The document discusses different theories of capital structure:

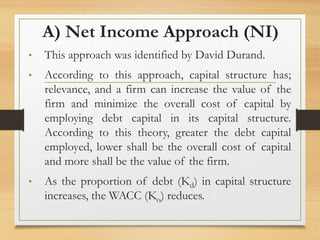

1) Net Income approach argues that increasing debt lowers cost of capital and increases firm value.

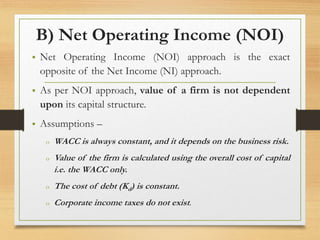

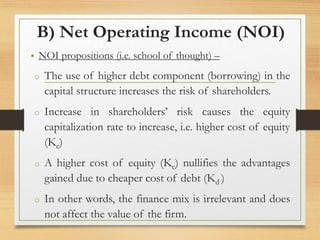

2) Net Operating Income approach argues that capital structure does not affect cost of capital or firm value.

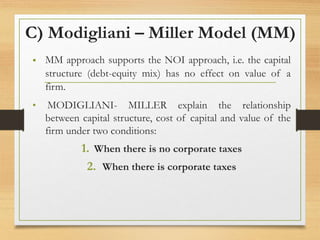

3) Modigliani-Miller approach agrees with NOI when there are no taxes, but recognizes that capital structure affects cost of capital and firm value when taxes exist due to interest tax deductibility.

4) The Traditional approach finds an optimal capital structure that minimizes weighted average cost of capital and maximizes firm value.

![A) Net Income Approach (NI)

Relationship between capital structure and

value of the firm.

Its cost of capital (WACC), and thus directly affects the

value of the firm.

NI approach assumptions –

o NI approach assumes that a continuous increase in debt does

not affect the risk perception of investors.

o Cost of debt (Kd) is less than cost of equity (Ke) [i.e. Kd < Ke ]

o Corporate income taxes do not exist.](https://image.slidesharecdn.com/captialstructuretheories-221230090055-b6a62e16/85/Captial-Structure-Theories-pptx-8-320.jpg)