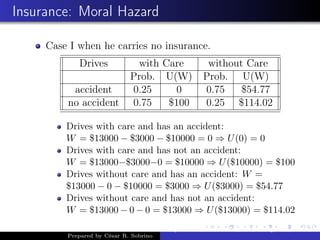

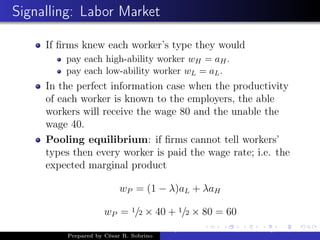

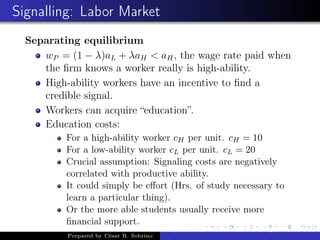

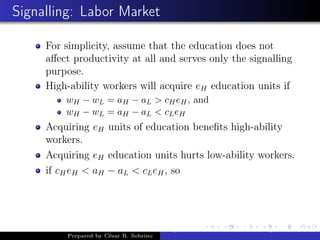

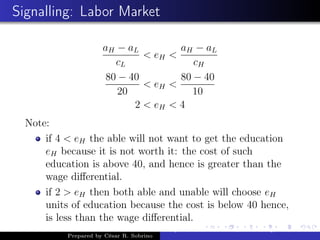

This document discusses the concepts of asymmetric information, uncertainty, and auctions. It begins by defining asymmetric information as situations where one party has more or better information than the other party in a transaction. Examples given include hidden actions by workers that employers cannot observe, and hidden qualities of used goods like cars that buyers are unaware of. The document then explores the economic issues of moral hazard and adverse selection that can result from asymmetric information. It provides examples of signaling and screening methods that parties may use to help resolve information asymmetries.

![Market for used cars:“Peaches” and “Lemons”

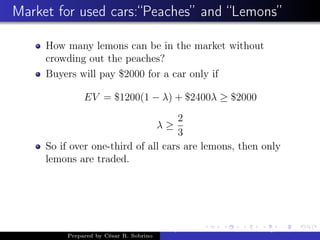

Suppose no buyer can tell a peach from a lemon before

buying. What is the most a buyer will pay for any car?

Let λ be the fraction of peaches. For all, λ ∈ ]0, 1[

(1 − λ) is the fraction of lemons.

Expected value (EV) to a buyer of any car is at most

Suppose EV > $2000.

Every seller can negotiate a price between $2000 and

$EV (no matter if the car is a lemon or a peach).

All sellers gain from being in the market.

Prepared by César R. Sobrino

Asymmetric Information, Uncertainty, and, Auctions](https://image.slidesharecdn.com/asymwun-180822214107/85/Asymmetric-Information-14-320.jpg)

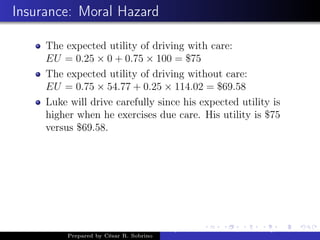

![Insurance: Risk Aversion

Ty is a student who gets a monthly allowance of $200

(initial wealth W0) from his parents.

He might lose $100 on any given day with a probability

0.5 or not lose any amount with 50% chance.

His expected loss (E[L]) is 0.5($0) + 0.5($100) = $50.

His expected final wealth is

E(FW) = 0.5 ∗ ($200 − $0) + 0.5 ∗ ($200 − $100) =

W0 − E(L) = $150.

How much Ty would be willing to pay to hedge his

expected loss of $50?

Assume that Ty’s utility function is U(W) =

√

W , a

risk averter’s utility function

Prepared by César R. Sobrino

Asymmetric Information, Uncertainty, and, Auctions](https://image.slidesharecdn.com/asymwun-180822214107/85/Asymmetric-Information-47-320.jpg)

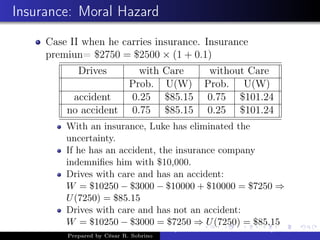

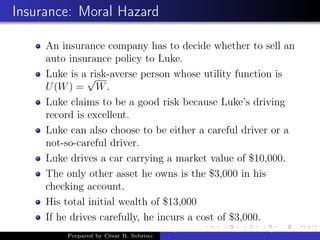

![Insurance: Moral Hazard

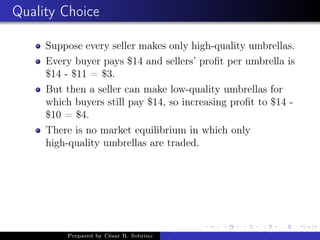

Luke faces the following “loss distribution”

Drives with Care without Care

Prob. Loss Prob. Loss

accident 0.25 $10,000 0.75 $10,000

no accident 0.75 0 0.25 0

When he has an accident, his car is a total loss.

The probabilities of “loss” and “no loss” are reversed

when he decides to drive without care.

EV[loss]= $2,500 and EV[loss]= $7,500.

Luke’s problem has 4 parts: whether to drive with or

without care, (I) when he has no insurance and (II)

when he has insurance.

Prepared by César R. Sobrino

Asymmetric Information, Uncertainty, and, Auctions](https://image.slidesharecdn.com/asymwun-180822214107/85/Asymmetric-Information-54-320.jpg)