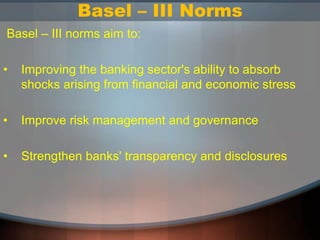

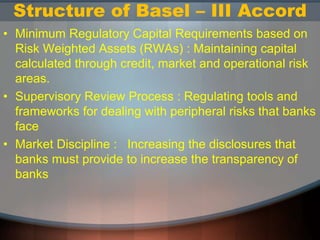

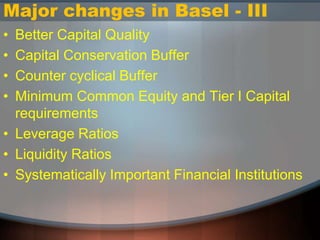

Basel III is an international regulatory accord that introduced a series of reforms to regulate banks' capital adequacy and stress testing. It was implemented in response to the deficiencies exposed by the global financial crisis. The key changes introduced by Basel III include stronger capital and liquidity requirements, a leverage ratio to monitor financial leverage, and measures to promote the build-up of capital buffers. Basel III aims to improve the banking sector's ability to absorb shocks from financial and economic stress and reduce risks.