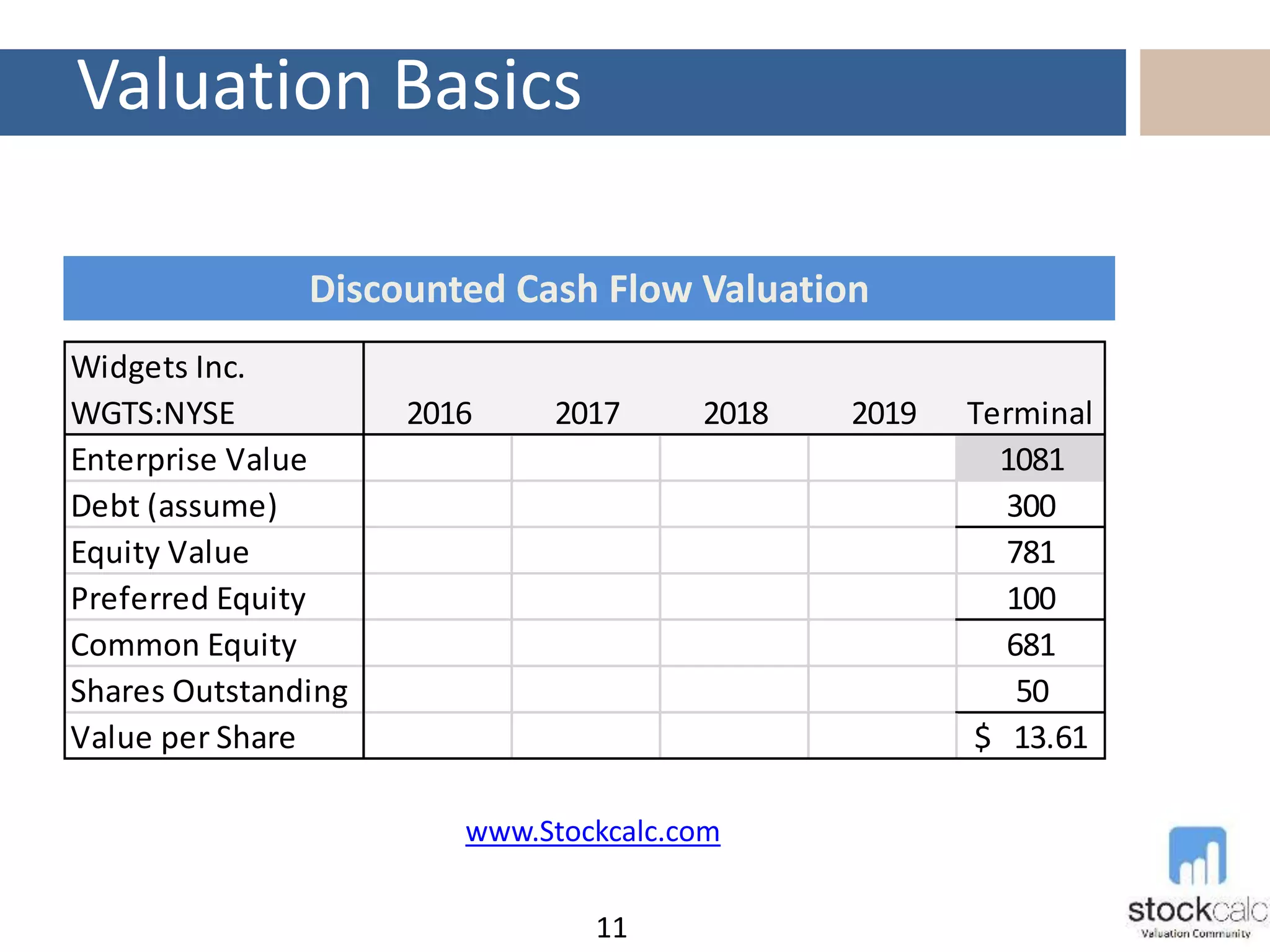

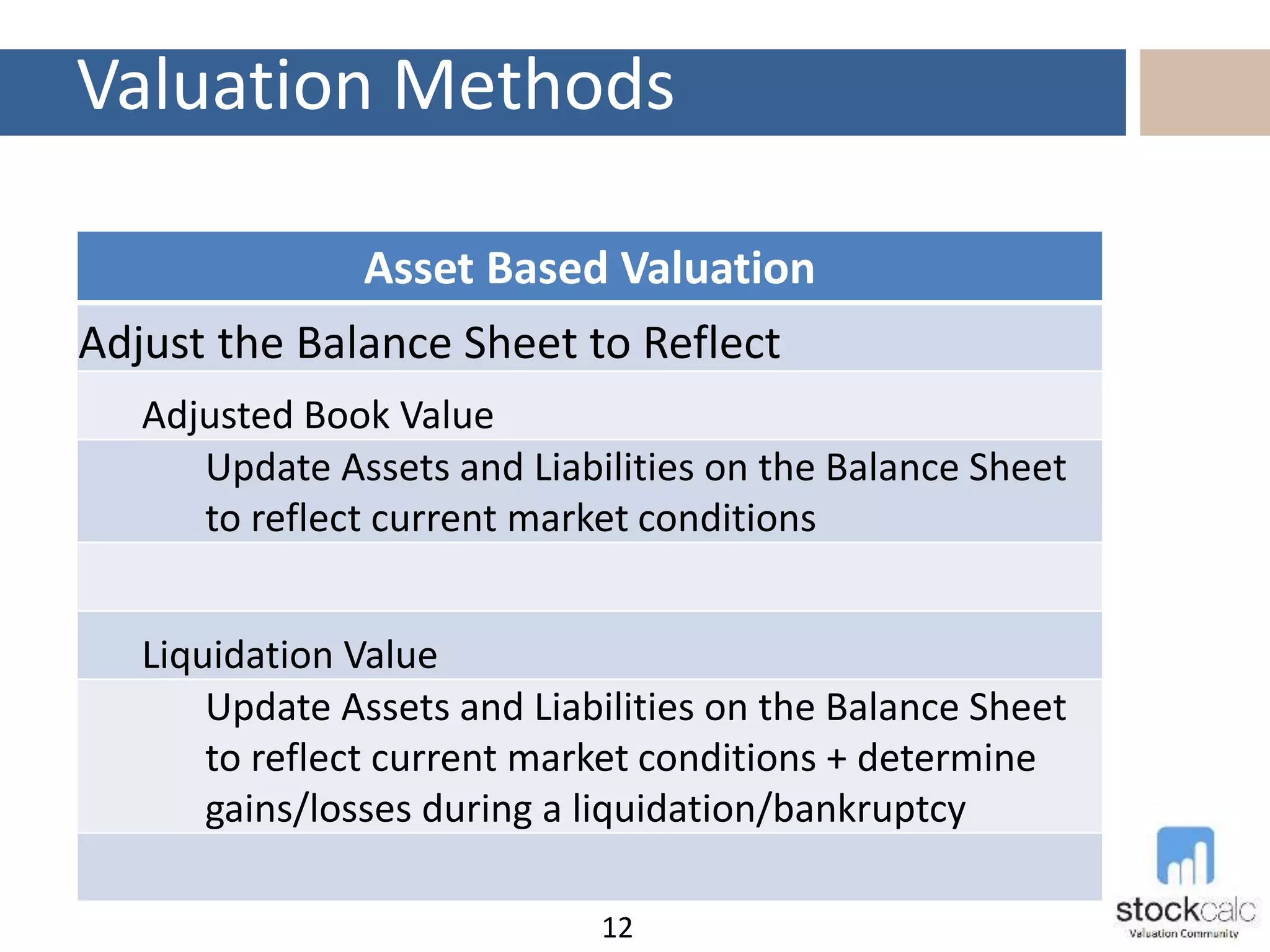

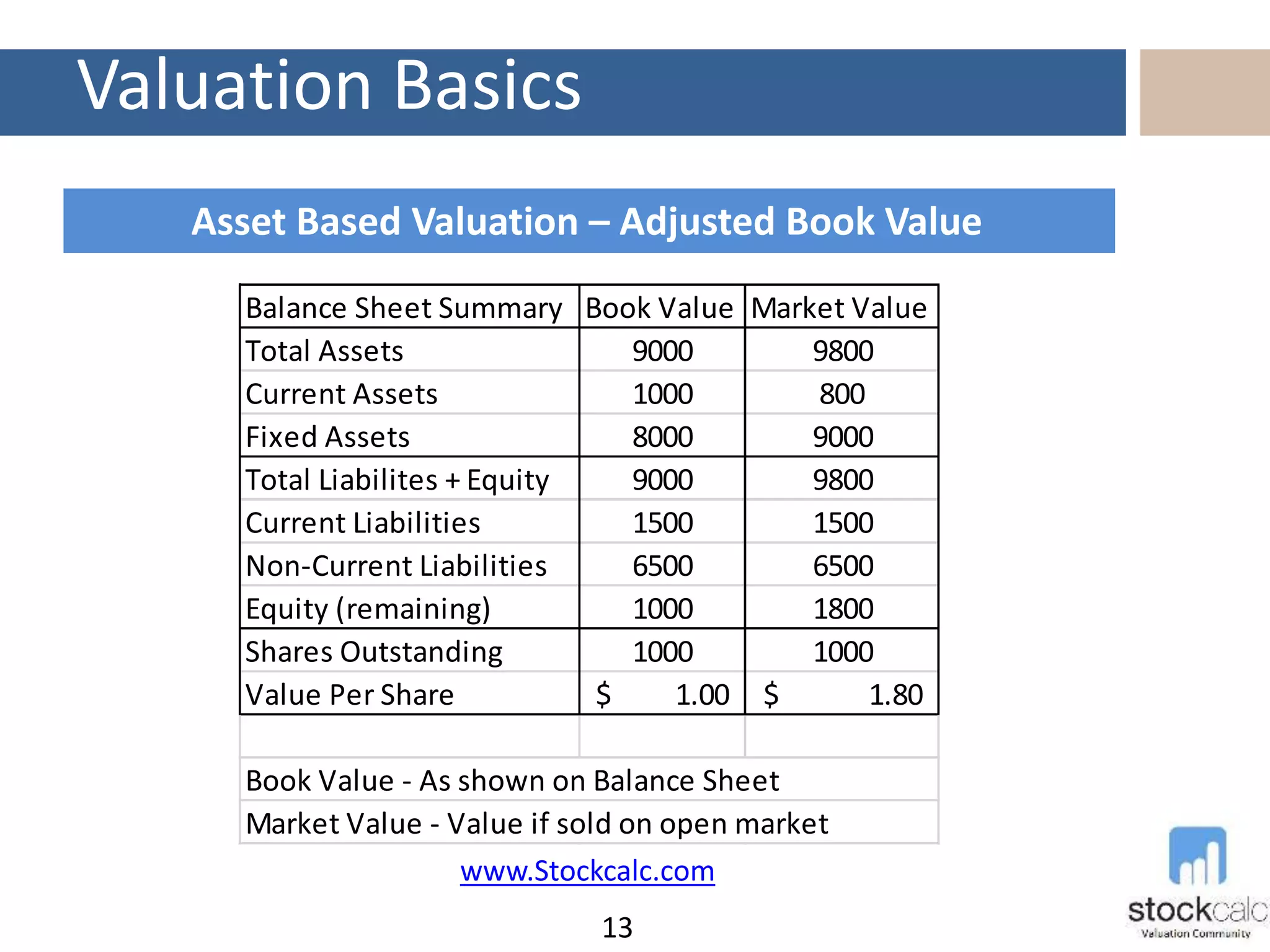

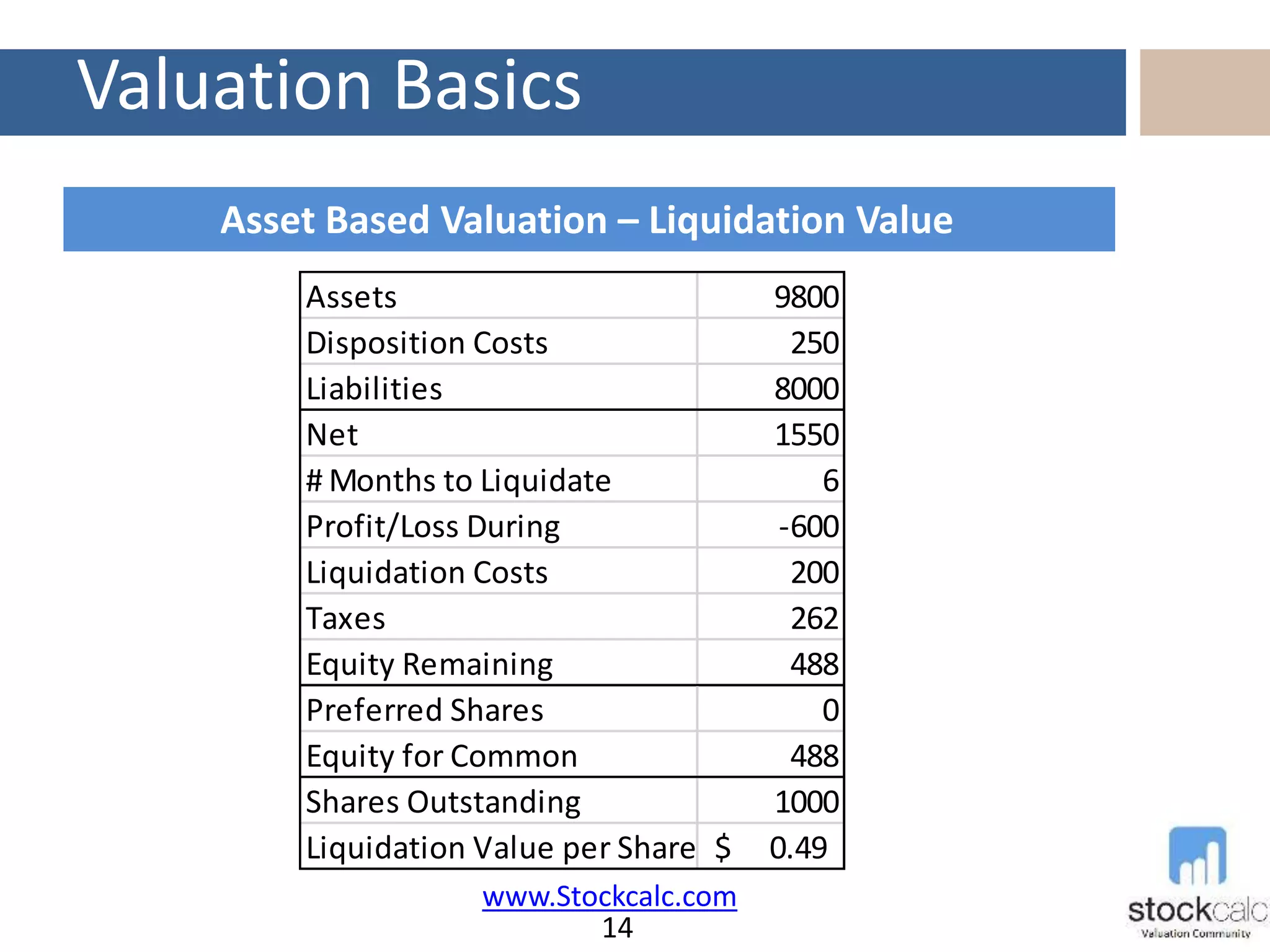

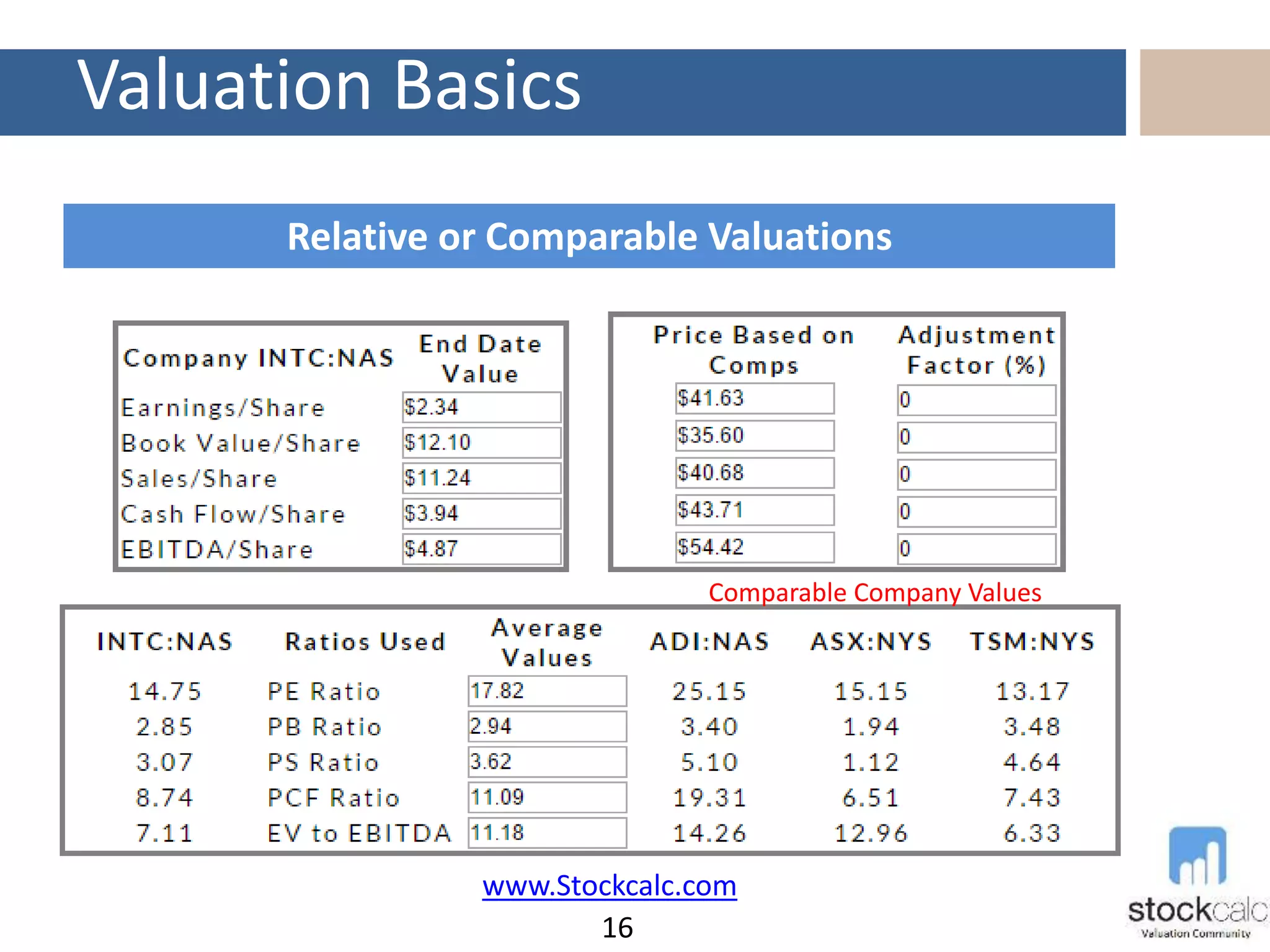

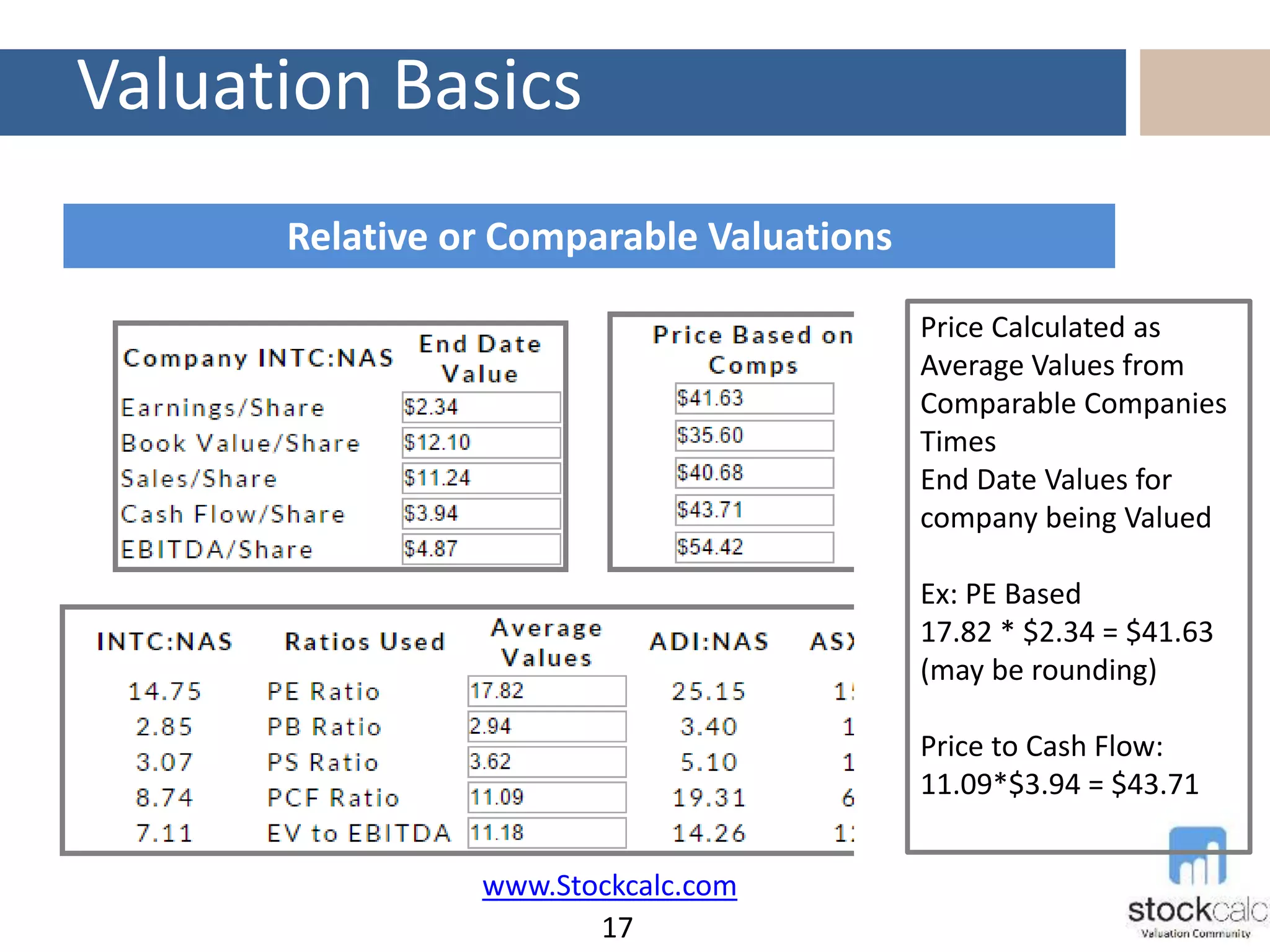

The document provides an introduction to stock valuation, detailing key concepts such as enterprise value, equity value, and cost of capital. It discusses various valuation methods, including cash flow, asset-based, and relative valuations, with examples and calculations. The StockCalc website is presented as a resource for conducting these valuations.