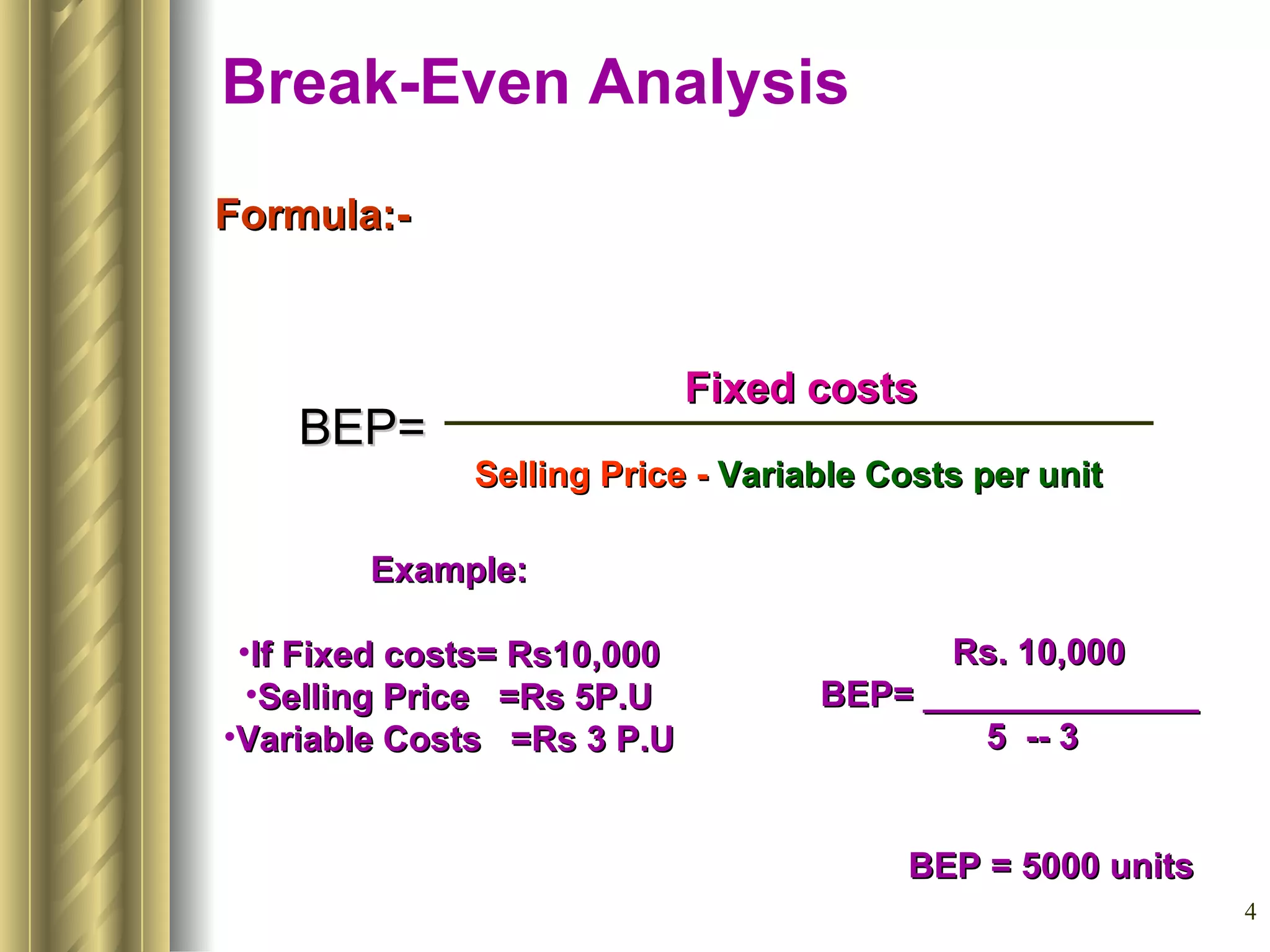

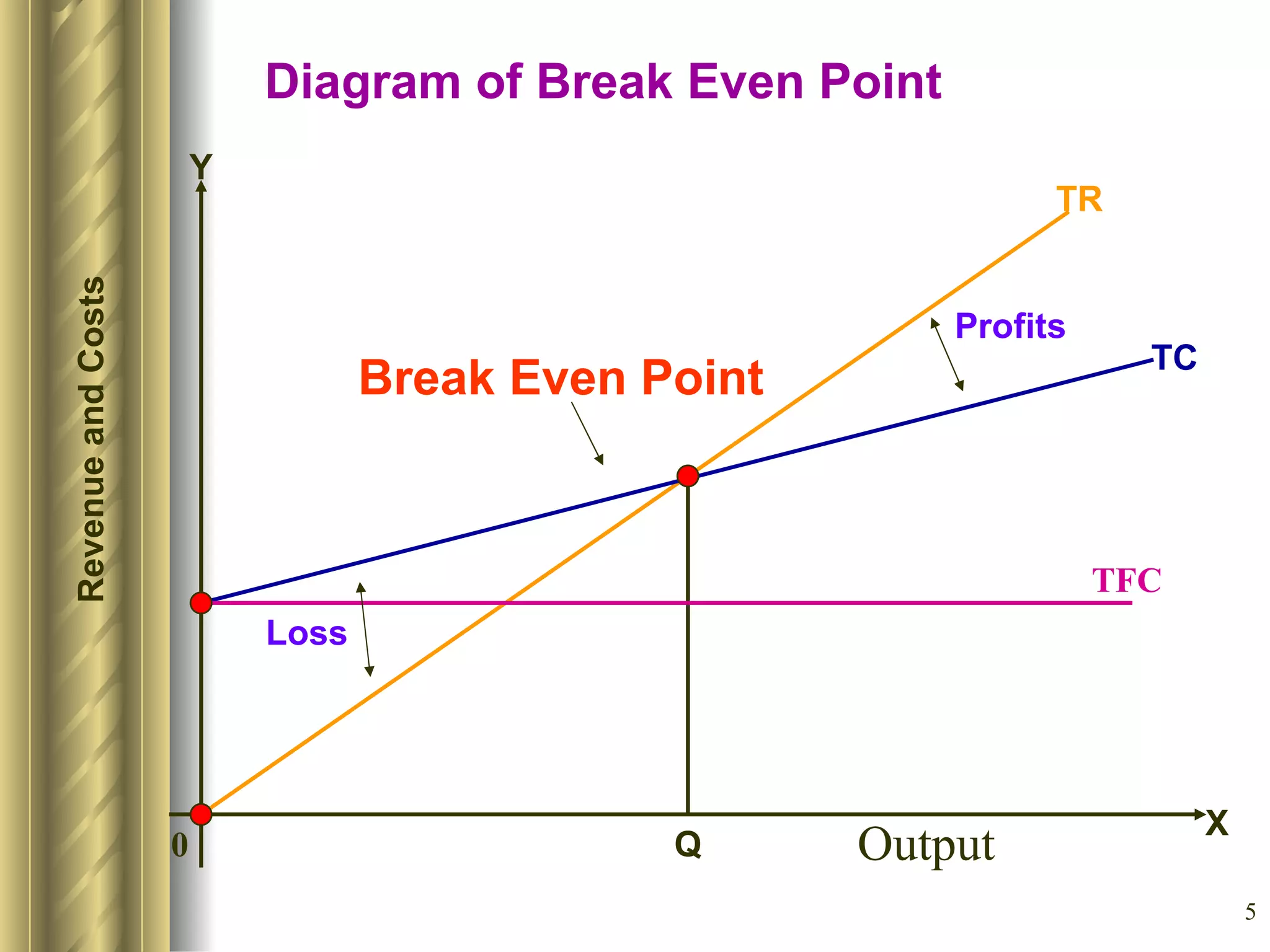

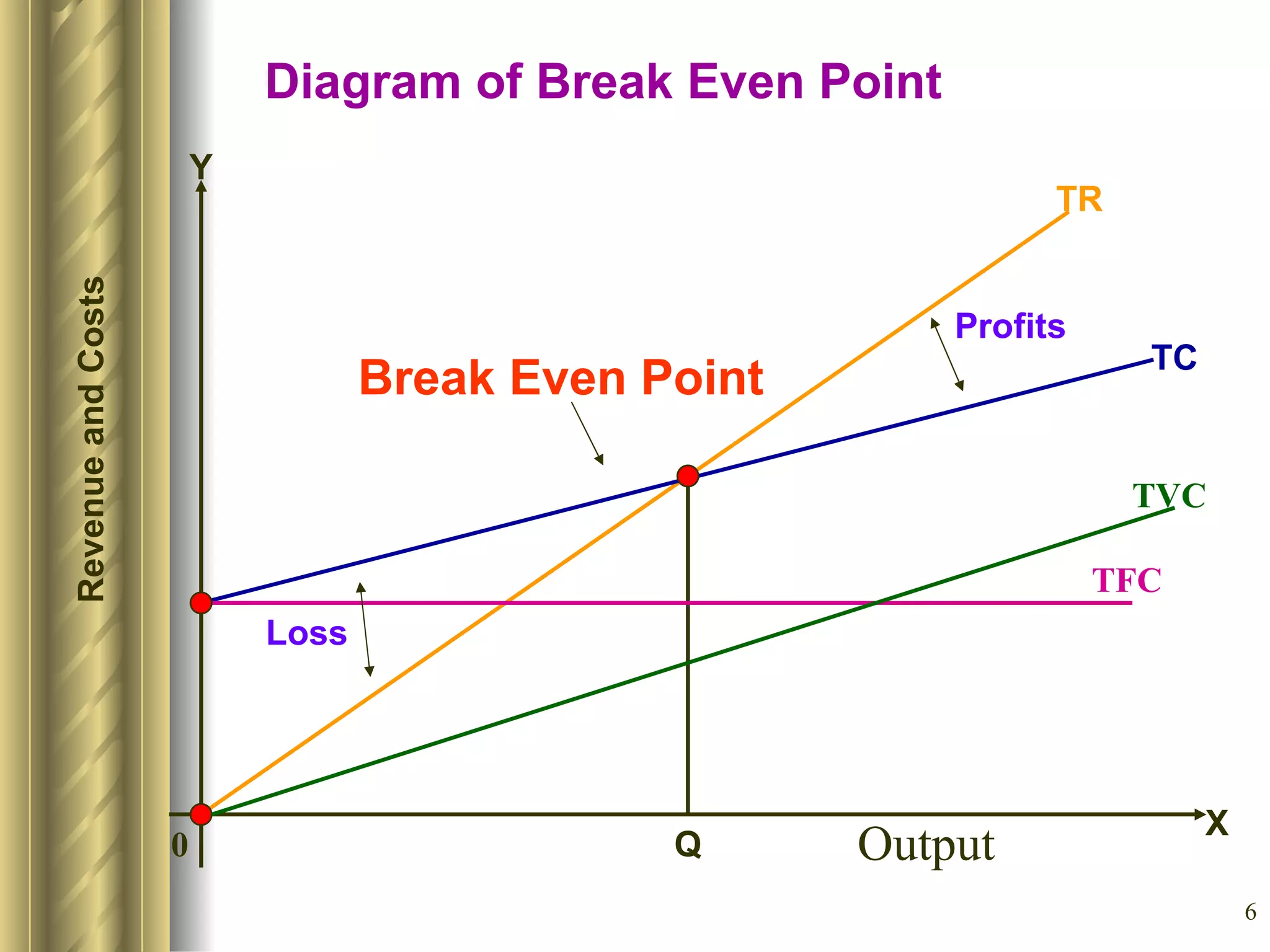

Break-even analysis (BEA) is used by firms to understand the relationship between costs, prices, and profits. BEA determines the sales volume needed for total revenue to equal total costs, known as the break-even point. The break-even point formula is: BEP = Fixed Costs / (Selling Price - Variable Cost per Unit). BEA can be used to analyze the impact of new products, price changes, and changes in costs on overall profitability. It also helps firms determine the optimal output level and target capacity.