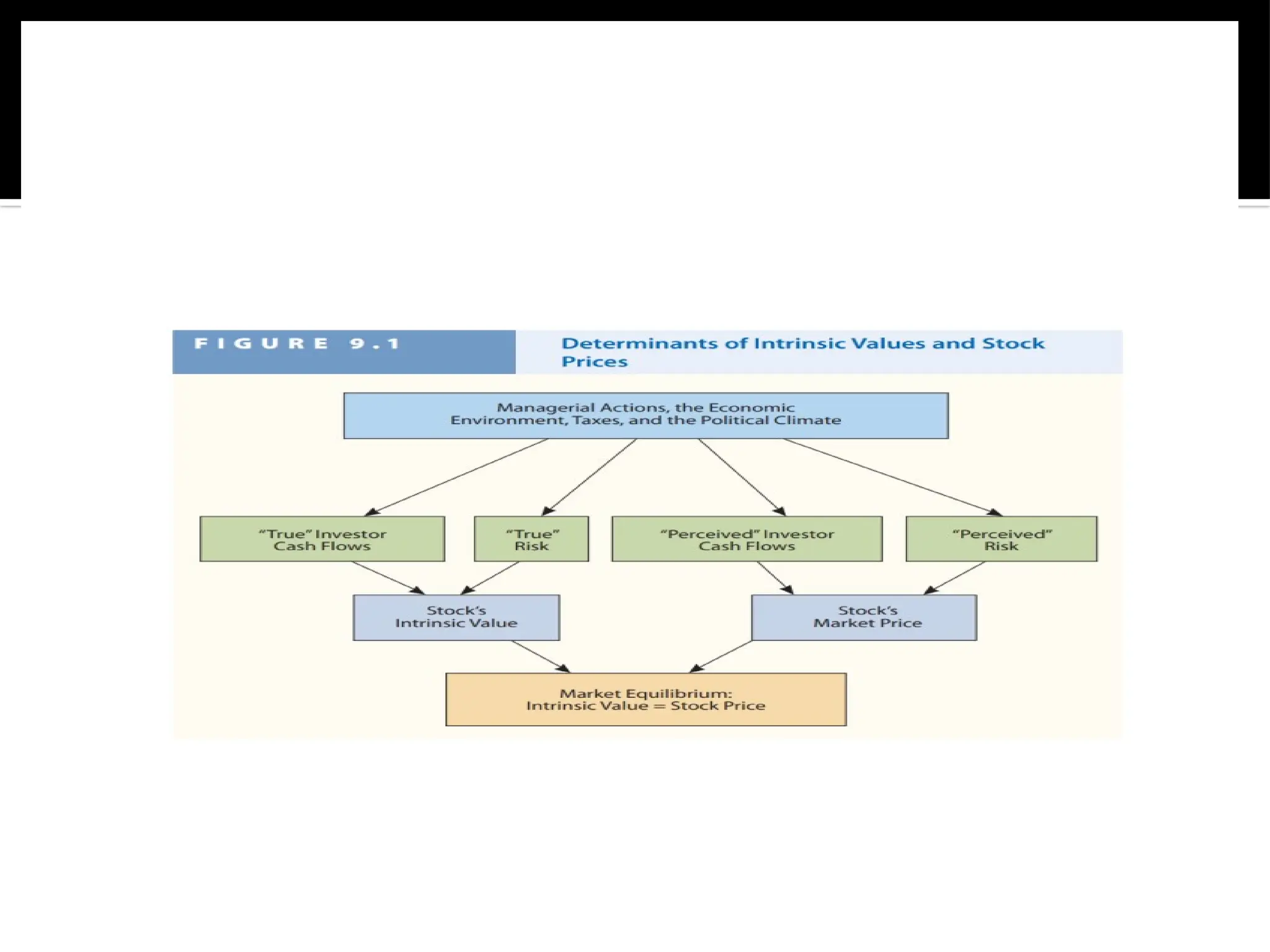

This document discusses financial management concepts focusing on stock valuation models and types of common stock. It explains the differences between classified stocks, such as Class A and Class B, and how they help founders maintain control. Additionally, it covers methods for estimating intrinsic value, like the discounted dividend model, and various aspects of stock returns, including dividend yield and capital gains yield.