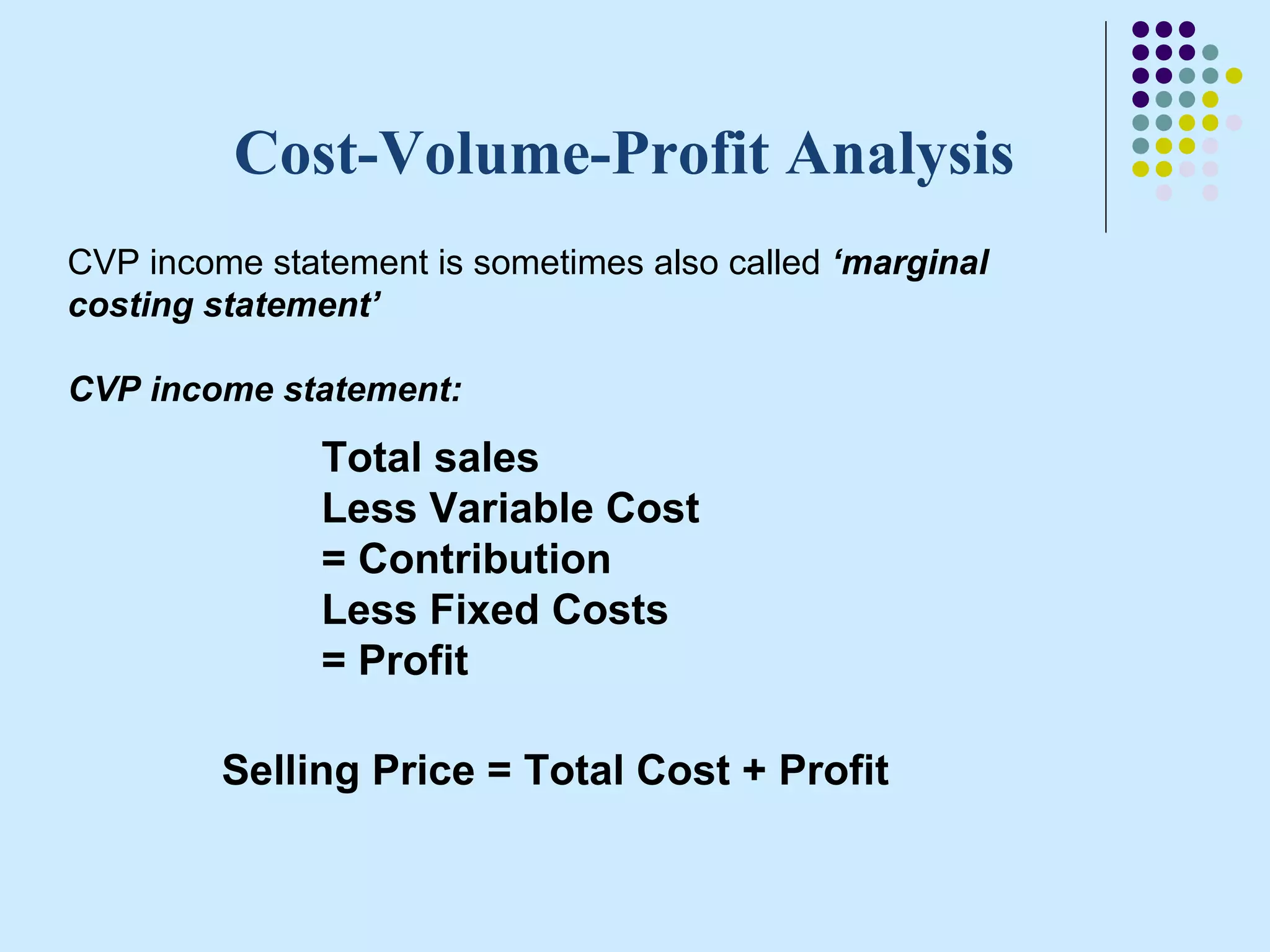

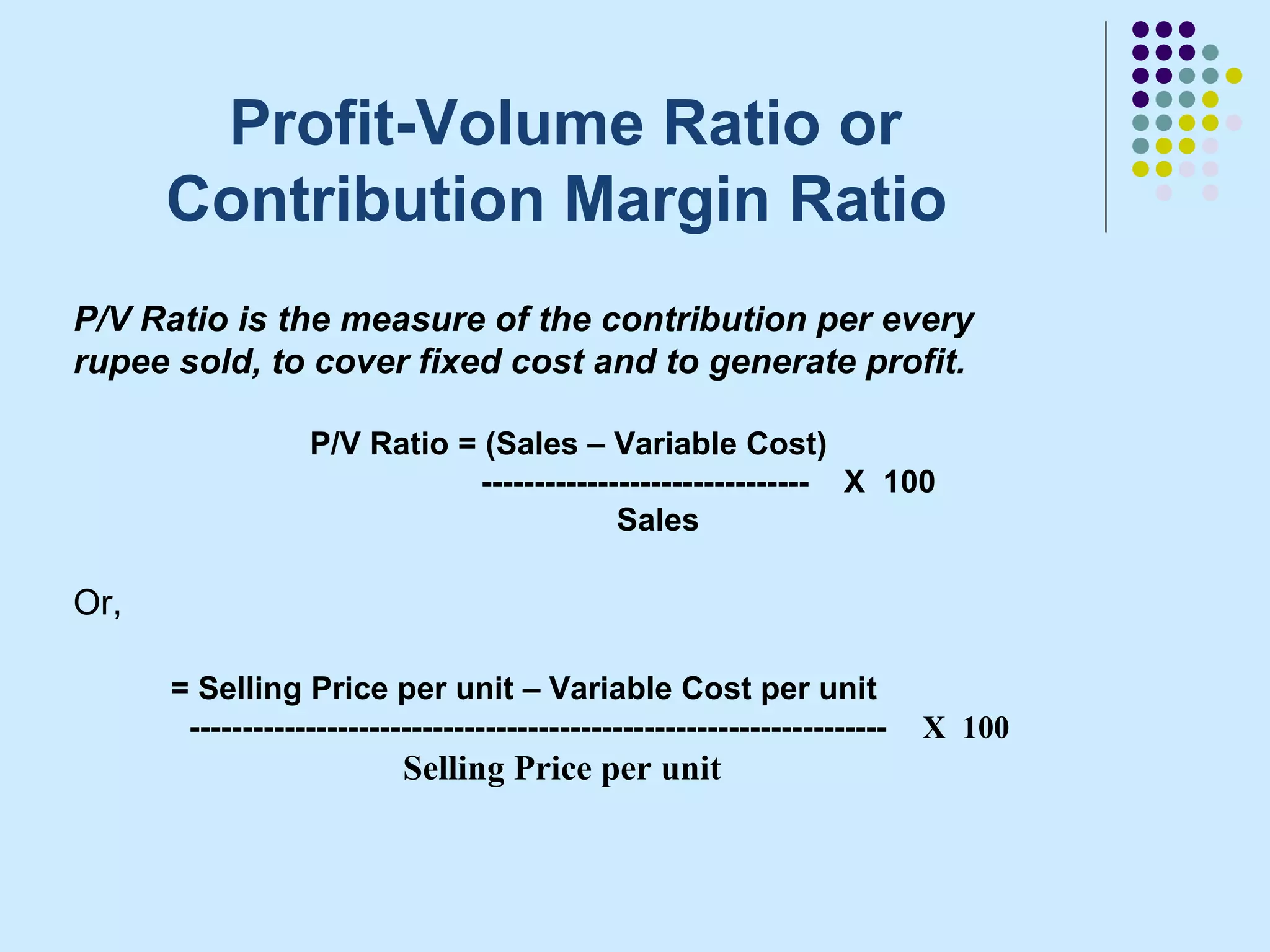

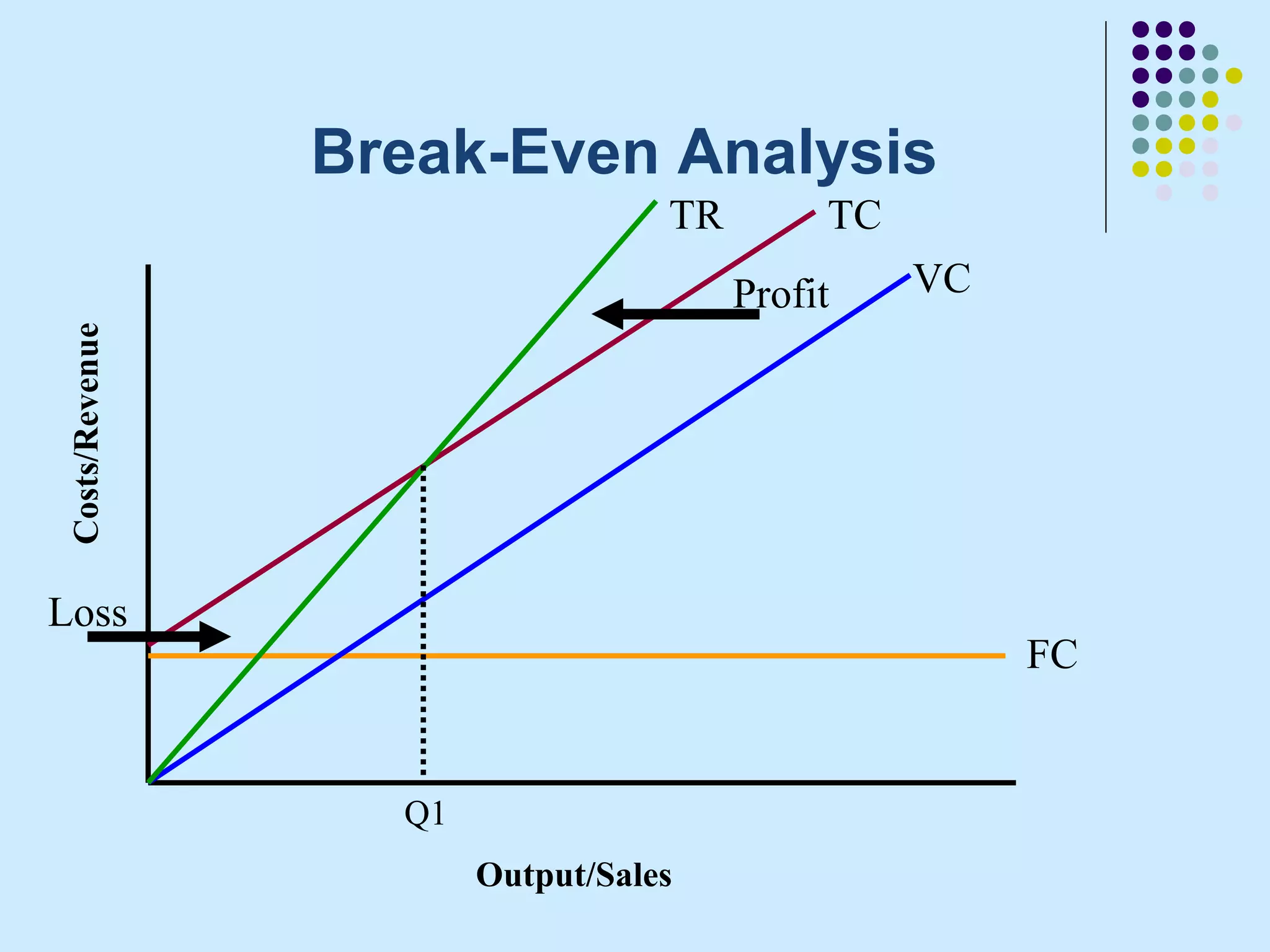

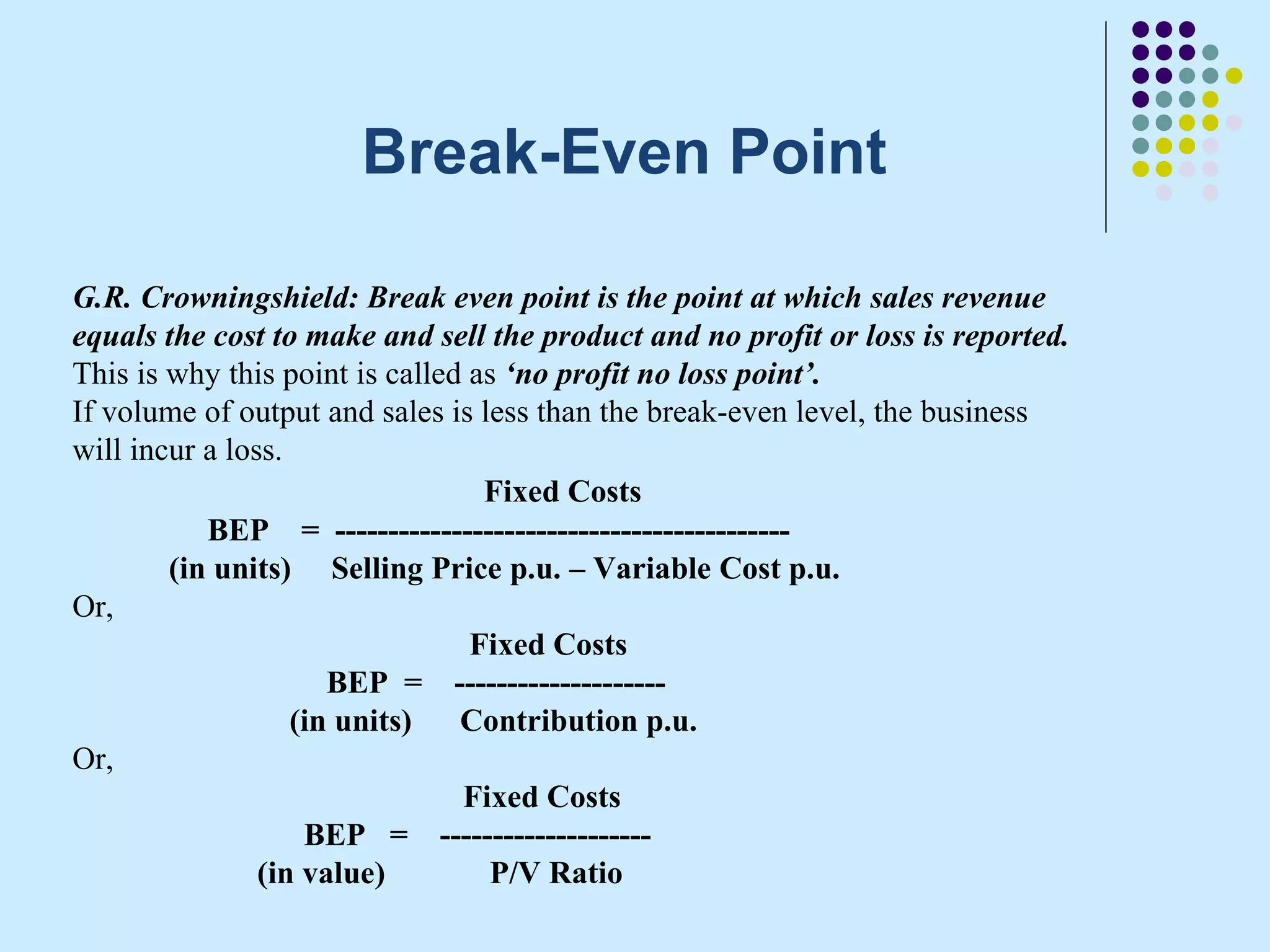

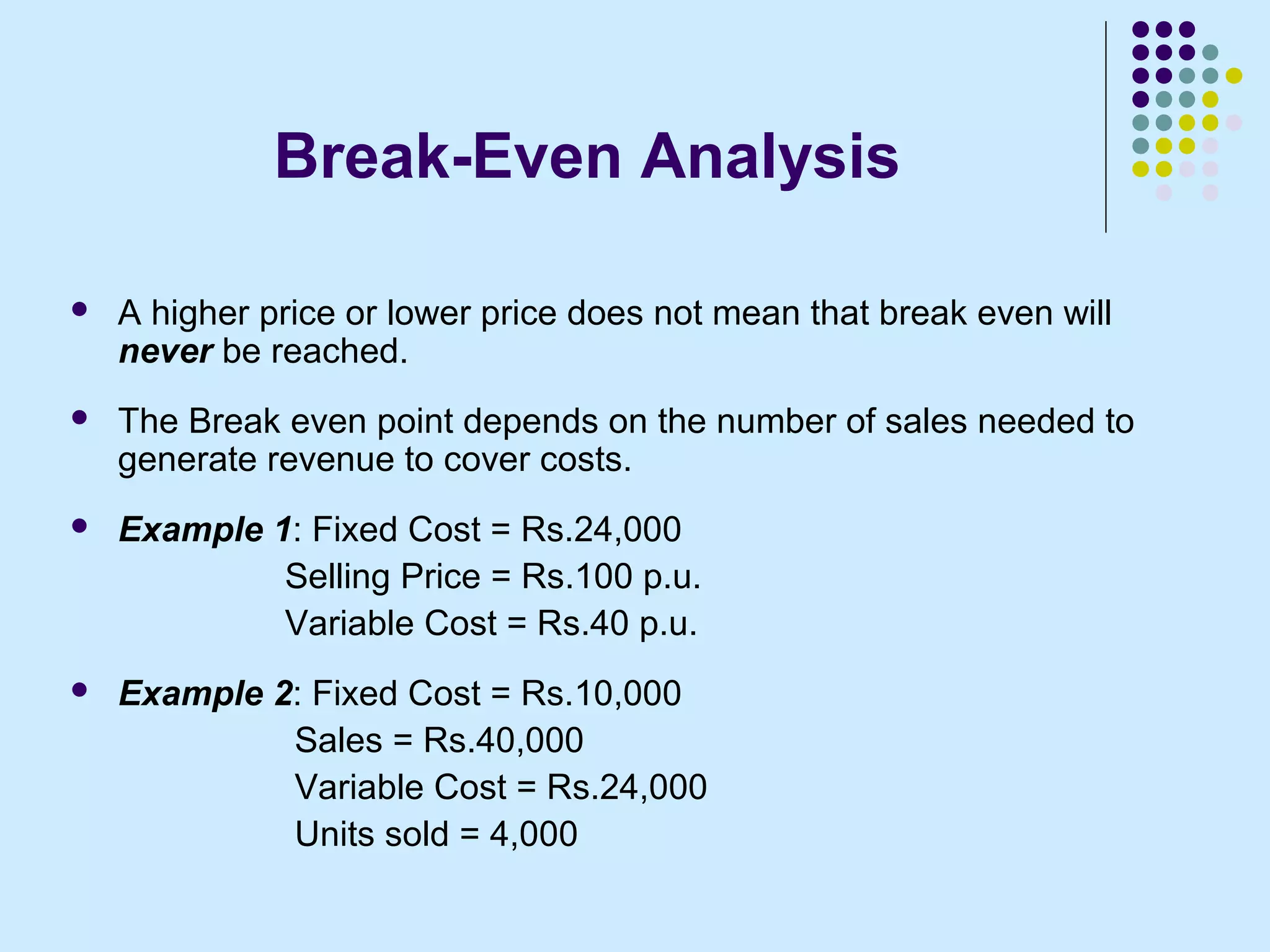

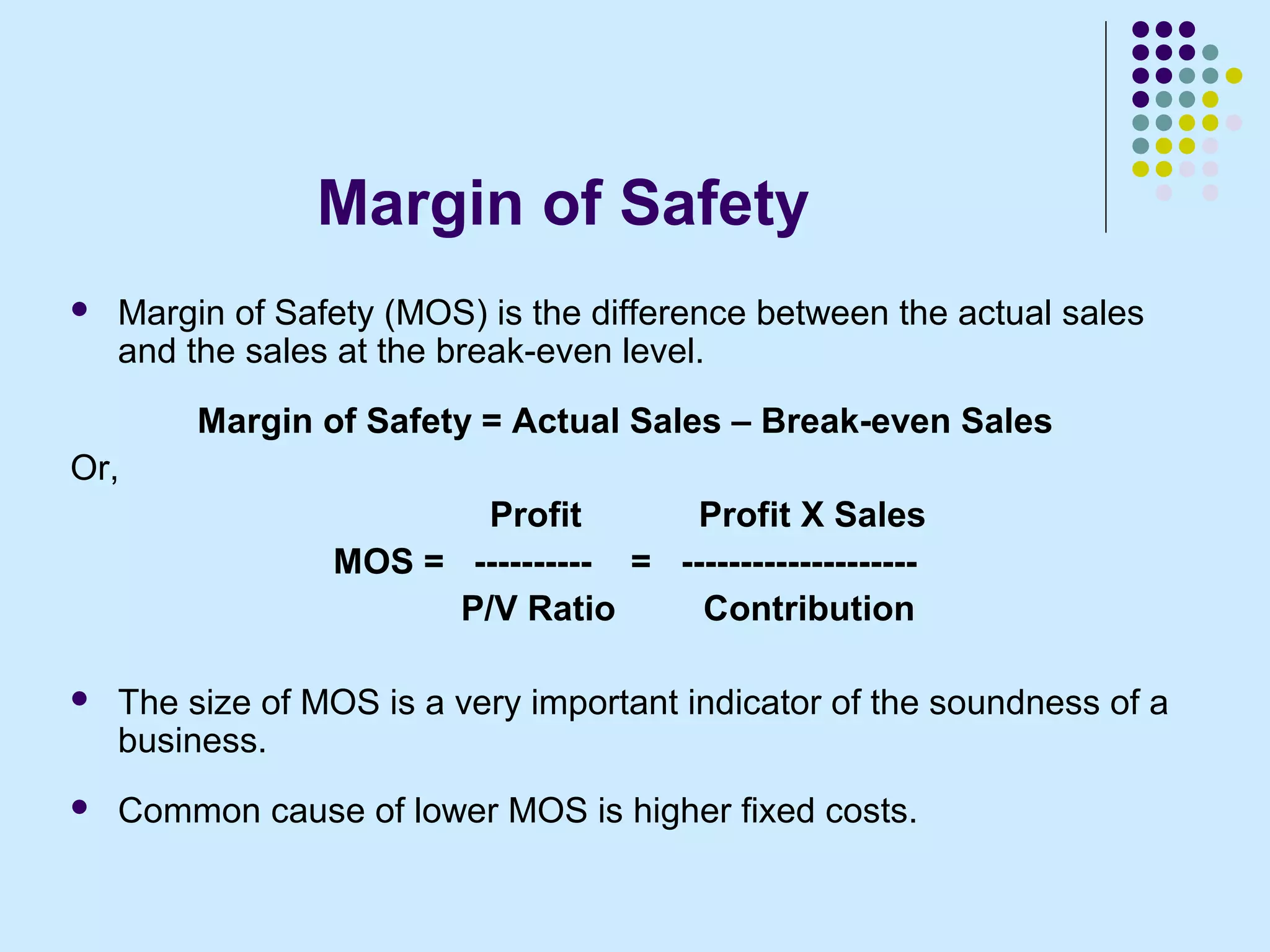

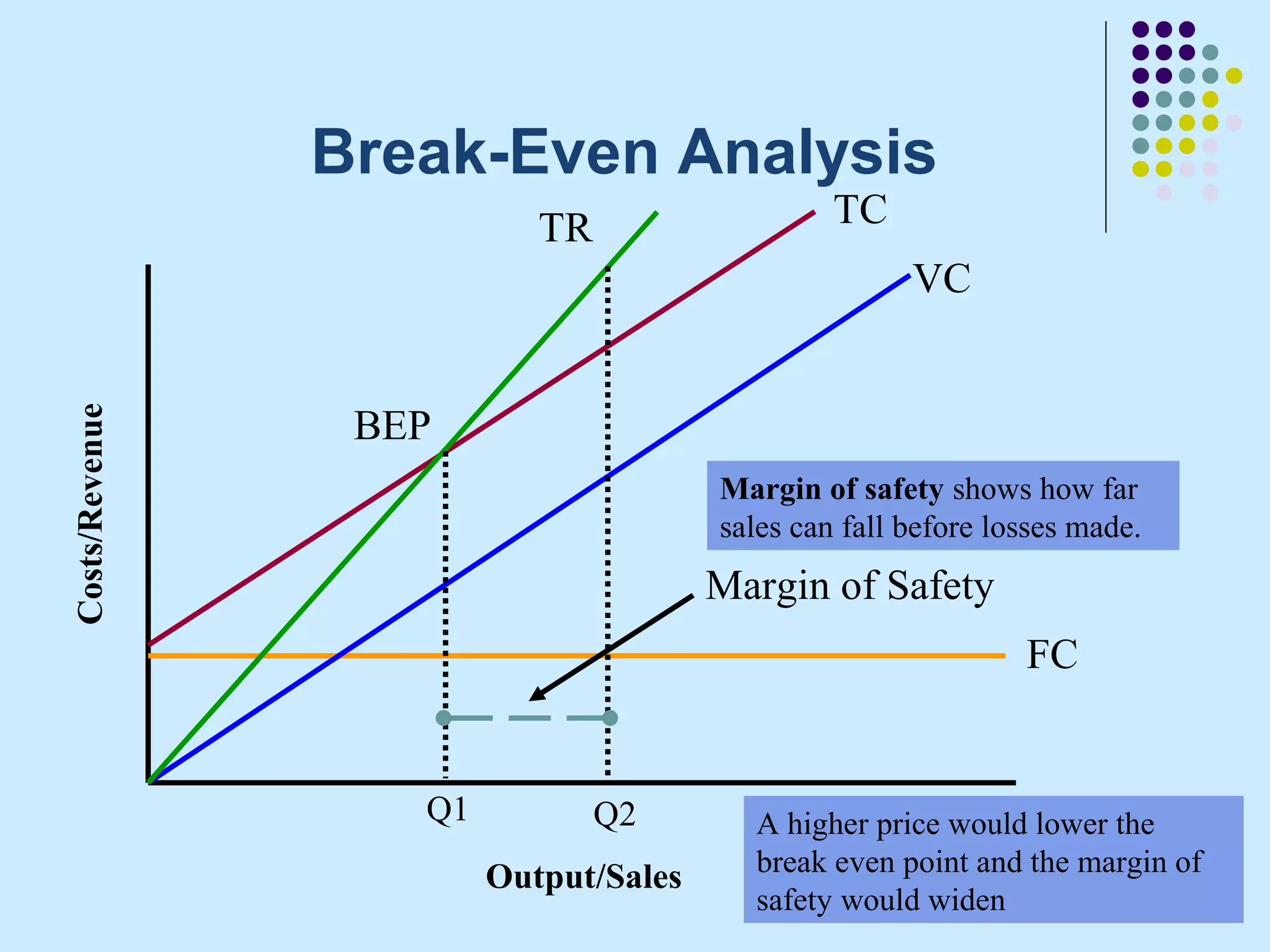

Cost-volume-profit analysis examines how changes in costs and sales volume affect a company's profit. It helps management make decisions about pricing, production levels, and facility choice. It shows how volume impacts total costs and profits. Key assumptions are accurate classification of fixed and variable costs and linear relationships. The breakeven point is where sales revenue equals total costs, with no profit or loss. Margin of safety is the difference between actual and breakeven sales levels, indicating a business's soundness.