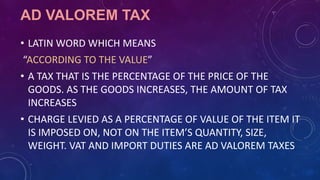

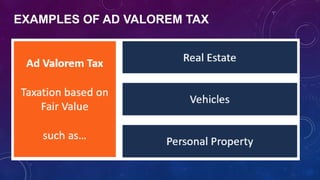

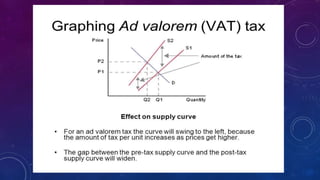

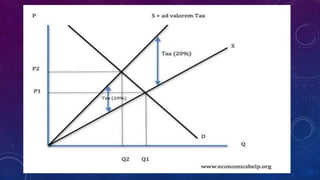

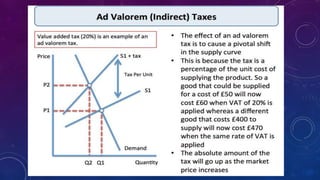

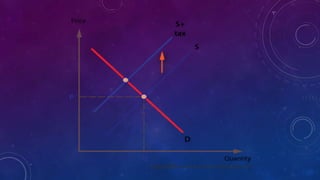

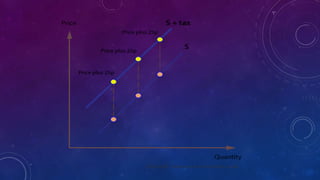

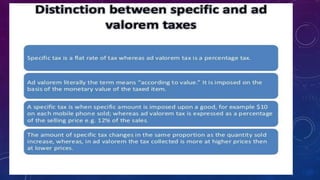

An ad valorem tax is a tax based on the value of the item, where the amount of tax increases as the value increases. A specific tax is a fixed amount placed on an item regardless of its price. Examples of ad valorem taxes include VAT and import duties, while specific taxes are often placed on items like alcohol, cigarettes, and sugary beverages at a set rate per unit.