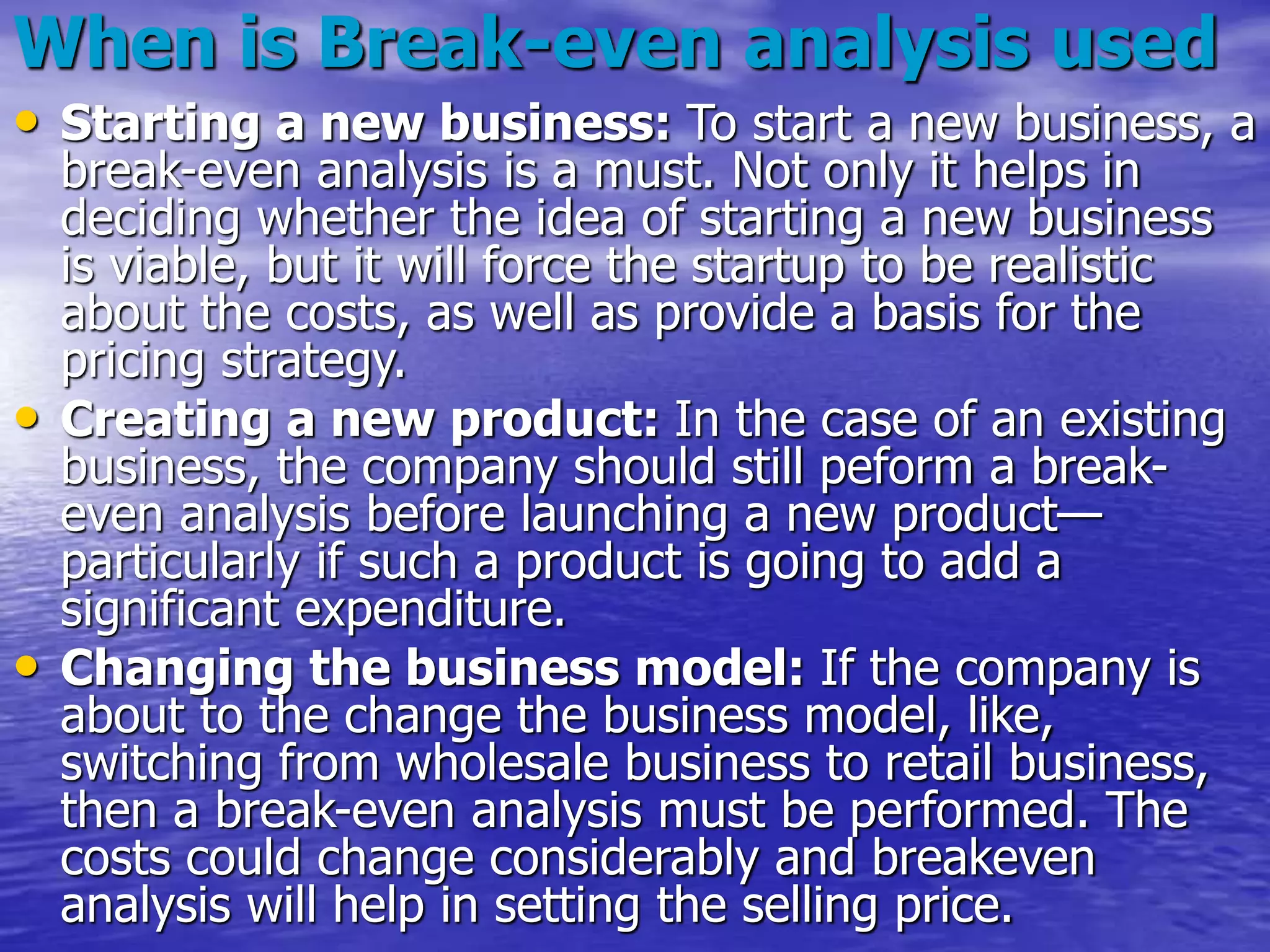

Break-even analysis is a financial tool that helps companies determine the level of sales or production needed to cover total costs. It calculates the point at which revenue equals total costs (fixed and variable). This is known as the break-even point. Fixed costs remain constant regardless of production levels, while variable costs change in relation to production. Break-even analysis is useful for starting a new business or product, changing a business model, and setting price targets. It helps companies make smarter financial decisions and ensure fixed costs are covered.