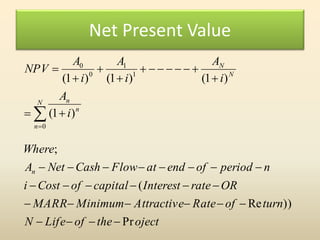

The document discusses capital budgeting, which involves planning long-term investments and uses various methods such as payback period, net present value (NPV), and internal rate of return (IRR) to evaluate project profitability. It differentiates between mutually exclusive and independent projects, elaborates on financing methods, and explains important concepts like profitability index and cost of capital. The document includes illustrations and examples to demonstrate calculations for each method, helping businesses assess investment decisions.