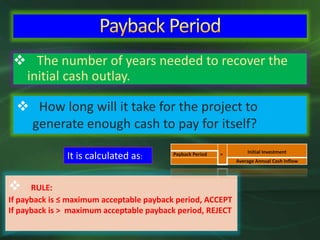

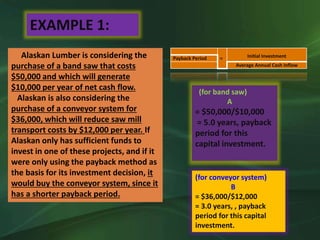

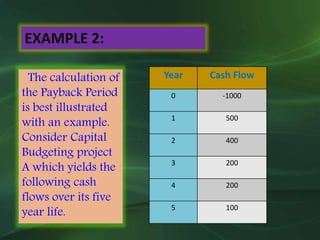

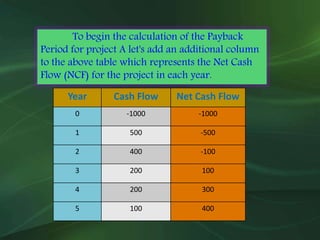

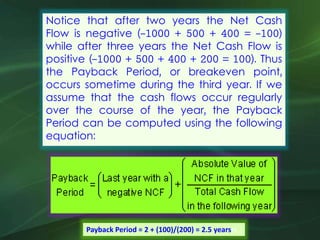

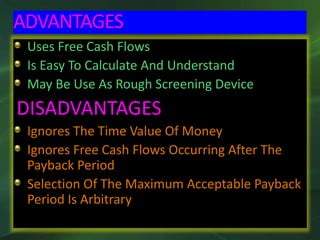

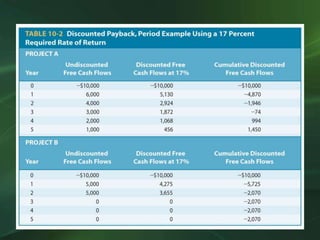

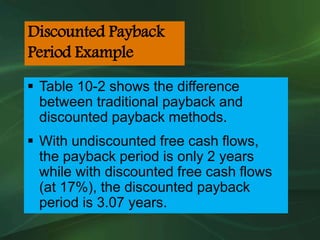

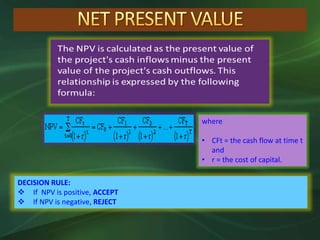

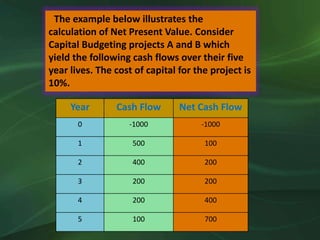

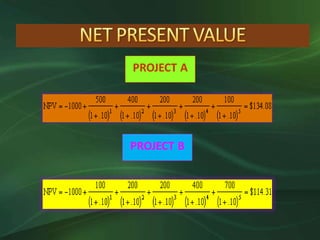

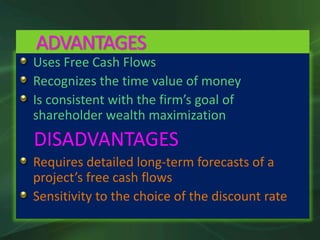

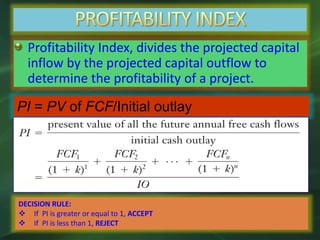

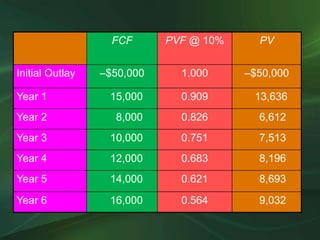

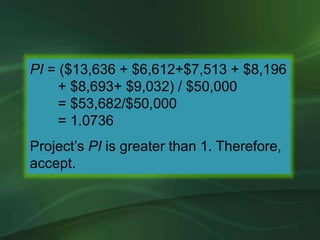

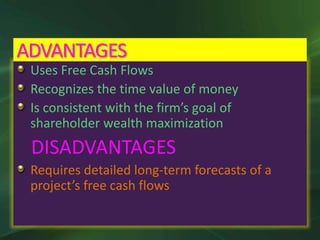

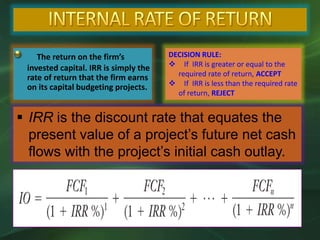

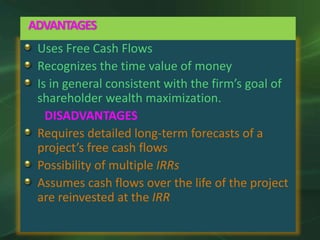

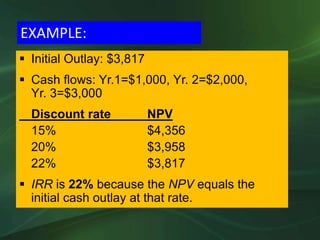

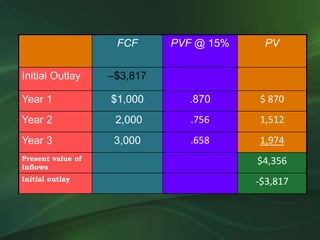

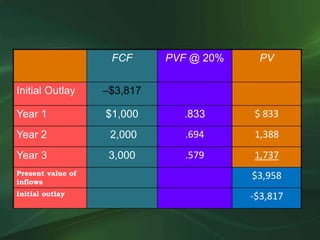

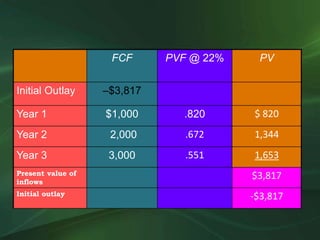

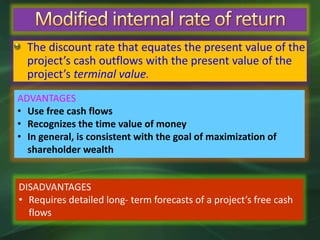

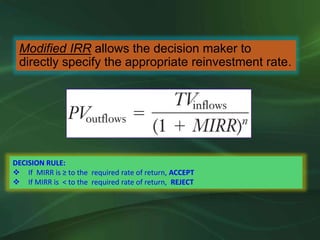

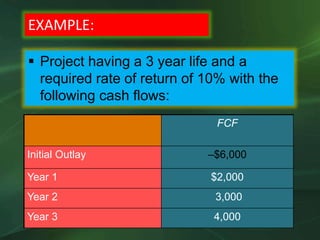

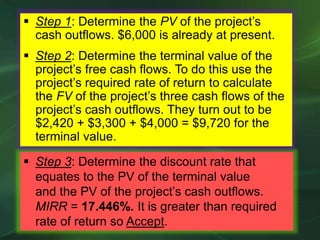

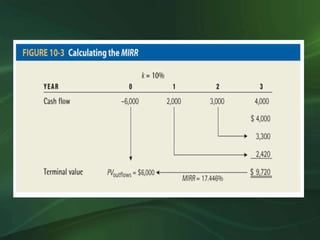

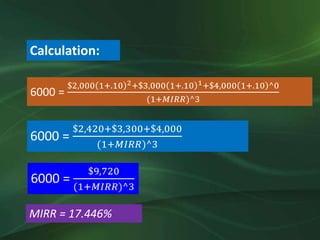

The document discusses various capital budgeting techniques used to evaluate long-term investment projects, including payback period, net present value (NPV), internal rate of return (IRR), and profitability index (PI). It provides examples of how to calculate each metric and the decision rules for whether to accept or reject a project based on the results. Modified IRR is also introduced as an alternative to standard IRR. Finally, the importance of ethics in capital budgeting decisions is highlighted.