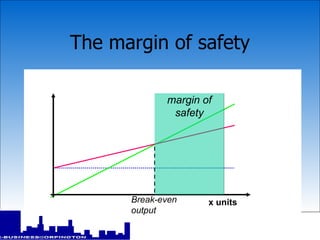

Break-even analysis is a technique that allows businesses to determine the sales volume needed to break even. It involves classifying costs as fixed or variable and calculating the break-even point, which is where total revenue equals total costs. Break-even analysis can be used to understand how changes in output, price, or costs affect profits. While useful for planning, it has limitations as it assumes costs change linearly with volume and ignores factors like multiple products or price changes.