The document provides an overview of IAS 7 Statement of Cash Flows. It discusses:

1) The objective of the statement of cash flows is to provide information about a company's cash receipts and cash payments.

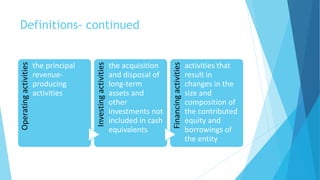

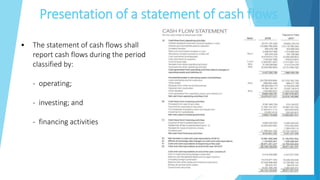

2) Cash flows are classified into operating, investing and financing activities.

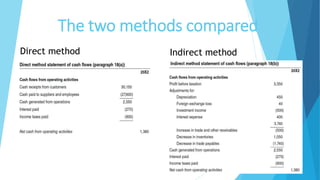

3) The statement of cash flows can be prepared using either the direct or indirect method, with the direct method being encouraged for operating cash flows.

![Reporting cash flows from operating activities

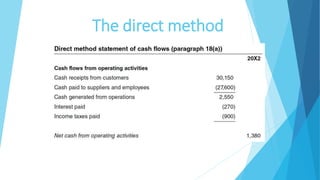

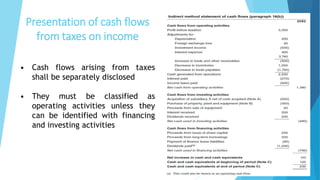

• Cash flows from operating activities must be reported by using either:

- the direct method

• whereby major classes of gross cash receipts and gross cash payments are

disclosed [7.18(a)]

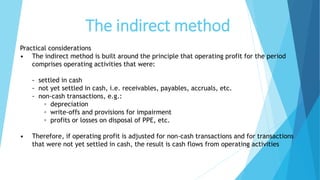

- the indirect method

• whereby profit or loss is adjusted for:

- the effects of transactions of a non-cash nature, any deferrals or

accruals of past or future operating cash receipts or payments,

- items of income or expense associated with investing or financing

cash flows [7.18(b)]](https://image.slidesharecdn.com/ias7presentation-190627141807/85/Ias-7-presentation-11-320.jpg)

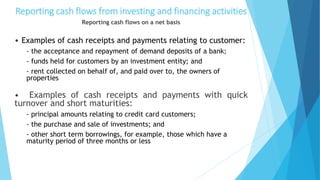

![Reporting cash flows from investing and financing

activities

• An entity shall report separately major classes of gross cash receipts and

payments arising from investing and financing activities except to the

extent that cash flows are reported on a net basis [IAS 7.22-24]:

- cash receipts and payments on behalf of customers when the cash

flows reflect the activities of the customer rather than those of the

entity; and

- cash receipts and payments for items in which the turnover is

quick, the amounts are large, and the maturities are short](https://image.slidesharecdn.com/ias7presentation-190627141807/85/Ias-7-presentation-17-320.jpg)

![Foreign currency cash flows

• Cash flows arising from transactions in a foreign currency

are recorded in an entity’s functional currency [IAS 7.25-28]

- the exchange rate to be used is the exchange rate applicable at the

date of the cash flow

- the cash flows of a foreign subsidiary are translated at the exchange

rates between the functional currency and the foreign currency at the

dates of the cash flows](https://image.slidesharecdn.com/ias7presentation-190627141807/85/Ias-7-presentation-19-320.jpg)

![Other disclosures

The amount of cash and cash equivalents held by

the entity that is not available for use by the group

should be disclosed, together with a commentary by

management [IAS 7.48]](https://image.slidesharecdn.com/ias7presentation-190627141807/85/Ias-7-presentation-30-320.jpg)