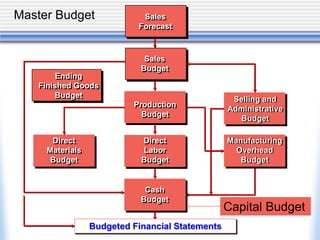

The document outlines the basic framework and process for budgeting. It discusses key elements like the production budget, direct materials budget, direct labor budget, and cash budget. The purpose of budgeting is to aid in planning, coordination, and control of financial and other resources to help achieve organizational objectives.