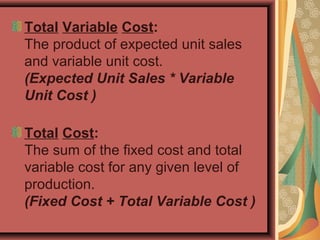

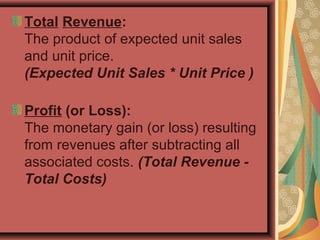

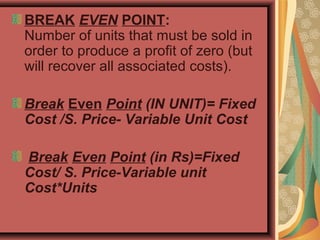

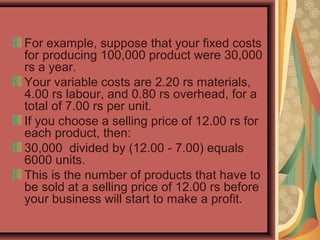

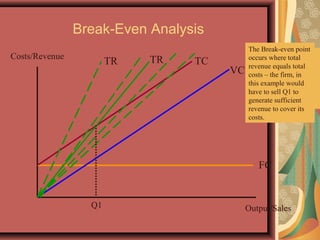

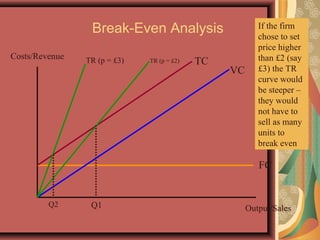

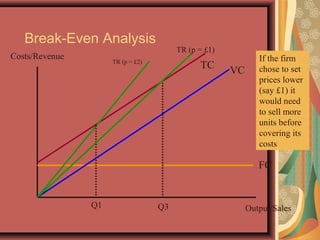

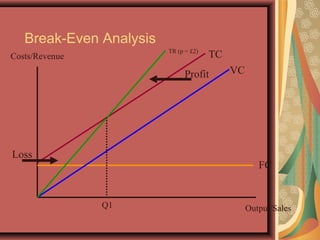

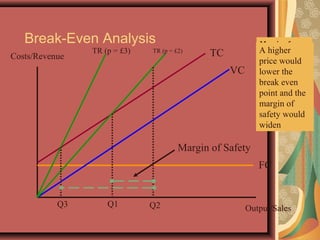

Break-even analysis is used to determine the sales volume needed for a business to start making a profit. It calculates the fixed costs and variable costs per unit and determines the break-even point - the number of units that must be sold to cover total costs. It can help with pricing strategy, examining profitability impacts, and deciding sales quantities. Limitations include assuming fixed costs are constant and not accounting for changes in inventory or multi-product businesses. Break-even analysis should be distinguished from flexible budgets and standard costs which are concerned with cost components and control rather than the relationship between costs, revenues and sales volumes.