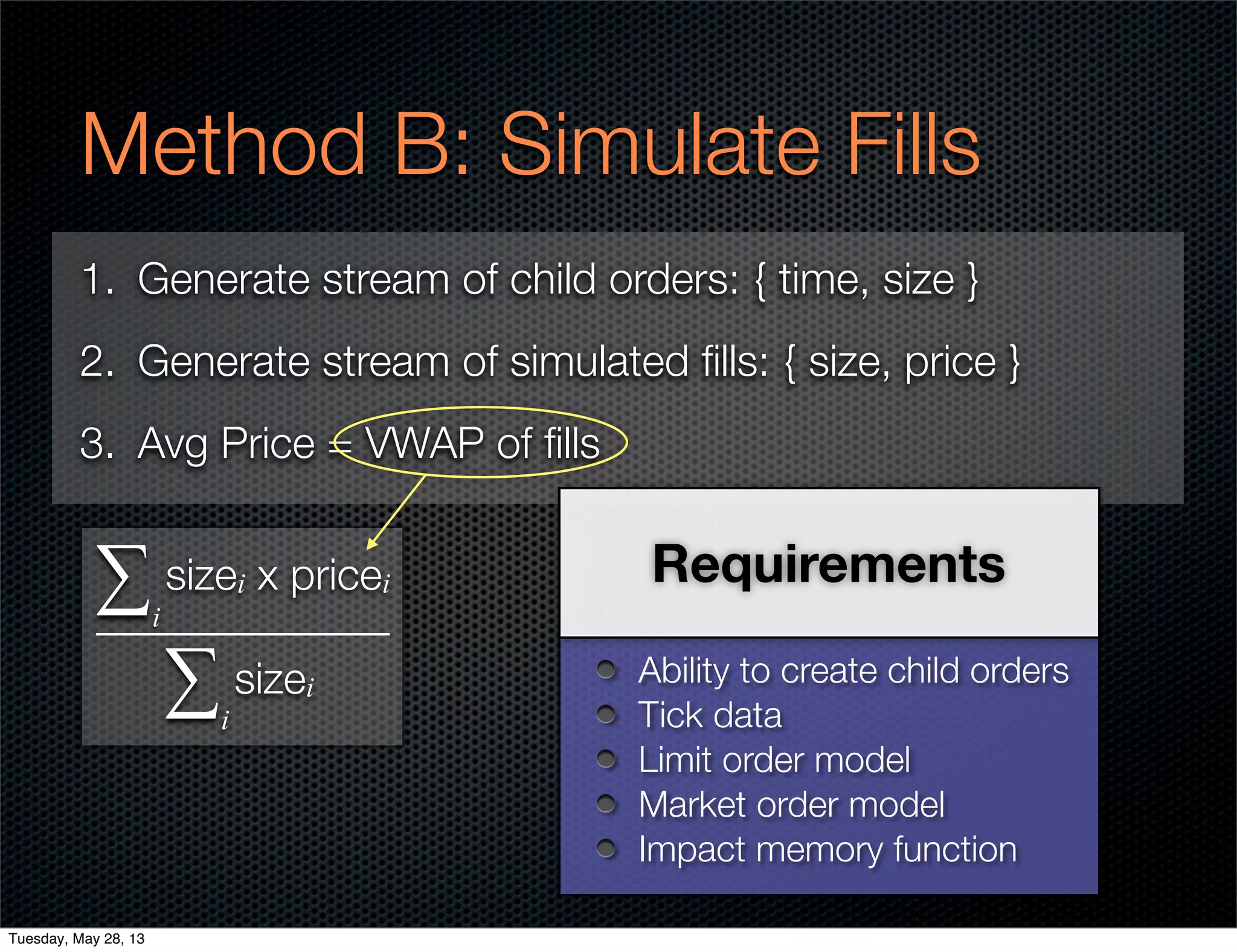

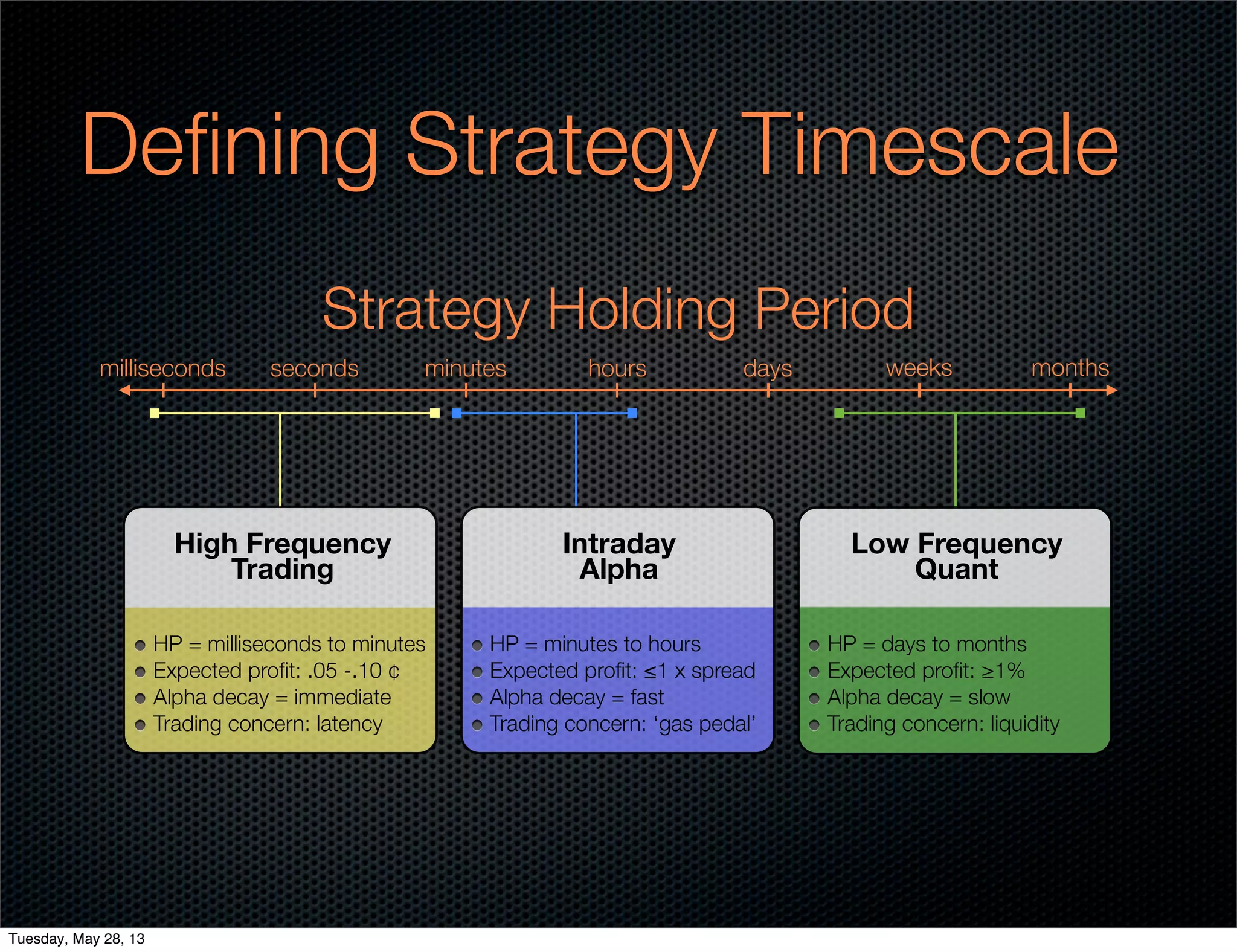

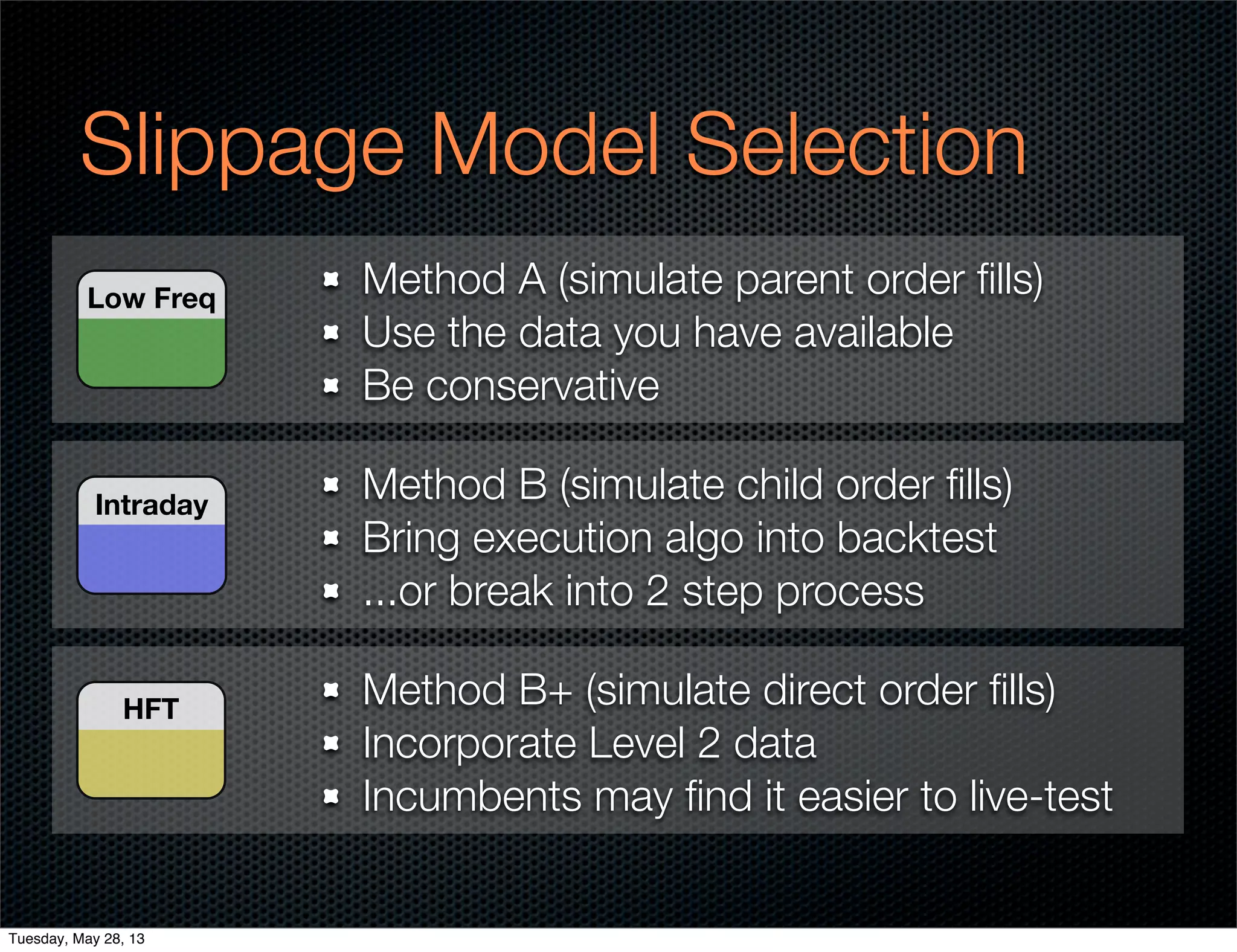

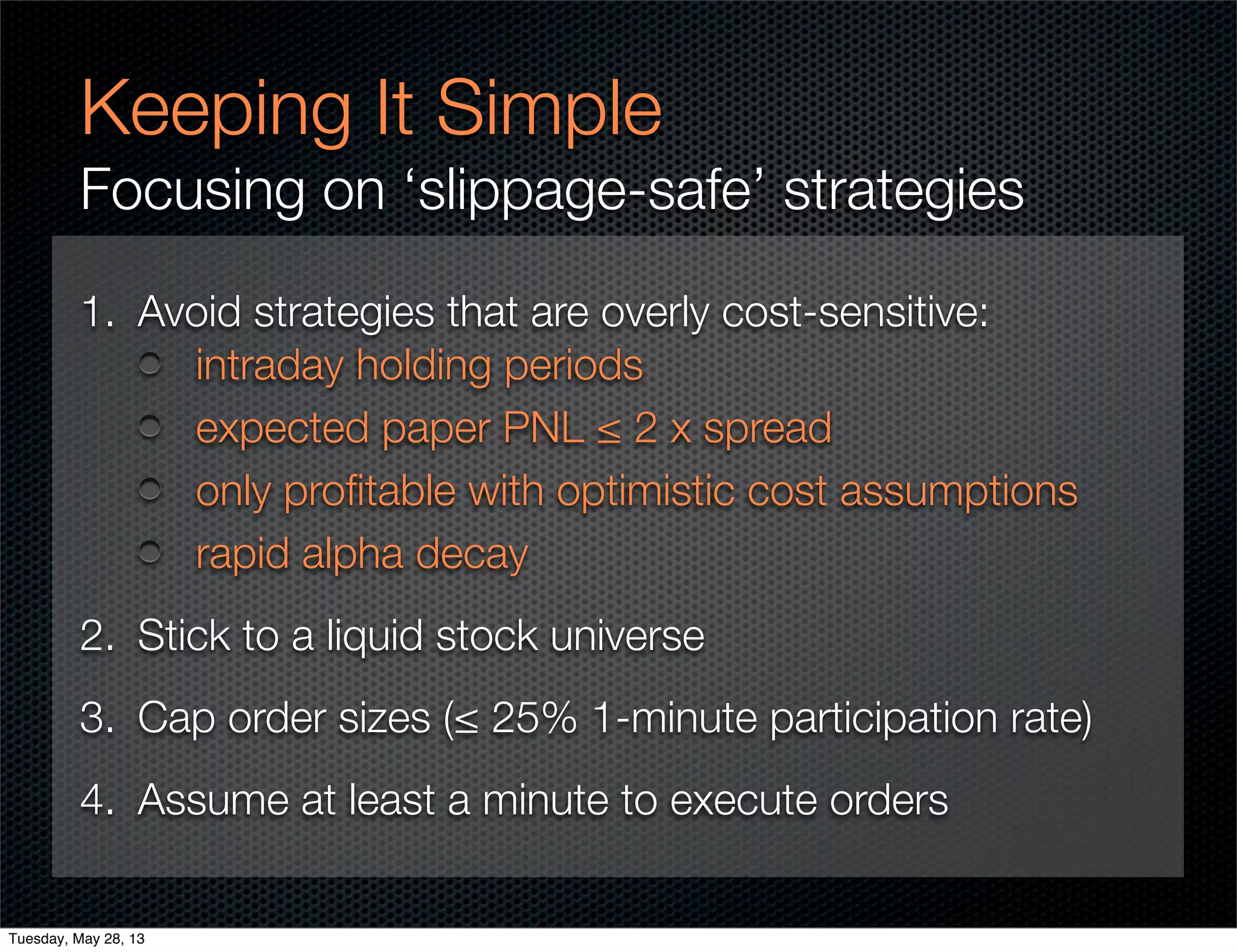

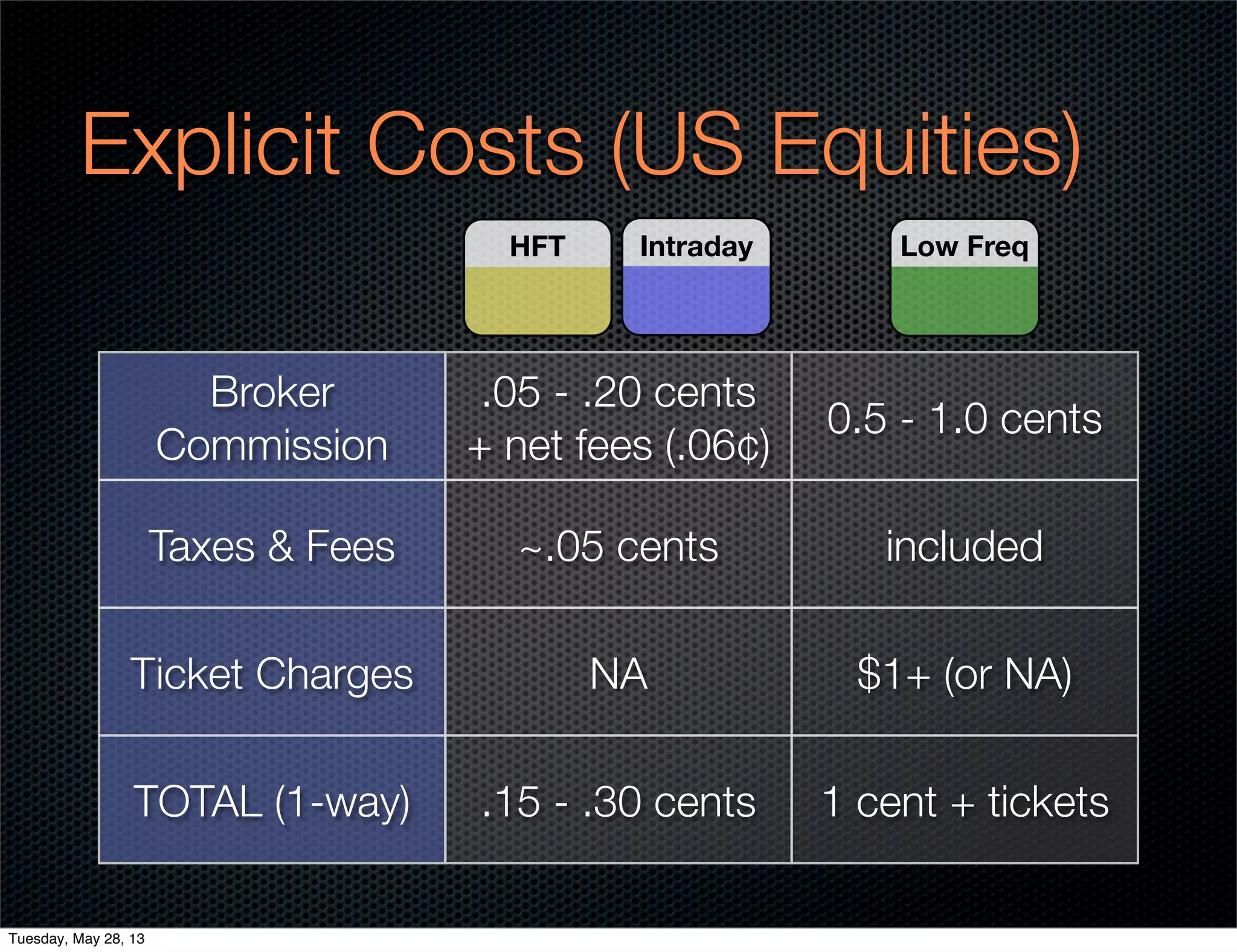

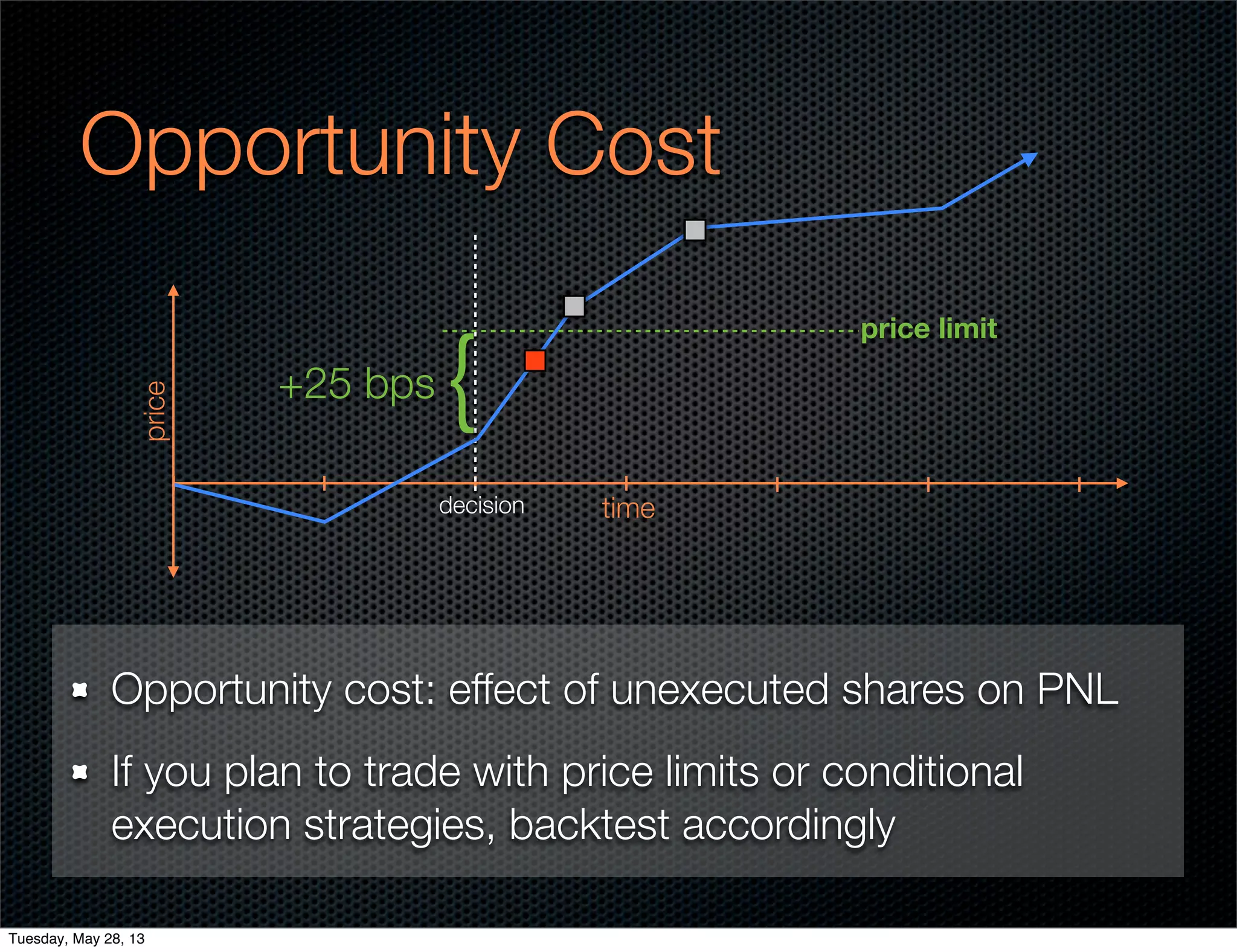

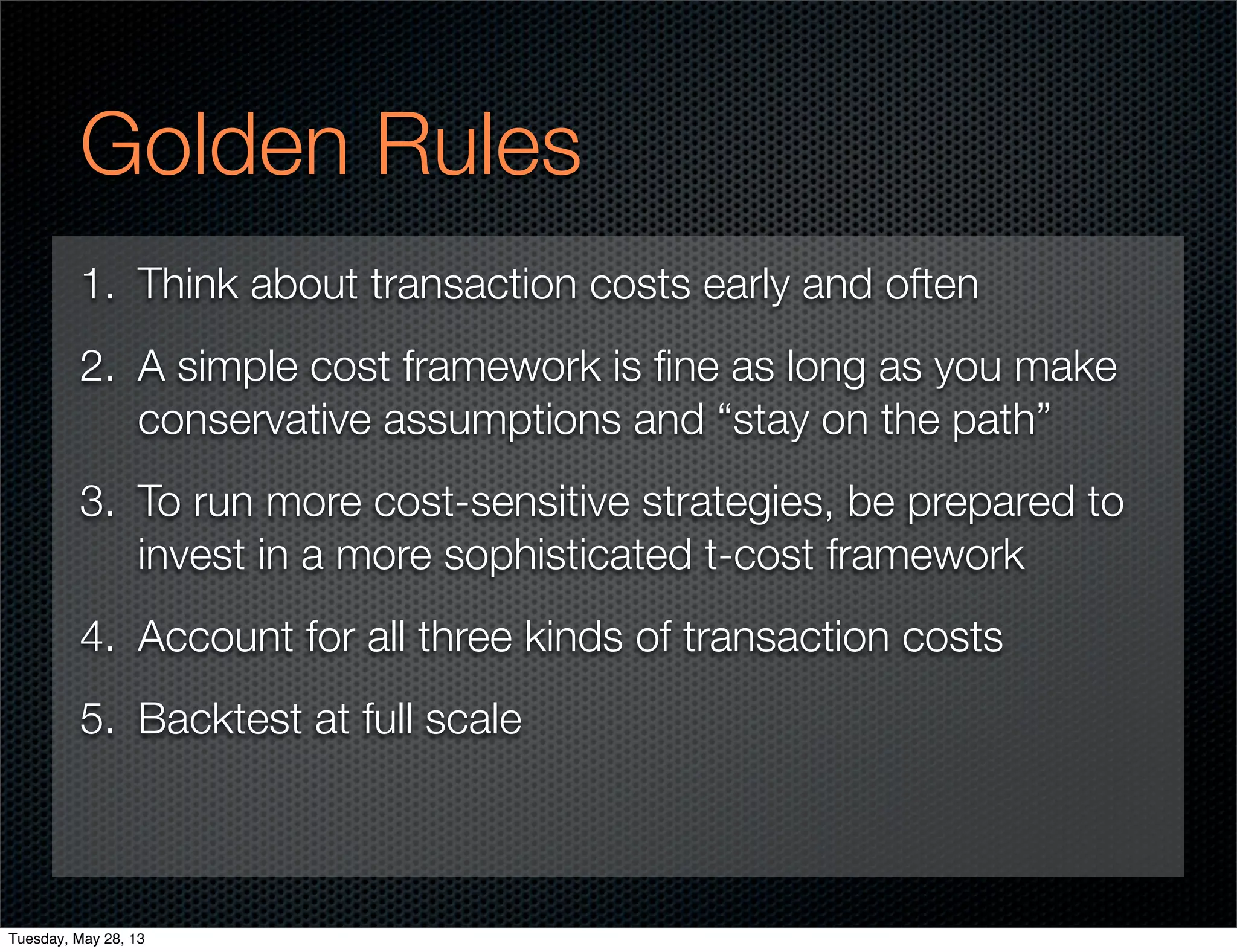

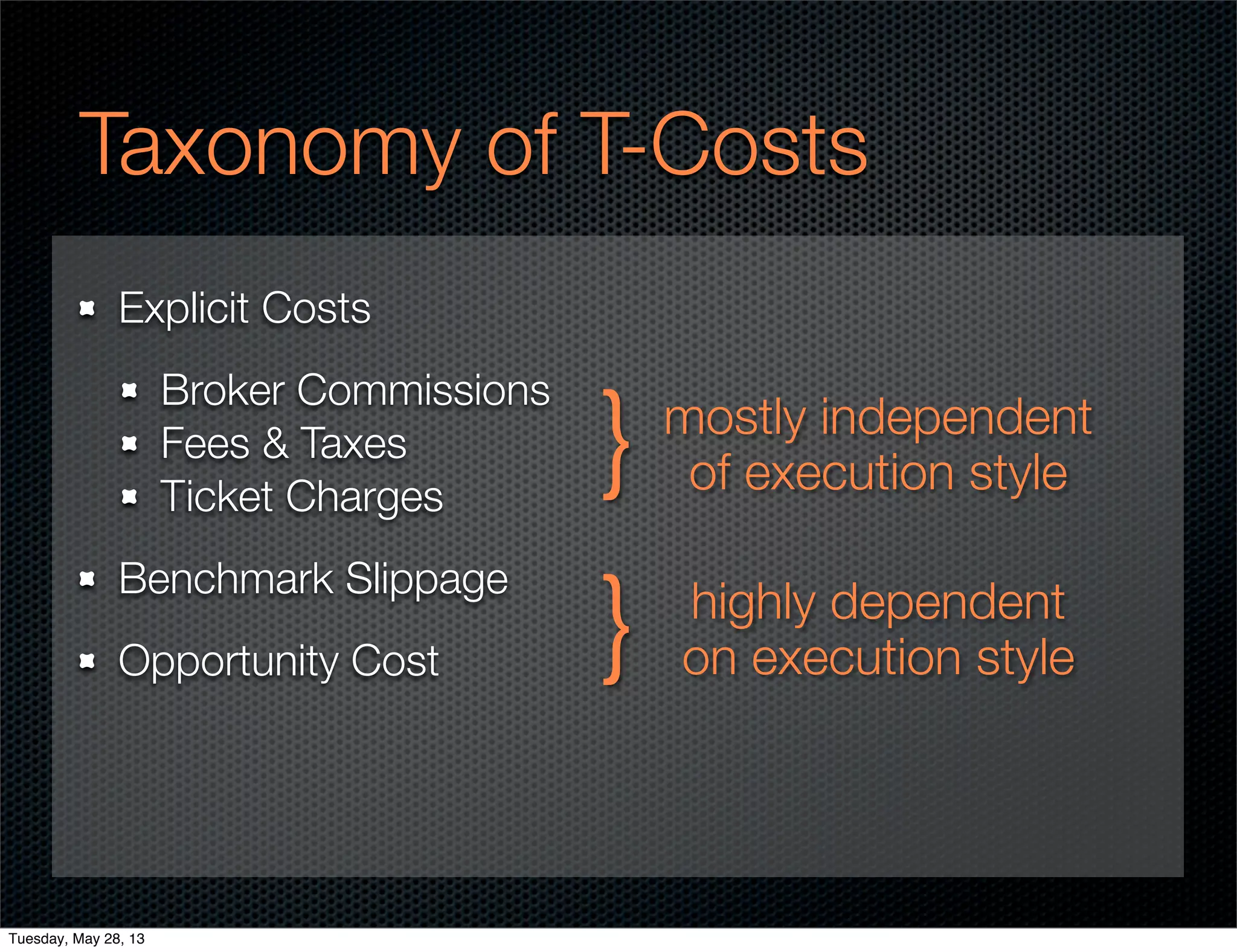

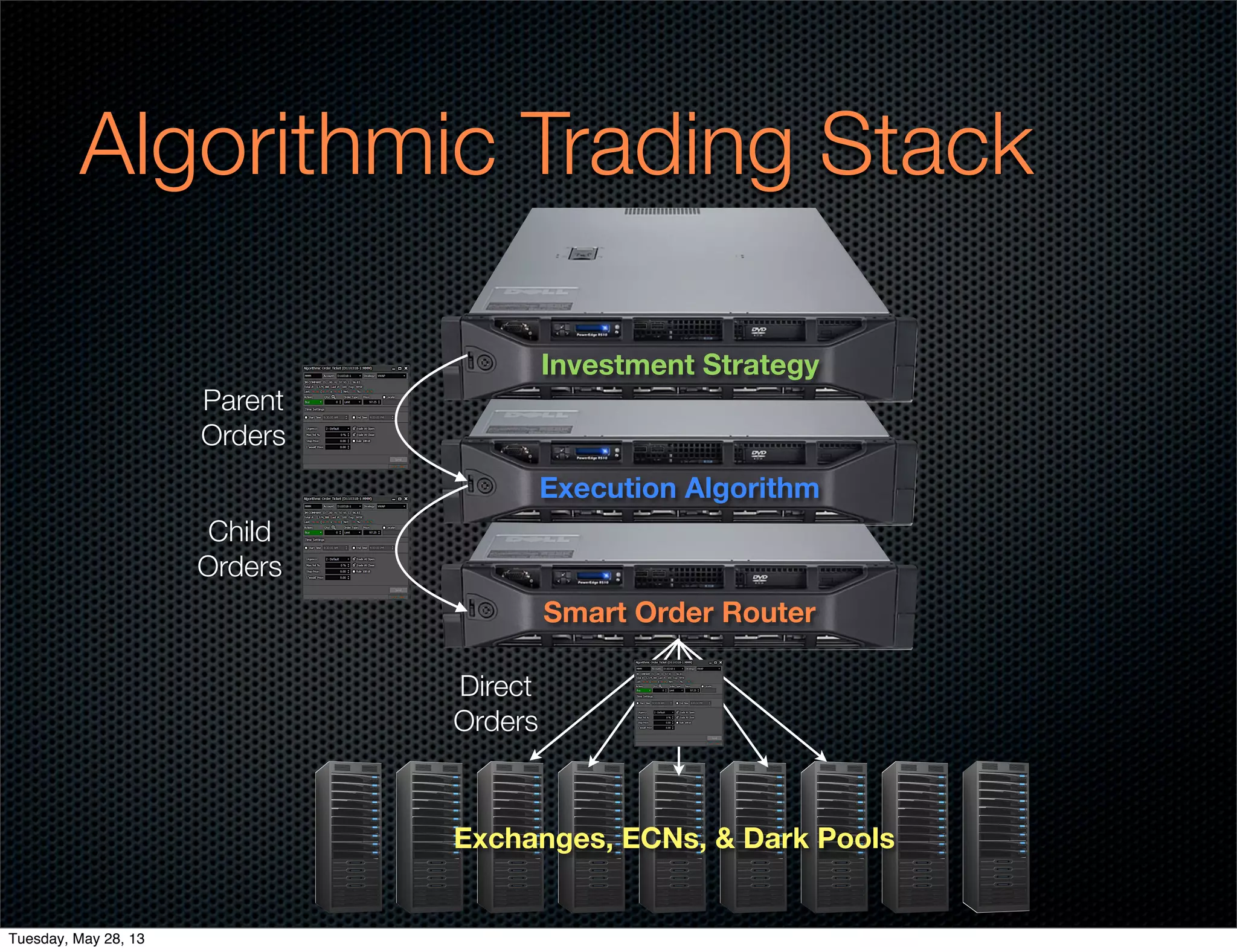

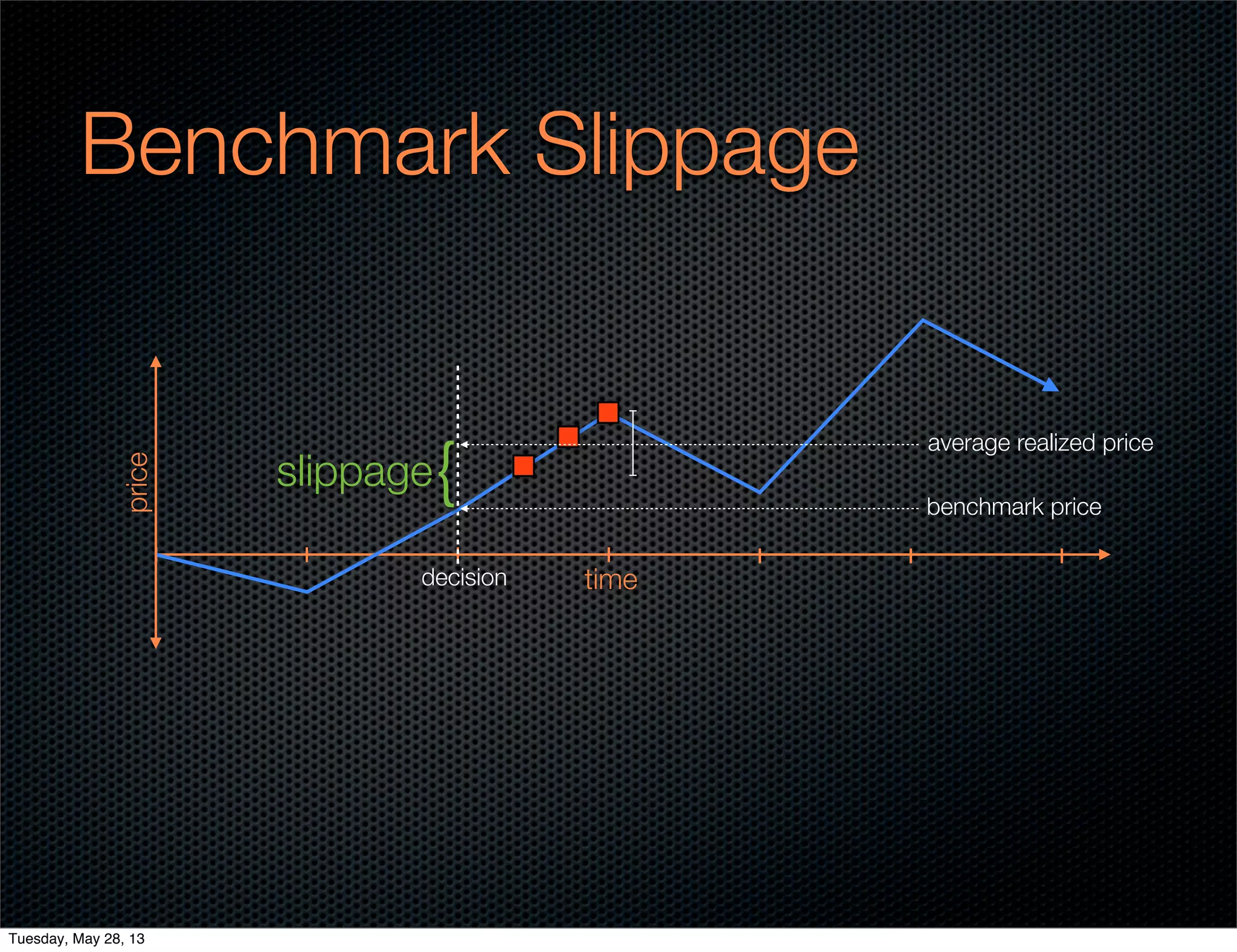

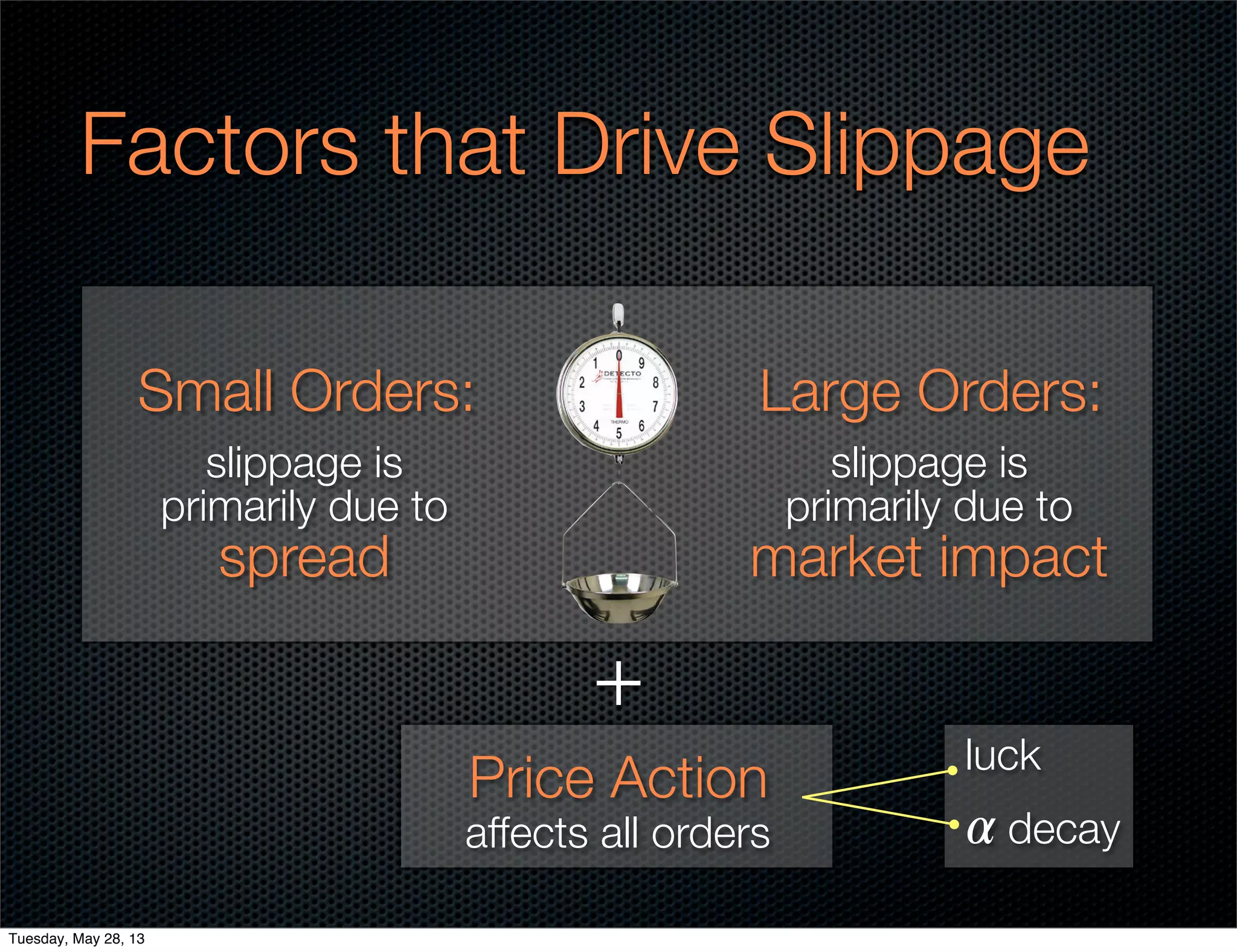

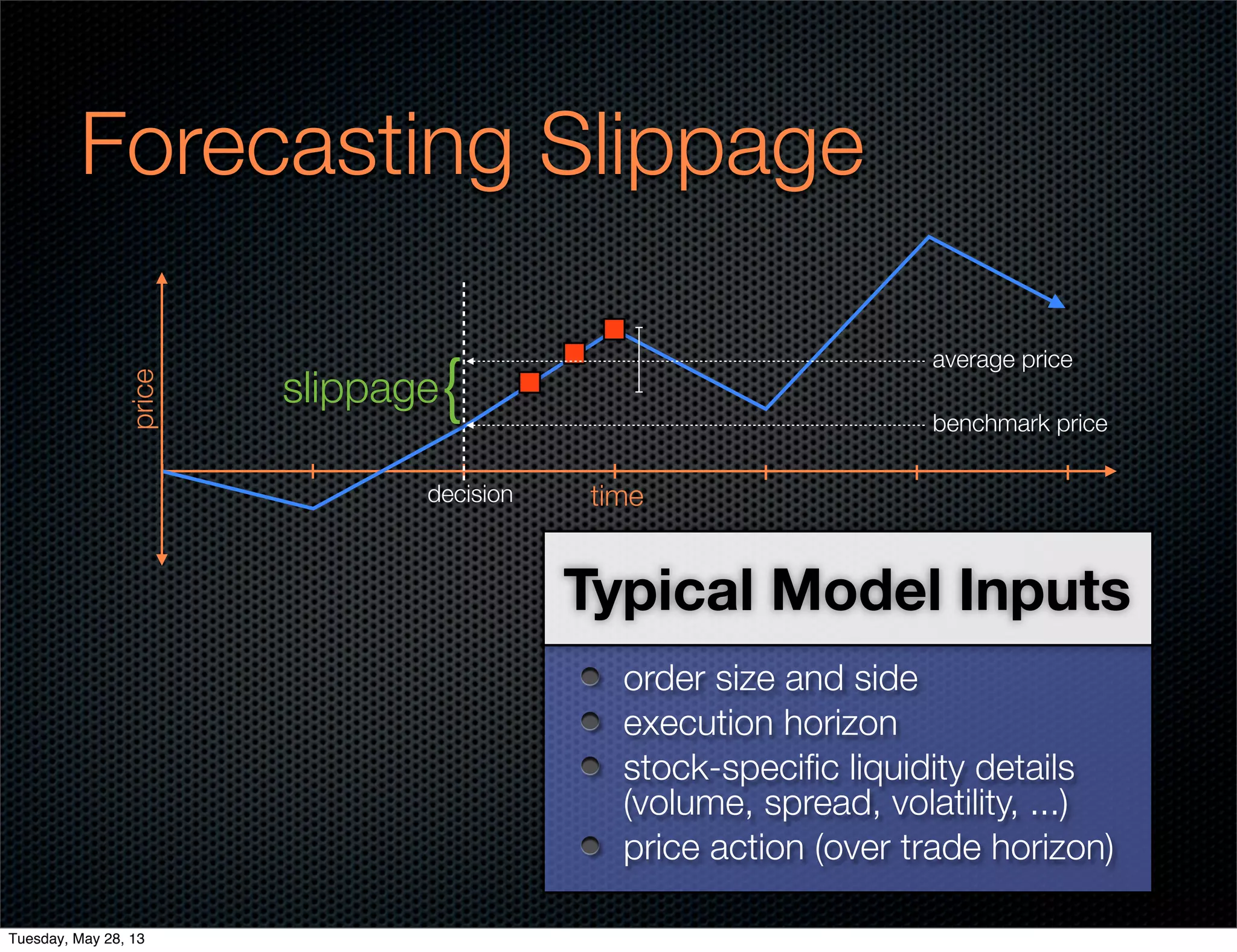

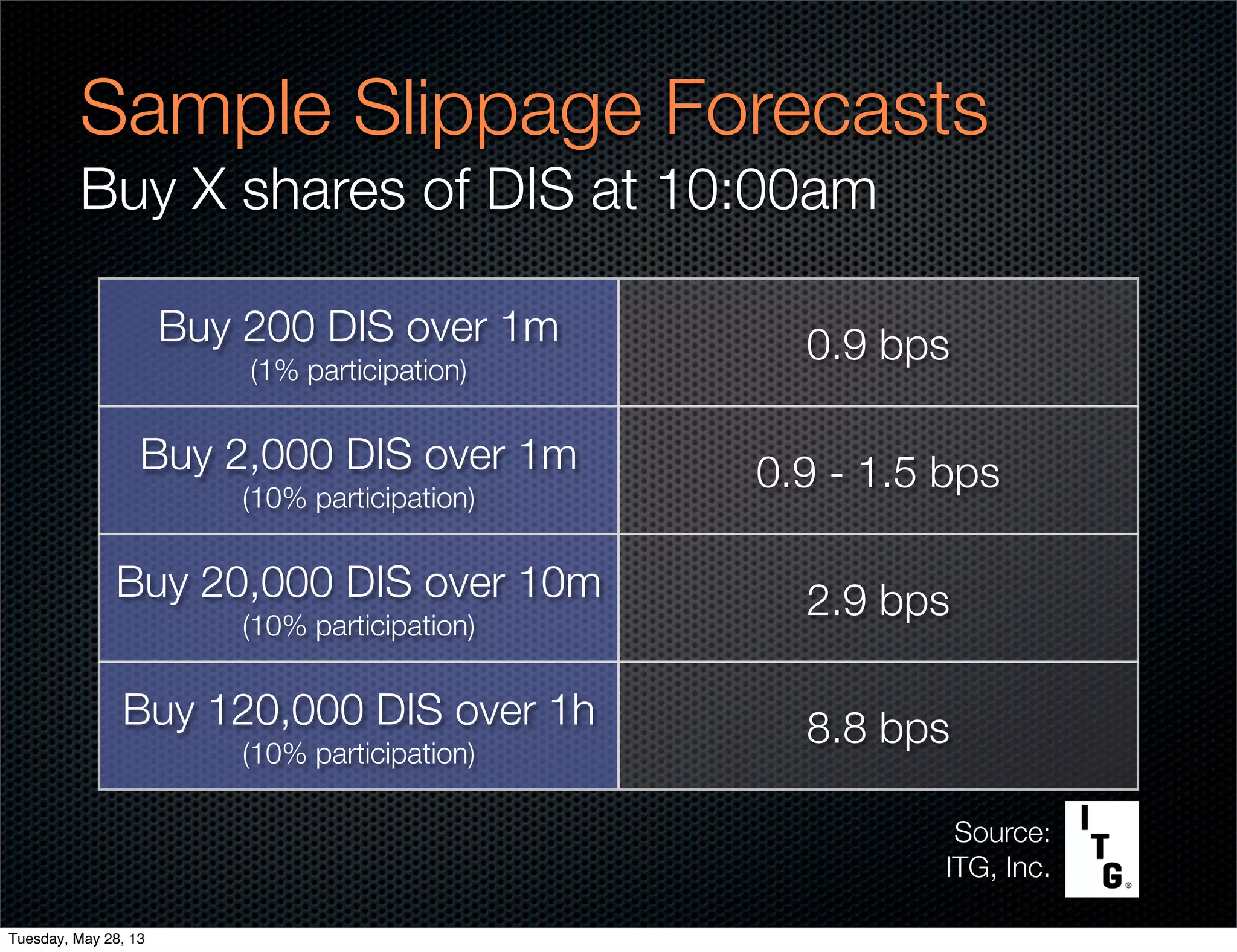

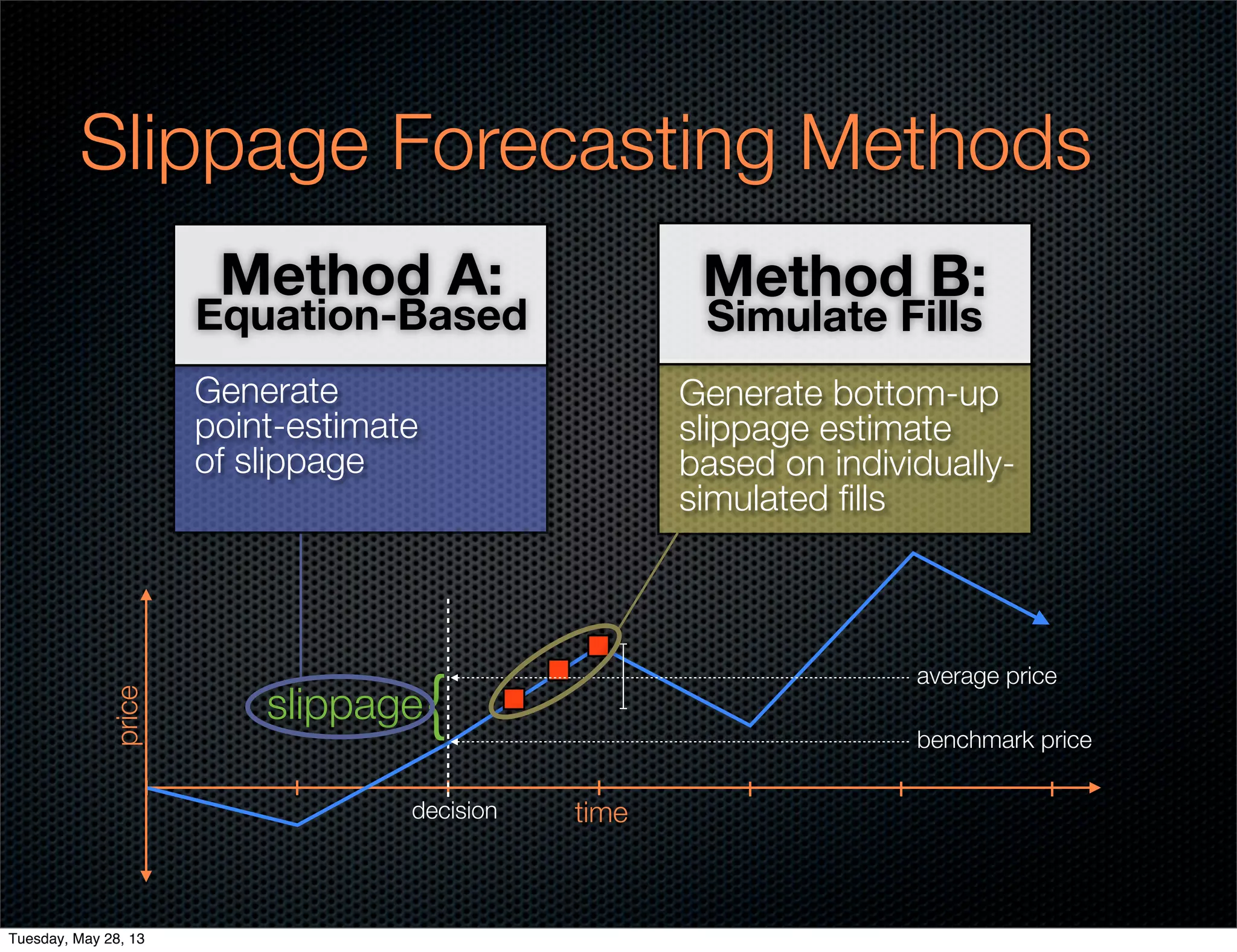

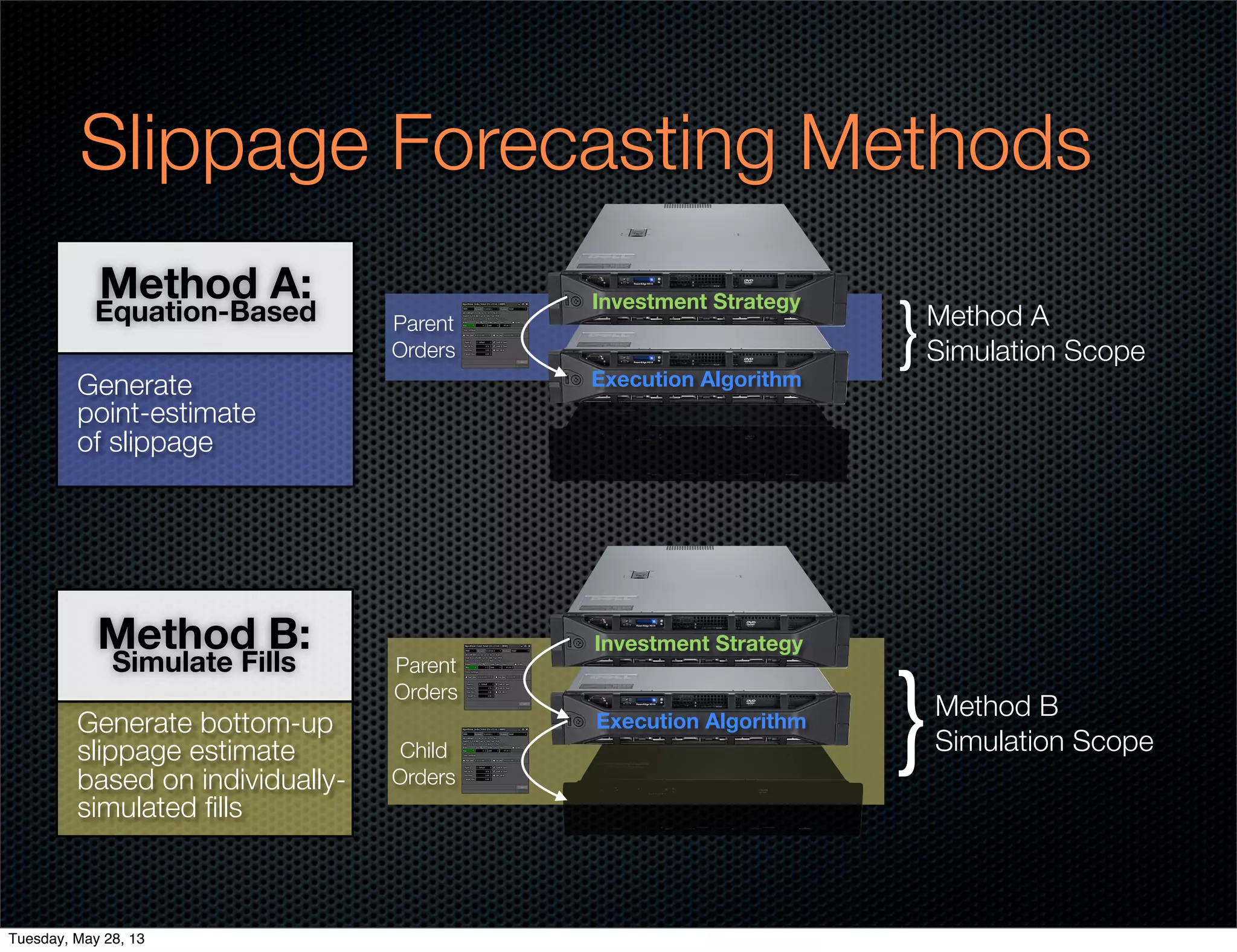

This document discusses modeling transaction costs for algorithmic trading strategies. It presents a taxonomy of explicit costs like commissions, fees, and taxes as well as opportunity costs and benchmark slippage. Two methods are described for estimating slippage: equation-based models and simulating child order fills. The appropriate method depends on the strategy's timescale. The document provides guidelines for keeping transaction cost modeling simple while still accounting for costs accurately. It emphasizes considering costs early in the strategy development process.

![Method A: Equation-Based

Avg Price = Baseline Price +/- [ f(spread) + g(size,...) ]

Last Price

Next Price

Bid-Ask Midpoint

Baseline

Price

✓

4 bps

f(typical spread)

f(starting spread)

f(TWA spread)

Spread

Cost

✓

✓

0

g(size, horizon,

volume, volatility)

Impact

✓

Horizon Close

Horizon VWAP

Horizon TWA-Mid

✓

✓

✓

[basic f( ) = 0.5 x spread]

Tuesday, May 28, 13](https://image.slidesharecdn.com/quantopianwebinarversion-tombok-130618142029-phpapp01/75/Modeling-Transaction-Costs-for-Algorithmic-Strategies-10-2048.jpg)