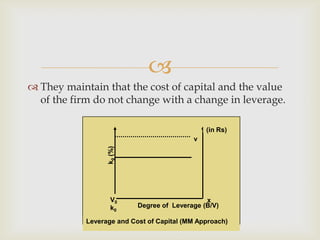

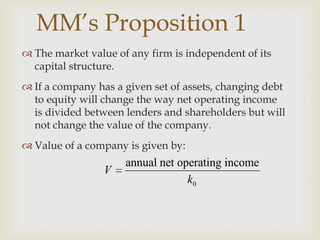

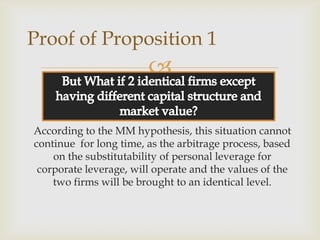

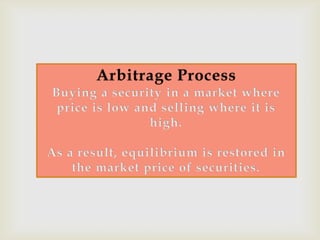

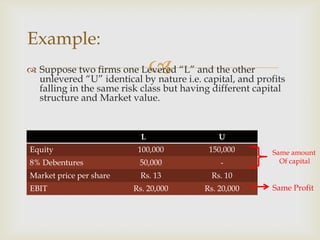

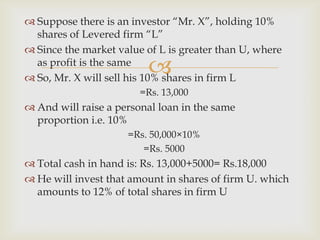

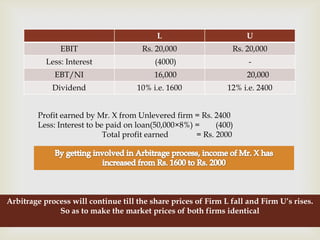

The document discusses capital structure and the Modigliani-Miller approach. It provides definitions of capital structure and optimal capital structure. It then outlines the key assumptions of the Modigliani-Miller approach, including perfect capital markets, no taxes, 100% dividend payout, and constant business risk. The document explains the Modigliani-Miller propositions that the market value and cost of capital of a firm are independent of its capital structure. It provides an example to demonstrate how arbitrage would eliminate any differences in market values between levered and unlevered firms.