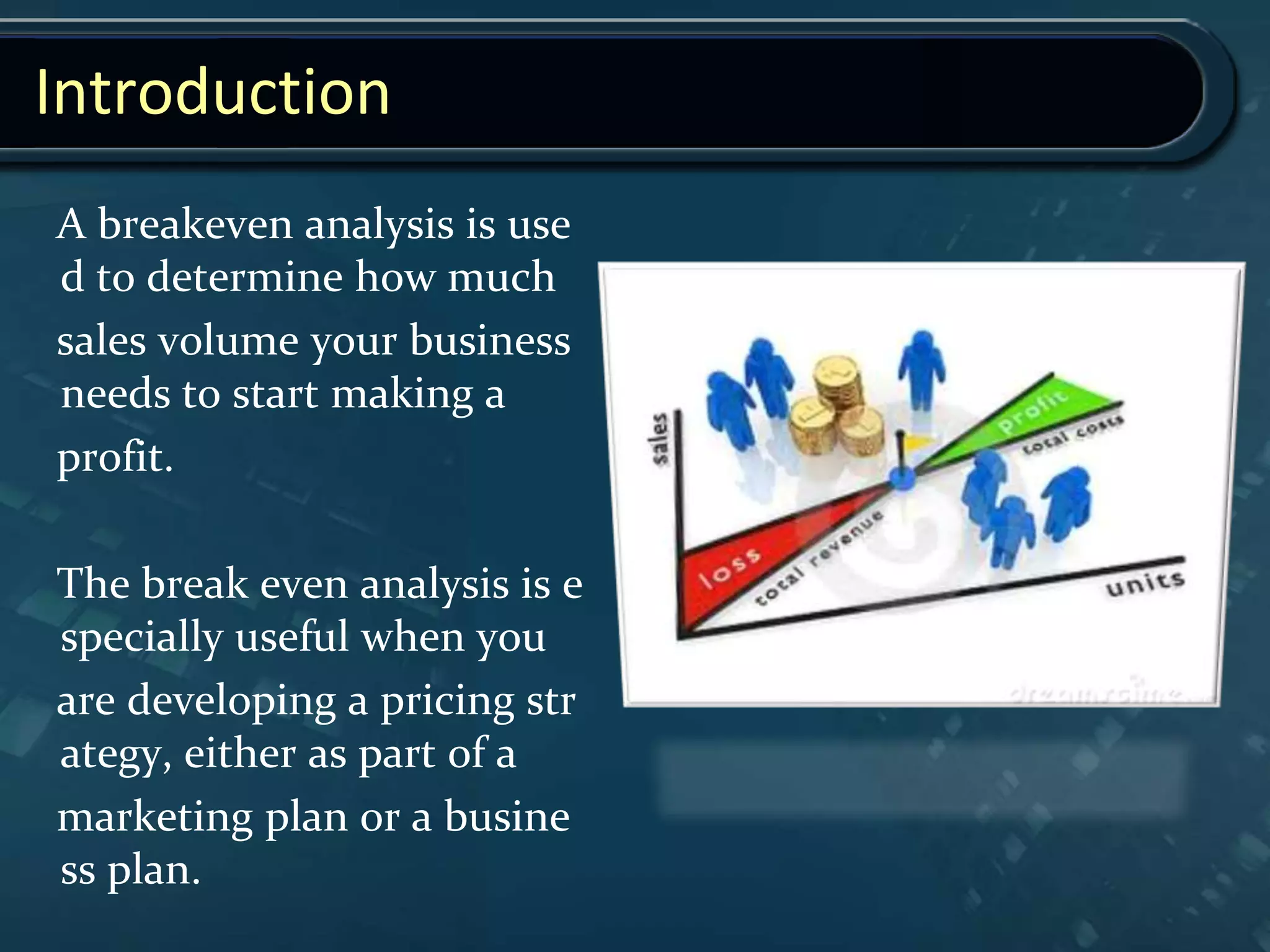

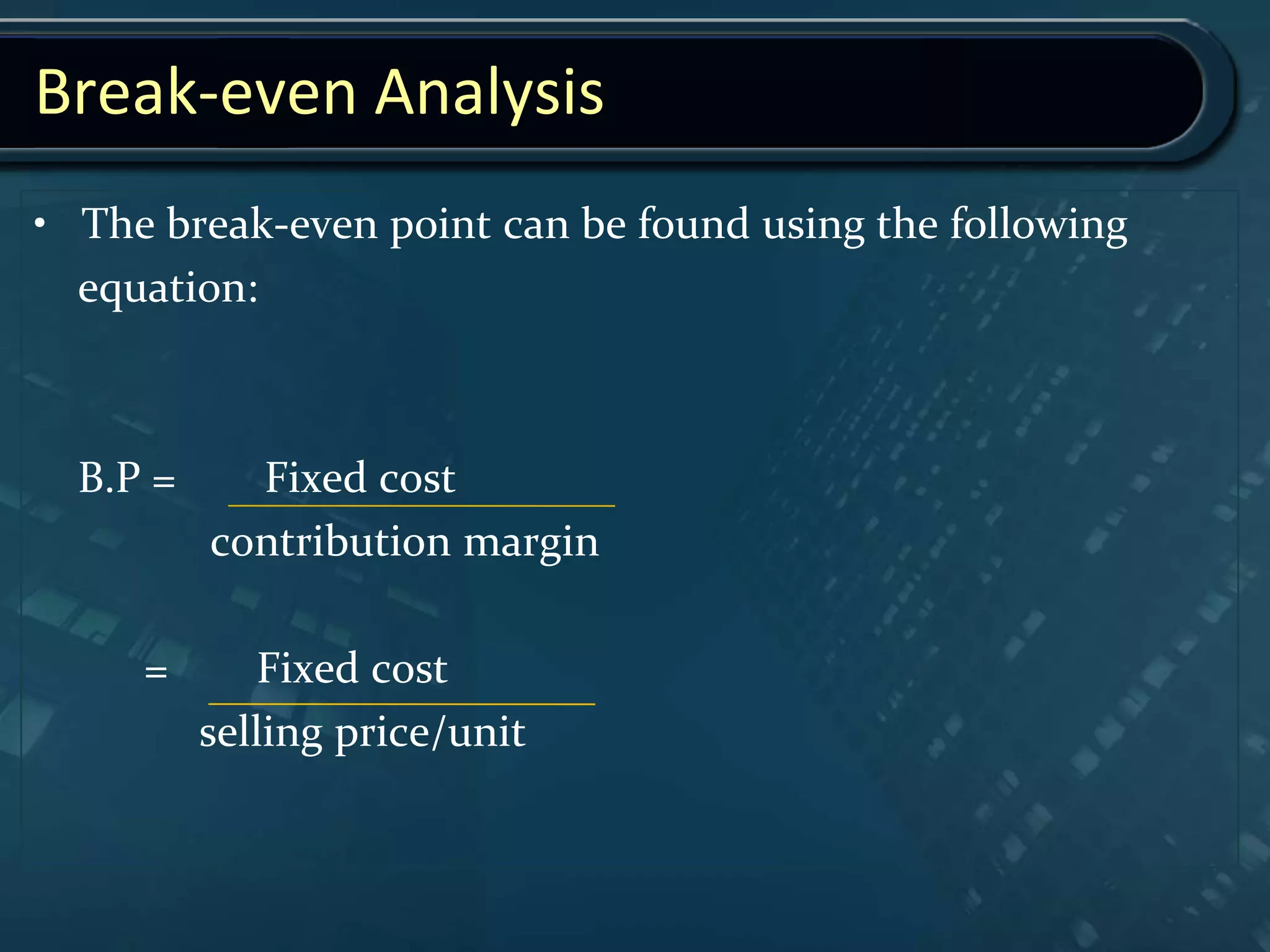

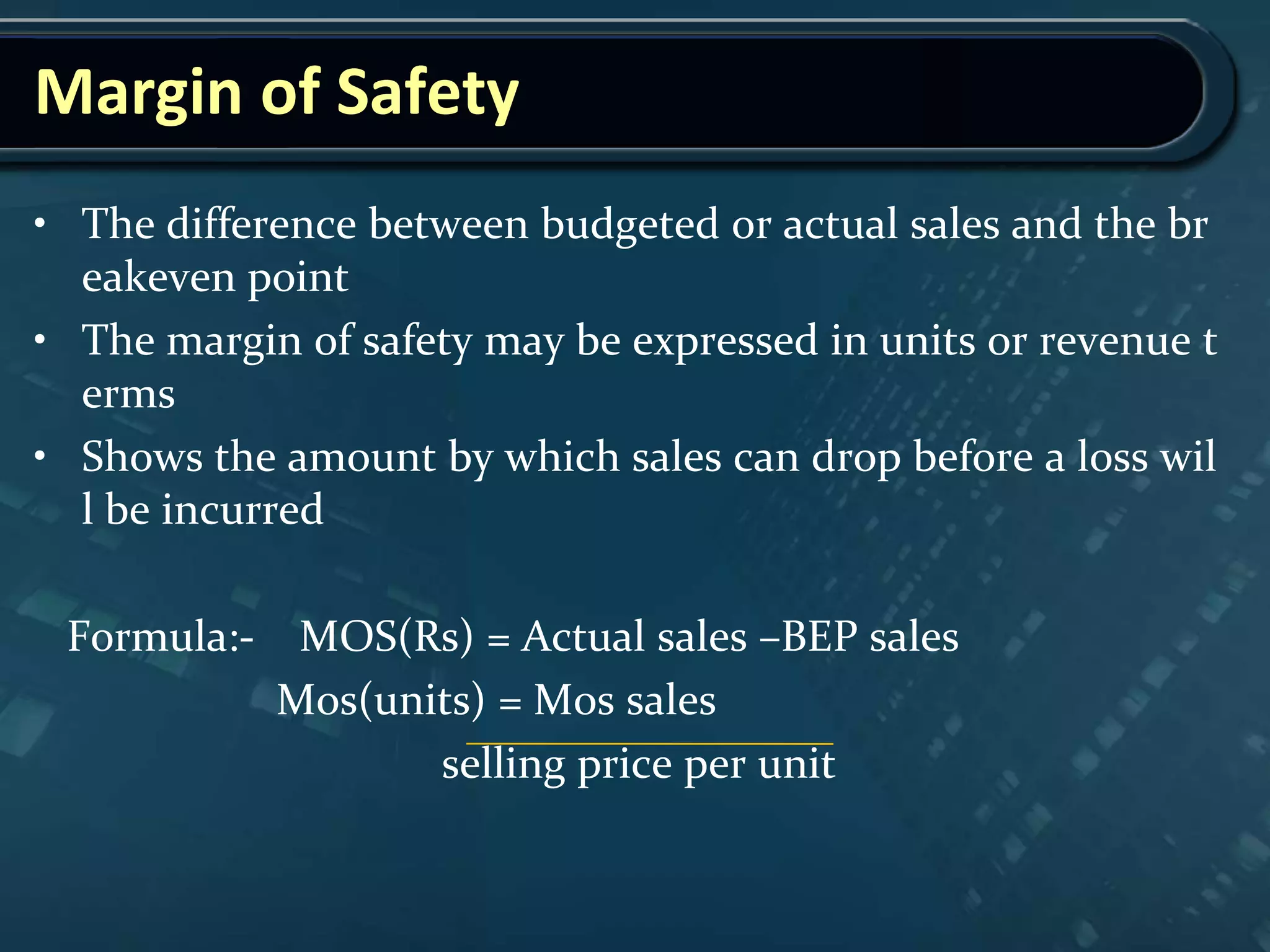

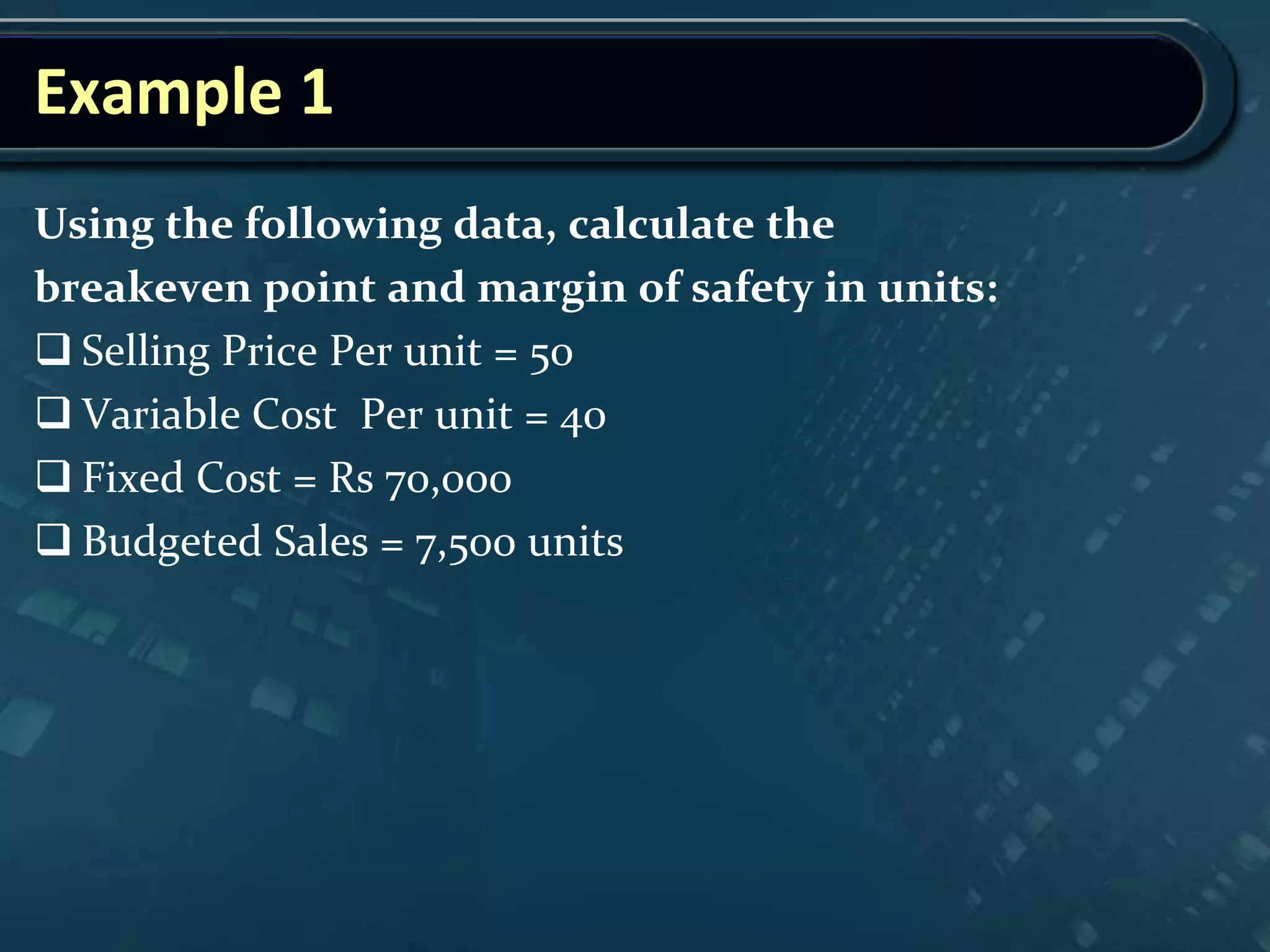

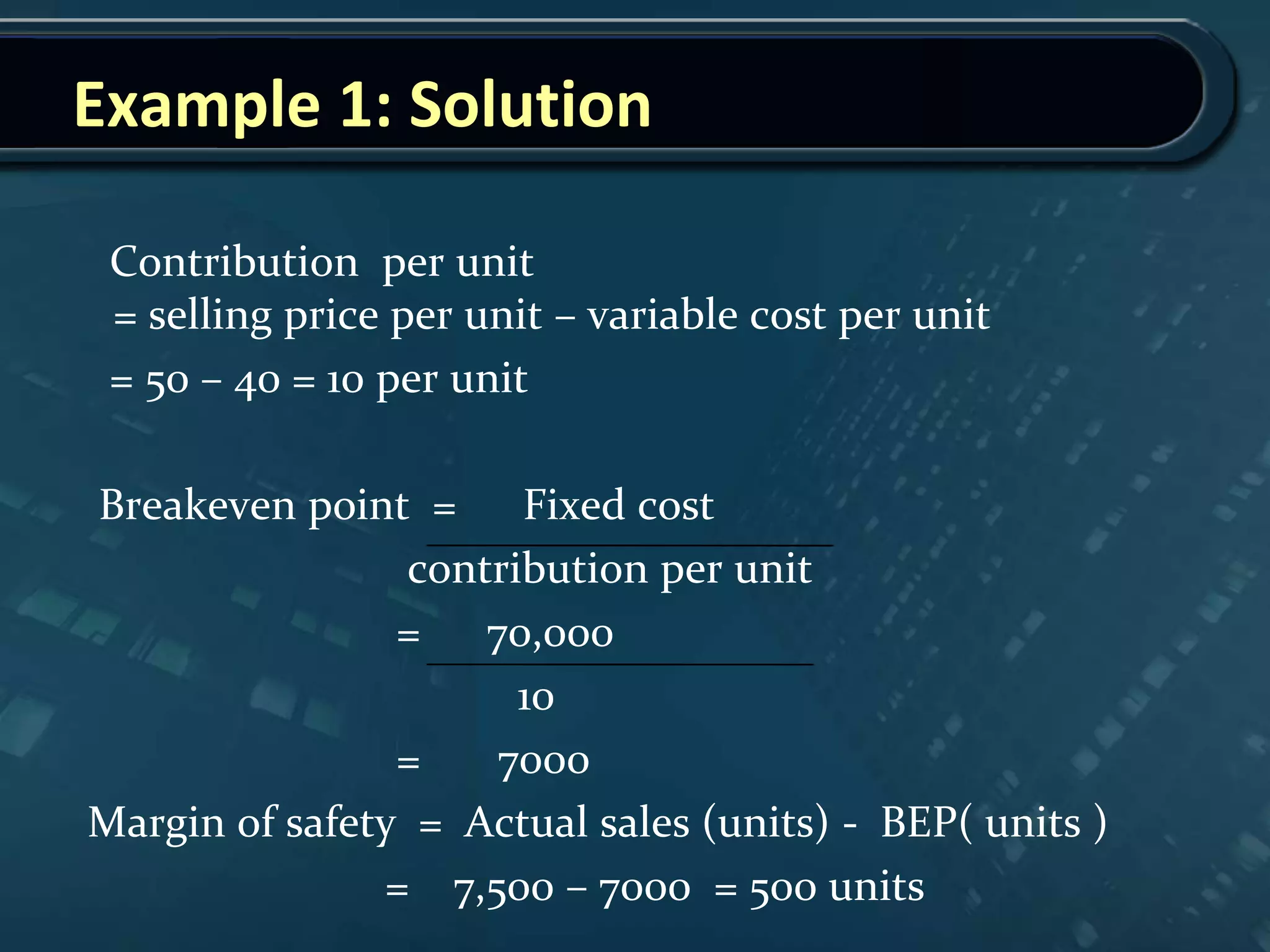

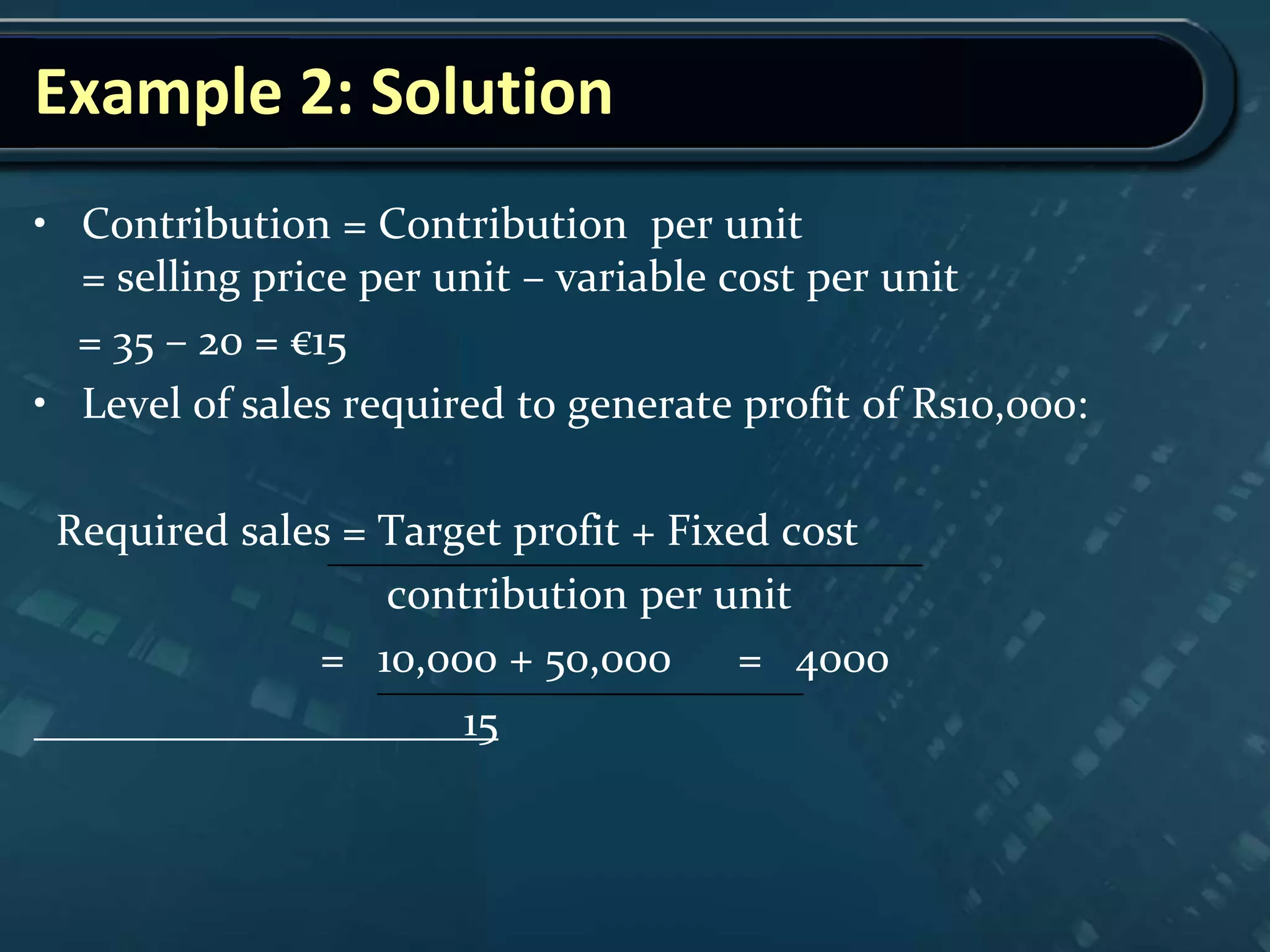

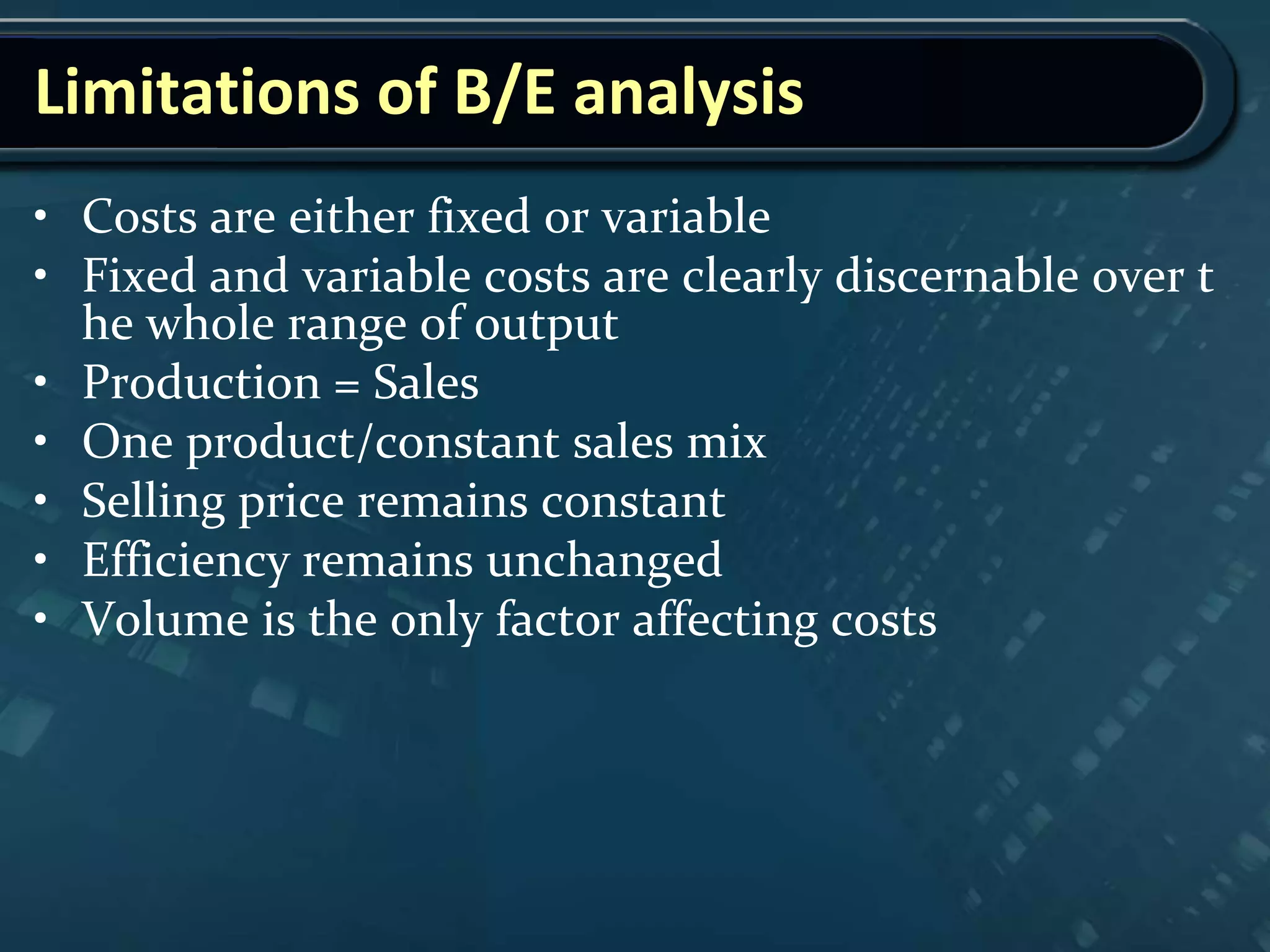

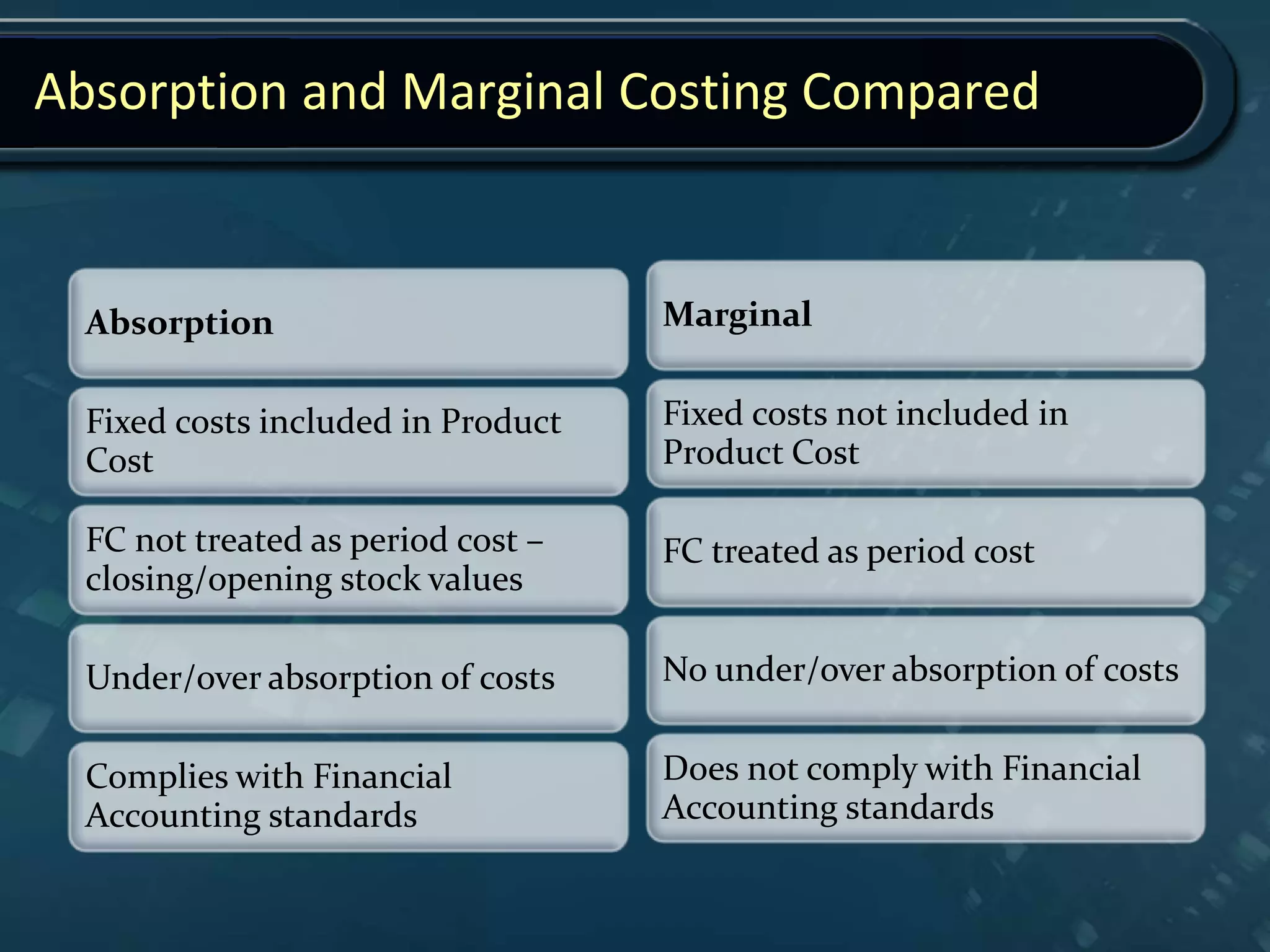

This document provides an overview of break even analysis for a management accounting class. It defines break even analysis as a tool that determines the sales volume needed for a business to start making a profit. It then discusses key break even analysis concepts like fixed and variable costs, how to calculate the break even point using the contribution margin approach, how to determine the margin of safety, and how target profits can be incorporated. The document also provides examples of calculating break even points and sales levels needed for a target profit. It concludes by discussing limitations of break even analysis and comparing absorption and marginal costing approaches.