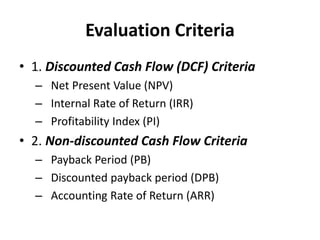

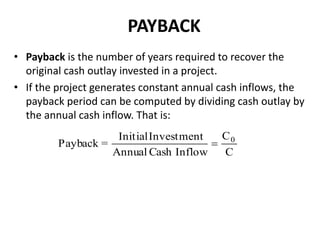

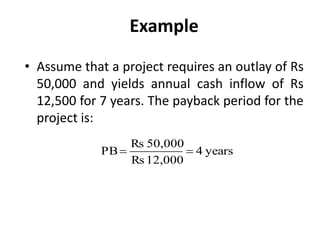

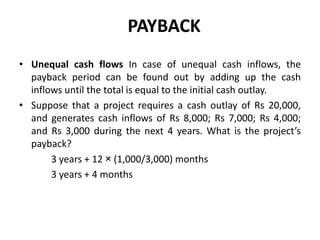

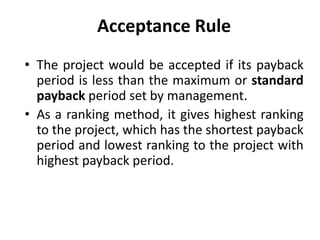

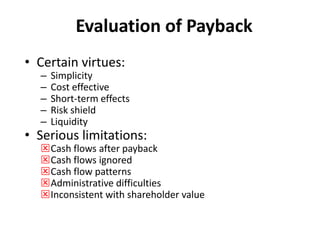

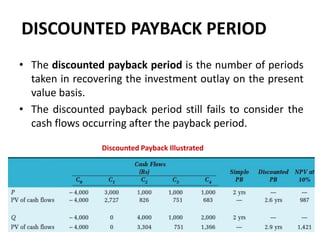

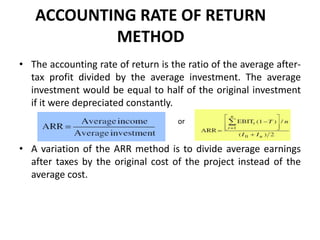

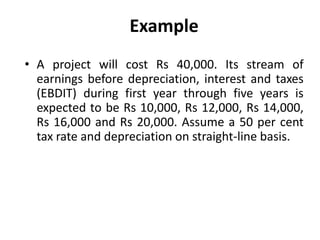

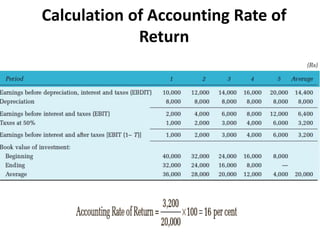

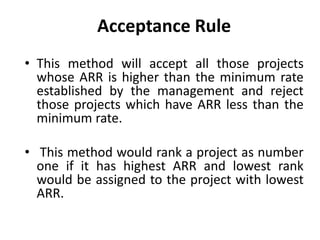

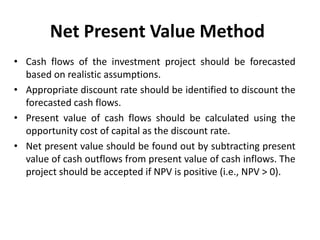

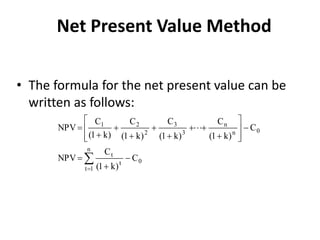

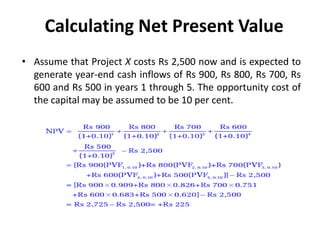

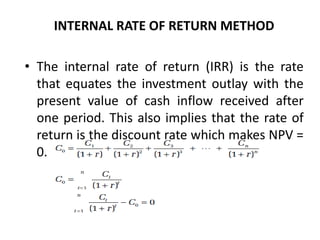

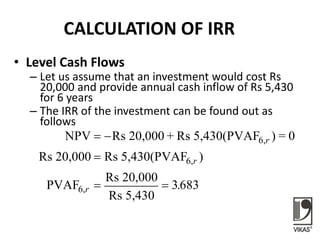

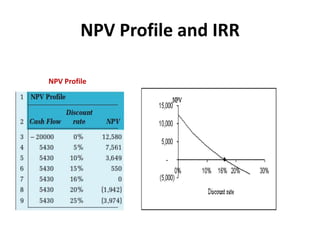

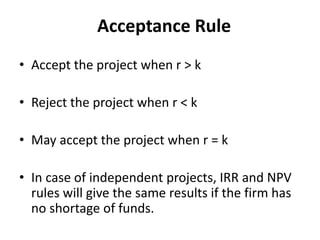

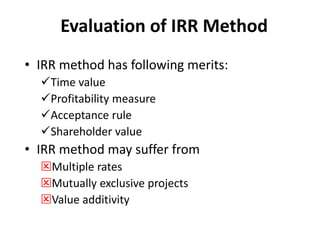

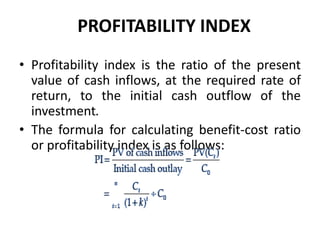

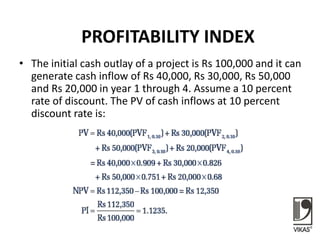

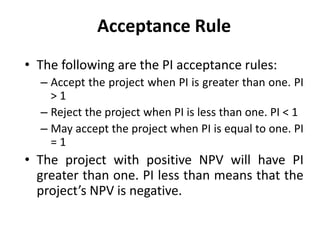

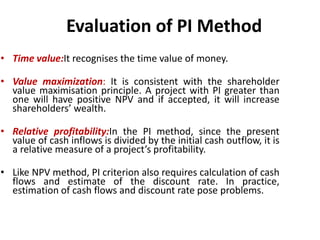

The document discusses various capital budgeting techniques used to evaluate investment decisions. It describes methods such as payback period, accounting rate of return, net present value, internal rate of return, and profitability index. Each method is explained with examples and their advantages and limitations are discussed. The net present value method is considered the most appropriate technique as it incorporates the time value of money and maximizes shareholder wealth.