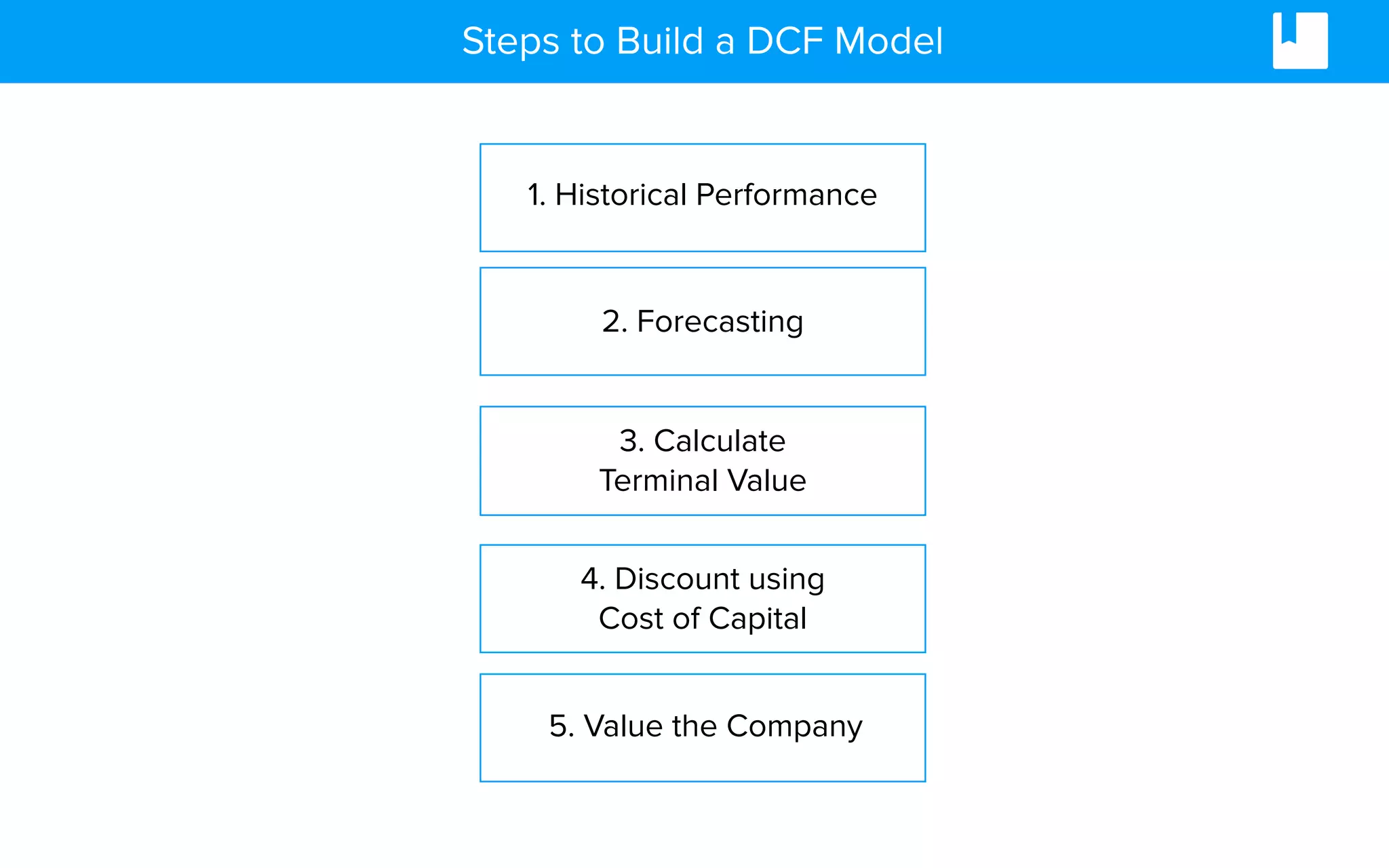

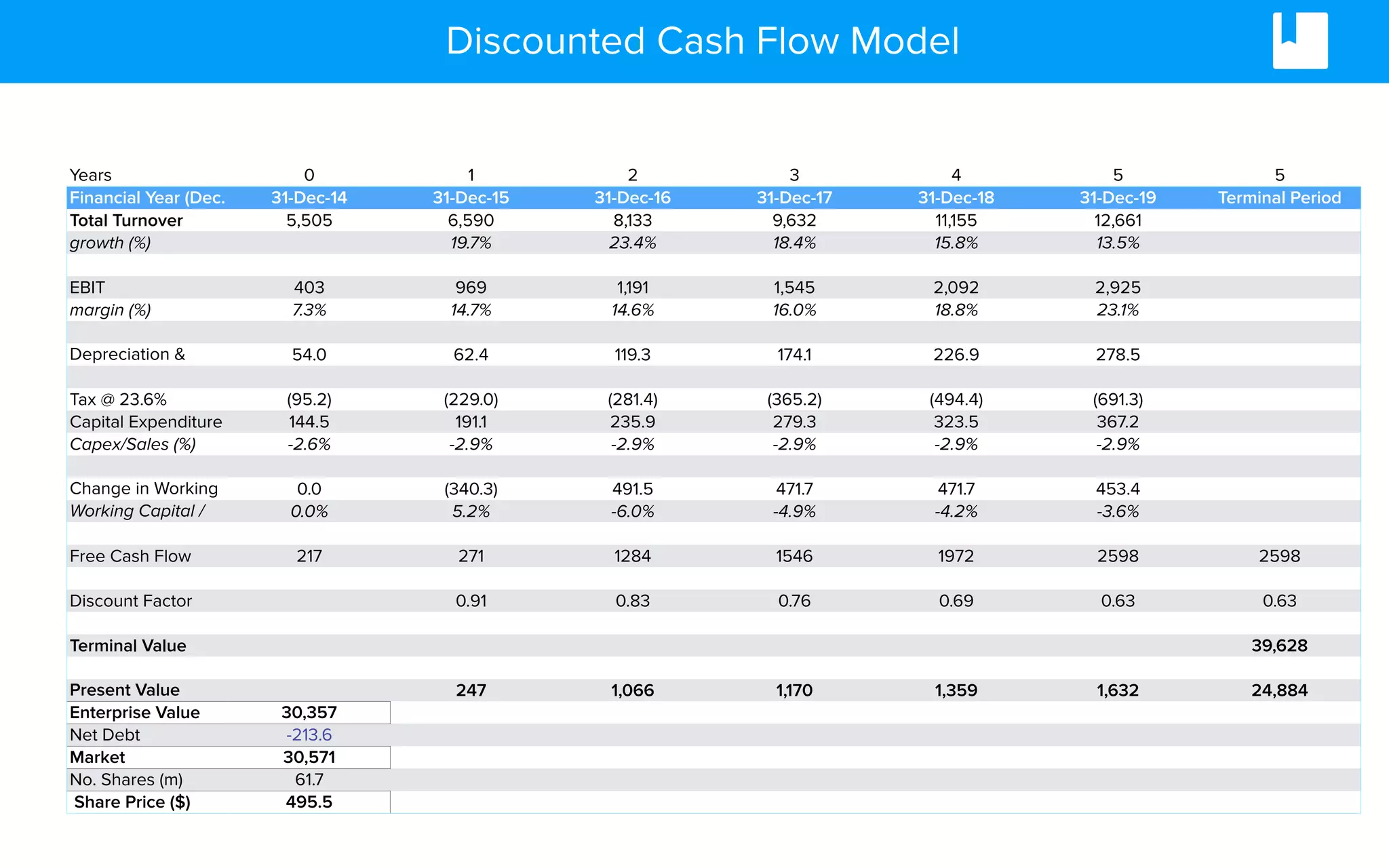

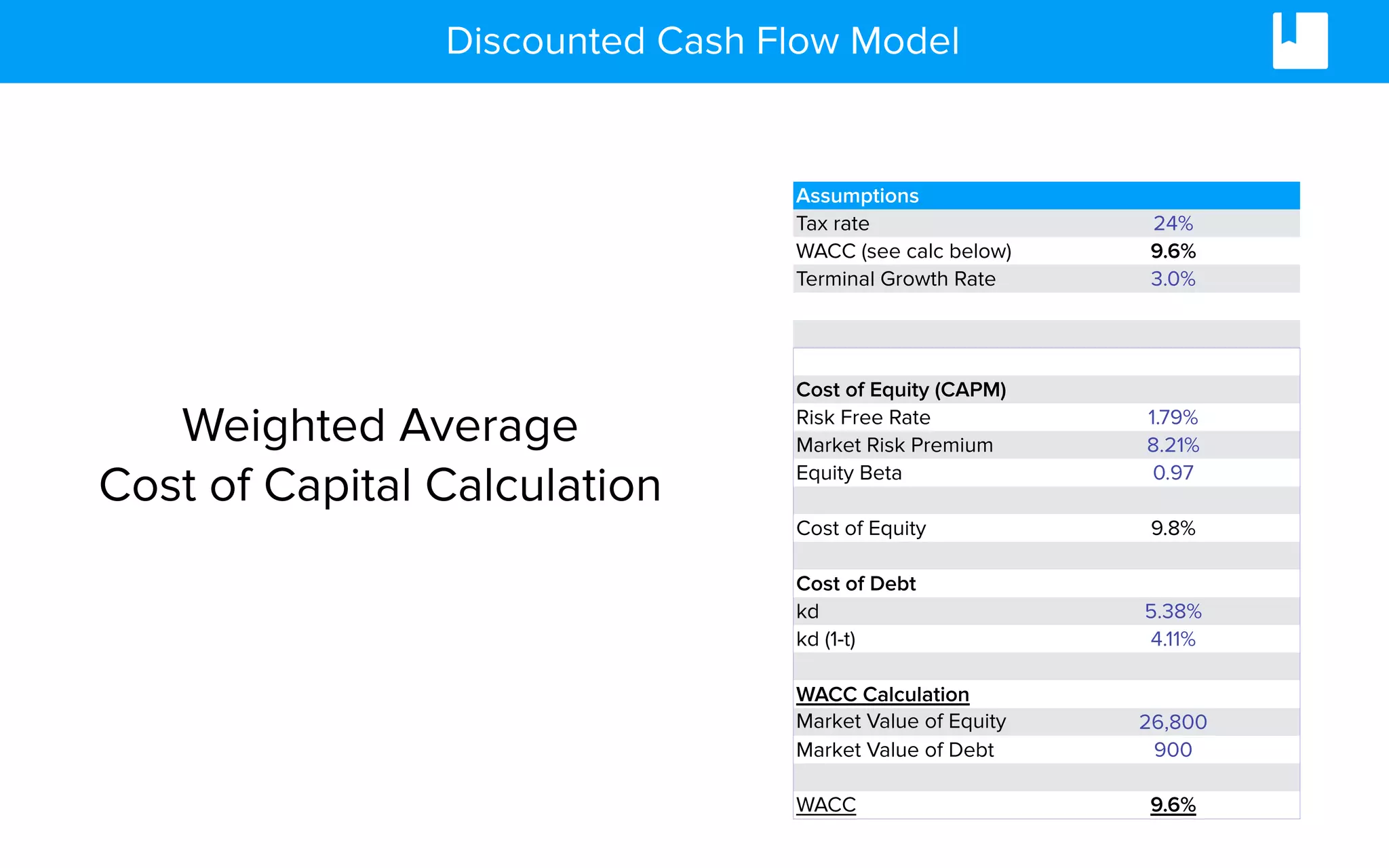

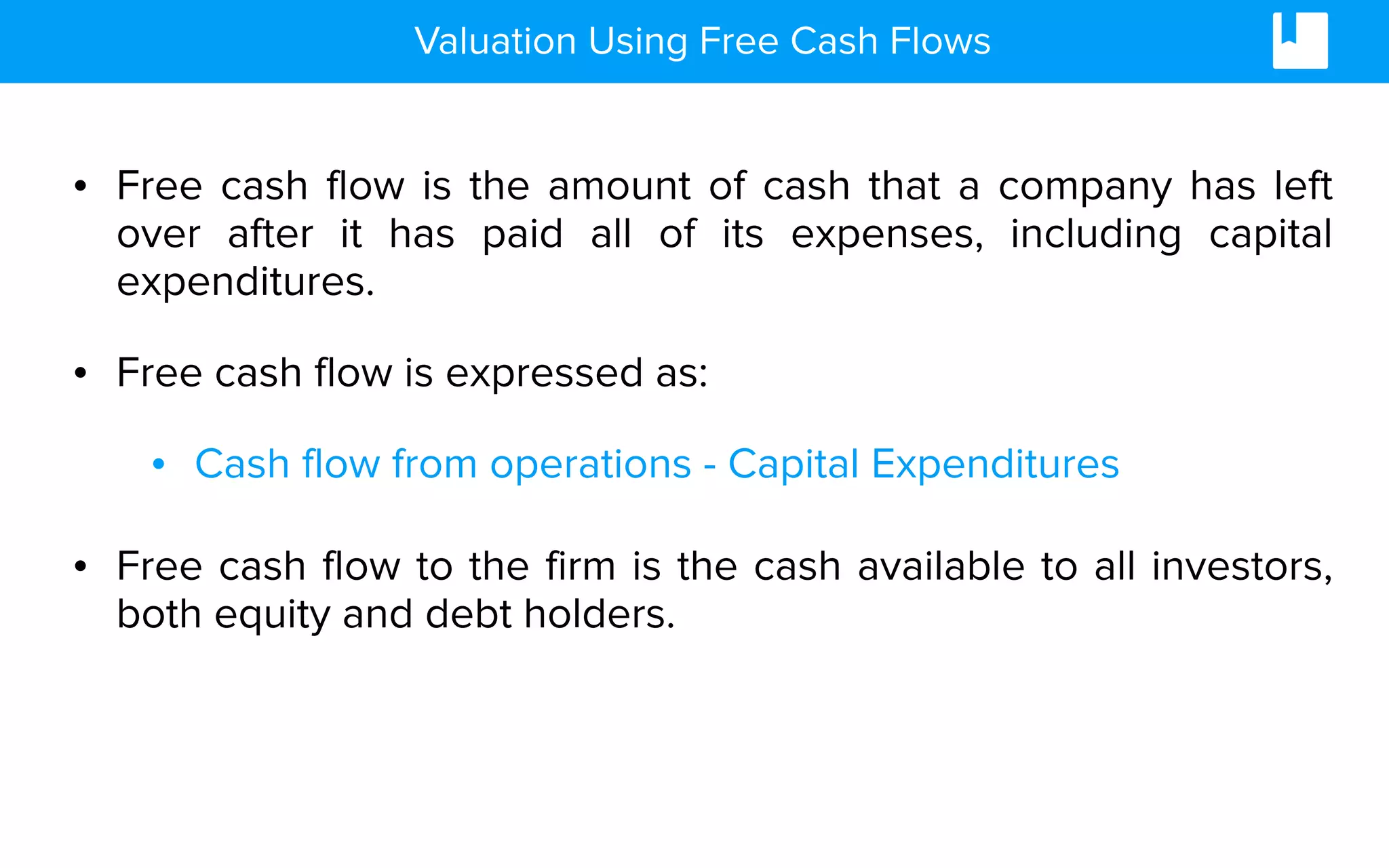

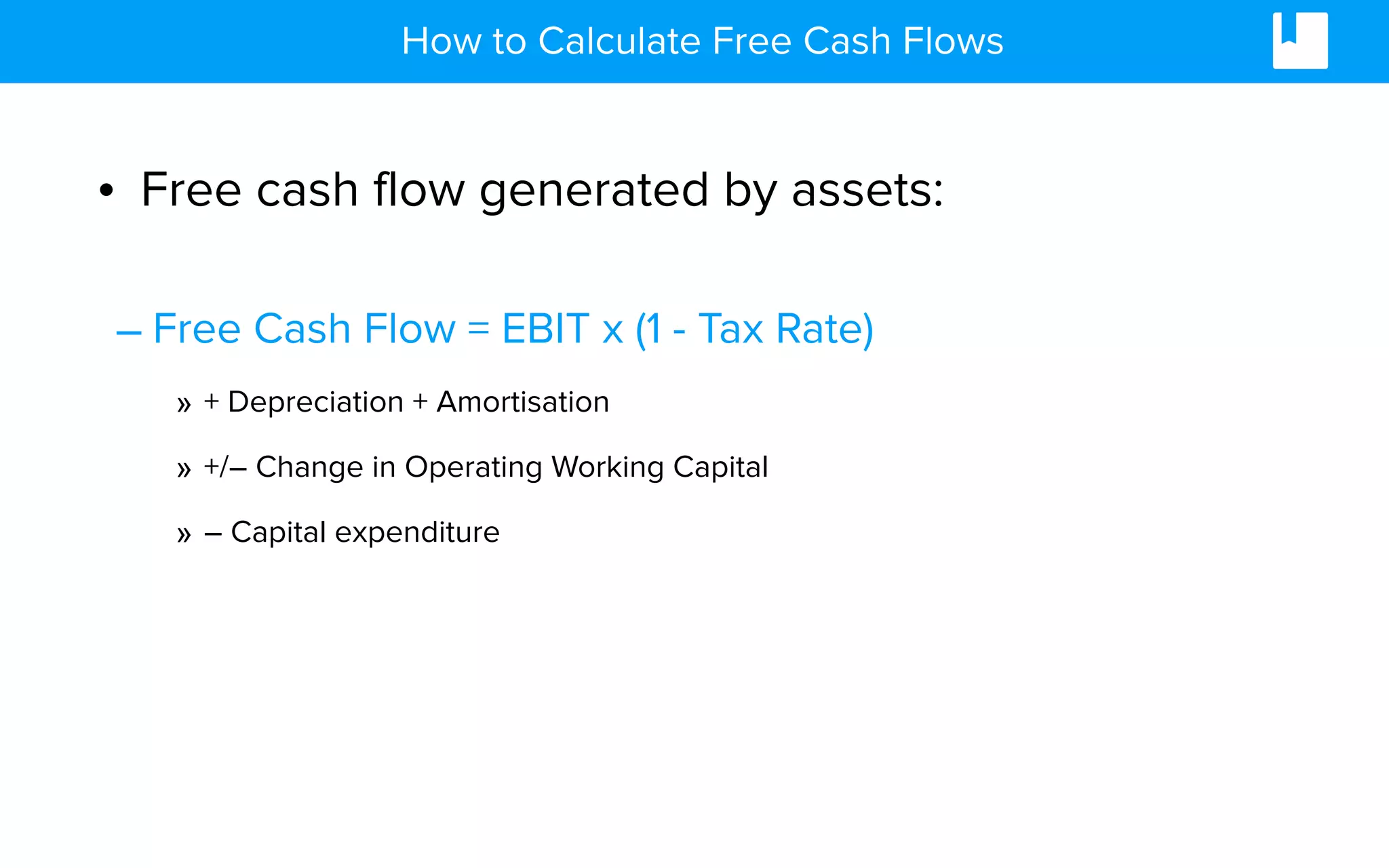

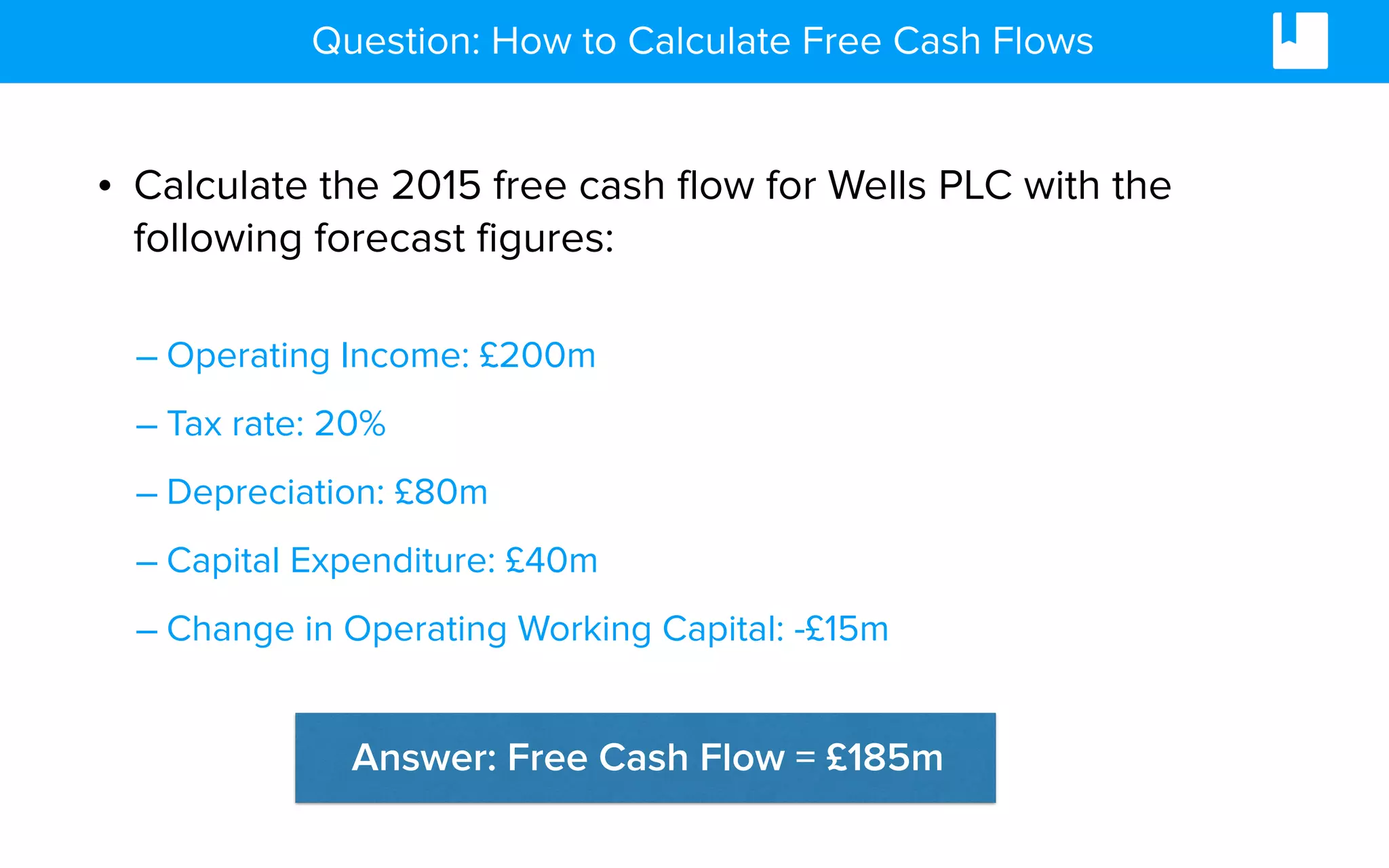

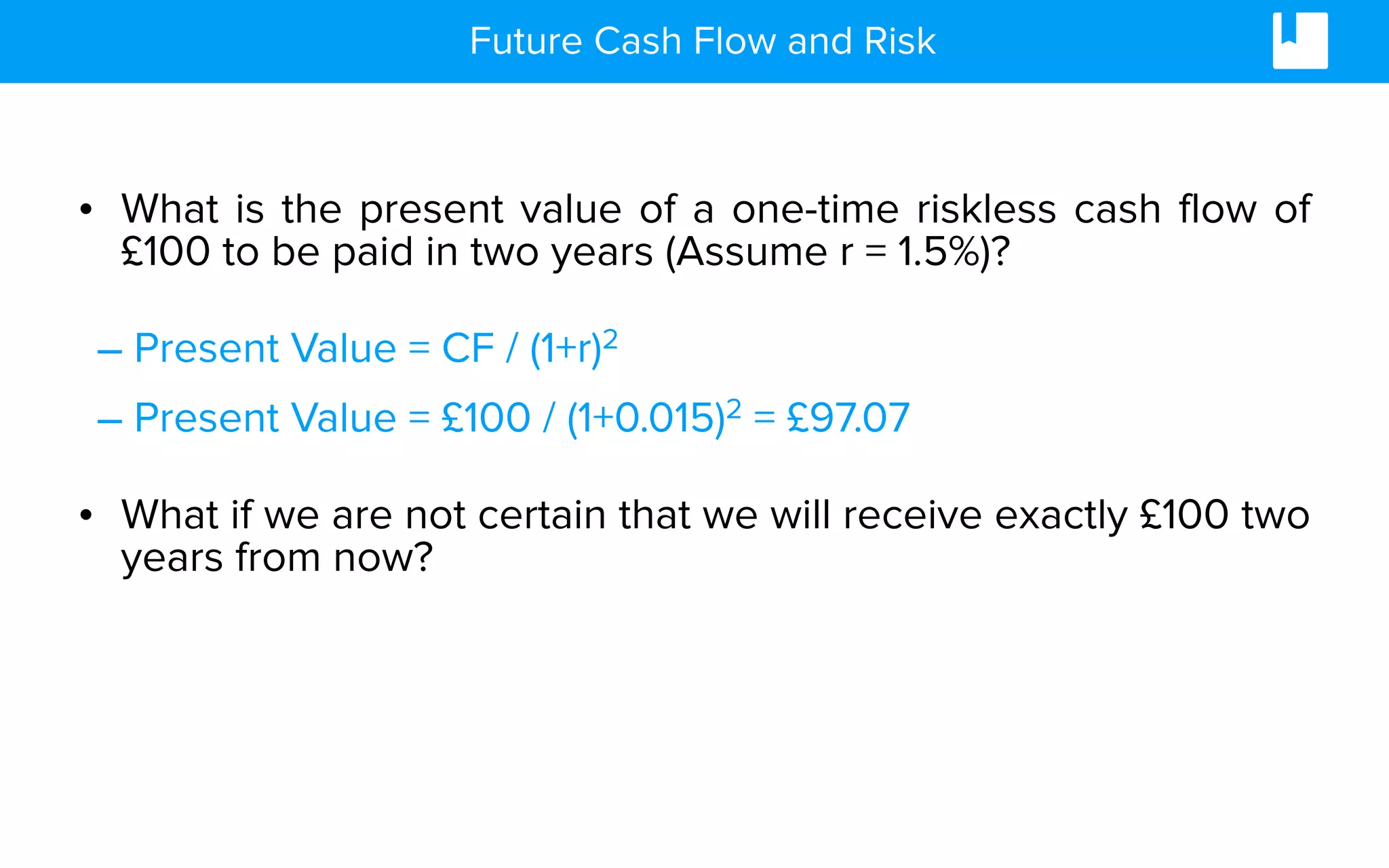

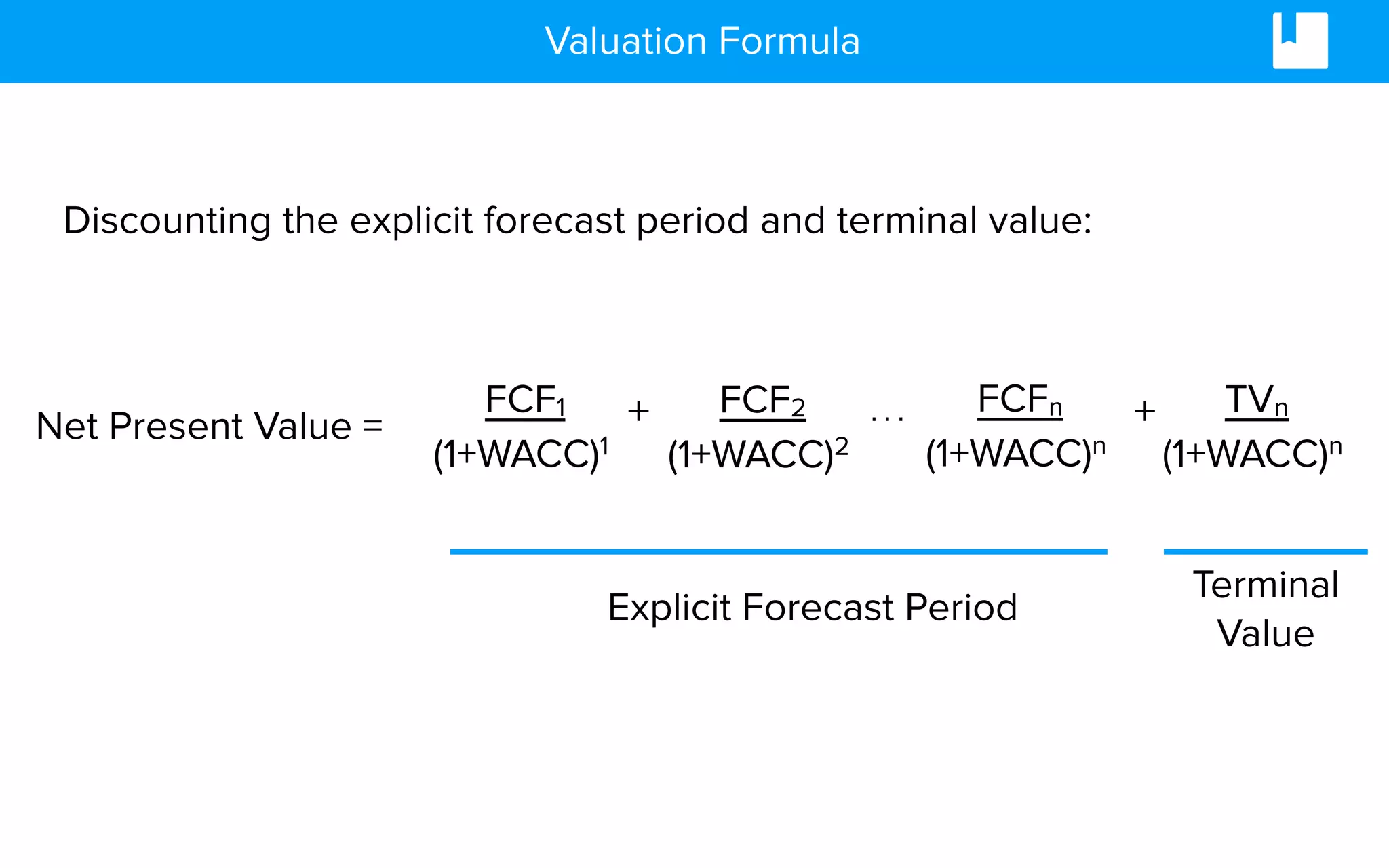

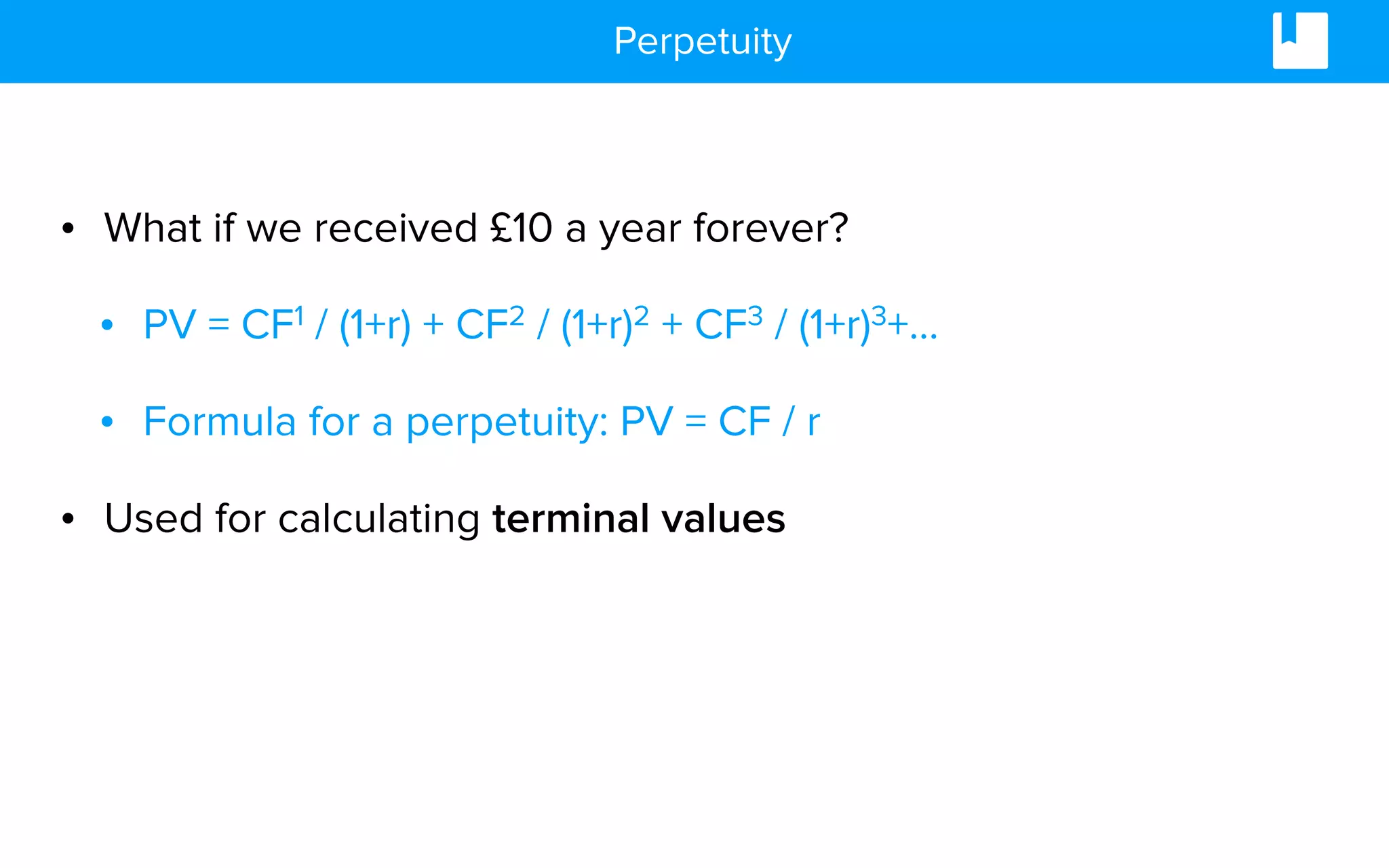

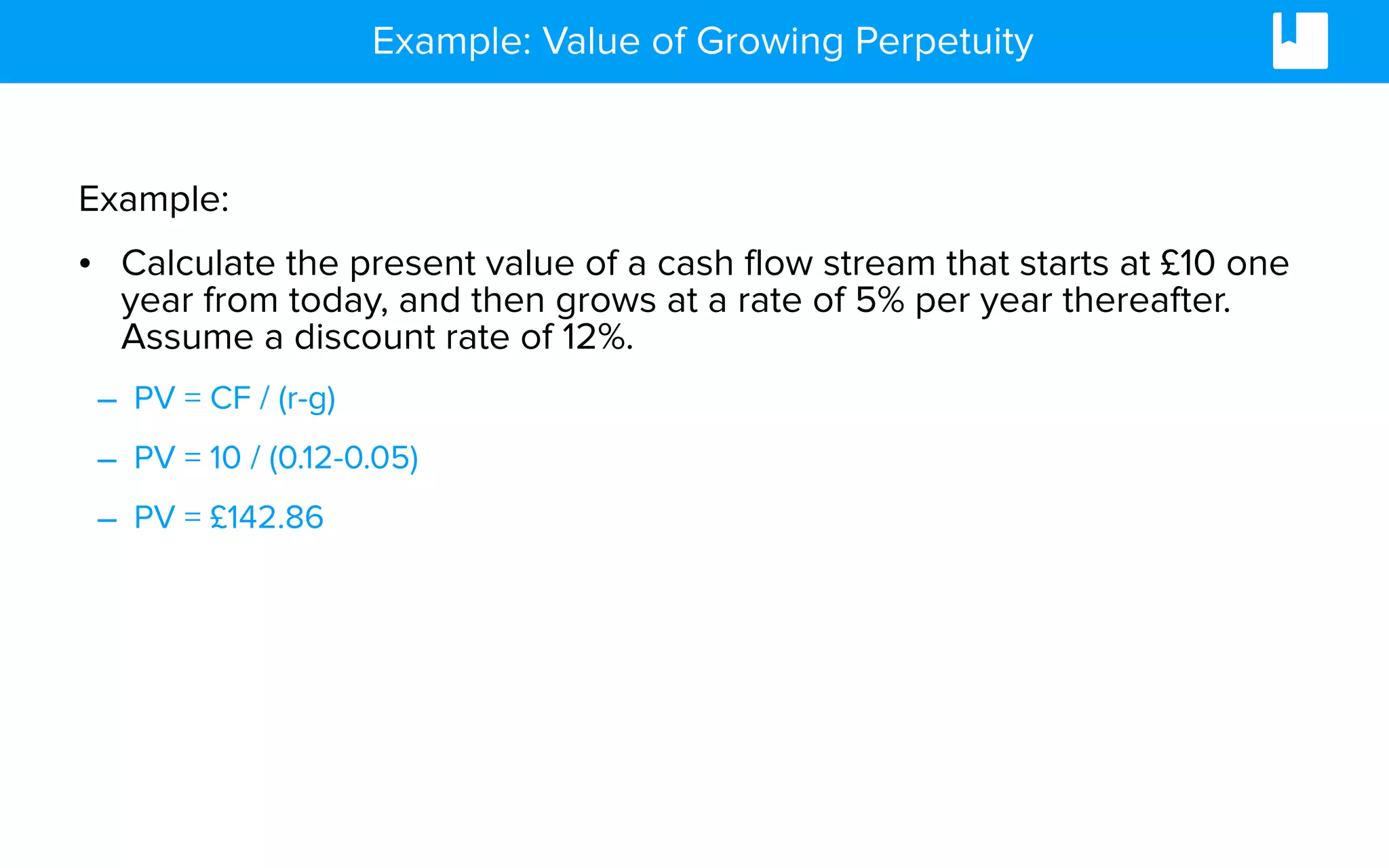

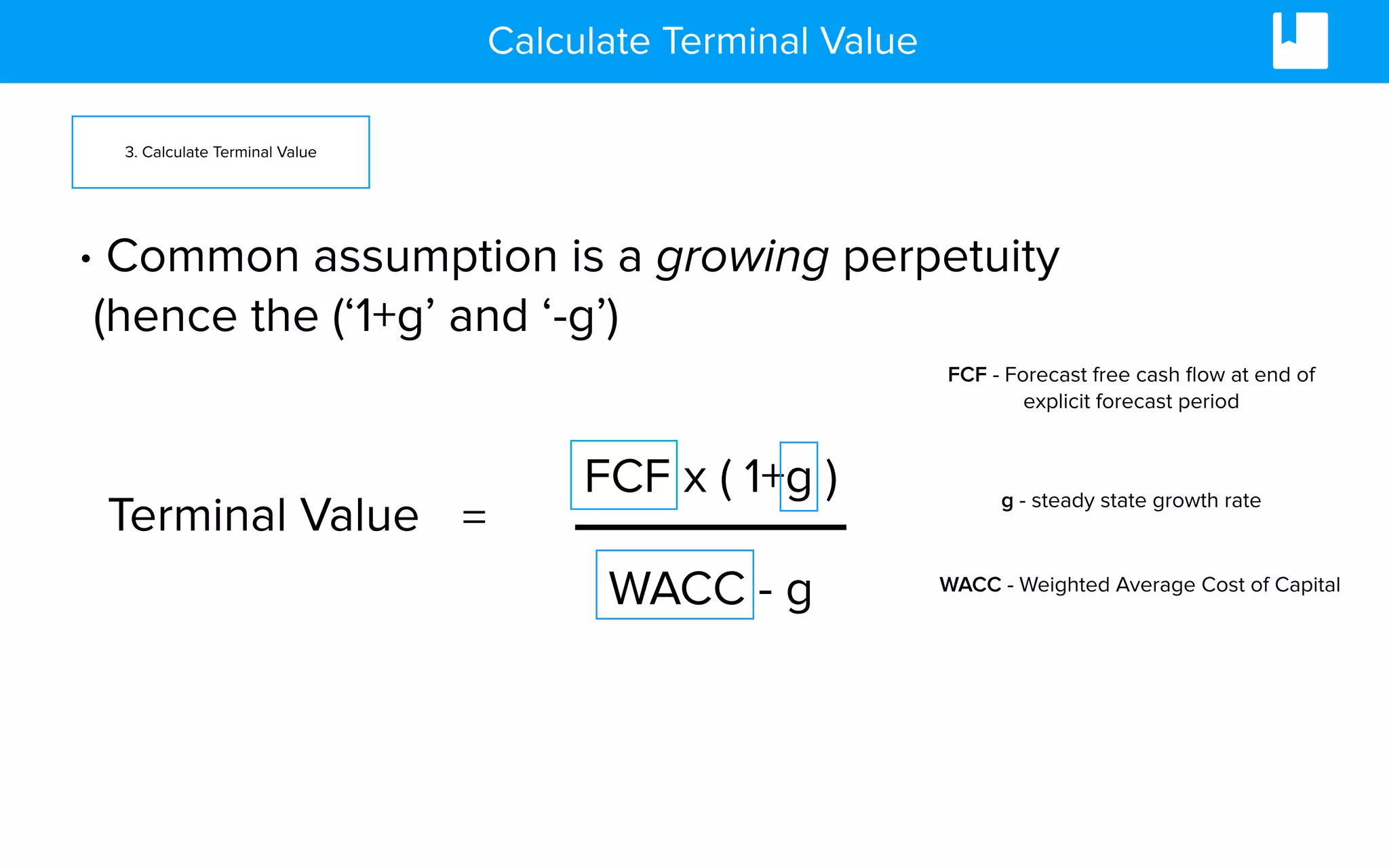

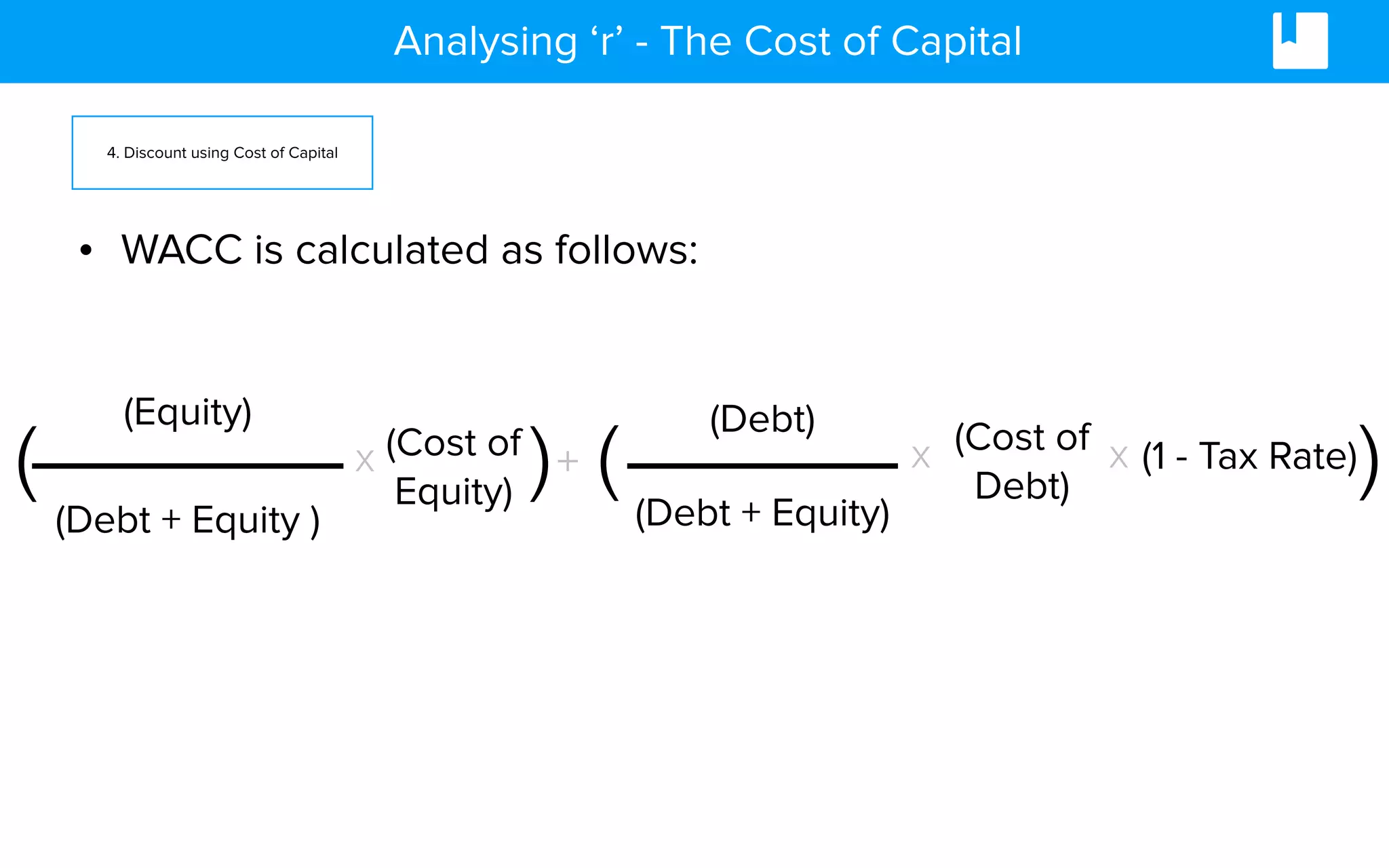

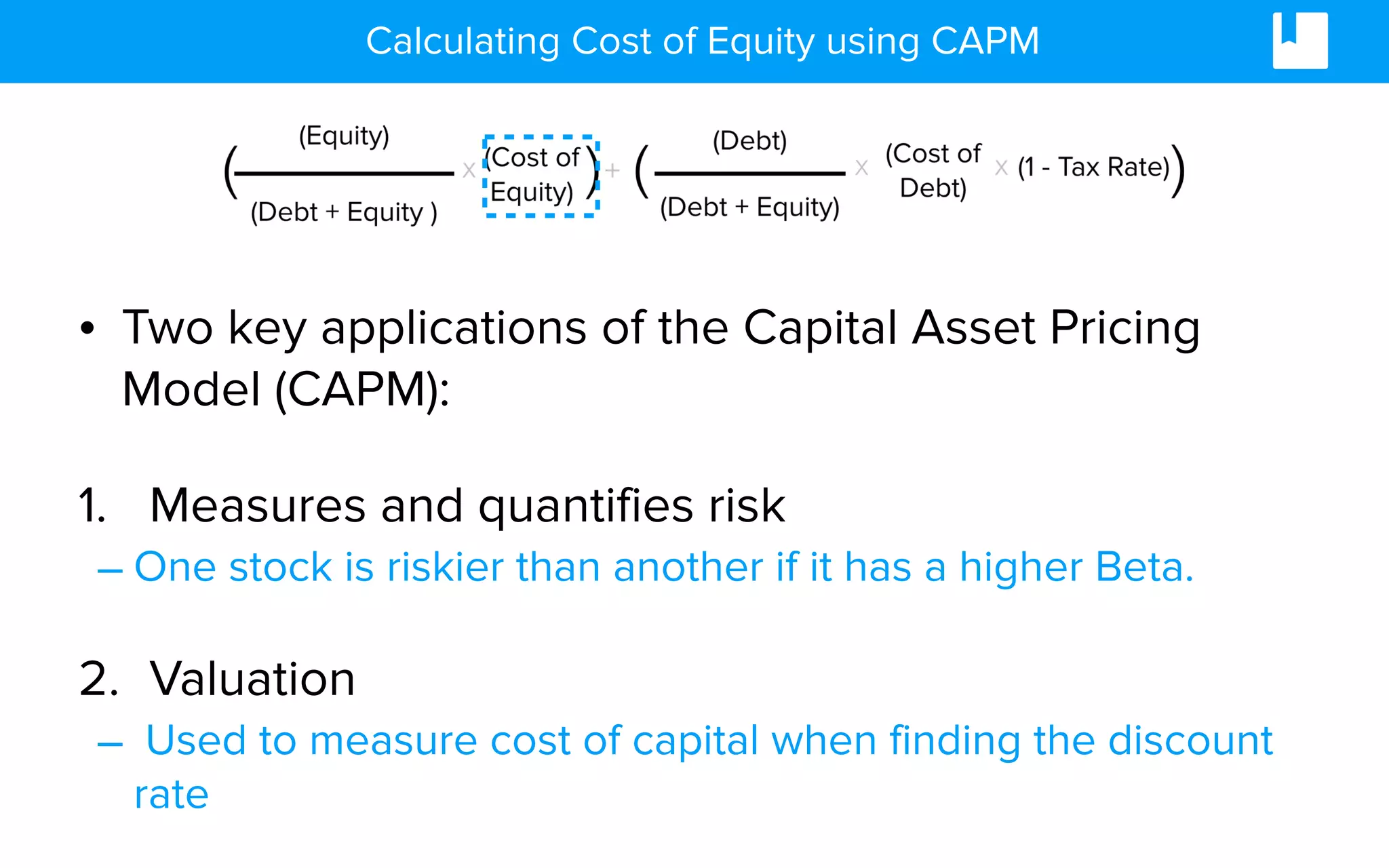

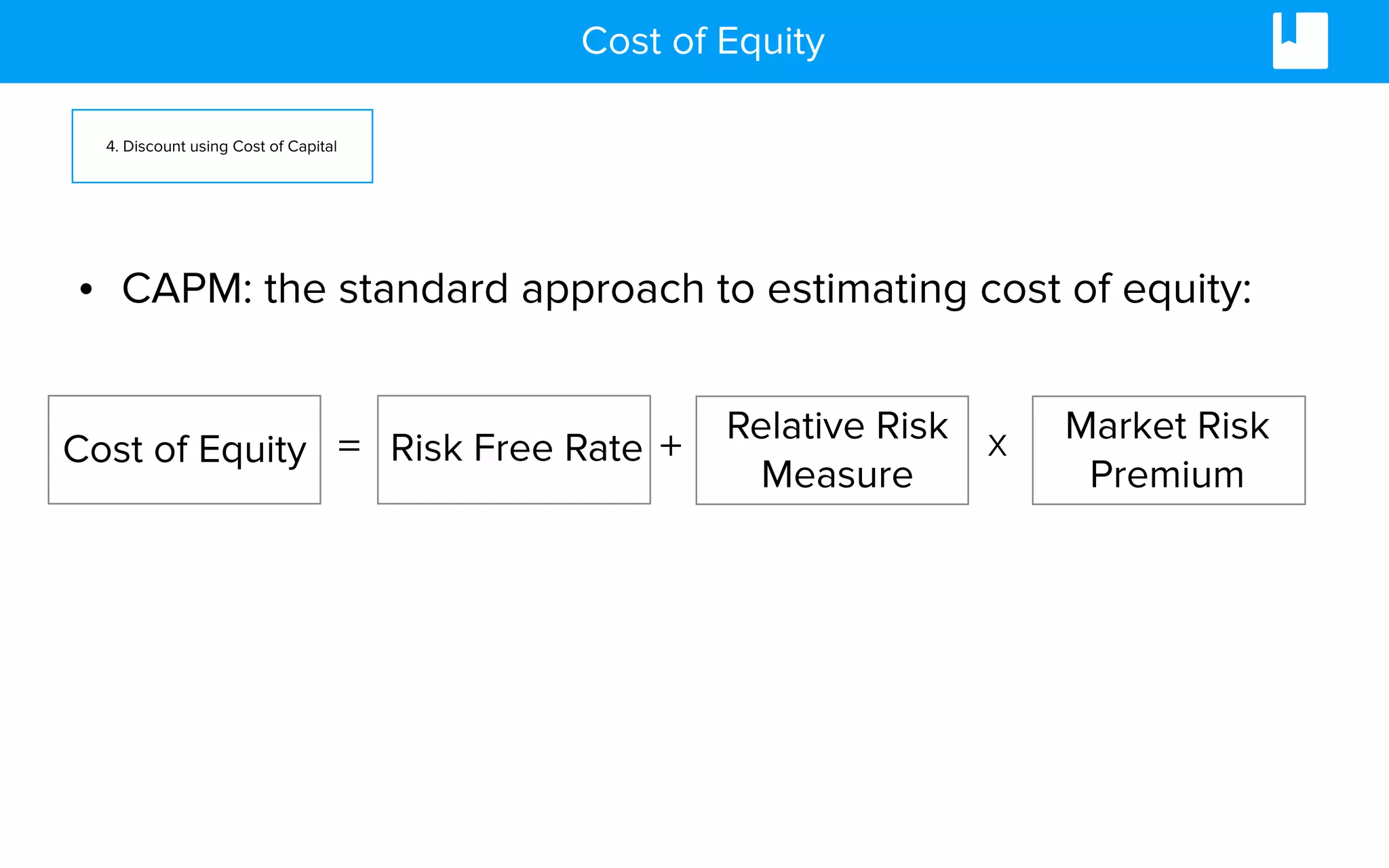

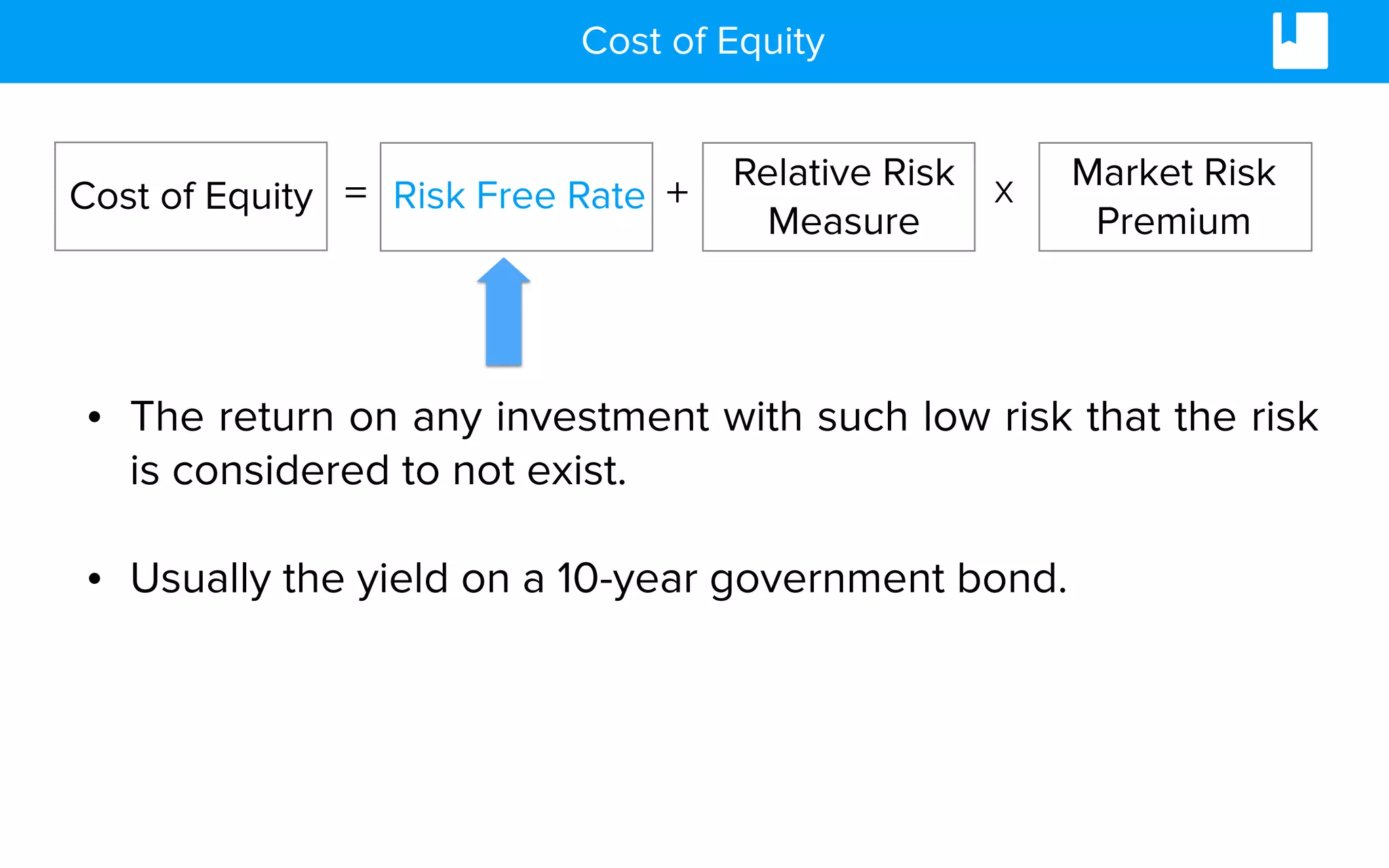

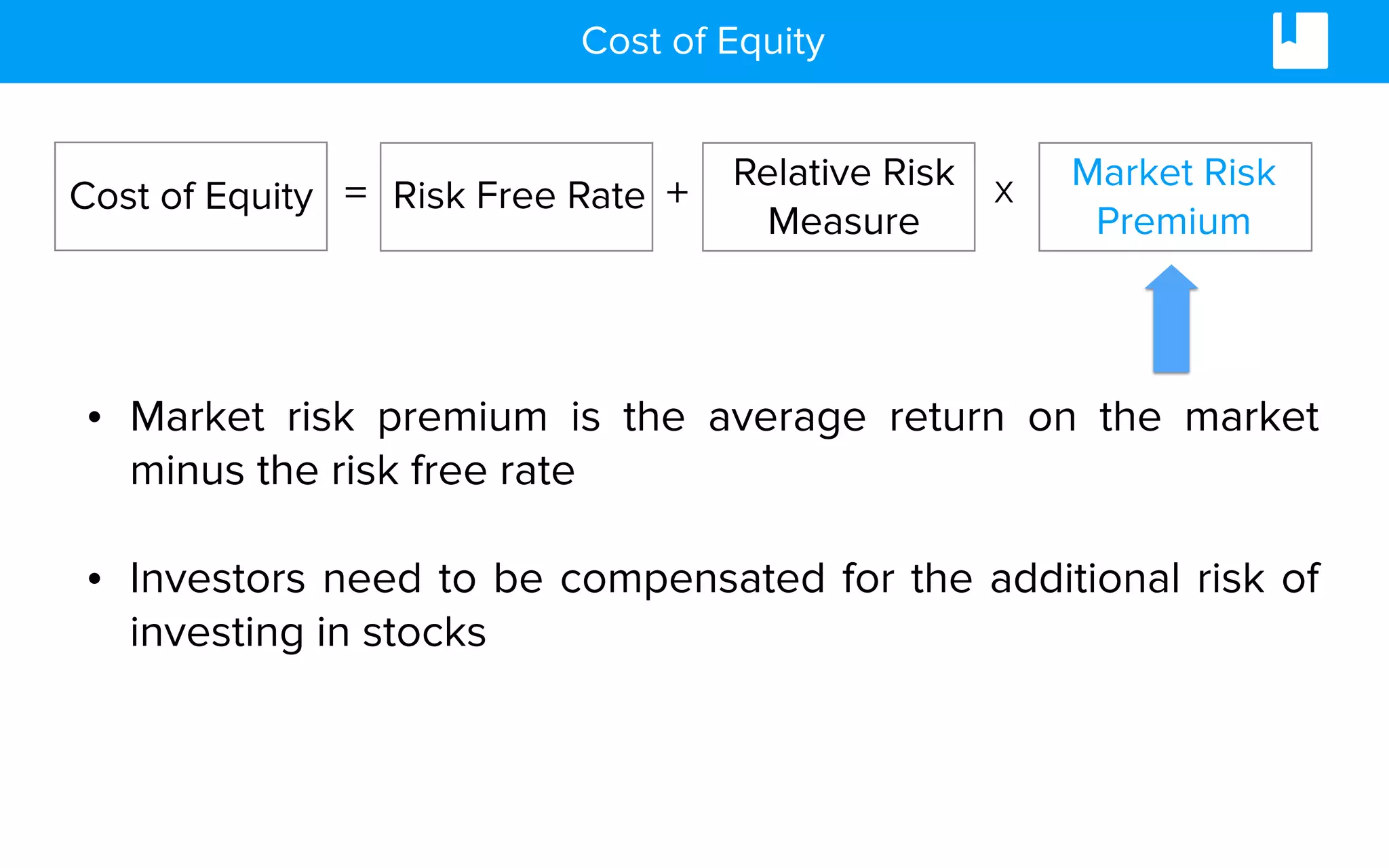

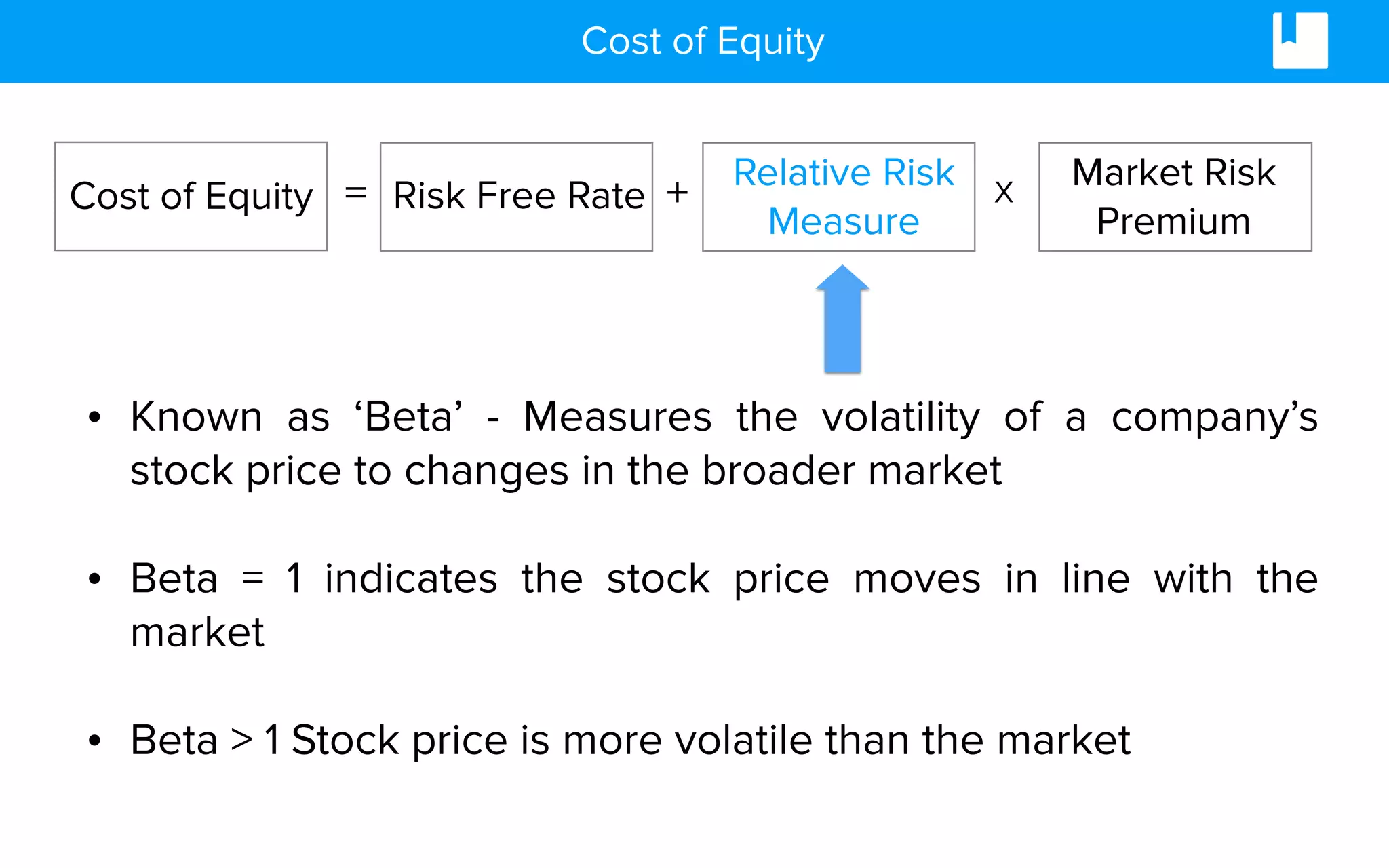

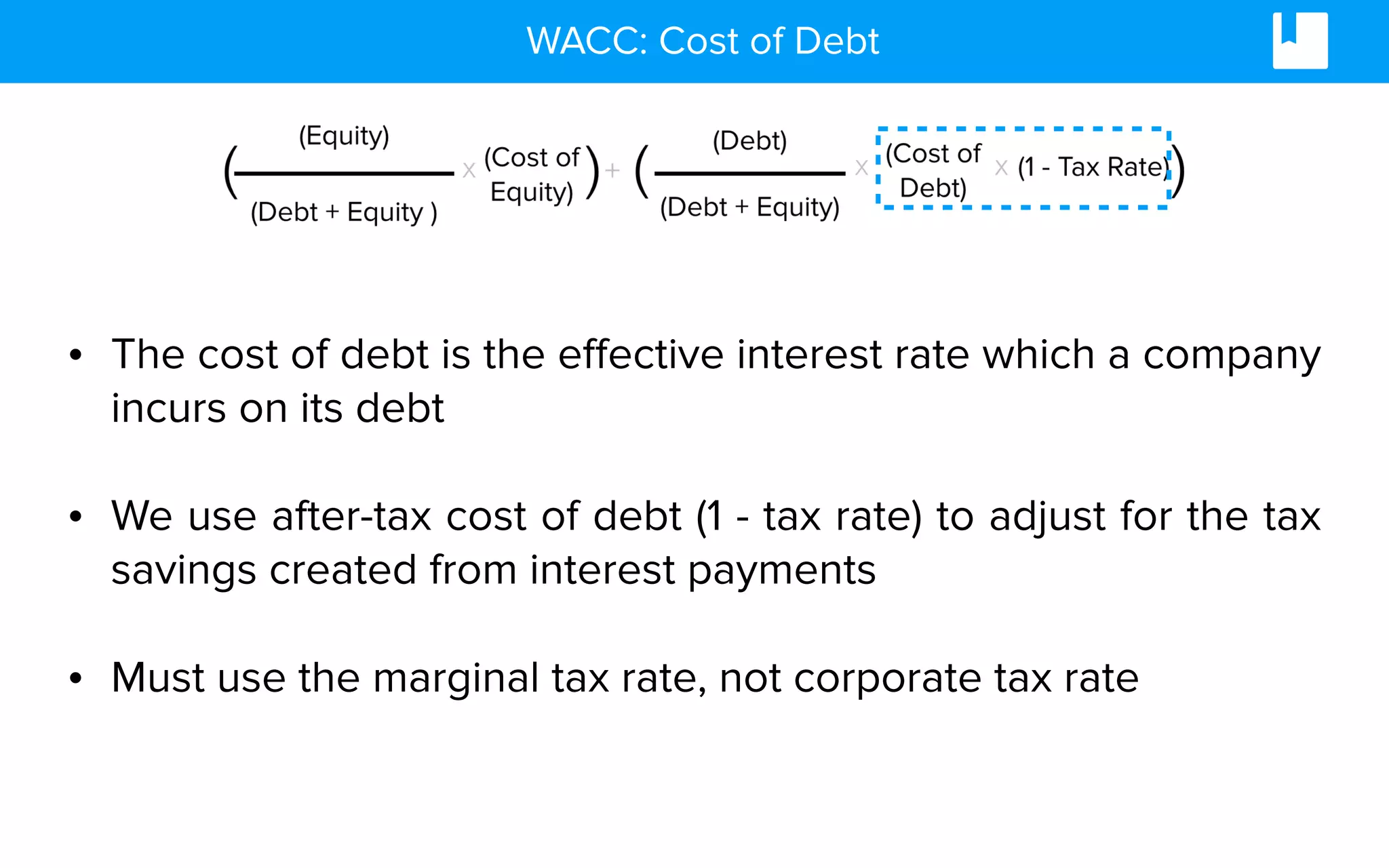

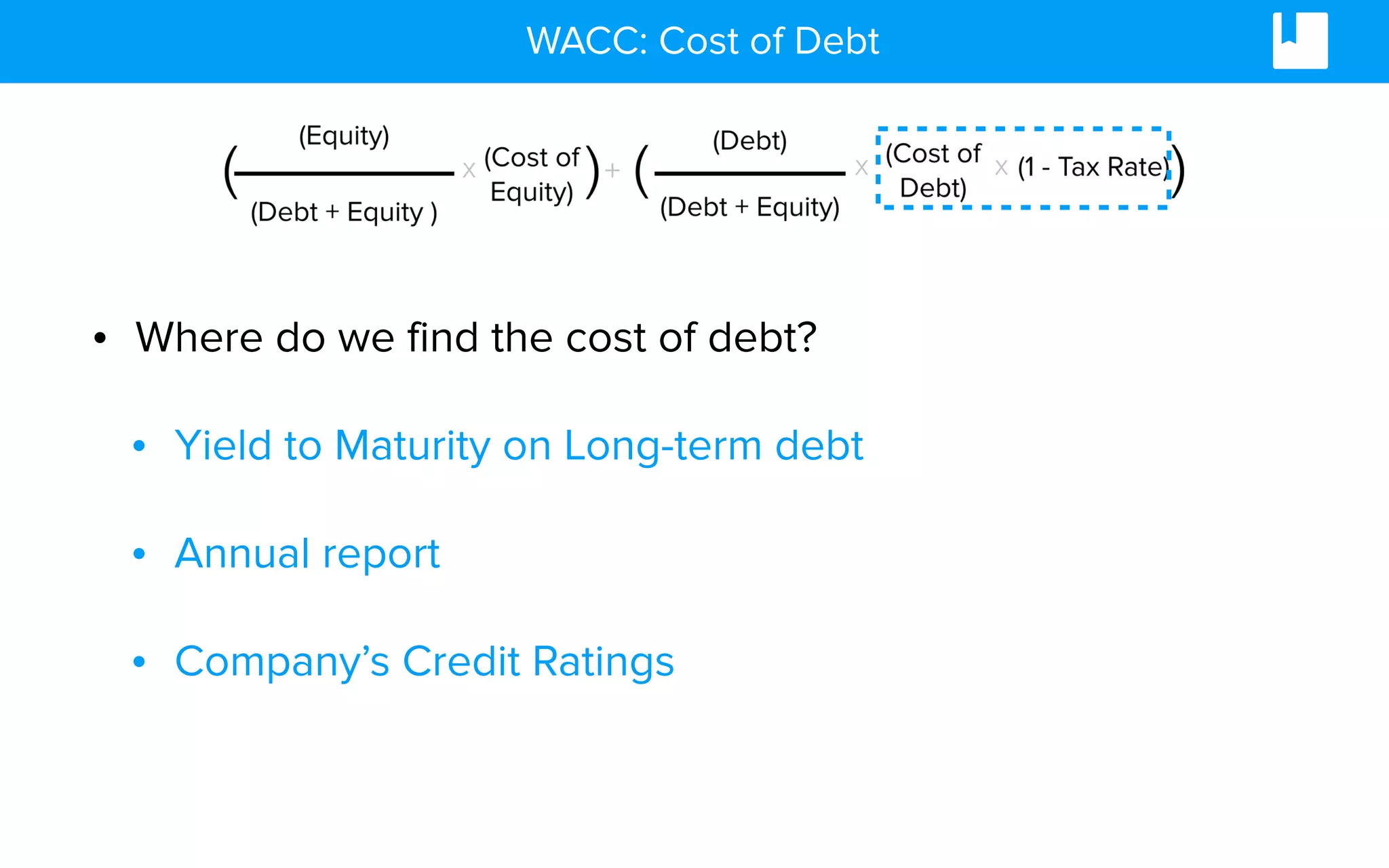

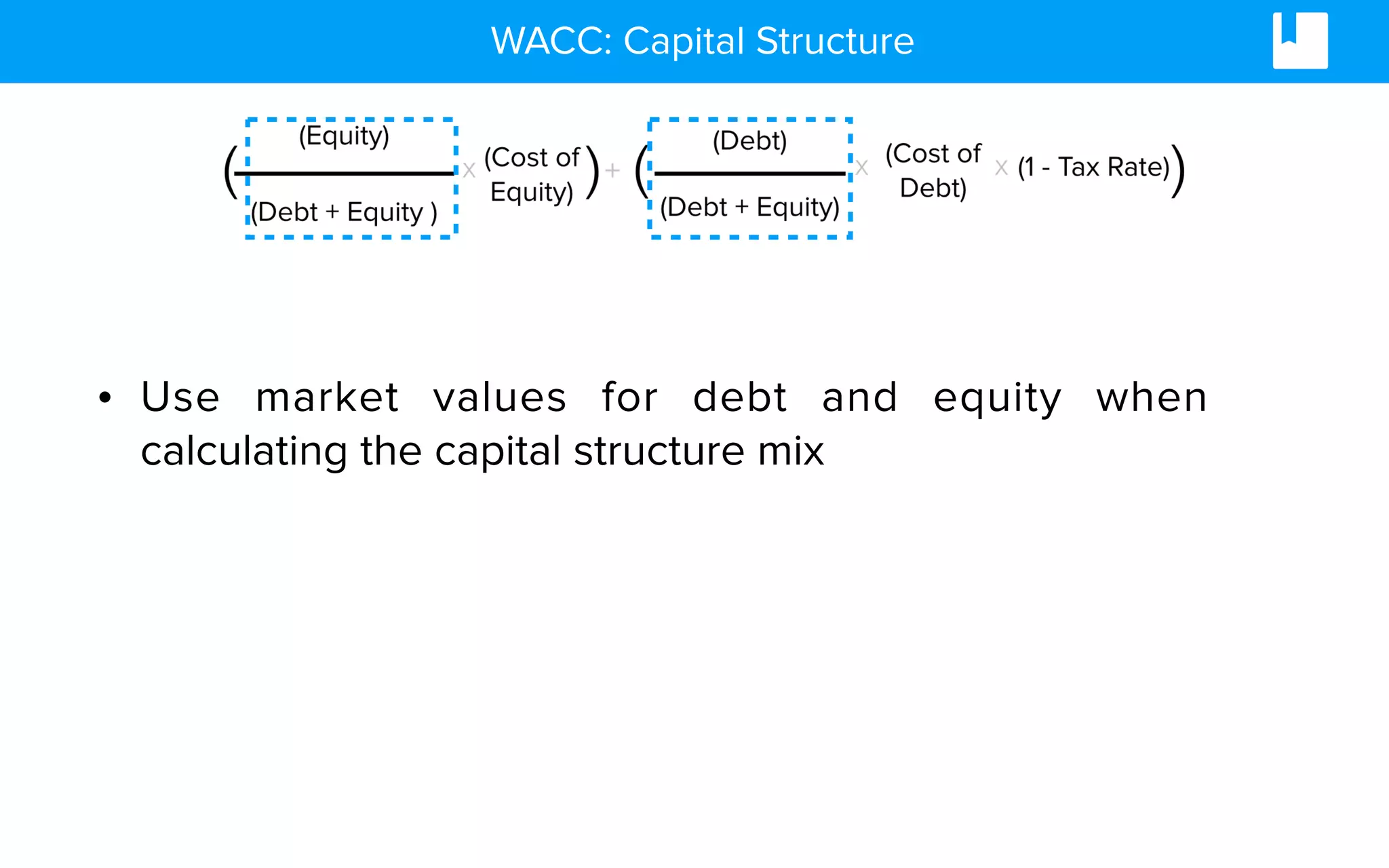

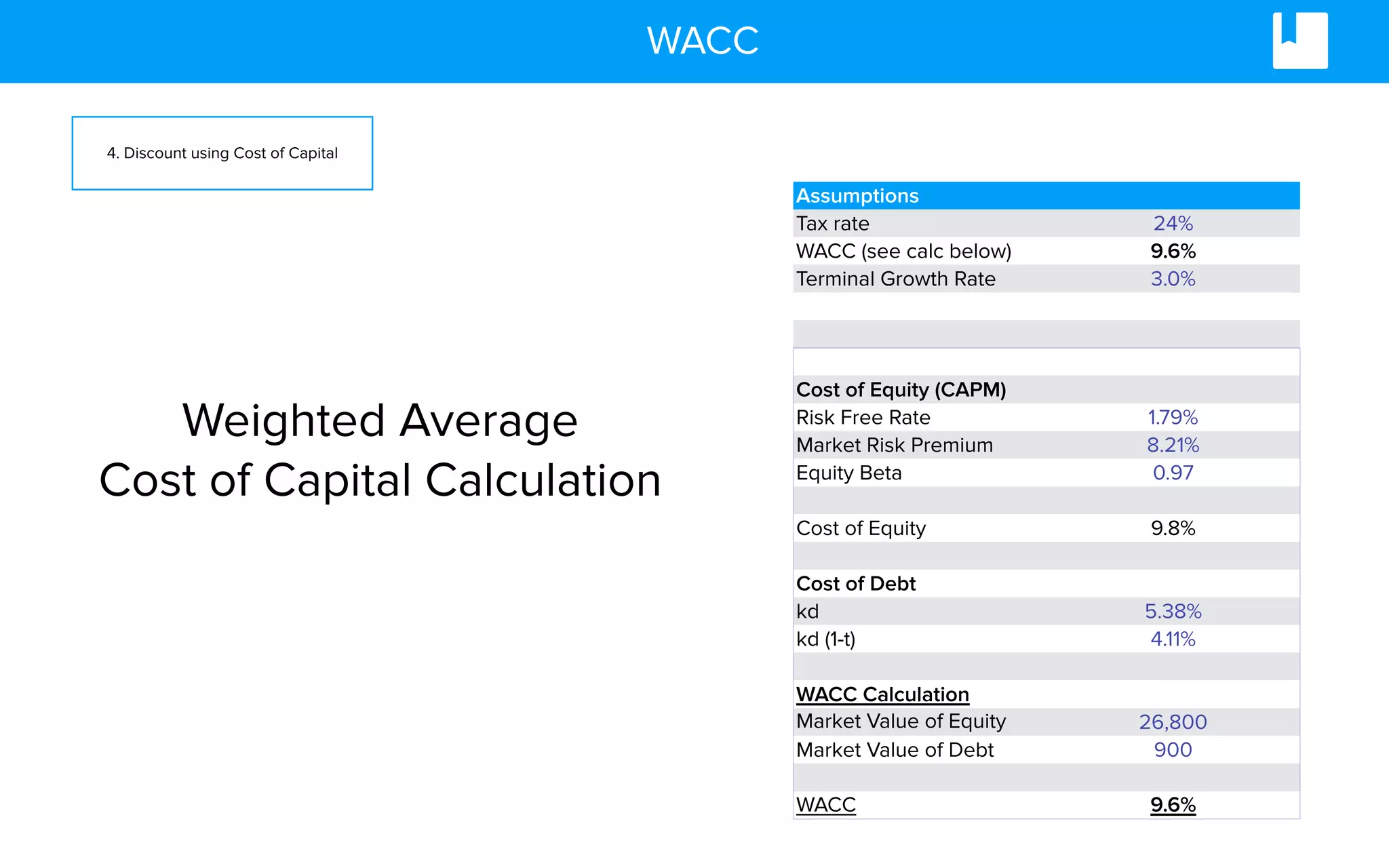

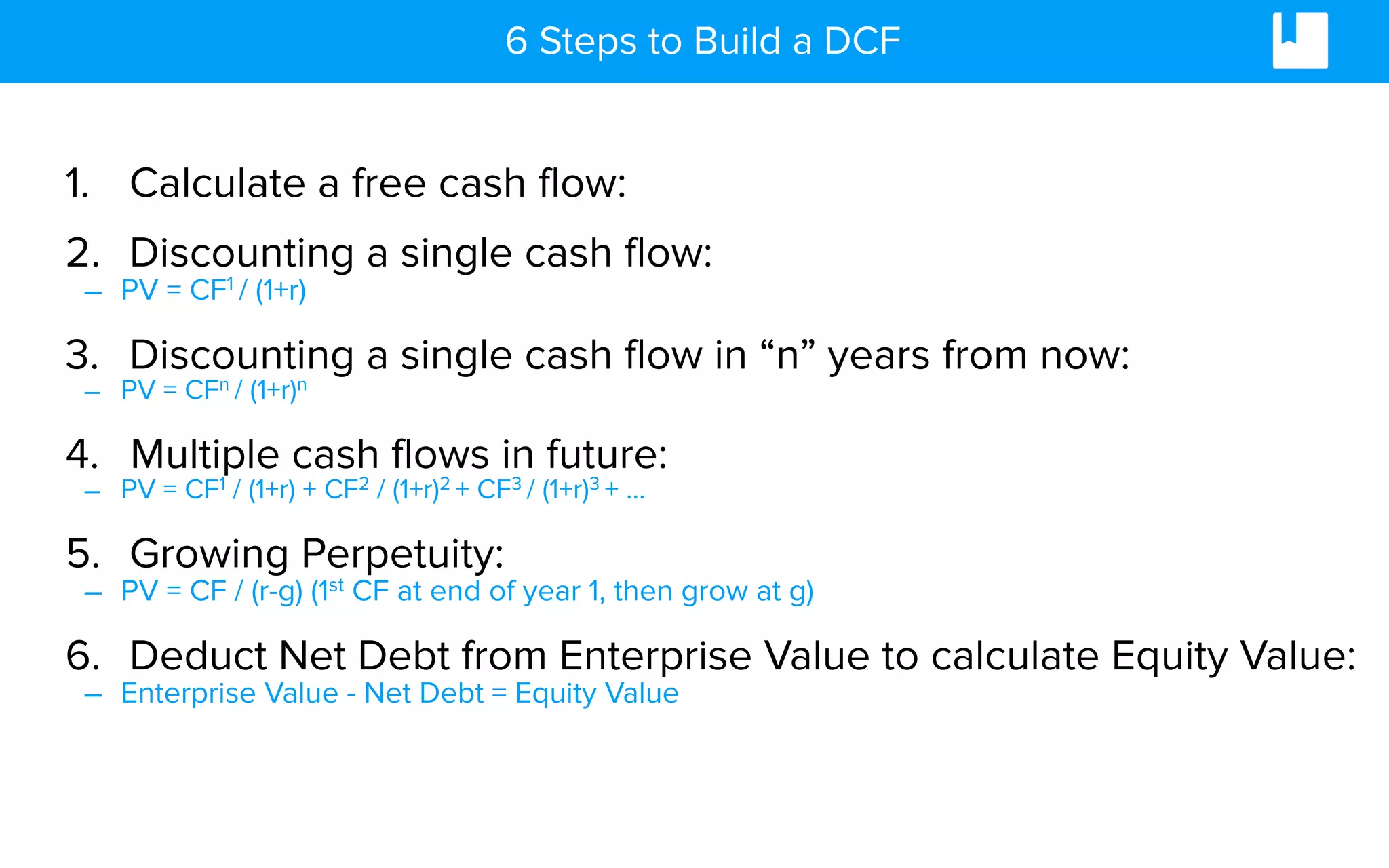

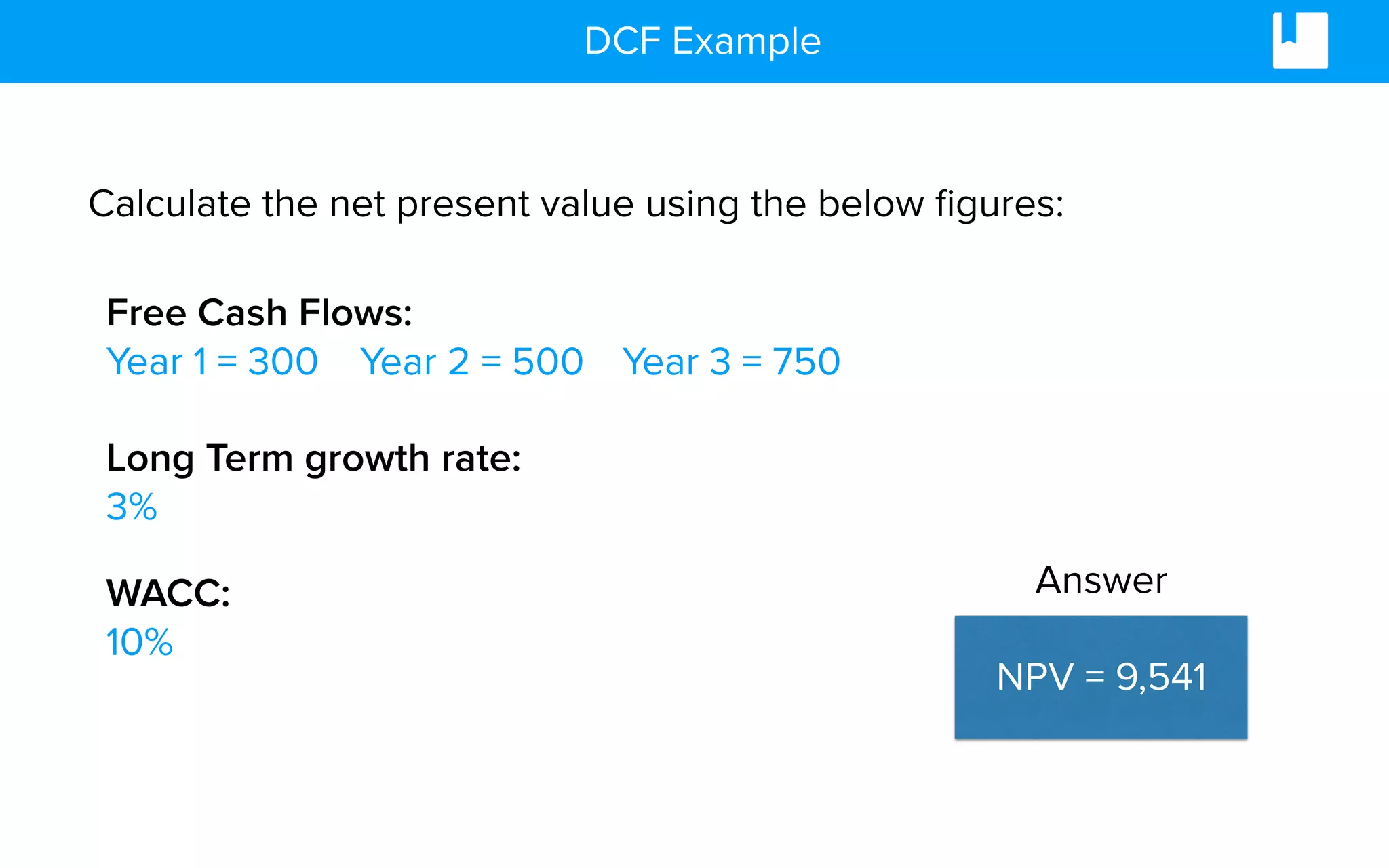

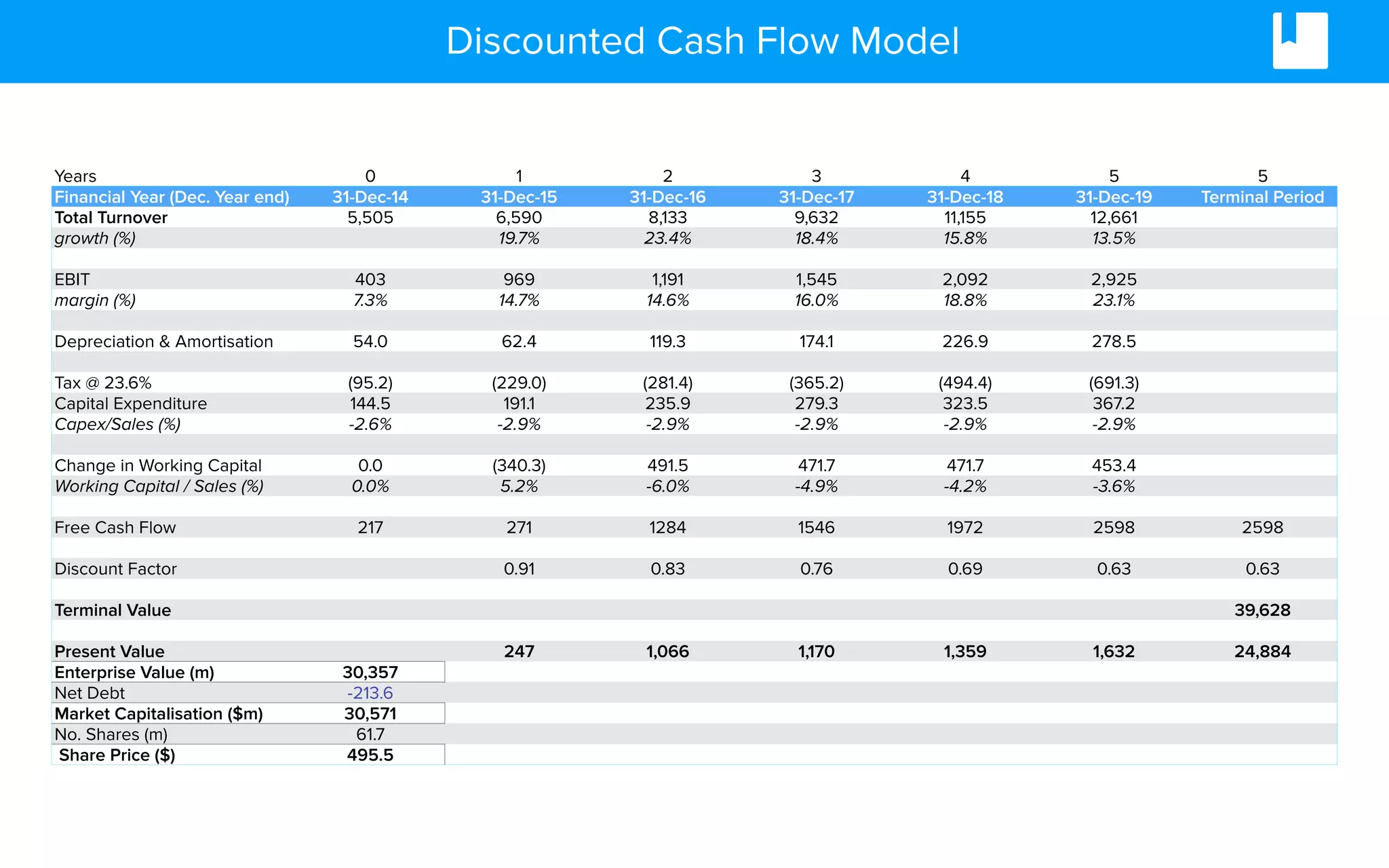

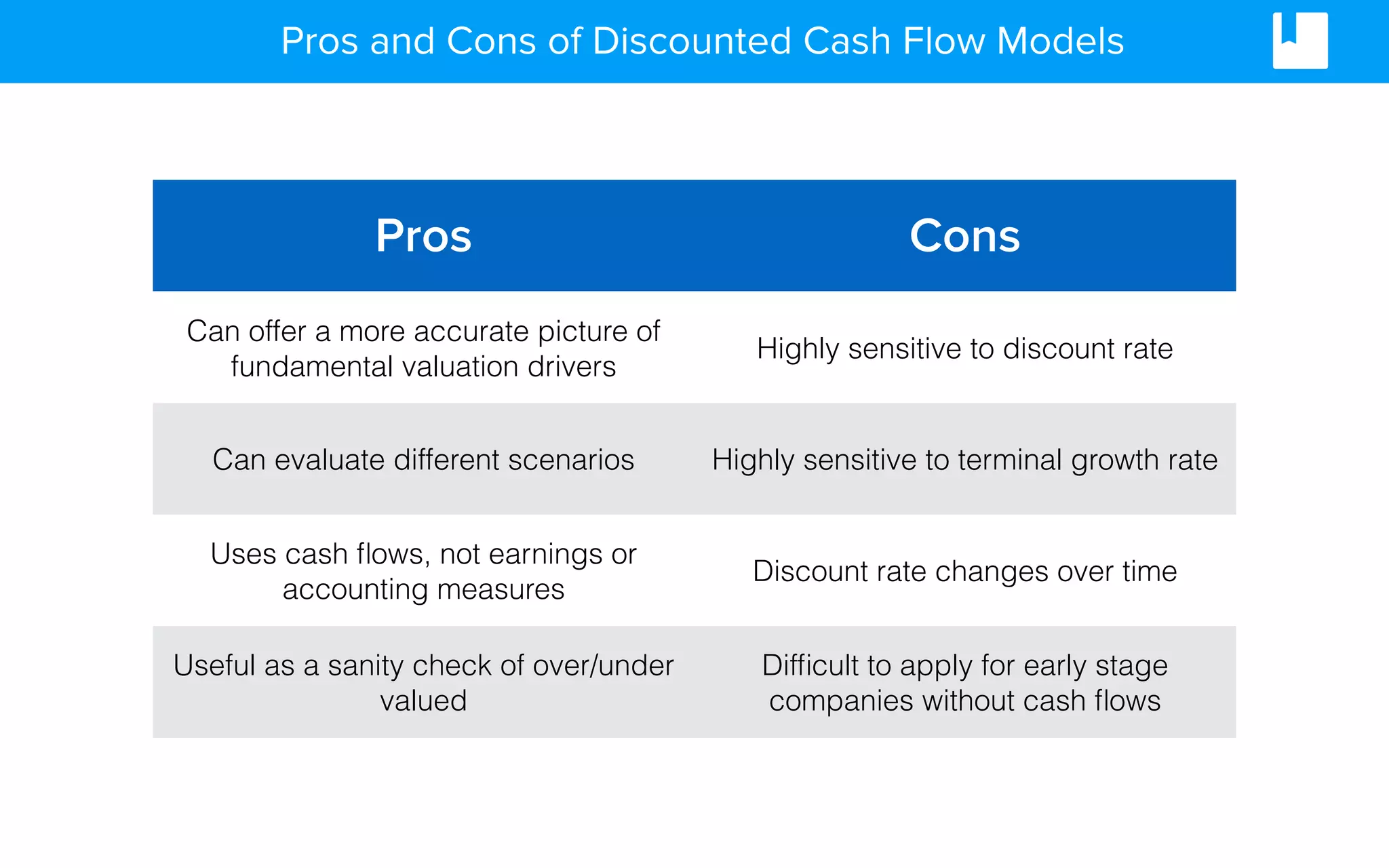

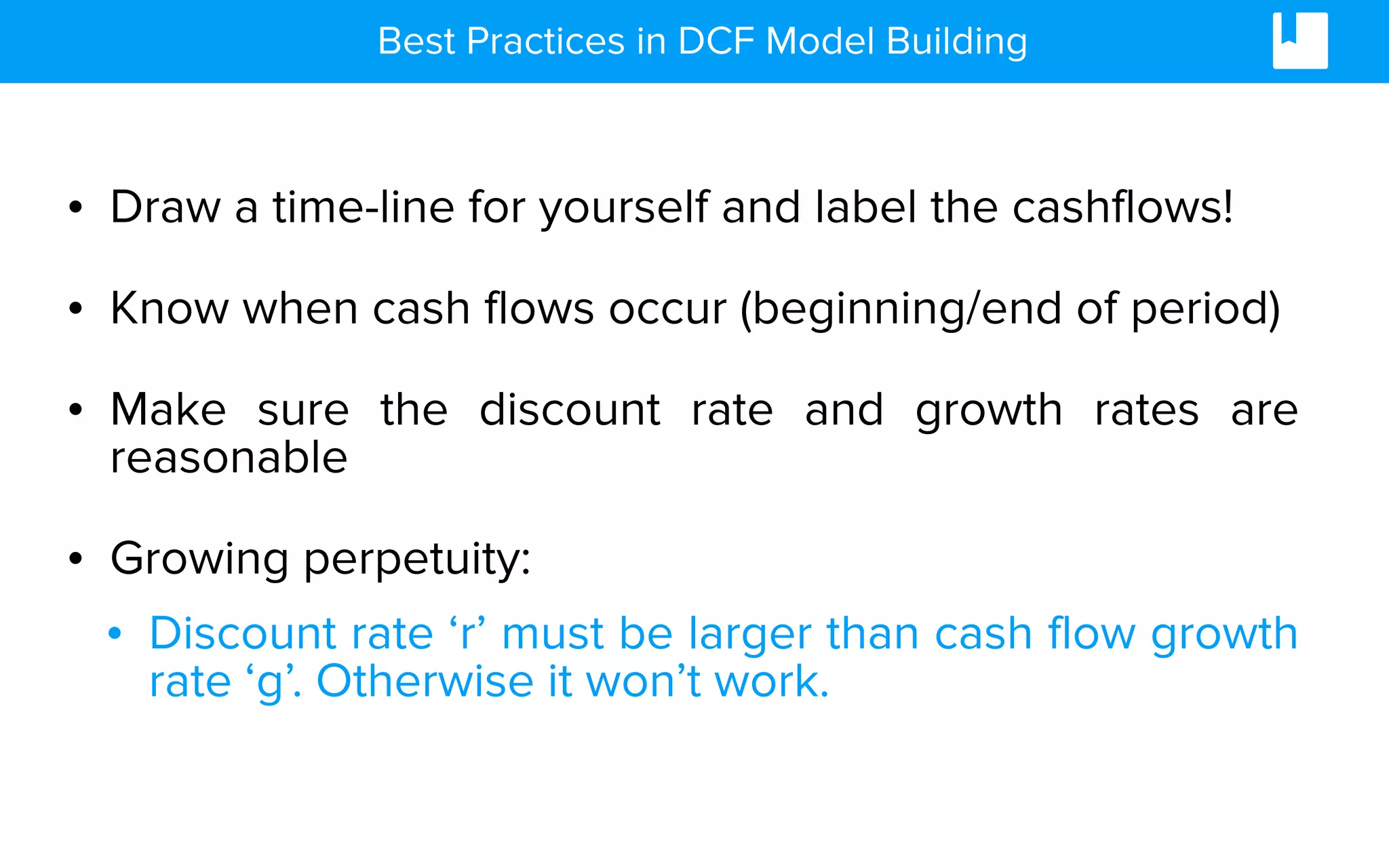

The document outlines the steps to build a discounted cash flow (DCF) valuation model. It includes: 1) forecasting historical performance and future cash flows, 2) calculating the terminal value, 3) determining the weighted average cost of capital (WACC) discount rate, and 4) discounting the forecasted cash flows and terminal value to calculate the firm's value. An example DCF model is provided with assumptions and valuation results. Pros, cons, and best practices of DCF modeling are also discussed.