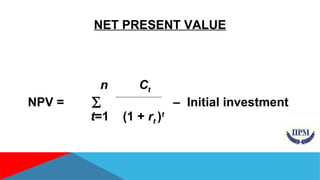

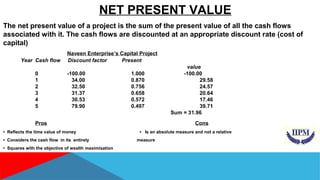

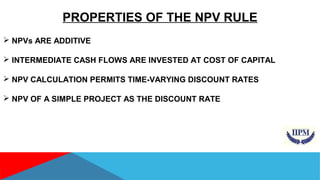

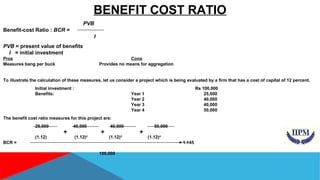

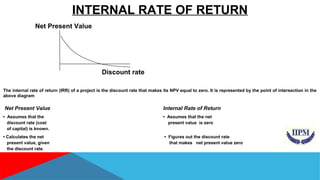

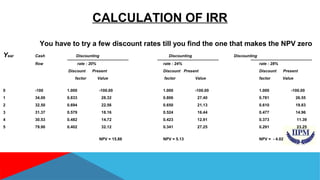

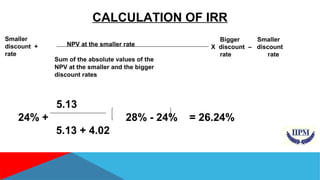

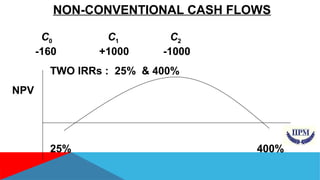

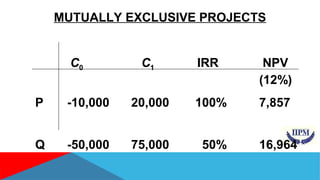

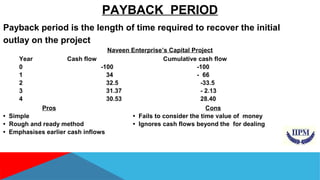

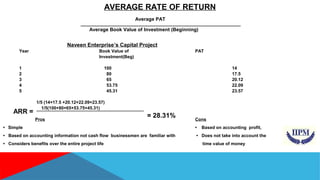

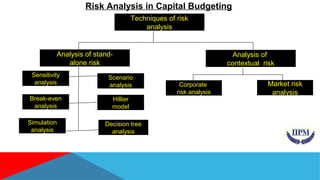

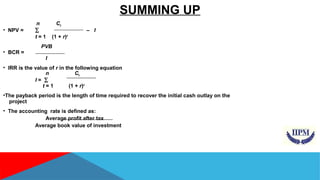

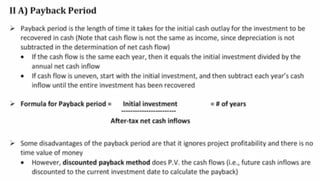

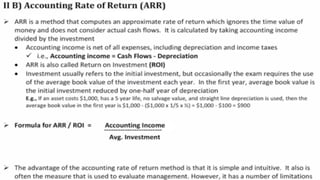

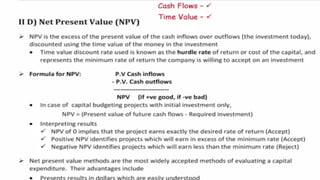

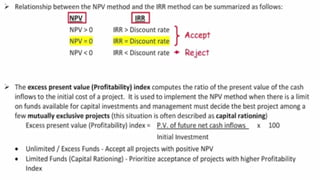

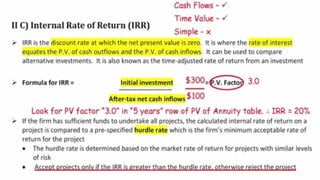

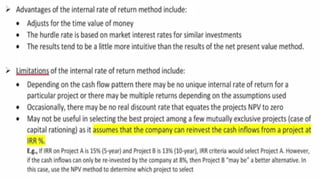

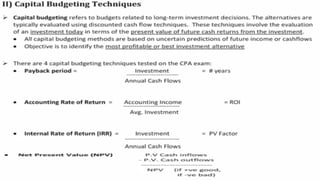

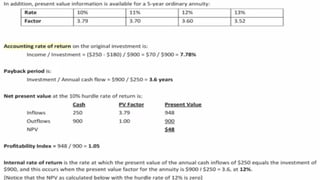

This document provides an overview of capital budgeting techniques. It discusses the importance of capital budgeting and the process involved. It then defines various investment criteria used to evaluate projects, including net present value, benefit-cost ratio, internal rate of return, payback period, and accounting rate of return. Formulas for calculating each are presented along with their advantages and disadvantages. Risk analysis techniques like sensitivity analysis and decision trees are also summarized.