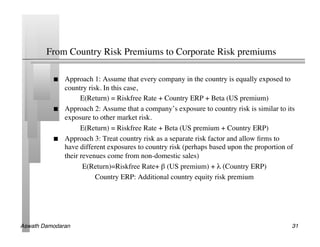

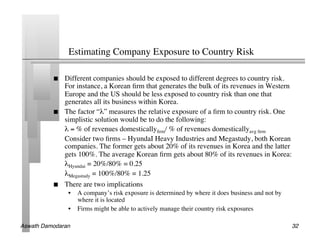

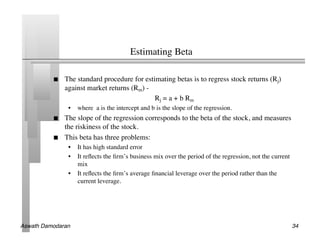

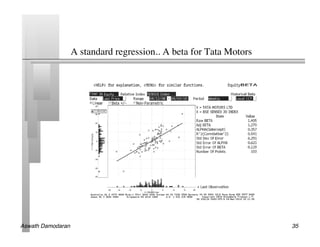

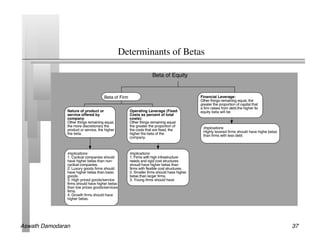

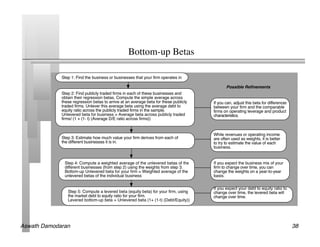

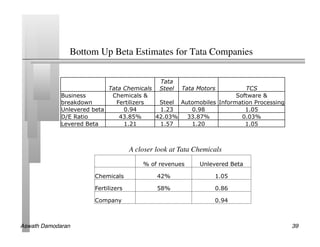

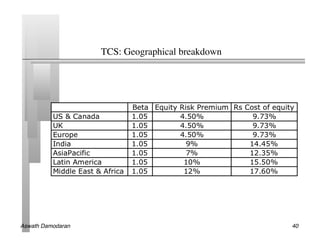

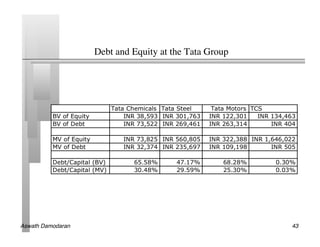

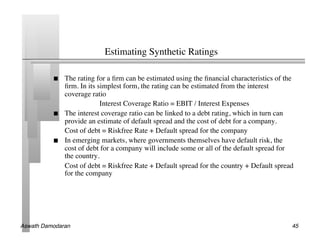

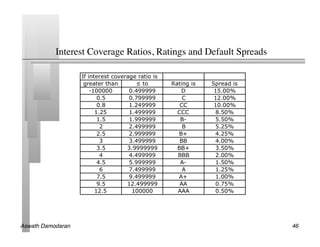

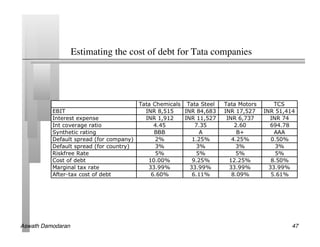

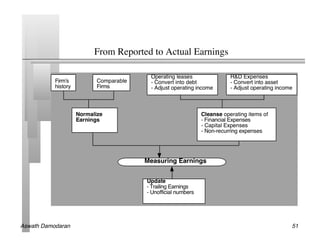

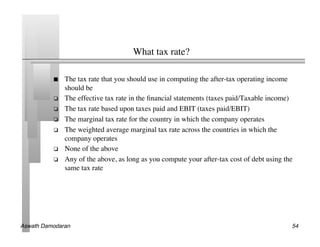

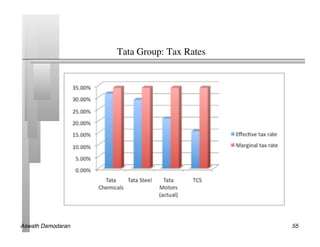

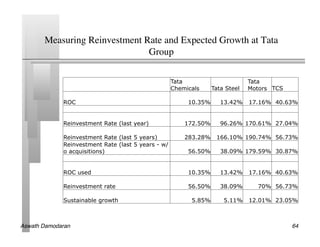

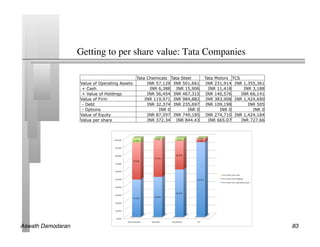

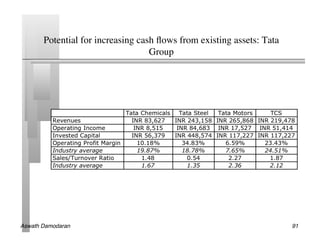

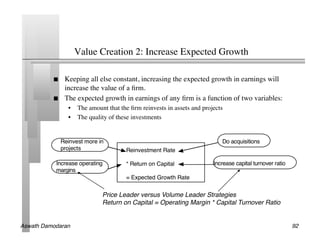

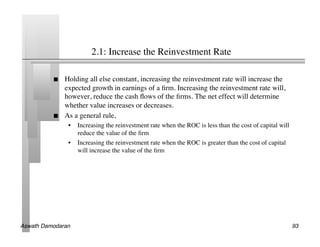

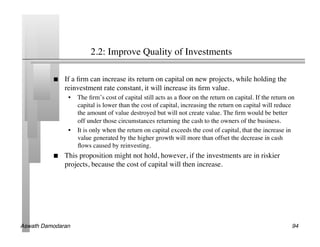

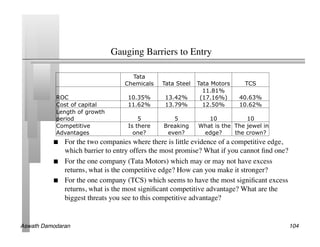

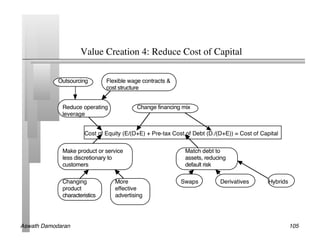

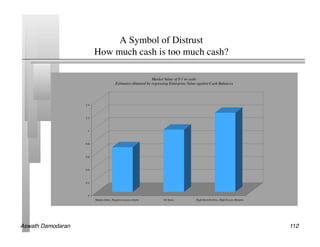

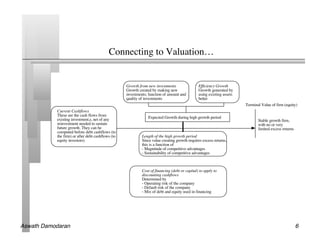

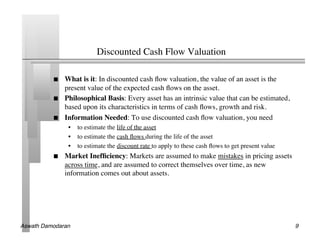

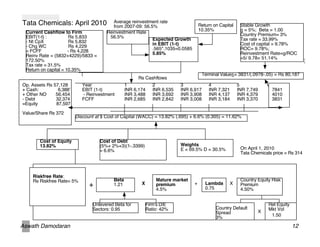

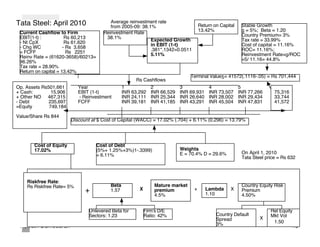

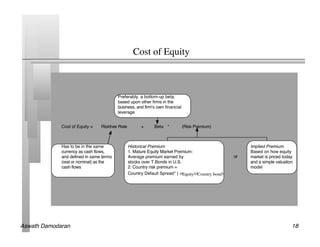

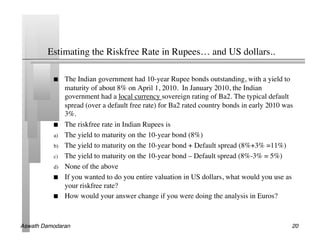

The document discusses corporate finance and valuation principles, highlighting the importance of understanding biases in valuations, the roles of discounted cash flow (DCF) methods, and the need for accurate assessments of growth and risks. It covers various valuation models, emphasizes that there are no precise estimations in valuations, and provides examples from major Tata companies with detailed calculations. Key themes include the intrinsic value of assets, the impact of operating risks, and the necessity for discerning the cost of capital.

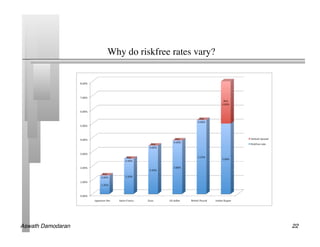

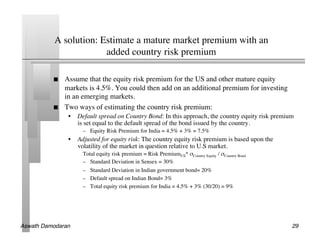

![Austria [1]

4.50%

Albania

11.25%

Belgium [1]

4.95%

Armenia

9.00%

Cyprus [1]

5.63%

Azerbaijan

8.25%

Denmark

4.50%

Belarus

11.25%

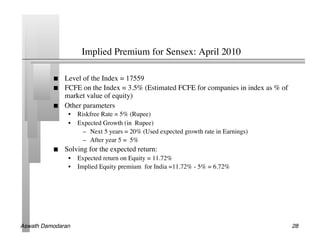

Country Risk Premiums

Finland [1]

4.50%

Bosnia and Herzegovina

12.75%

January 2010

France [1]

Germany [1]

4.50%

4.50%

Bulgaria

Croatia

7.50%

7.50%

Greece [1]

6.08%

Czech Republic

5.85%

Iceland

7.50%

Estonia

5.85%

Ireland [1]

4.95%

Hungary

6.90%

Italy [1]

5.40%

Kazakhstan

7.20%

Canada

4.50%

Malta [1]

5.85%

Latvia

7.50%

Mexico

6.90%

Lithuania

6.90%

Netherlands [1]

4.50%

United States of America

4.50%

Moldova

15.75%

Norway

4.50%

Montenegro

9.75%

Portugal [1]

5.40%

Poland

6.08%

Spain [1]

4.50%

Romania

7.50%

Argentina

Sweden

14.25%

4.50%

Russia

6.90%

Belize

Switzerland

14.25%

4.50%

Slovakia

5.85%

Bolivia

12.75%

Kingdom

United 4.50%

Slovenia [1]

5.40%

Brazil

7.50%

Turkmenistan

12.75%

Chile

5.85%

Ukraine

12.75%

Colombia

7.50%

Bahrain

6.08%

Australia

4.50%

Costa Rica

8.25%

Israel

5.85%

New Zealand

4.50%

Ecuador

19.50%

Jordan

7.50%

El Salvador

19.50%

Kuwait

5.40%

Guatemala

8.25%

Lebanon

12.75%

Honduras

12.75%

Oman

6.08%

Nicaragua

14.25%

Qatar

5.40%

Panama

8.25%

Saudi Arabia

5.85%

Paraguay

14.25%

United Arab Emirates

5.40%

Peru

7.50%

Uruguay

9.75%

Venezuela

11.25%

Aswath Damodaran! 30!](https://image.slidesharecdn.com/tatavaluationbyaswath-100803060544-phpapp01/85/Tata-valuation-by-aswath-30-320.jpg)