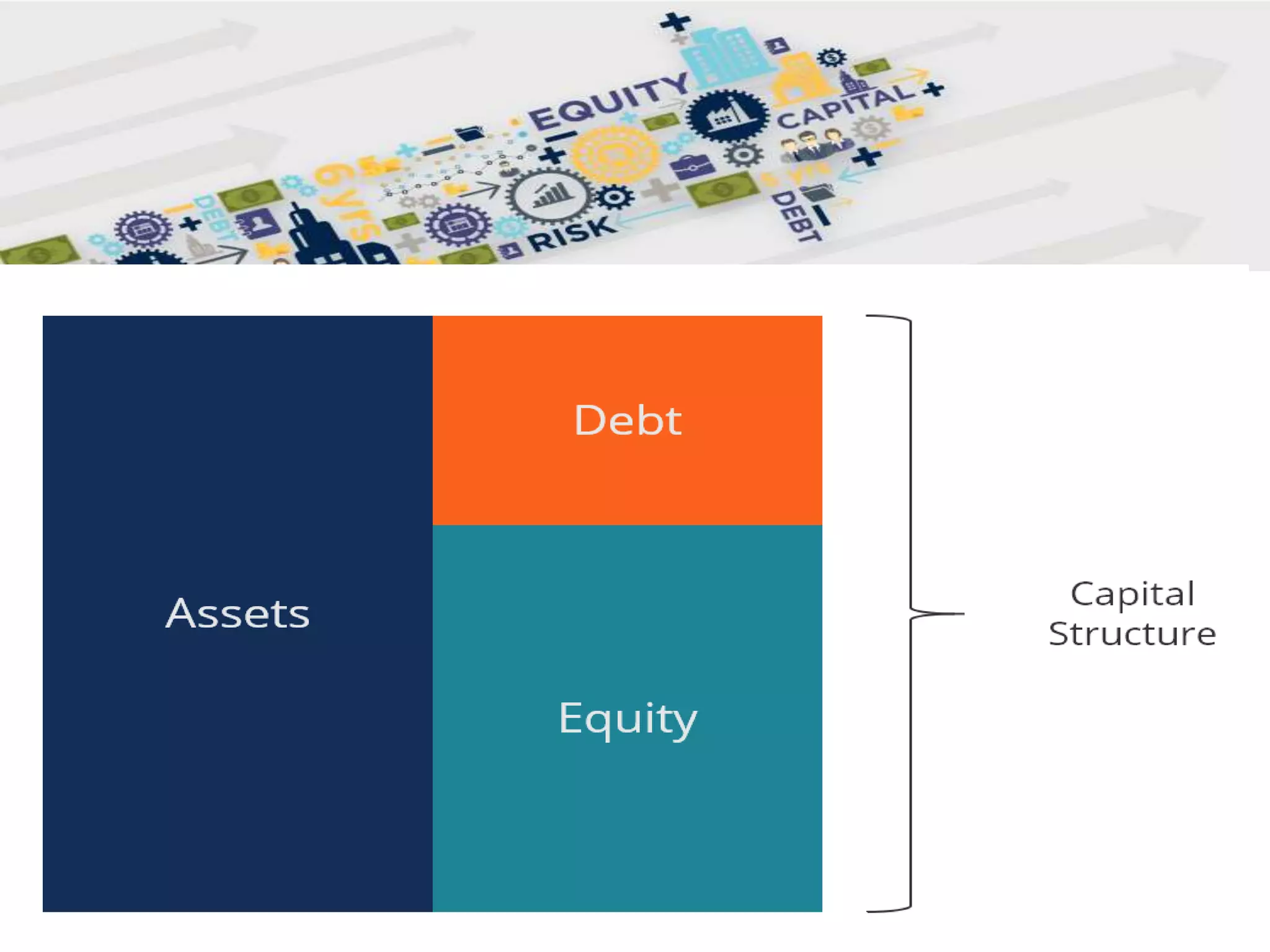

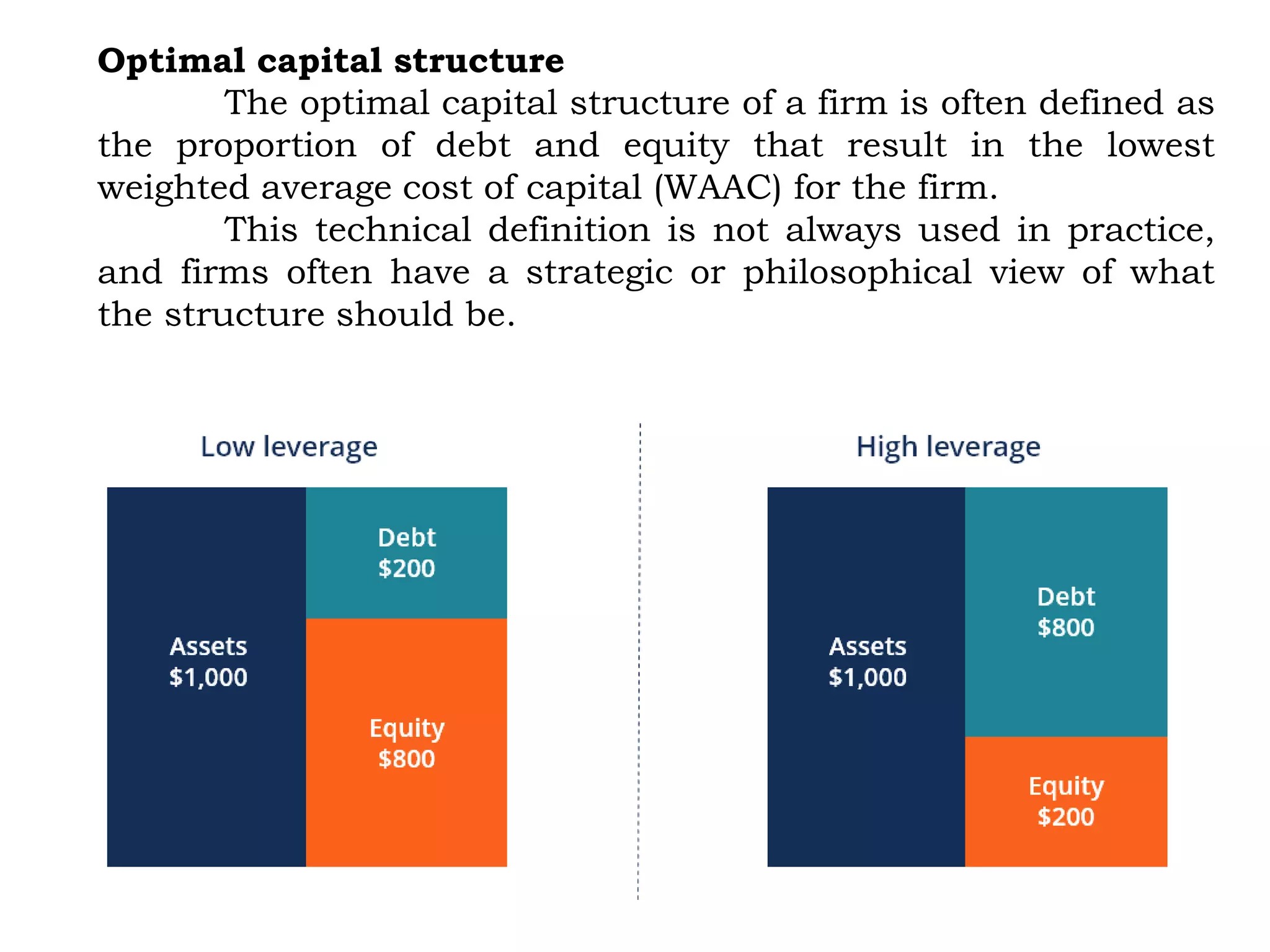

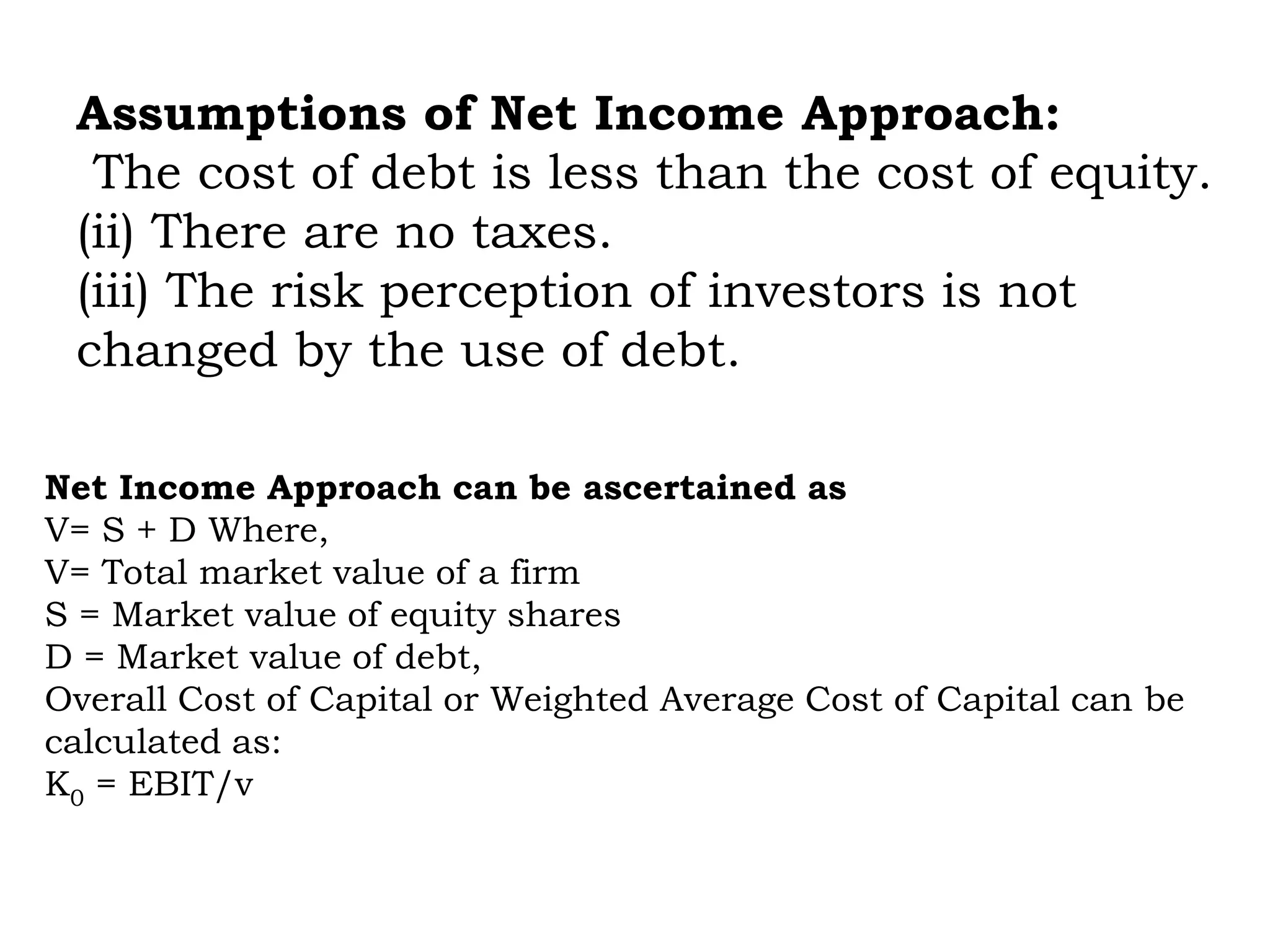

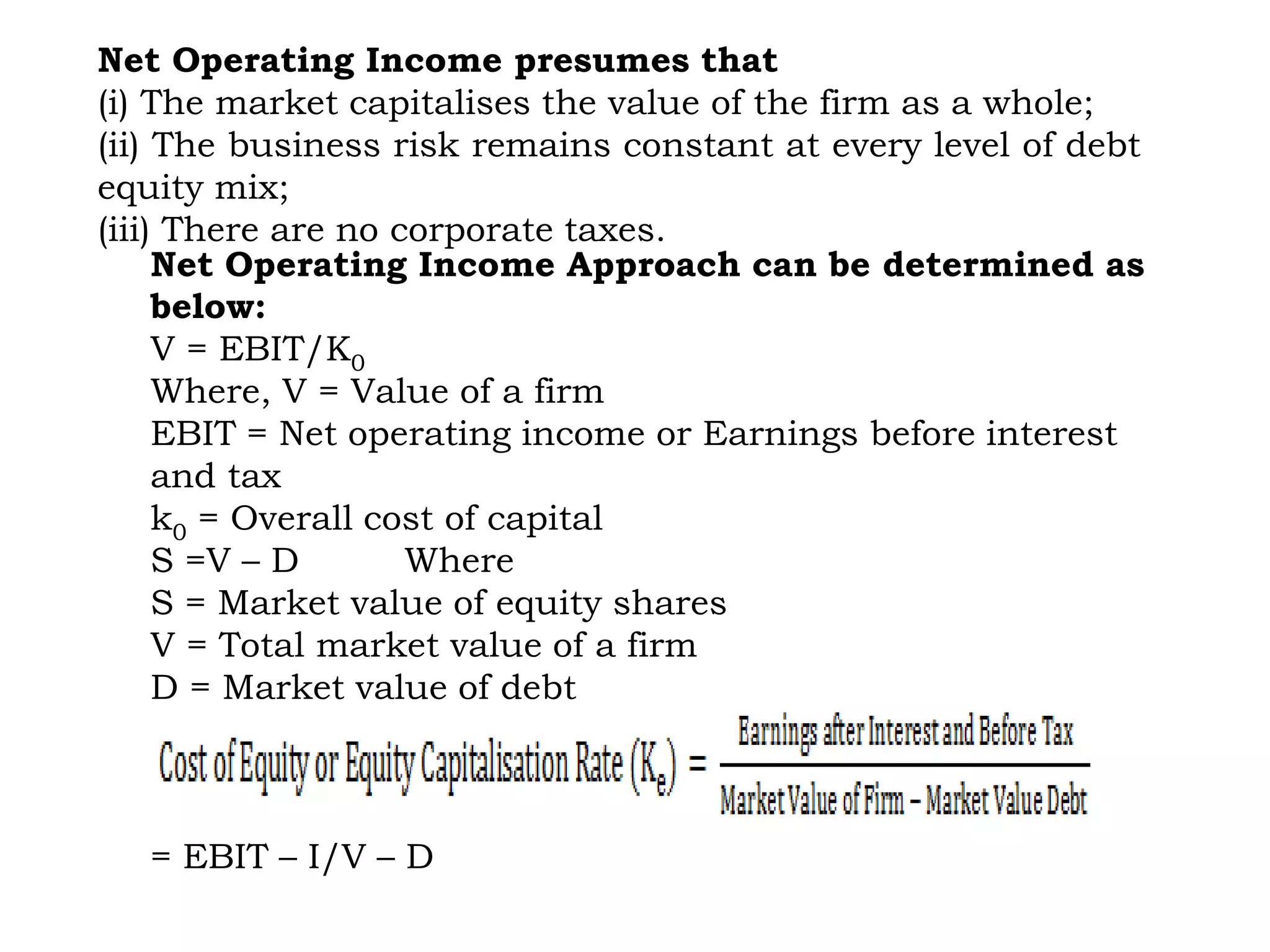

The document discusses capital structure, which refers to the proportions of different financing sources like equity, debt, retained earnings that a firm uses. It provides definitions of capital structure from different authors. It then discusses the different patterns of capital structure that a firm can have based on the types of securities issued. The major factors that influence a firm's capital structure are also outlined. Different theories of capital structure are explained, including the Net Income Approach, Net Operating Income Approach, Traditional Approach, and Modigliani & Miller Approach. The assumptions and calculations under each approach are summarized as well.