This document summarizes key concepts regarding capital structure analysis:

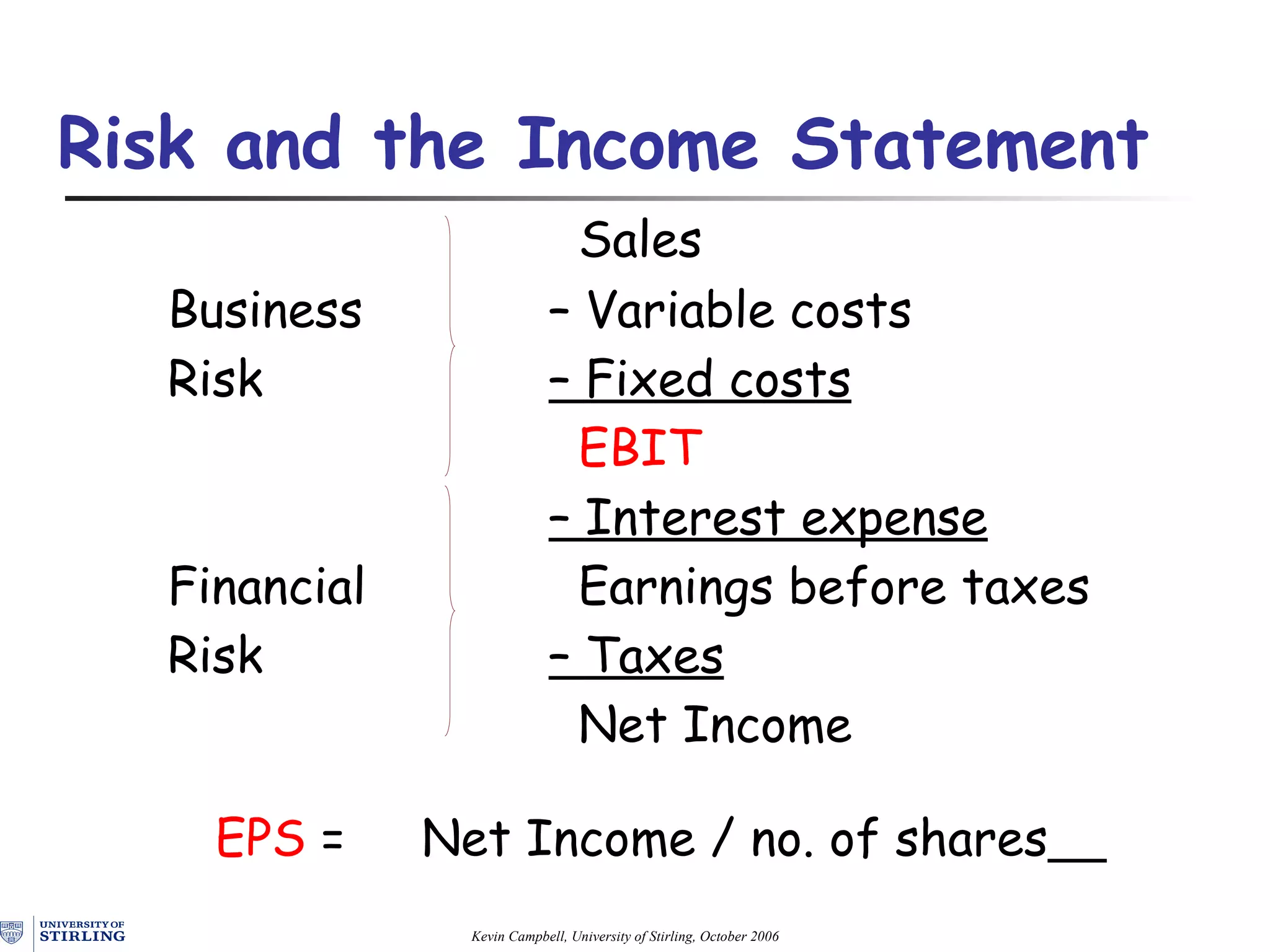

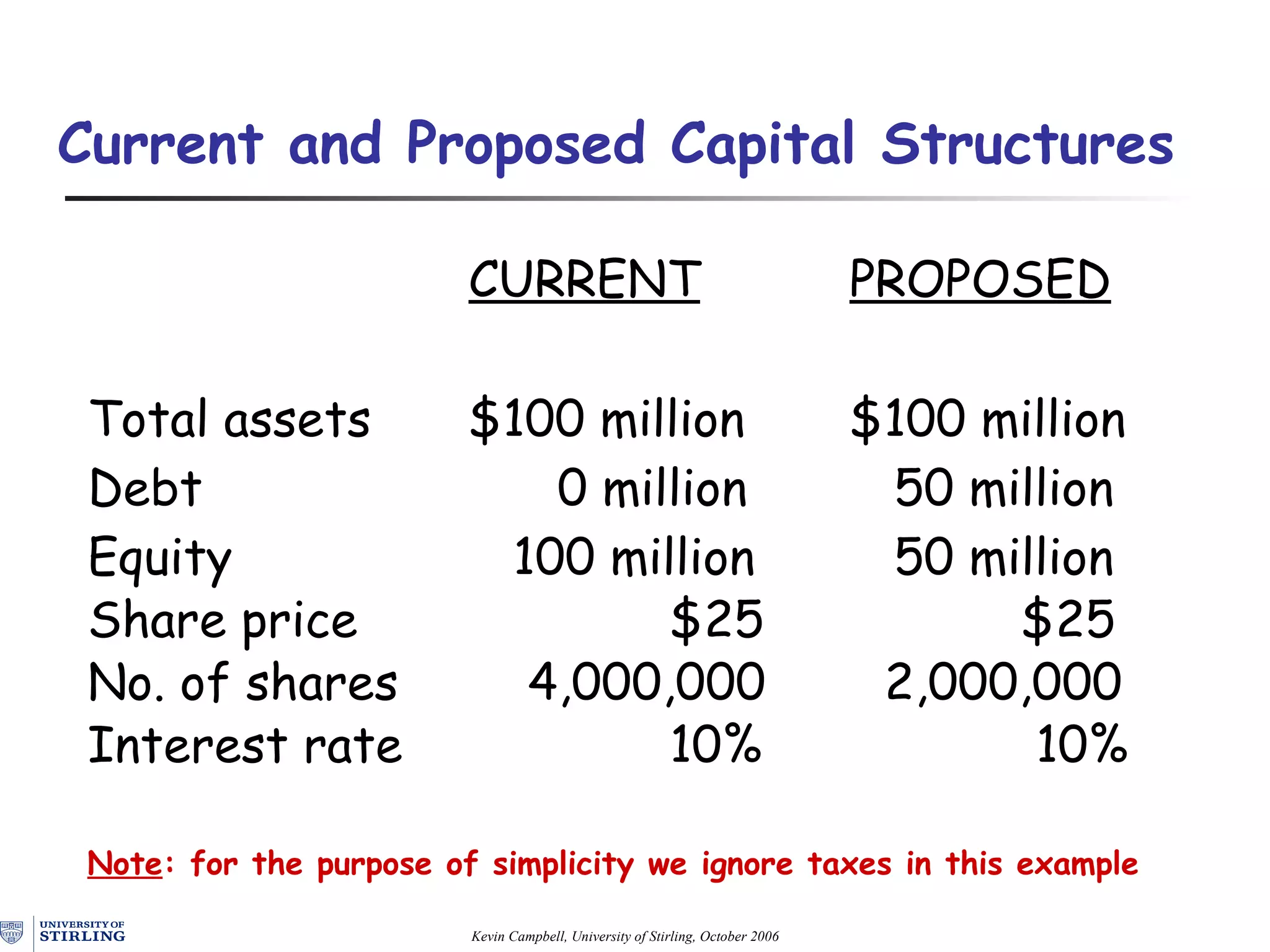

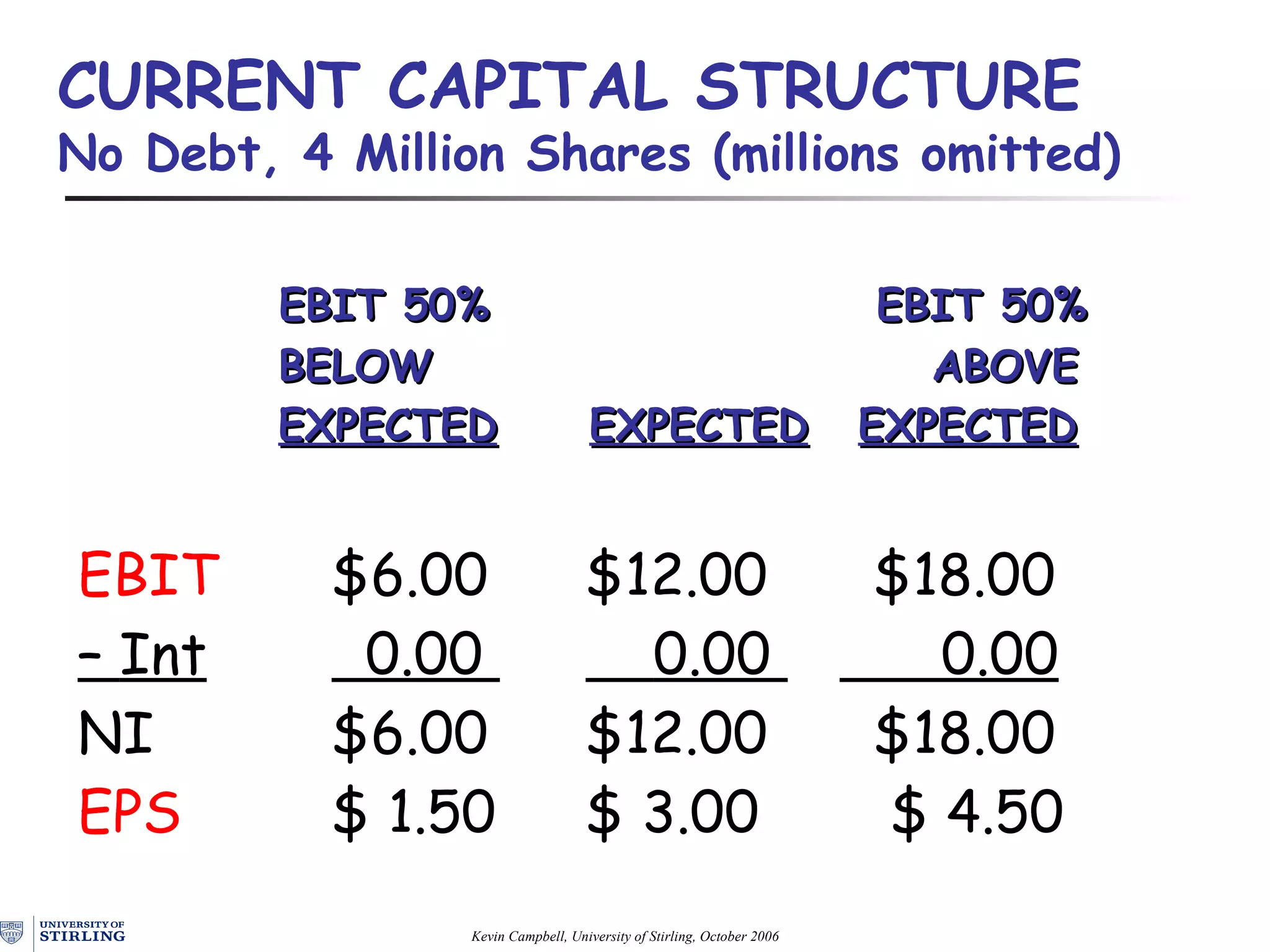

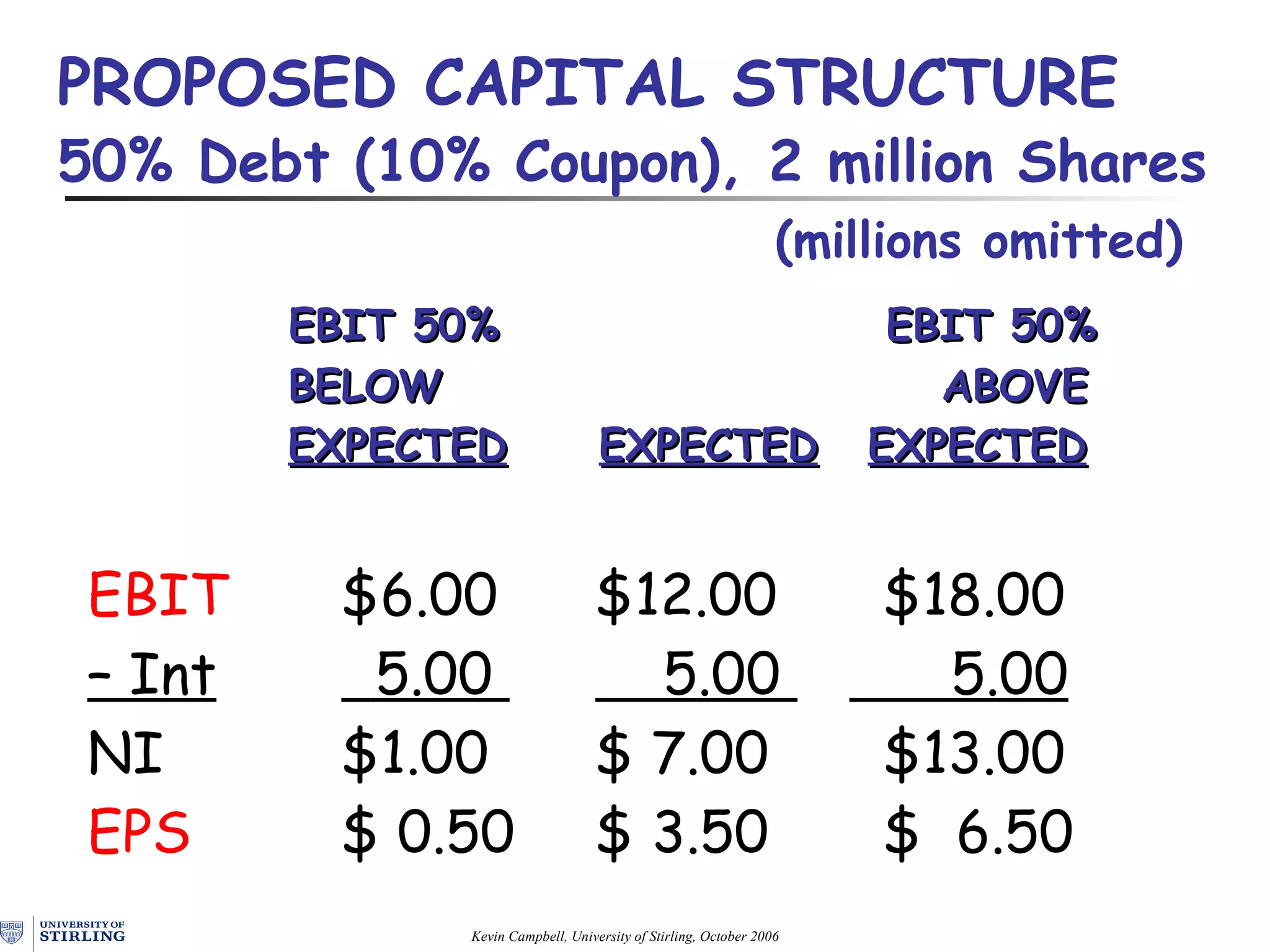

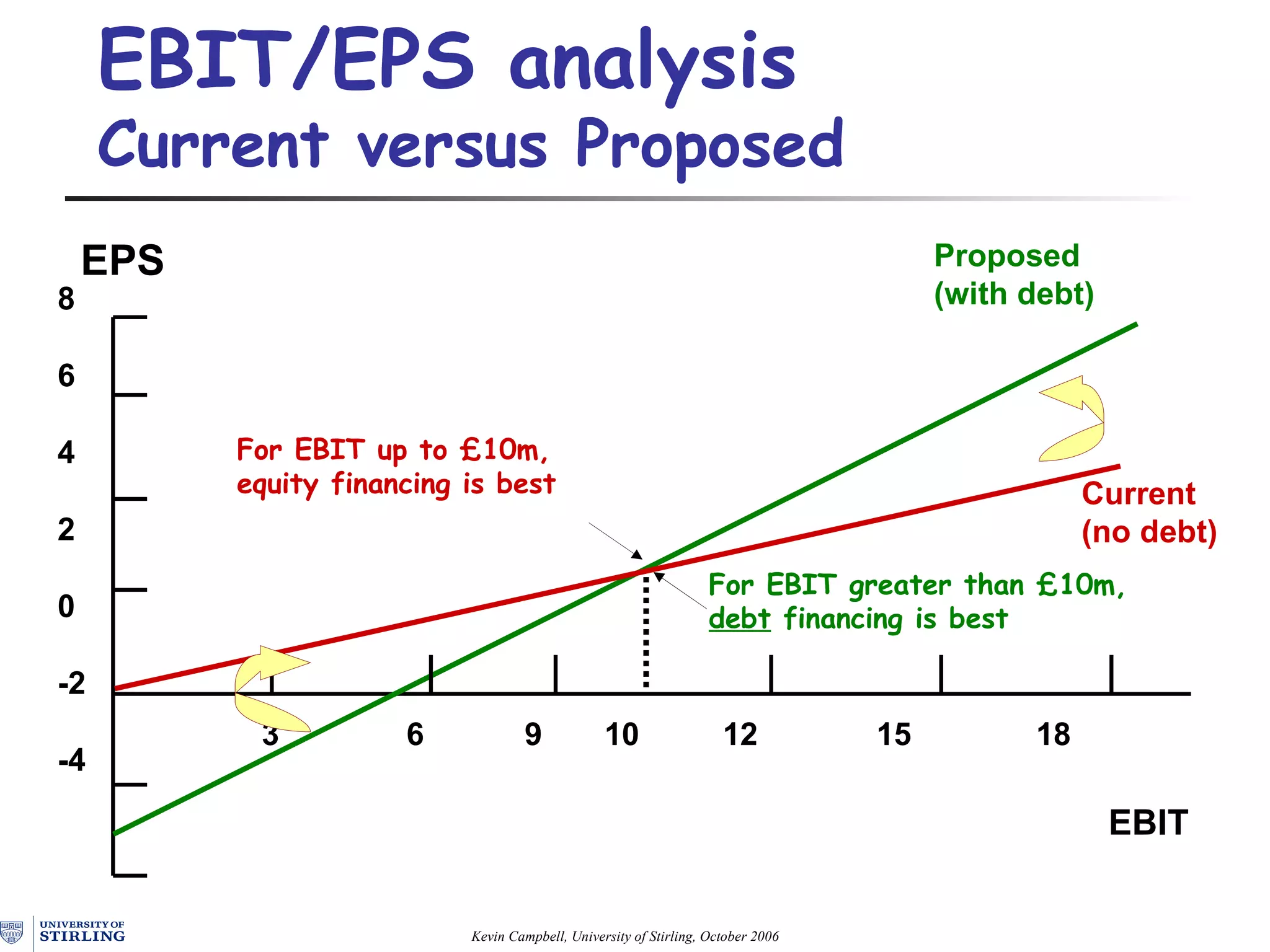

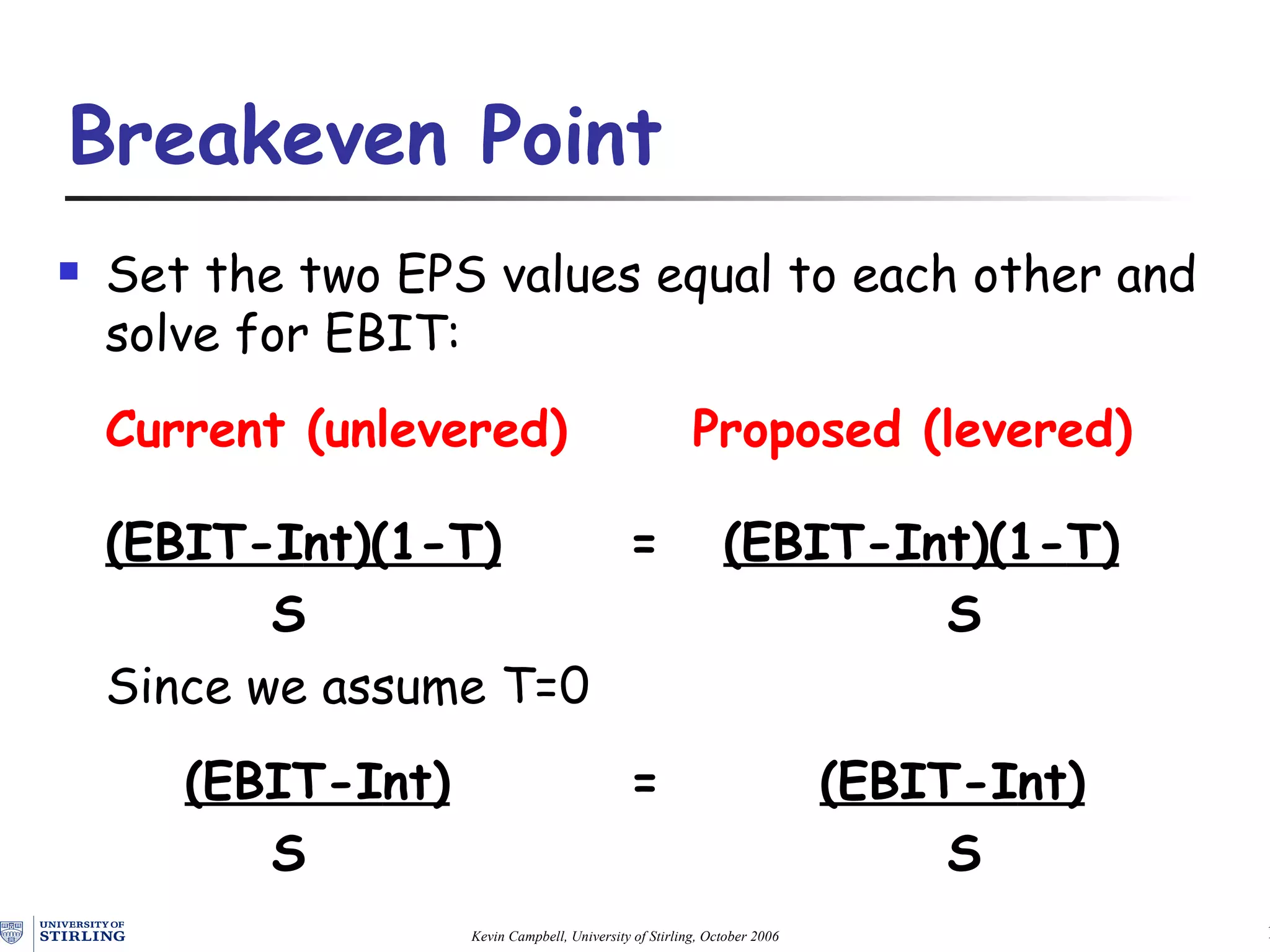

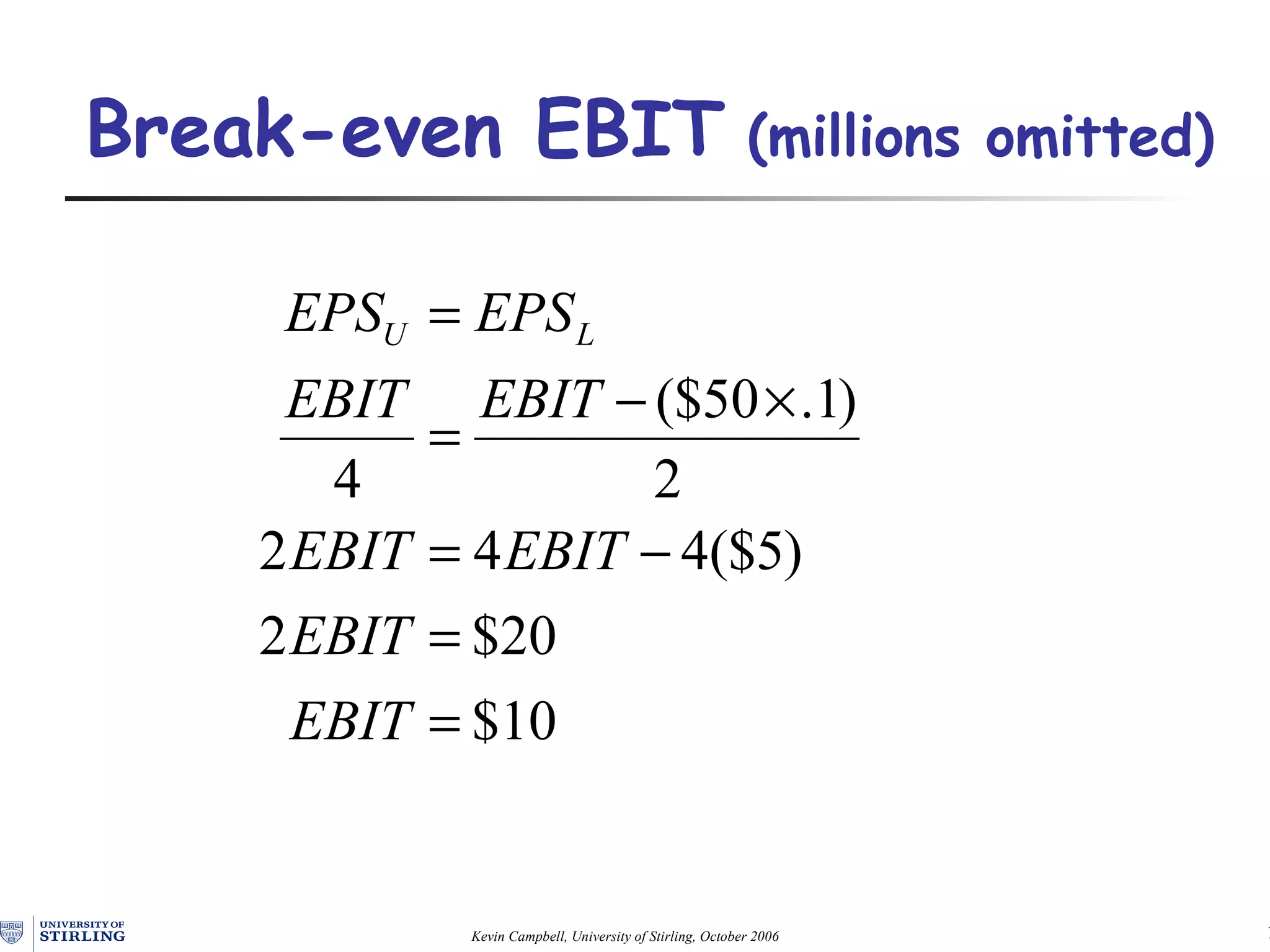

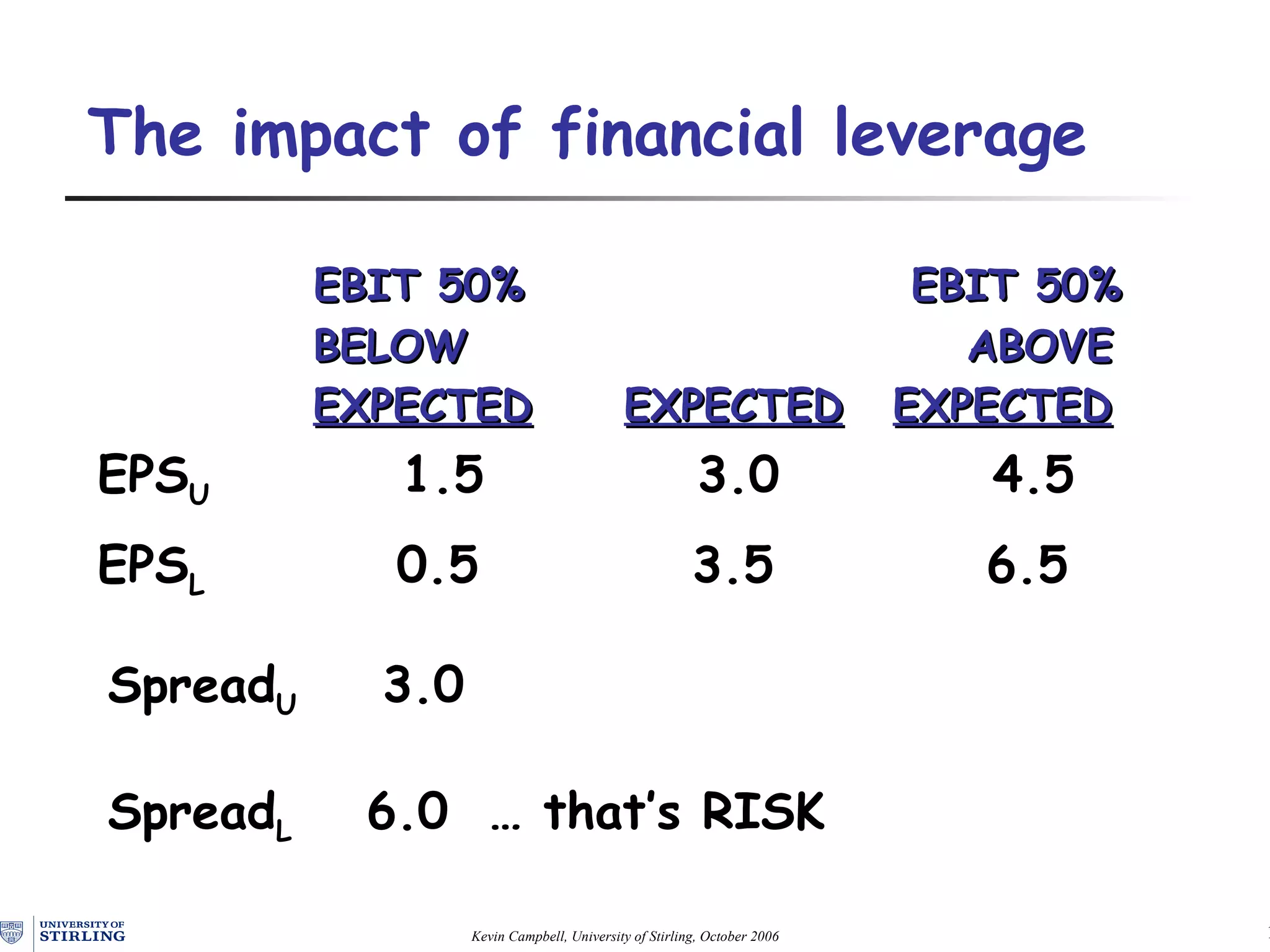

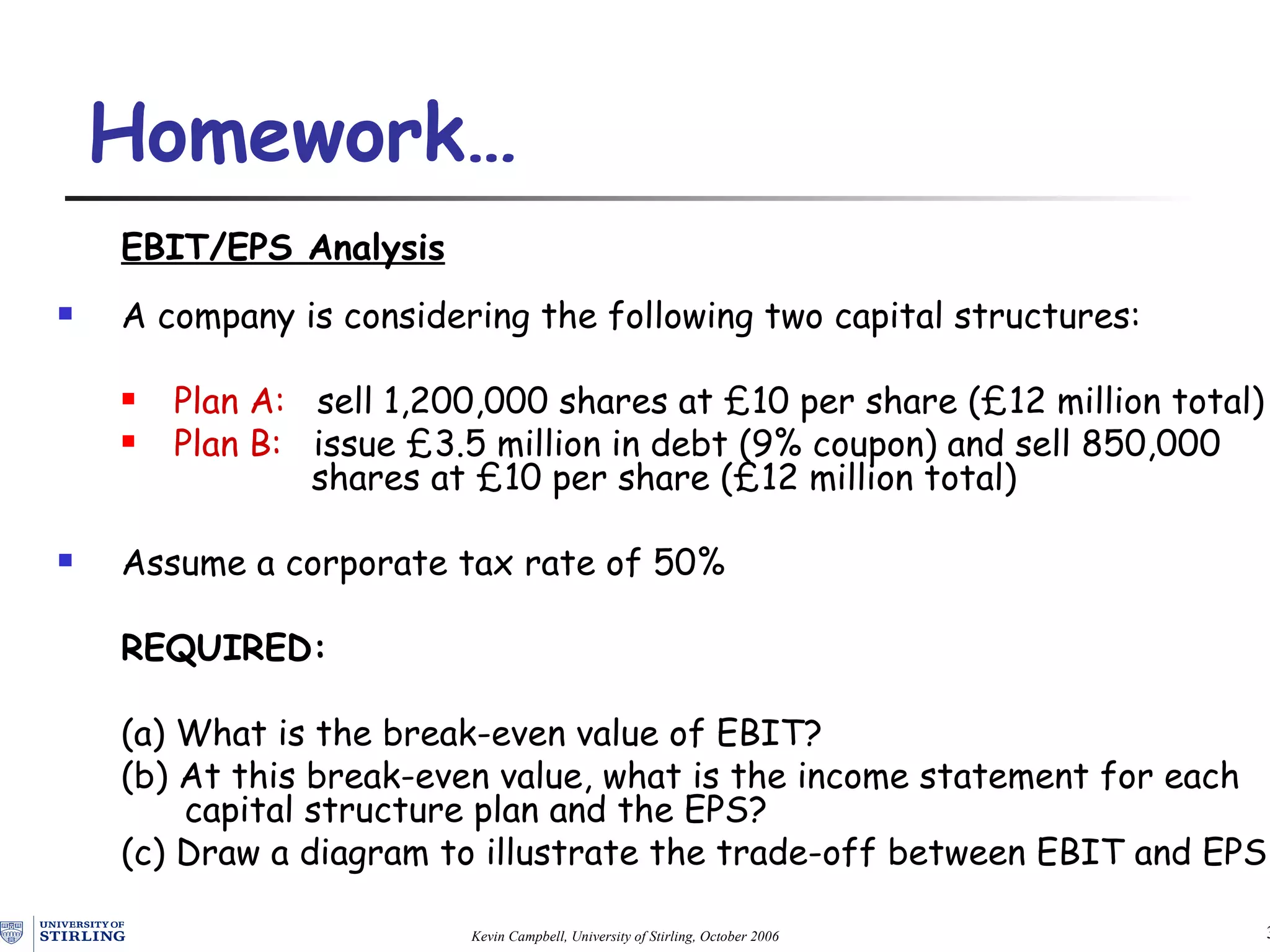

1) EBIT/EPS analysis examines how different capital structures affect earnings available to shareholders and risk based on different levels of EBIT. Leverage increases EPS at high EBIT levels but decreases it at low levels.

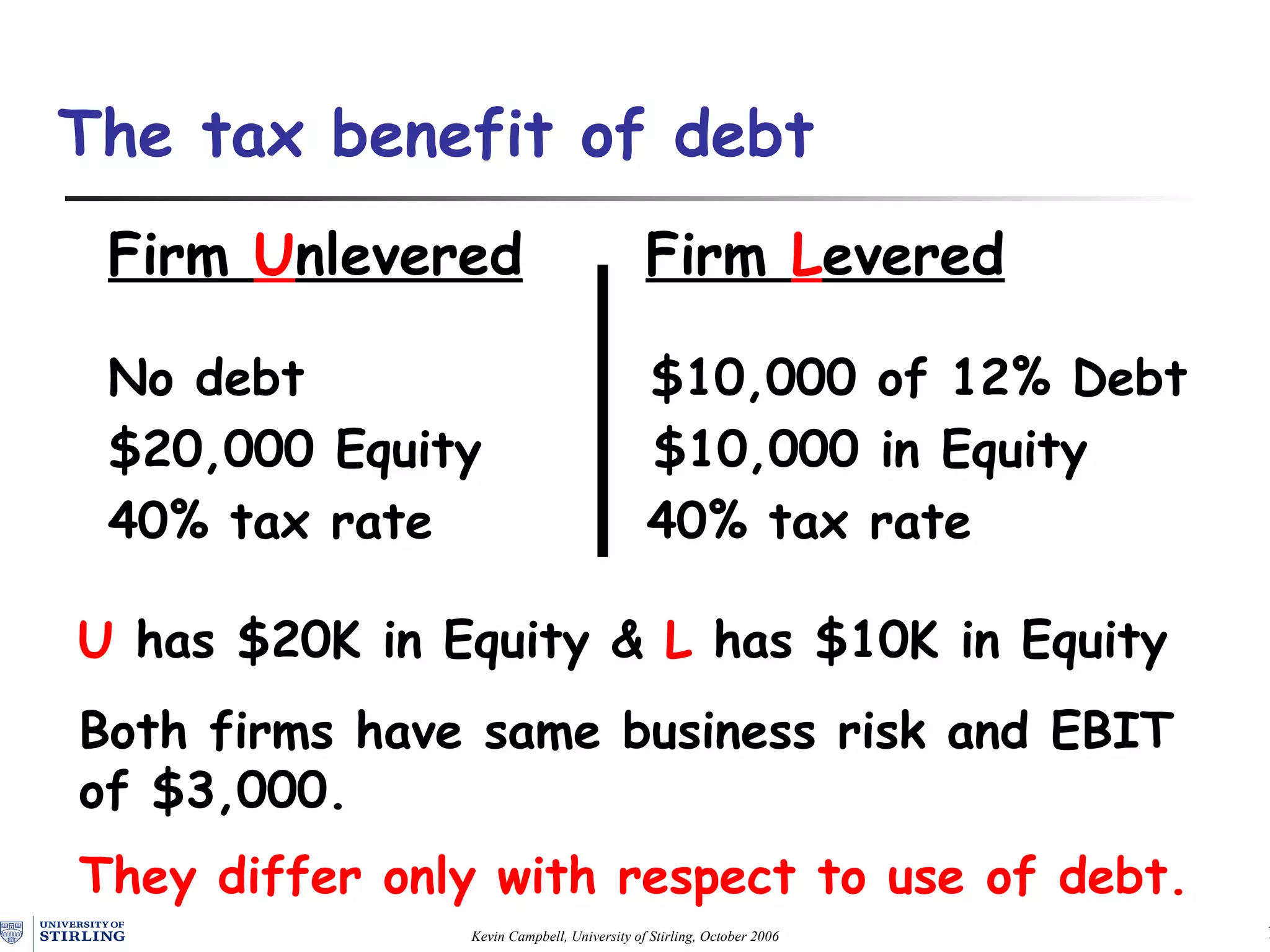

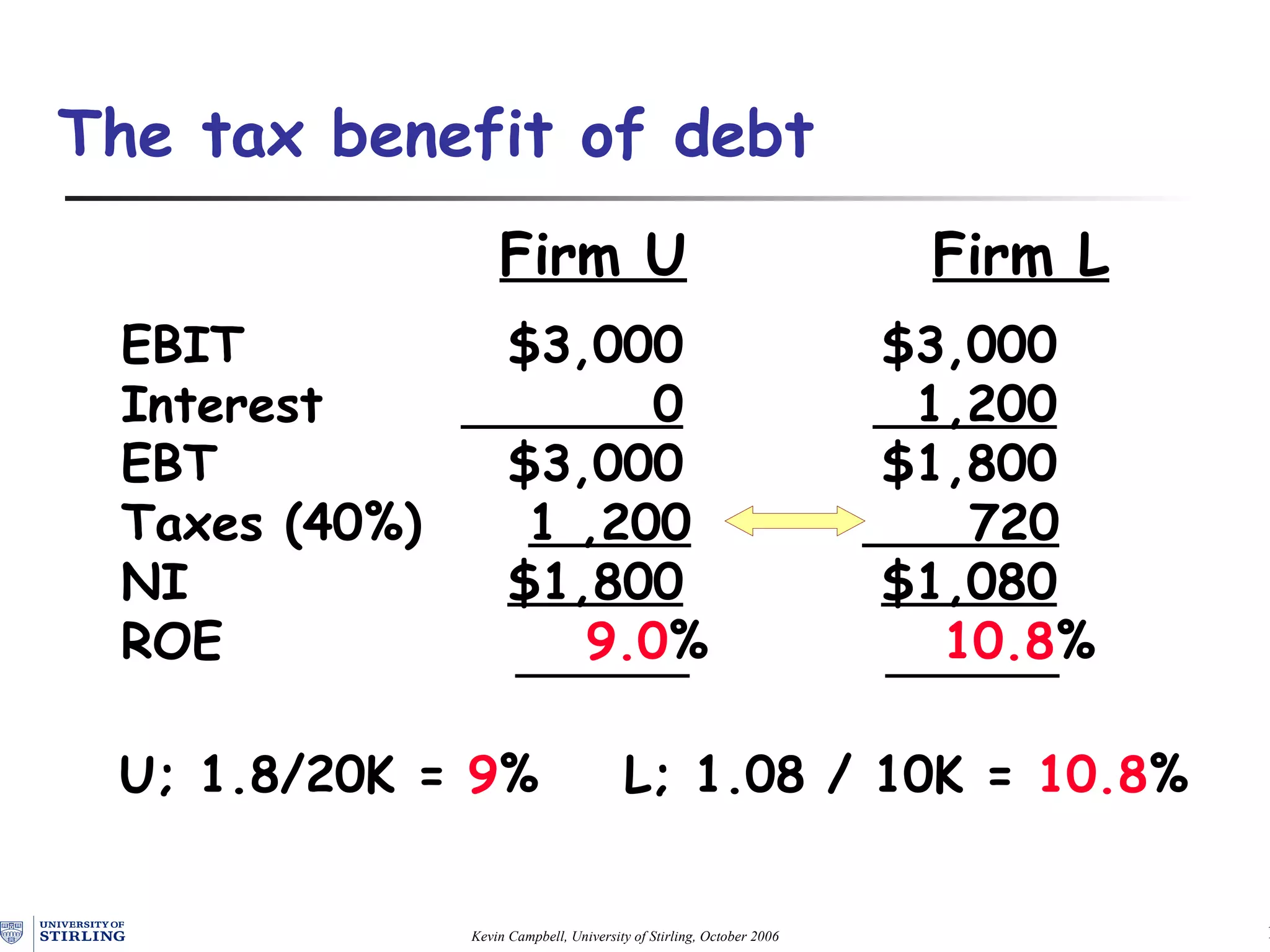

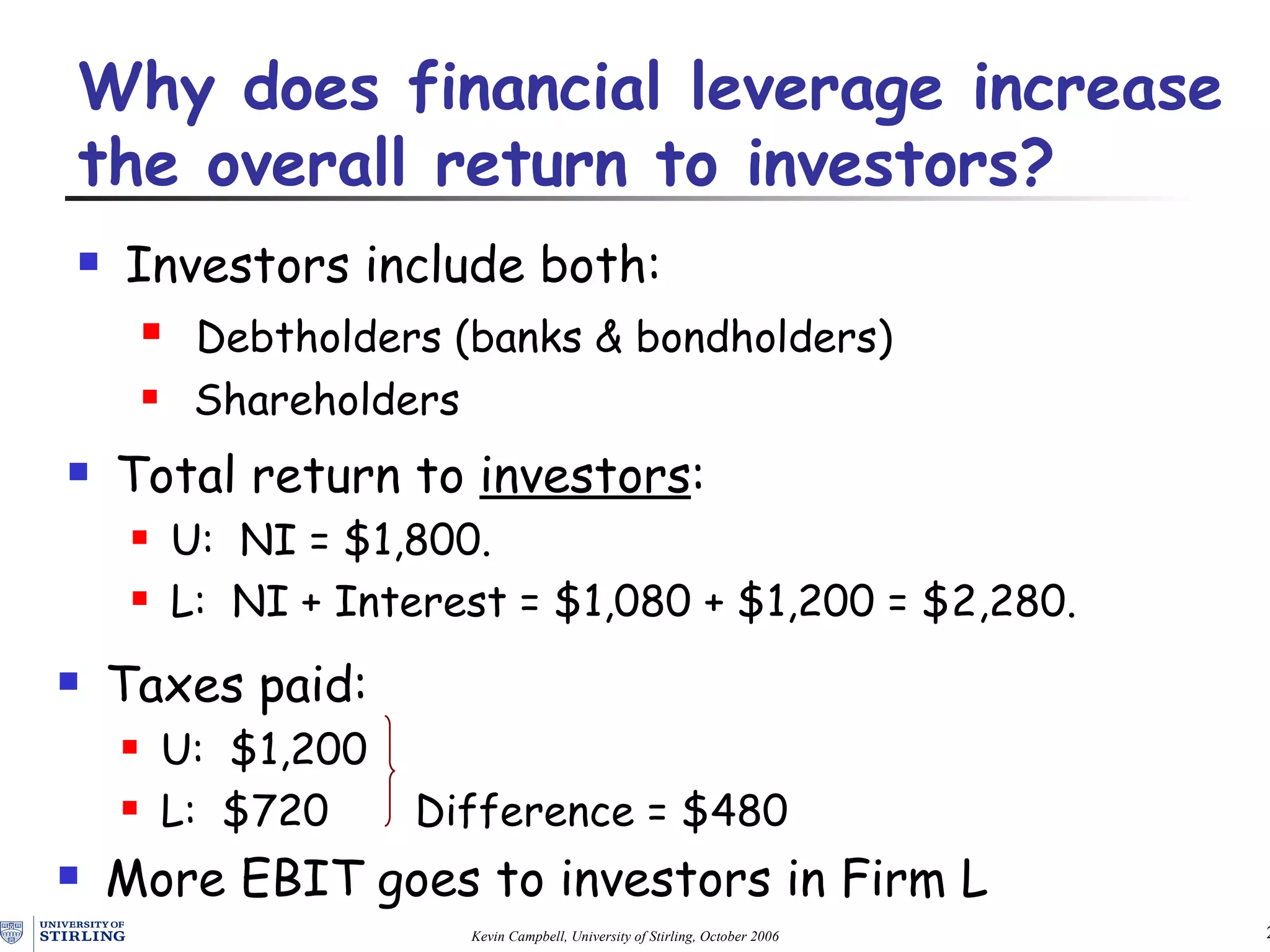

2) Debt provides a tax shield benefit as interest payments reduce taxable income. This increases overall returns to investors compared to an unlevered firm.

3) There is a trade-off between the tax benefits of debt and the financial distress and agency costs of debt as leverage increases. Optimal capital structure balances these factors.

4) Practical considerations like industry standards, creditor requirements, maintaining borrowing capacity, and manager