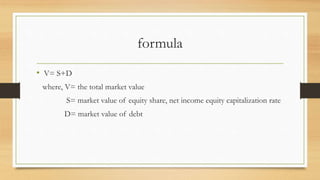

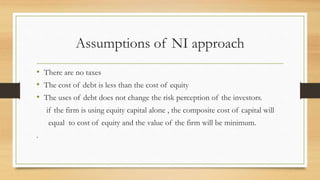

The Net Income (NI) approach proposes that a firm's value increases as it takes on more debt financing due to debt generally being a cheaper source of capital than equity. According to the NI approach, the costs of debt and equity remain constant regardless of capital structure, so the overall cost of capital declines as debt levels rise. However, the NI approach assumes unrealistic conditions like taxes being ignored and that more debt does not affect investor risk perceptions. It implies the maximum firm value occurs with 100% debt financing.