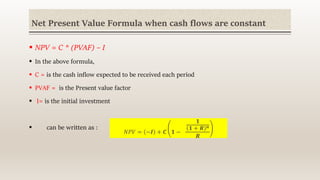

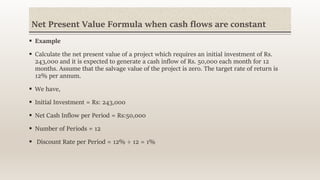

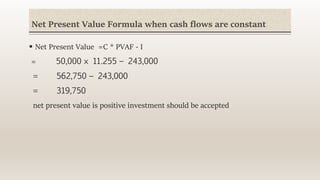

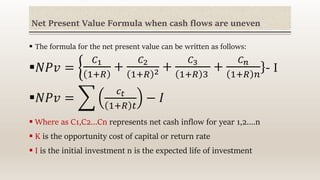

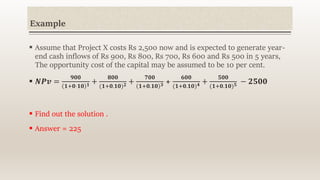

The document discusses investment criteria in capital allocation, focusing on methods such as Net Present Value (NPV) and Payback Period, distinguishing their advantages and disadvantages. NPV helps assess the value of investments based on future cash flows and opportunity cost, while the Payback Period estimates the time needed to recover an initial investment without considering the time value of money. Additionally, it introduces the Discounted Payback Period as a refinement of the Payback Period that incorporates the time value of money.