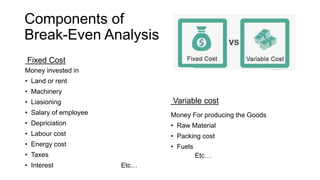

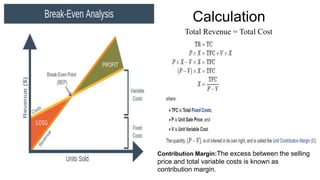

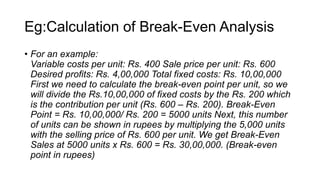

Alisha Ancheary has 9 years of experience in operations management at a chemical company. She holds a BTech in chemical engineering and an MBA in human resource management. The document discusses break-even analysis, which is used to determine the level of production or sales needed to cover total costs. It defines key terms like fixed costs, variable costs, and contribution margin. An example calculation shows how to determine the break-even point in units and sales revenue. Benefits of break-even analysis include setting revenue targets and making better pricing decisions. Limitations include not accounting for variable demand and assuming fixed costs remain constant.