The document discusses different theories of capital structure:

1. The traditional approach argues that an optimal capital structure exists where the weighted average cost of capital (WACC) is minimized, maximizing firm value.

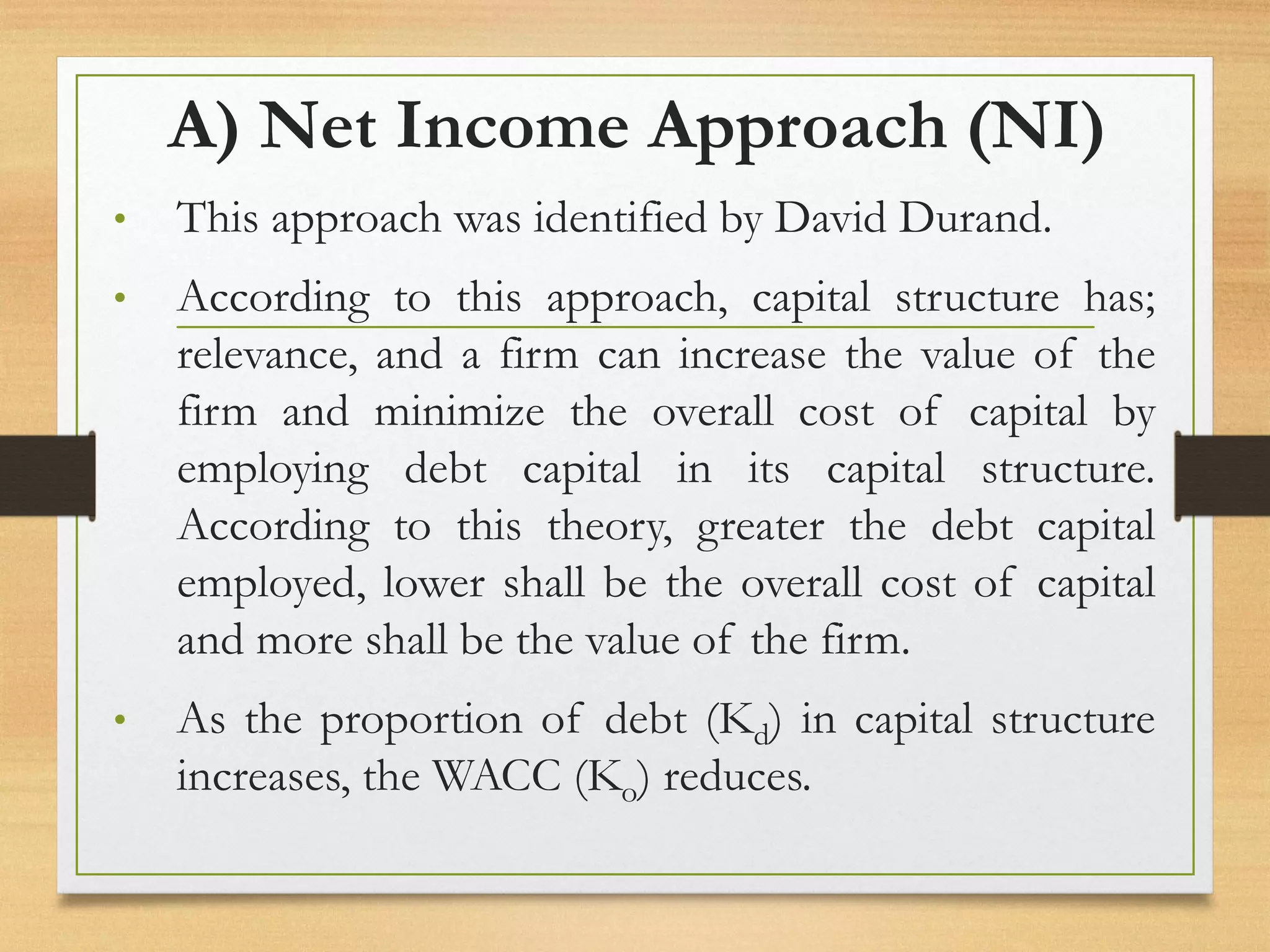

2. The net income (NI) approach argues that greater debt use lowers WACC and increases firm value, while the net operating income (NOI) approach argues capital structure does not impact WACC or value.

3. Modigliani-Miller's first proposition agrees with NOI when there are no corporate taxes, but their second proposition recognizes capital structure impacts WACC and value when taxes exist due to interest tax deductibility.

![A) Net Income Approach (NI)

Relationship between capital structure and

value of the firm.

▪ Its cost of capital (WACC), and thus directly affects the

value of the firm.

▪ NI approach assumptions –

o NI approach assumes that a continuous increase in debt does

not affect the risk perception of investors.

o Cost of debt (Kd) is less than cost of equity (Ke) [i.e. Kd < Ke ]

o Corporate income taxes do not exist.](https://image.slidesharecdn.com/captialstructuretheories-230718045058-511b01de/75/Captial-Structure-Theories-pdf-8-2048.jpg)