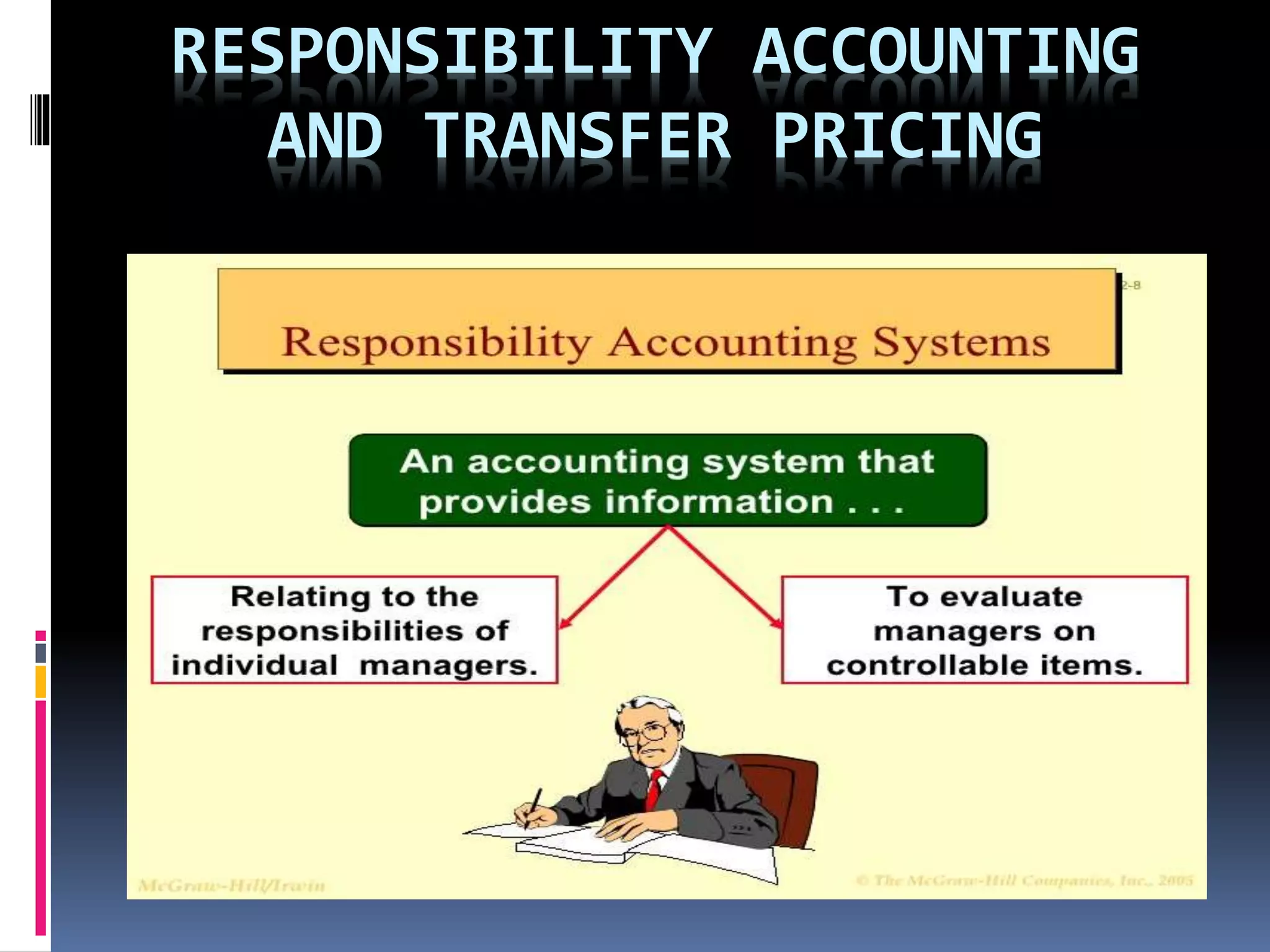

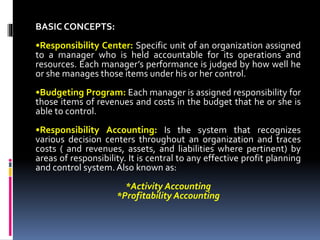

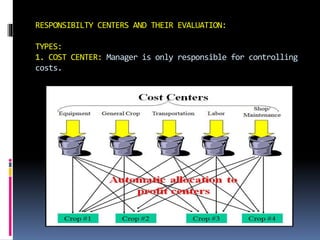

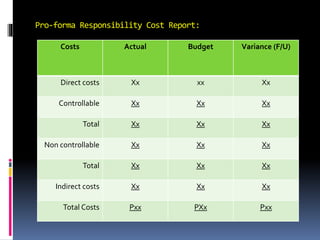

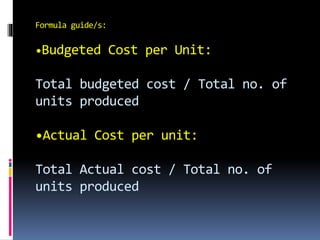

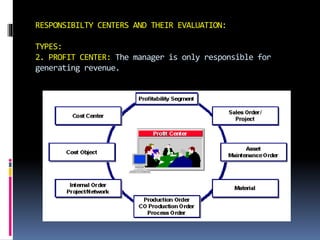

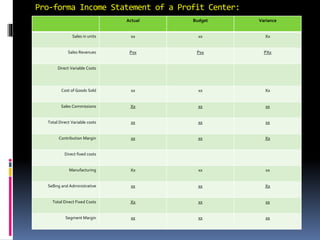

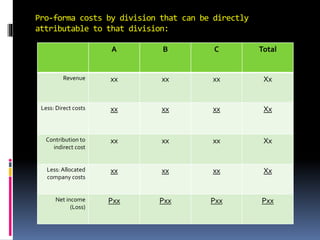

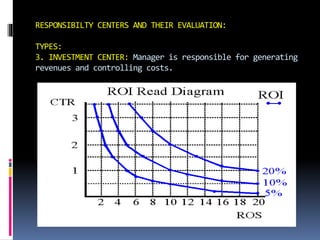

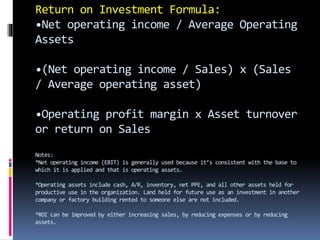

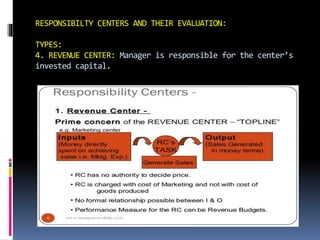

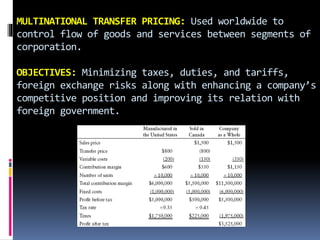

This document discusses responsibility accounting and transfer pricing. It defines responsibility accounting as a system that recognizes decision centers within an organization and traces costs, revenues, assets, and liabilities by area of responsibility. Responsibility centers are specific units assigned to managers who are held accountable. The main types of responsibility centers are cost centers, profit centers, and investment centers. Transfer pricing refers to the value assigned to goods and services transferred between segments. Alternative transfer pricing schemes include minimum transfer price, market-based transfer price, and cost-based transfer price.